Cryptocurrency Exchange vs. Broker: What’s the Difference?

Whether you are a veteran crypto trader or just starting, the two most popular ways of trading cryptos–brokers and crypto exchanges–are likely on your radar. Even with this, distinguishing between the two options can be challenging even for those who consider themselves blockchain fans.

Unlock the mysterious realm of cryptocurrencies with a trustworthy broker! From buying to selling, these platforms provide an efficient and secure way to explore digital currencies.

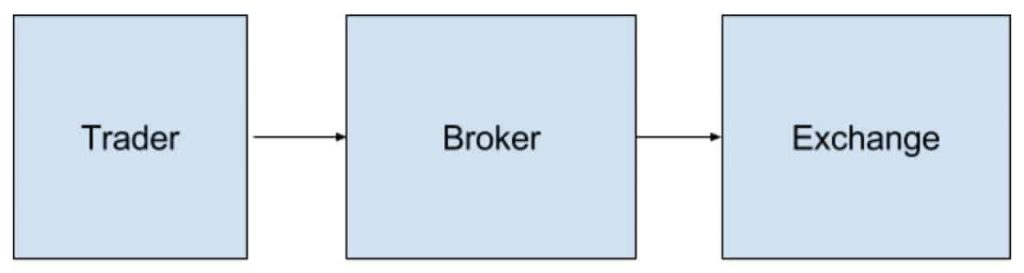

Brokers are invaluable in financial transactions, acting as intermediaries between those who require goods or services and those with money to spend. They provide a vital service by connecting people otherwise unable to secure the resources for either side of an exchange.

Bitpanda is a broker that provides people with online financial services to buy or sell cryptocurrencies. They charge users premiums for using the platform as a service.

Table of content

- The perfect method to begin

- Buying, selling and exchanging digital assets

- Exchange vs. broker

- The main difference between a broker and an exchange

- Registration and verification

- How to deposit funds into a Blockchain account?

- Trading cryptocurrency

- Security

- Revenue

- Comparison table of best cryptocurrency brokers and exchanges

- Finally, which should you utilize: a cryptocurrency broker or an exchange?

- FAQ

The perfect method to begin

Being new to cryptocurrency can be scary, and exchanging currency is different. A cryptocurrency broker offers the perfect environment for those just getting started because they will buy Bitcoin, Litecoin, Ethereum, or another form of cryptocurrency from you while allowing exchanges between fiat currencies.

Utilizing a cryptocurrency broker offers numerous benefits, including:

- Take advantage of the best prices and buy or sell your favorite cryptocurrencies through a broker.

- If you want to purchase only a limited amount of cryptocurrencies, then employing the services of a cryptocurrency broker is your best bet.

Bitpanda is a user-friendly cryptocurrency broker providing customers exceptional support through the Bitpanda Helpdesk. Moreover, users can seamlessly convert various fiat currencies, including the euro, Swiss franc, British pound, and US dollar, to popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

To begin trading digital assets on Bitpanda, register using your email address, verify your account, and choose one of the various available payment methods to fund it. Start buying and selling right away!

Our selection of services is broad enough to cover any requirement you may have.

Not only do cryptocurrency brokers facilitate trading, but they may also hold cryptocurrencies for their customers. For example, Bitpanda supports users who distrust third-party wallets by allowing them to buy and sell cryptocurrencies directly from their Trezor or Ledger hardware wallets. In this way, Bitpanda promotes user trust.

Before selecting a cryptocurrency broker, check to make sure they have the credentials and competence that you require. Your chosen broker should meet or exceed current national regulatory measures for financial services providers. Investing in a cutting-edge security system is essential to ensure 24/7 safeguarding of your assets, regardless if you are on desktop or mobile devices.

Buying, selling and exchanging digital assets

Cryptocurrency exchanges make purchasing, selling, and exchanging digital assets easier in one convenient location.

