7 mistakes➱cryptocurrency investing

Table of content

- Mistake #1: Steer clear of the assumption that purchasing high and selling low is an effective way to generate substantial profits.

- Mistake #2: Following only one side

- Mistake #3: Your lack of a strategy.

- Mistake #4: Insufficient security measures are an issue of utmost importance.

- Mistake #5: Basic market analysis is unknown by many.

- Mistake #6: It's also possible that you don't have a diverse enough portfolio or are invested in too many different coins.

- Mistake #7: Placing money in an investment where you cannot bear to suffer the loss is a highly hazardous tactic.

- The Benefits of Keeping Your Crypto in an Online Wallet

- Withdrawal

⚡️ Is it still profitable to invest in cryptocurrency?

Investing in crypto-tokens is a unique venture where the potential rewards far outweigh any risks taken. Cryptocurrency is a good investment if you want immediate access to ➦digital currency demand. Buying stock in cryptocurrency-related firms may be a safer but less lucrative option.

⚡️ Is Bitcoin a good investment in 2022?

Because of the way well it has been embraced, ➦Bitcoin is the greatest cryptocurrency to buy in 2022. Its popularity makes it a more secure investment since it is more difficult to hack, making it technically safer and less prone to large price fluctuations.

⚡️ How low will cryptocurrency fall in 2022?

The prediction game has grown even more difficult since then, as Bitcoin's price has plummeted. The most ➦far-out naysayers believe bitcoin will bottom out at $10,000 in 2022, but many experts believed it would rise to ➦$100,000 late last year but over a longer time period.

⚡️ How much is Ethereum worth in 2025?

Ethereum is expected to be worth ➦$11,764 in 2025.

As cryptocurrency tales of success and loss spread like wildfire, it's no surprise that Bitcoin, Ethereum, Elon Musk and Tesla tweeting about Dogecoin have seen a dramatic increase in popularity. People are investing more heavily than ever into the digital currency market due to these potential returns – curious investors may be asking themselves whether they can join this potentially profitable journey too?

Although prices have experienced a slight dip and some uncertainty has engulfed the crypto marketplace, cryptocurrency is still an area of interest. Even the savviest of investors may find it daunting to break into the digital currency market. A commentator once so eloquently noted:

Cryptocurrency remains a trending topic, but the crypto world can be complex to explore and understand – especially for those new to it. That's why we've highlighted seven mistakes that crypto investors often make so you won't have to! Arm yourself with information today and stay ahead of the game by averting these all-too-common errors.

So, here are the top 7 most common Bitcoin investing blunders.

Mistake #1: Steer clear of the assumption that purchasing high and selling low is an effective way to generate substantial profits.

The biggest blunder people make is investing excessive money all at once. Because cryptocurrency is so volatile, this leads to “rekt.” Timing the market is a huge key to success when buying and selling, but it's difficult to do. Knowing patterns can help you time the market better.

There are two significant blunders that individuals frequently make:

- FOMO is a term used to refer to the anxiety of missing out. We've all been there. You see a project shoot up in value, and you want to get involved. Even more so if you missed out on previous similar possibilities.

Unfortunately, every rise must eventually be followed by a fall. If you invest when a project is gaining steam, there's a greater chance of losing money since early investors will begin taking profits, and you may have to wait a long time before breaking even or making money.

It's also difficult to acquire coins when a project is expanding rapidly. Trades on decentralized exchanges (dex) like Uniswap can be challenging, especially if you're crypto trading against the market. If you are not mindful, you can easily spend a fortune on gas fees and other expenses related to Ethereum trading.

- FUD is a term that refers to any type of negative publicity. It's designed to throw investors into a panic and drive them away from your coin, even if it's an amazing project (Sell cheaply). Few things are more disheartening than seeing your investment go deeper and deeper in the red. When a currency rapidly falls in value, it creates a lot of FUD.

