DAY TRADING IN CRYPTOCURRENCIES

Table of content

- How do Day Traders generate income?

- Day Trading crypto strategies for a quick profit

- How to get started trading Cryptocurrency daily

- Advantages and disadvantages of cryptocurrency day trading

- 4 Mistakes Day Traders Should Avoid

- The fear of missing out can be a significant factor in trading.

- Beware of trading with funds you are unwilling to part with and may suffer losses.

- Failing to investigate a topic for yourself

- Conclusion

⚡What is Cryptocurrency Stacking

The process of securing crypto assets to earn rewards or interest is known as crypto staking. Users utilize blockchain technology to create cryptocurrencies, facilitating secure transactions.

⚡What does HFT mean?

By leveraging sophisticated algorithms to analyze the markets and make decisions at lightning-fast speeds, high-frequency trading (HFT) is a practical approach for executing profitable trades.

⚡What percentage does the trader make?

A successful trader can expect to earn about 50% a year. Significant figures are feasible, but they also come with considerable risk. However, such earnings do not arrive immediately.

⚡What is trading and how does it work?

In brief, online trading is buying and selling monetary assets through a digital platform. Traders and investors use a trading platform a broker or bank supplies to buy and sell financial instruments online.

⚡Is technical analysis sufficient for day trading?

Technical analysis is for short-term or intraday trading only. It is a common myth that technical analysis is only suitable for short-term and computer-driven trading, such as intraday and high-frequency trading.

In the last few years, cryptocurrencies have created a revolution that has captivated and intrigued people worldwide. With so many different options, people are raking in cash, trading them. If you're searching for the perfect entry into day trading crypto on Reddit, look no further! In this post, we'll explore the fundamentals of day trading, grasp how traders profit from it, and uncover some exceptional strategies successful day traders use.

We'll also teach you how to start cryptocurrency day trading with little or no experience. Subsequently, we will thoroughly evaluate the positives and negatives of crypto day trading Reddit to ensure you are equipped with all the necessary information before deciding if it suits your requirements.

Day traders take advantage of intra-day price changes by never holding open positions overnight. The term “day trader” stems from the stock market, where trading only occurs during weekdays.

How do Day Traders generate income?

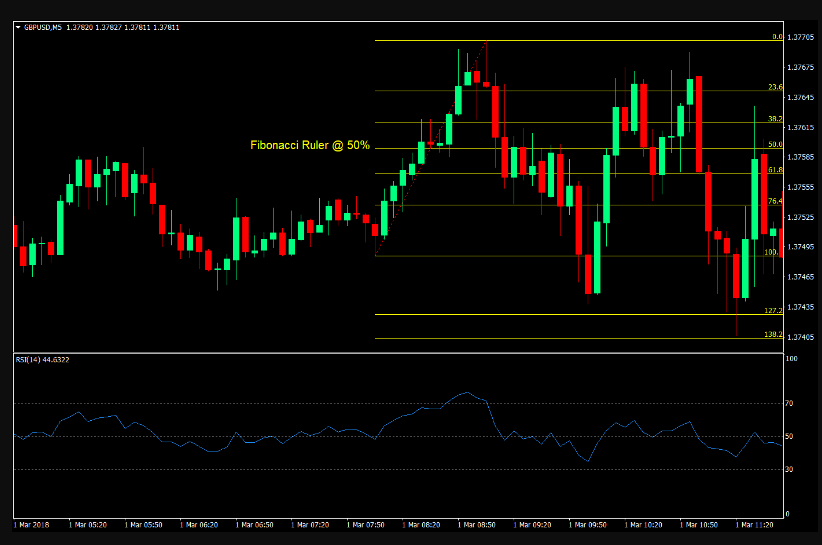

Successful intraday traders will have thorough market knowledge and significant expertise. Intraday traders frequently utilize technical analysis (TA) to generate trading ideas. They generally use volume, price movement, chart formations, and technological indicators to identify transaction entry and exit points. Risk management is critical in intraday trading,

Fundamental analysis is not for intraday traders since entire events might take a long time to play out (FA). Traders, nevertheless, may utilize “news trading” as part of their approach at some point. It entails looking for assets with a high level of trade volume due to a recent announcement or news event and making money from a price change.