If you're looking for an immediate way to trade cryptocurrencies with fellow crypto enthusiasts, cryptocurrency exchanges provide precisely what you need – no intermediary required! These online platforms offer buyers and sellers a secure space to transact digital currencies with either other crypto coins or fiat money. The difference between an exchange and a broker is that deals let users trade directly with each rather than the middleman taking trades based on current market prices.

Cryptocurrency exchanges are ideal for holders and traders of cryptocurrencies who want to take advantage of price fluctuations through speculation, hoping to make gains or avoid losses.

For experienced cryptocurrency users

When you want to start trading cryptocurrencies, there are a few things exchange experts suggest you look into first.

A functional comprehension of the functioning of cryptocurrencies

Inexperienced traders often make costly mistakes because they need to learn the basics of crypto trading or how a cryptocurrency exchange works. The theory is essential, but so is practical experience.

To become a cryptocurrency trader, you must equip yourself with the fundamentals of how cryptocurrencies function. Once you have a fundamental grasp of the concept, begin exploring exchanges that fit your needs. One factor to look out for when choosing a business is whether they provide educational resources like lessons and articles, which can indicate Exchange's trustworthiness and reliability – especially for beginners.

We recommend reading Bitpanda Academy's beginners section if you are new to cryptocurrency. If you want to start trading cryptocurrencies on an exchange like Bitpanda Pro, get comfortable with the platform and study which strategies might be right for you.

Fiat currency markets

It is advisable to explore the payment methods offered by crypto exchanges and determine which businesses are accessible from your location. For instance, Bitpanda Pro is accessible to users in 54 countries. It provides markets for crypto-to-fiat trading pairs, including Bitcoin and Euro, Ethereum and Euro, Bitpanda Ecosystem Token (BEST), and Euro, among many others, exclusively in Europe.

User interface that is easily understood

Take advantage of all opportunities – always stay connected to your Exchange. Bitpanda Pro offers users of the cryptocurrency exchange an interface that is fully responsive and automatically scales to any device (notebook, desktop, smartphone, or tablet). Extensive user support is available via the Bitpanda Helpdesk.

Our cutting-edge trading APIs

Use API trading technology and automated trading bots for a better chance at success as a trader. Download historical market data and receive live order updates via easy-to-use REST Bitpanda Pro.

We are staying up-to-date with regulations and compliance standards.

Here at ico and borderless block, we prioritize transparency with our users. To ensure that your assets are safe, we use only the most reliable security measures regularly updated to stay current. You can trust us to keep your investments secure!

Choosing the appropriate crypto broker or Exchange is crucial to preserve your security throughout trading. Bitpanda Pro complies with the EU's fifth anti-money laundering directive (AML5) provisions and holds a PSD2 payment service provider license.

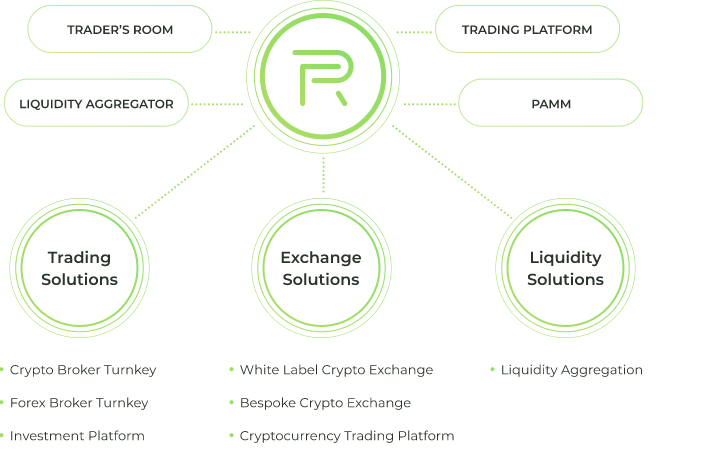

Exchange vs. broker

Note the apparent parallels between the transaction process and this one. After this, the Exchange acts as a middleman who provides the trading capability and charges a fee for this service.