Selling your coin at a loss to see it spike in value over the next several days or weeks may seem appealing, but that option carries with it considerable risks. It's best to take caution rather than plunge into something too quickly. I'm not suggesting this merely for the sake of saying it… as of this writing, while my whole portfolio is still generating excellent gains, half of my coins are in the red.

Mistake #2: Following only one side

What sparked your enthusiasm for Bitcoin? Where did you locate the materials to gain a deeper understanding of it? Is it friends, Twitter, YouTube, or Reddit? It's always a good idea to diversify your “news channels” to gain a deeper knowledge of the market, regardless of who it is or how reliable that source appears.

For example, I have my sources:

- I have three favorite YouTubers, and I follow each of them for different reasons: altcoin research, technical analysis, and an alternative viewpoint/approach.

- On Twitter, there are several people with the same three names.

- I also pay attention to all of the major projects that I am interested in on Twitter, Telegram, and Discord.

- There are a few of Patreon's premium services.

- Finally, a few newsletters and websites like Coinbureau or CoinMarketCal, for example

I remain vigilant and always seek further information before solidifying any decision.

It's difficult to make investment choices if you only have one source of information, especially because what might be a great investment for one person may not work for someone else due to different risk tolerance, entry point, or goals.

Mistake #3: Your lack of a strategy.

What are your risk tolerance and desired return on investment? When do you want to take some money out of the market for a profit or cash out (either re-enter at a lower price or completely cash out)?” Is it short-term or long-term that you're investing in?

Considering your investment strategy, responding appropriately to all of the above considerations is essential. It doesn't matter how much you spend for bitcoin if you intend to keep it for the long term; its value is almost assured to rise over time (anything can be guaranteed in crypto money!)

When investing for the extended-term, you should expect to experience fluctuations in returns. However, if you seize the right moment and buy smaller cryptocurrencies when their prices are low, your ROI may be more generous than usual. Conversely, if you invest too heavily at high costs per coin–you might not observe any return on investment until many years have elapsed.

Mistake #4: Insufficient security measures are an issue of utmost importance.

Not the most fascinating subject, but it's critical. It is essential to remember that, unlike traditional banking systems, cryptocurrency remains largely unregulated. If something goes wrong, you may face an impossibility of recovering your assets – making the stakes even higher when investing.

Since there are many fraudulent cryptocurrency influencers on social media sites like YouTube, Twitter, and Telegram, these platforms have to be extra careful of potential scammers. On Telegram especially, you'll discover a slew of phony “admin” and “tech support” accounts. They typically provide some fantastical great offers or promise to double your cryptocurrency in a short period.

Having your bank has disadvantages, such as the need to protect your private key, password, and source phrase. They should never be saved on your computer, phone, email, or in the cloud. Instead, make a copy of them and store them in a secure location (ideally also have another copy in yet another safe place).

Consider using the Brave browser if you use Metamask or a similar software wallet. It has better security and, as a bonus, it includes some interesting features, such as earning a little amount of cryptocurrency when you surf the web.

If you want to maintain security for your cryptocurrency, 2FA and YubiKey are two essential tools. If you have a higher volume of crypto, then Ledger or Trezor can provide extra protection.

Mistake #5: Basic market analysis is unknown by many.

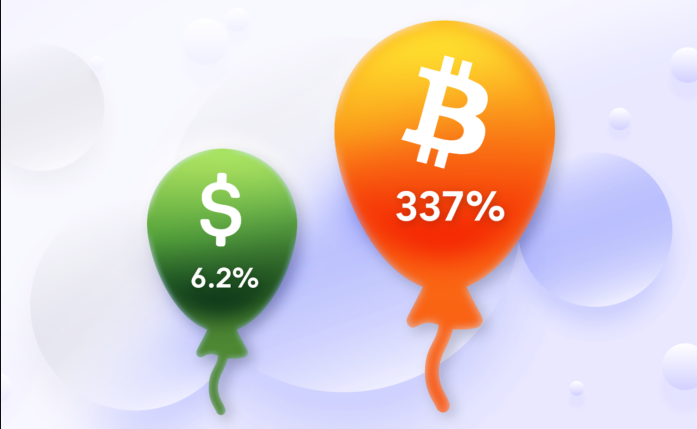

Have you ever wondered: “What if bitcoin is now worth over $30,000 and ADA or XRP reaches the same values?” If I invest right now, in a few years I'll easily make a 1,000-fold return.” No.