Intraday traders who seek to profit from market volatility rely heavily on volume and liquidity. Intraday traders usually only trade in highly liquid markets to avoid significant slippage.

On a specific day, traders engage in the trading of the BTC/USDT pair.

Traders. Others will create a watch list based on technical or fundamental criteria (or both) and then select which instrument to trade from.

Day Trading crypto strategies for a quick profit

Scalping

Traders who frequently trade on small timeframes are known as scalpers. It involves profiting from little price changes in a brief period. Liquidity gaps, bid-ask spreads, and other market inefficiencies are examples of this strategy.

Scalpers may increase their earnings by leveraging with margin or futures contracts. Because price percentage objectives are frequently lower, larger position sizes make more sense. The majority of intraday trading techniques do.

Although leveraging does not necessarily mean disregarding risk management, successful scalpers are still aware of margin rules and use reliable position size standards. If you need help calculating position size while trading, be sure to check out our guide on the topic. Scalping is generally easier for experienced traders because of its fast execution speed and high risk. Furthermore, since using leverage is so common, a few unsuccessful trades may rapidly drain a trading account.

Range Trading

Range trading is an essential strategy that draws much of its strength from studying candlestick charts and identifying support and resistance levels. As the name implies, range traders look for price ranges in the market structure and develop trading ideas based on those ranges. A range trader may buy the support and sell the barrier if the price fluctuates between two support and resistance levels.

Range trading operates on the concept that the boundaries of a range function as support and resistance levels until the range is breached. The bottom of the content can push prices up, while the top of it will more likely result in a decrease.

The more times the price reaches a support or resistance level, the more probable the group will be broken. As a result, range traders constantly look for a chance to see the market break out of range. It usually entails placing a stop loss order when the range breakout is confirmed.

For further information on this topic, see the sections on support and resistance.

Fundamentally, margin trading is akin to arbitrage with a few important distinctions: the trader borrows funds from an exchange at a rate of interest that varies from what they pay their broker. The concept behind trading on margin is simple: buy low and sell high using leverage (borrowed funds). Investing with margin comes in various forms, all subject to unique regulations and conventions.

High Frequency Trading (HFT).

Have you ever wondered what High-frequency trading (HFT) is? It's a common question, and we have the answer for you!

High-frequency trading is a style of algorithmic trading often used by quantitative traders (natives or “quants”). Creating trading bots and algorithms that can open and close multiple positions in a short amount of time is what this entails. What does the term imply in terms of duration? Consider milliseconds. A few milliseconds might be crucial for a high-frequency trading algorithm.

HFT's complicated strategies are easier to implement than they appear. Although it might look easy, intraday trading with high-frequency trading is more challenging. High-frequency traders need to test against history and monitor and constantly modify algorithms to fit the market's mood swings. If you believe you can kick back and let your computer take care of everything, I'm sorry to inform you that this won't happen.

High-frequency trading is also gendered. As a result, the general public needs help to obtain high-quality knowledge.

What is the cause of this? It's straightforward. If successful high-frequency trading firms and hedge funds begin disclosing their HFT techniques to individual investors, these methods will be ineffective.

Furthermore, there is another factor to consider when considering the use of trading bots. If you made a profitable trading bot yourself, why not utilize it instead of selling it? Consequently, considering investing in a high-frequency trading bot, you must know the risks.

Technical Analysis

Technical analysis (TA) studies financial data, such as price and volume data points, to identify market statistical patterns. TA teaches traders how to use science to find profitable trading possibilities by utilizing historical price and volume information.

Technical analysis can be used on any market or security if there is historical trading data. Traders may employ technical analysis to assess how previous performance can predict future gains and losses in the cryptocurrency market.

Some traders express concerns about the technique's effectiveness when they utilize technical analysis in cryptocurrency trading. Many people believe Cryptocurrency is unsuitable for technical analysis because there is no worldwide regulation and many exchanges. Many people believe that indicators like the Relative Strength Index (RSI) can be an invaluable asset. The RSI indicator assesses a cryptocurrency's strength by looking at the price's recent gains and losses.