There are two well-known examples of using cryptocurrency exchanges. Buying bitcoins for real money and trading different cryptocurrencies with each other occurs when you want to convert your Bitcoin for Ether.

When trading cryptocurrencies with limited funds, utilizing a cryptocurrency exchange proves to be the most effective approach, as it has emerged as the preferred platform for numerous traders, what is the difference between cryptocurrency and Exchange?

Cryptocurrency trading with limited funds is best facilitated by using a cryptocurrency exchange, which has become the go-to platform for many traders.

To put it bluntly, anyone who entrusts a broker with their funds (or crypto currency) is classified as a “depositor.” Trading is optional to benefit from the wide range of services the brokerage provides; you can take advantage of any product they offer! In certain circumstances, the broker can locate a trading counterpart; in other conditions, they may assume that role and perform the deal.

To gain a better understanding, here is an example. A client invests in Bitcoin but wishes to leverage the Ethereum/XRP pair. So, he may trade the chosen trading pair for the number of bitcoins he purchases. To transact on a cryptocurrency exchange, traders must first convert their Bitcoin to Ethereum.

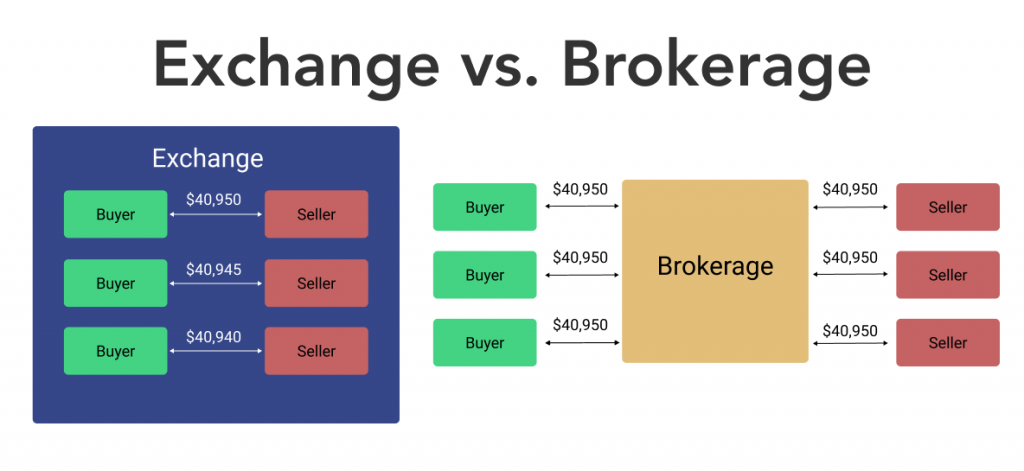

The main difference between a broker and an exchange

Ready to learn more about the distinction between a crypto broker and an exchange? Let's dive in!

Using a broker is far more advantageous than transferring funds to an offline wallet. The primary causes are security and greater liquidity, but there's also the array of services that brokers offer – like leverage trading once you've made your deposit.

Market forces dictate the value of a cryptocurrency, and its worth can increase or decrease. On May 12, 2018, bitcoin's value rose to roughly $20,500 per coin from around $6,000 in early March. -> A cryptocurrency exchange offers a straightforward way to engage in cryptocurrency trading, utilizing a trading pair order book organized based on the provided prices. It is a digital marketplace where buyers and sellers sell cryptocurrencies.

When trading gold or silver, it's essential to realize that there is the actual delivery of the traded asset on a spot exchange, but there needs to be in-margin trading with a broker.

The target audience of an exchange and a broker is one of the most significant differences. Most crypto discussions are utilized by cryptocurrency traders who want to make a long- or medium-term investment to acquire a specific cryptocurrency, after which they wait for future possible price appreciation. Buy and move those cryptocurrencies into their well-protected hardware wallet.