You'll notice that in this instance, price isn't as essential. What matters is market capitalization (market capitalization), which is the value of asset times its quantity.

As an illustration, Cardano stands at approximately $1.5 per unit and is valued at around a staggering $50 billion in market capitalization. So ADA would need to increase in value by more than 60 times for it to be worth $100 per coin (market cap of $100 billion).

Conversely, if XRP's market cap is increased to a whopping $100 billion , it'll merely have to reach a price of roughly seventeen cents apiece.

In general, smaller market capitalization cryptos have more upside potential than larger ones. The reason is that they need to increase less in value for their market capitalization to reach that of bigger crypto money.

If ADA is to rise to $100 per coin, it would have to be worth almost twice as much as the entire crypto money market or more than 4 times as much as Bitcoin.

With the rapid expansion of the crypto market, such an impressive increase in value is not only conceivable – it's likely! Before its recent downturn, the overall cryptocurrency value was estimated to be around $2.5 trillion and is likely to reach an astounding $8-10 trillion over the next twelve years! By 2033, we could easily see a significant shift in how digital currencies are perceived by society with this projected growth rate.

Nonetheless, this example demonstrates how much money it would take for ADA. You don't want to aim too high or low when looking for a profitable coin. If you're aiming to reap a 50-100x return, look no further than companies who have market capitalizations of less than $10 million! For comparisons between various cryptocurrencies, as well as their market capitalizations, trading volume, and more, Coin Market Cap and Coingecko are great resources.

Mistake #6: It's also possible that you don't have a diverse enough portfolio or are invested in too many different coins.

This is a little tricky since your portfolio's content should be determined by your goals (as in point 3). You may simply keep Bitcoin, Etherium, and/or Cardano if you just want to store coins for a long period.

Nevertheless, when investing in riskier altcoins with the aim of greater returns, it is wise to exercise caution and not overextend yourself. You can reduce your overall risk by spreading out your investments across multiple projects.

Mistake #7: Placing money in an investment where you cannot bear to suffer the loss is a highly hazardous tactic.

This should be obvious, but I want to reiterate it. You should only risk an amount you can afford to lose. Certainly, no one desires to make a costly error; however, you should bear in mind that Bitcoin is incredibly unpredictable and has the potential of leading to drastic losses. The more expansive its market capitalization becomes, the higher chance there is for volatility and risk.

Bitcoin and Ethereum are often considered dependable investments, yet they can suffer drastic losses in value of up to 70%, as seen when BTC rocketed from an all-time high of $20,000 to a heart-stopping low of around $3,200 within a year. When the market pivots again (which it always does), altcoins may experience freefalls greater than 90%, with some never recovering their original worth.

Before taking the plunge into investing, understanding and comprehending the risks involved is essential. Your circumstances and risk tolerance will determine how much money you invest and where you get it, but just be sure you're fully informed of the dangers and consider the worst-case scenario.

The Benefits of Keeping Your Crypto in an Online Wallet

A cryptocurrency is a digital form of money that requires an online wallet for safekeeping. Online wallets are more convenient but also much riskier than storing your crypto offline. They are more vulnerable to attack and hacking, and hackers can drain your entire wallet through scams or hacks. To safeguard your cryptocurrency and ensure its safety, an offline hardware wallet is the most reliable solution. This device operates similarly to a USB stick with enhanced cryptographic protection for the private keys associated with it.

Withdrawal

DO NOT rely solely on the information in this post to make trading or investment decisions. Before investing or trading, do thorough research and due diligence.