The CoinFlow Index is another vital oscillator crypto technical researchers (MFI) employ. The MFI can be used with the RSI to determine whether BTC is on track for a bullish or bearish divergence.

The CoinFlow Index, employed by crypto technical researchers (MFI), is another important oscillator. The MFI can team up with the RSI to help determine if BTC will have a bullish or bearish divergence. If traders and investors can hone their comprehension of technical analysis, they can boost their long-term returns. However, these strategies must first be comprehended and practiced before investing real money to avert pricey mistakes. https://www.investopedia.com/articles/active-trading/102914/technical-analysis-strategies-beginners.asp

Trading Bots.

A trading bot is a computer program that allows investors to purchase and sell financial instruments in predetermined intervals or under specified conditions to improve earnings. Designers create cryptocurrency trading bots to reduce losses and maximize profits.

Bots can help you trade intraday Cryptocurrency faster by saving time and effort. Exchange fees, market research, and near-term profit possibilities all might be accelerated using algorithmic trading bots. Traders have been employing automated trading systems for decades on stock exchanges. Traders familiar with the software's creators and APIs should use this knowledge.

How to get started trading Cryptocurrency daily

So, you've decided to give cryptocurrencies a go as a day trader. What should you do first? If you're a novice looking to gain expertise in cryptocurrency trading, then The Complete Guide to Day Trading Cryptocurrency for Beginners is an ideal read.

It contains all the necessary information and helpful advice tailored to everyday investors. If you already understand the basics, you may practice trading on the Binance crypto exchange by following these steps:

Which online trading platform is appropriate for day trading Cryptocurrency? We can't advise you on this, but Binance Ecosystem has hundreds of market pairs, margin trading, quarterly and perpetual futures, leveraged tokens, real-time market data, and more. To begin with, go to Binance and convert fiat dollars to Cryptocurrency.

Advantages and disadvantages of cryptocurrency day trading

Every cryptocurrency investment has significant risk and high potential return. When it comes to cryptocurrency investments, investors should remain aware that the value of their digital assets may fluctuate. After all, cryptocurrencies are a novel form of financial aid.

Traders should familiarize themselves with the forthcoming taxation rules for cryptocurrencies. Earlier, we discussed that Cryptocurrency is not free from short-term capital gains tax. Crypto-day trading makes marginal income by selling Cryptocurrency for less than a year. Include cryptocurrency profits when reporting income online or through an accountant.

Pros of

✅ Anyone with a cryptocurrency account may trade. There are no longer any restrictions for retail investors or intraday traders to access, research, and participate in cryptocurrency markets. Beyond verifying their identity and paying for their exchange account, there are no more barriers for retail investors or intraday traders to access, research, and participate in cryptocurrency markets.

✅ Cryptocurrencies are always at your fingertips, with markets open around the clock, seven days a week. Traders may buy and sell without limitation since cryptocurrency markets are available 24 hours a day, seven days a week. The NYSE and Nasdaq halt trading at 9:30 a.m., granting investors some respite from the frenetic day of exchanging stocks.

✅ Cryptocurrencies and the blockchain technology they are founded on provide users with an autonomous means to engage in transactions without intermediaries. Intraday traders on a centralized exchange may profit from the absence of government taxes and fees since trading cryptocurrencies is incredibly cost-effective.

Minuses

❌ Because trading cryptocurrency is so simple, even a novice or inexperienced trader may lose everything as quickly as they might make money.

❌ The market's openness 24 hours a day, seven days a week is its double-edged sword. Bitcoin is always accessible, so there are fewer patterns during the day when traders can make preordained (and profitable) transactions. Crypto-day traders in the cryptocurrency market might need to dedicate more time to monitoring charts than traditional traders, who actively search for favorable opportunities to capitalize on for quick profits.

❌ The cryptocurrency market is mostly unregulated, which unfortunately means that exchanges, institutions, and hacked or defrauded traders have no protection. It implies that users will be hard-pressed to get their money back if an exchange closes unless they possess a personal insurance policy.