Speculative investors who make various trades and utilize various brokers' TA tools, such as margin trading, generally employ brokers. They need short-term or medium-term gains, and a broker is simply a means to provide them.

Registration and verification

The registration procedure varies from Exchange to Exchange. In some services, the customer must provide a valid email address that will be verified later. Afterward, they are assigned their unique password.

Others, particularly those using fiat currency, need some verification. It might be anything from a video call to a photo of a face with an ID to a scanned identity or even a complete KYC procedure, especially if a trader wants to utilize higher deposit and withdrawal restrictions.

The most extensive Exchange, Binance, allows trading without a complete KYC and a daily withdrawal limit of 2 BTC.

The verification procedure might take hours to days, but it has taken some time in the bull market of 2017-18, with some exchanges needing much longer and others not opening new accounts due to high demand.

Registering with a broker follows a similarly straightforward process, but the broker must undergo verification due to official regulations. In most cases, the individual who registers most commonly needs to provide identification and proof of residence address, such as an electric bill or rent.

The verification procedure on the Exchange may take longer than it does on OpenFinance. The trader can deposit and begin trading once the account is verified.

How to deposit funds into a Blockchain account?

Cryptocurrency exchanges offer two distinct methods of transferring and receiving funds. The first is to use traditional currency, which might be problematic. If you don't submit your deposit in Bitcoin, most exchanges will charge a hefty fee – and many do not accept fiat money.

There is often a cost for depositing fiat money using a bank account and a debit or credit card. With withdrawals, the fee is frequently more than that for a deposit. But will you be charged? Most likely, because you need the money, you're leaving. Before you purchase, look for any additional fees that might apply.

Fees are generally significantly lower when conducting only cryptocurrency deposits and withdrawals, particularly when it comes to deposit fees, as most platforms do not impose them. Therefore, you incur costs only for withdrawals.

There are several benefits to dealing with a cryptocurrency broker rather than an exchange. A broker provides myriad ways to deposit your funds, including bank transfer, debit card payment, credit card payments, e-wallet options galore, and even cryptocurrency. There are no withdrawal fees!

There is no need to pay hefty fees when withdrawing money from the broker because commissions can range from 0% to 3%, and at some cryptocurrency exchanges, the withdrawal charge might be as much as 6%.

Trading cryptocurrency

Trading cryptocurrencies using an exchange is straightforward. Most businesses provide trading via order books, allowing you to execute both a limit and a market order. The DOM (Docket Order Book) on each deal varies (DOM). Increased liquidity usually implies narrower spreads between purchase and sale orders.

Many exchanges offer only rudimentary services, which is enough for most people. Specialized discussions now also provide highly leveraged trading instruments, such as futures or open-ended swaps.

The Exchange's notable advantage lies in its platform's extensive range of cryptocurrencies available for trading.

The broker offers extended margin trading capabilities, such as CFD (Contract for Difference) trading, derivatives, etc.

Brokerage platforms commonly provide unique trading tools to help customers get the most out of their trades, such as technical analysis tools like indicators and moving averages. They also offer automated trading systems and robots that can assist traders in increasing their efficiency and risk management.

Leverage is employed in CFD trading to increase the danger. For example, if a cryptocurrency's leverage ratio is 1:2 and the price moves 5%, CFD traders can achieve a 10% gain. Alternatively, they may suffer a 10% loss, depending on the direction of price movement and the position taken.

Security

Unlike crypto exchanges, cryptocurrency dealers provide narrower spreads. It is a critical factor behind their appeal, especially for those who use margin trading.

Are you familiar with the recent incidents of theft involving KuCoin? How about the hacks that occurred at HitBTC or Mt.Gox? Likely, many of you are already aware of the frequent occurrence of cryptocurrency exchange hacks. Even prominent platforms like Binance have fallen victim to hackers and scammers, as evident from the Binance KYC data leak incident in the past year.