❌ When trading cryptocurrencies, you may encounter pump-and-dump and other fraudulent sales schemes. It happens when a group collaborates to artificially boost the price of a cryptocurrency to entice novice investors. The traders sell the Cryptocurrency afterward, causing its value to drop.

crypto day trading is an extremely stressful and expensive full-time job.https://www.sec.gov/reportspubs/investor-publications/investorpubsdaytipshtm.html

4 Mistakes Day Traders Should Avoid

Capitalizing on the ever-fluctuating crypto market through day trading is increasingly popular, although it can be treacherous. Traders can often lose money if they're not careful. To help you avoid making common mistakes, here's a list:

Overtrading

The cryptocurrency market is full of day trading possibilities because digital currencies are often unstable. But, investing your resources into it could be a costly misstep if you don't have the right expertise and prowess for day trading. To become a professional trader, it is advisable to prioritize trading with strategy and logic rather than allowing emotions to dictate your decisions.

Many beginner traders need to develop a plan before selling everything they see. Consequently, their trades frequently rely on emotions rather than logical reasoning.

The fear of missing out can be a significant factor in trading.

Many novice traders enter or exit a trade prematurely to avoid losses or missing out on gains, respectively. It primarily occurs due to cryptocurrencies being speculative assets influenced by the fear of missing out syndrome, resulting in the potential for substantial losses.

Hence, it is crucial for success to learn how to avoid FOMO trading cryptocurrencies. If you want to avoid trading FOMO:

- Stick to your trading plan. You can also set maximum losses or profits levels at which you will exit a trade.

- Remember, the world of cryptocurrencies is full of surprises, and new earning opportunities always arise.

- So relax and let FOMO pass by.

Beware of trading with funds you are unwilling to part with and may suffer losses.

Some beginning cryptocurrency traders make the mistake of putting all their life savings into trading to become rich quickly. However, cryptocurrencies are speculative financial instruments that can swing wildly in price at any moment, and even professional traders experience significant losses occasionally. Day trading is not an avenue to instantly achieve riches; instead, it presents a potential for generating long-term financial gains. Like any other endeavor, it demands proper planning and execution and risk management skills. The latter skill is critical in preventing cryptocurrency traders from losing all their capital or making significant losses.

Failing to investigate a topic for yourself

Many novice traders need to be more mindful of following so-called experts on social media platforms. These people might intentionally or unintentionally give you wrong information, which could cause substantial losses. As a wise cryptocurrency trader, you should research before following any signals. A trader who wants to be successful should not only rely on tips from other traders. They should know how to do technical analysis and pay close attention to news that might affect the market. Luckily, many online sources can teach basic trading skills.

Conclusion

In stock and cryptocurrency trading, intraday trading is a popular trading method. Intraday traders employ intraday techniques to profit from market volatility and generally do not keep positions for more than one day.

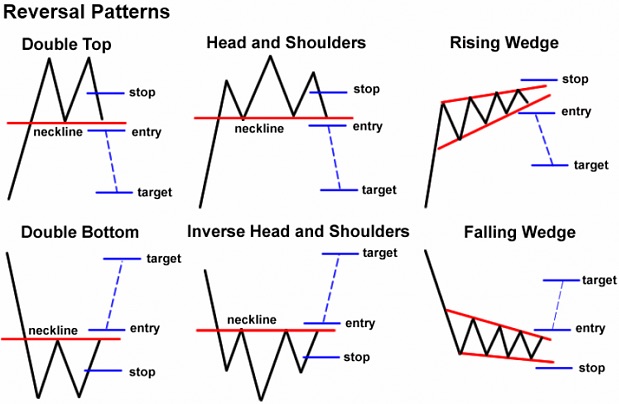

Are you ready to take the leap and dive into intraday trading? Then make sure your success is secured with these essential pieces of information! Technical analysis, chart patterns, and technological indicators are vital to finding trading opportunities. And when it comes to strategies, scalping, range trading, and high-frequency trading are some of the most popular choices among day traders.