While crypto exchanges remain susceptible to attacks, they are not as easily penetrable. However, this doesn't imply that crypto firms are immune to hacking or fund theft. The critical distinction is that brokers are regulated entities that offer customers a certain level of monetary security. This aspect can be a significant advantage, particularly for individuals transitioning from the unregulated realm of cryptocurrency exchanges operating in foreign jurisdictions.

Brokers also tend to be well-checked by authorities, which suggests they are serious. You will feel much better about sending your valuables to a broker thoroughly examined and governed by an authoritative body like the SEC or FCA than you would send them to an unknown exchange based in a tax haven. Brokers keep their clients' money in segregated accounts, adding an extra protection layer.

Though it is optional for a crypto exchange to run effectively, having features such as these in place means that you can contact your trading partner if anything ever goes awry. While other options are available, they all come down to the same concept: having a safety net of communication and assurance when needed.

Opting to store your cryptocurrencies in a sophisticated hardware wallet such as Trezor or Ledger is far more secure than keeping them on cryptocurrency exchanges, and the reason for this should be apparent. You might have hundreds of different cryptocurrencies in a business, but you must own those assets since you have private keys.

Revenue

There are similarities and distinctions when comparing a cryptocurrency exchange's source of income to a broker's. Both charge commissions but have distinct methods for interacting with their clients.

Exchanges that trade cryptocurrency provide a plethora of trading pairs, owing to the scarcity of liquidity in the modest market depth. They usually demand more outstanding fees for their trades, withdrawals, and deposits.

On the other hand, a liquidity provider has lower withdrawal and trading costs but trades considerably larger volumes, so the total amount of commission paid may be comparable.

Comparison table of best cryptocurrency brokers and exchanges

But let's look at a cryptocurrency exchange and a broker in our comparison chart to see if they're comparable.

Finally, which should you utilize: a cryptocurrency broker or an exchange?

Ultimately, selecting a cryptocurrency broker or Exchange is an individual decision; there is no single “correct” solution. Said, each is suitable for various sorts of clients and has its own set of circumstances.

Using a broker for a large volume of transactions would be better. The broker is regulated, audited, and their money is in their bank accounts, so even if they are hacked for the same reasons as above, the client may get compensated in some manner. Professional traders can also utilize technical analysis and automated trading techniques.

The broker's services are also ideal for clients who wish to profit from cryptocurrency price fluctuations through short- and medium-term margin trading.

Cryptocurrencies, on the other hand, offer higher risks and more enormous potential profits since they provide a more comprehensive range of trading pairs, even with some more recent altcoins that have very high returns owing to volatility.

Exchange services are essential for clients who need to store cryptocurrencies (i.e., keep assets on their own) and those who want to hold long bets.

Different people will benefit from each answer. Remember that you are handling your valued money, so do your homework and do more research before spending it.

FAQ

⚡️ What is the difference between a stock exchange and a brokerage firm?

There are several things to consider when getting involved with a spot market. In a spot exchange, the actual asset is delivered in person, while in margin trading with a broker, only the underlying asset is traded rather than the physical item.

⚡️ Is cryptocurrency a broker or an exchange?

The Crypto.com app is the official mobile application from which you may buy and sell cryptocurrencies in a secure, user-friendly platform. It's also known as the Secure Store, where customers can purchase digital assets with credit cards or other payment methods like wire transfers and ACH deposits. It's more natural to consider Crypto.com a crypto bank rather than

⚡️ Do you need a broker to buy cryptocurrencies?

You don't need a broker to purchase bitcoins. You could go straight to a reliable Bitcoin exchange and buy them independently. Or, if you're looking for something more specific, like derivatives, consider finding an experienced cryptocurrency broker who can provide the product immediately!

⚡️ Is cryptocurrency safer on an exchange or in a wallet?

Keeping your Bitcoin in a wallet is typically viewed as more secure than storing it on an exchange, but you should carefully consider all the factors before deciding which option is best for you.