How to Buy a Bitcoin Crypto Coin?

With the recent Blockchain and Bitcoin craze, it feels as if there's nowhere that hasn't been impacted. People are talking about the potential to make money everywhere you go. While some have made a fortune, others have lost just as much.

Surprisingly, many people see cryptocurrency as intangible when in reality, it is becoming more prevalent in our everyday lives – whether we use it for investment purposes or as to mean of payment. If you're wondering how to get started with buying bitcoins, look no further! We have outlined the steps required for trading this innovative digital currency below – so don't delay and start your journey into cryptocurrency today.

Table of content

- What is Bitcoin?

- Decentralized model

- Double spending is impossible

- Anonymity and continuous access to the network

- Bitcoin may not be switched off

- What is a 51% attack?

- So what about fees?

- What are altcoins?

- How and where to store bitcoins?

- How to Purchase Bitcoin Utilizing PayPal

- The Tutorial: How to Buy Bitcoin With a Credit Card

- When should you buy bitcoin?

- Rate and trend

- What is the definition of a downplay?

- What will the bitcoin value be in 2024?

- What else to invest in besides bitcoin?

- Conclusion

What is Bitcoin?

Utilizing cutting-edge cryptographic technology, Bitcoin revolutionizes the traditional peer-to-peer payment network and enables secure and swift funds transfer between people. It is an entirely decentralized currency with no single point of failure.

Despite the continuing debate among scientists and governments on what bitcoin is, whether an asset, a currency, a commodity or even just a collector's item; its origin lies in blockchain technology.

A bit of history:

The technology that gave birth to bitcoin has been evolving for decades, and cryptographers have refined the ideas worldwide.

The critical development of the bitcoin network occurred 13 years ago when Satoshi Nakamoto published a file describing it in 2008. While the individual or group of people behind the pseudonym is unknown, they have made a significant impact on digital currency. Where to buy bitcoins?

Bitcoin's birthday was on January 3, 2009. On this day, the first block and the first 50 bitcoins were generated. When we look back in history, the global economic crisis occurred about the same time as depicted in the film “Low-down game.” That will be discussed later.

The bitcoin graph was a clear reaction to the widespread corruption and avarice that plagues traditional banking. People were being taken advantage of by banks in an unjust manner, so this chart emerged as a solution for fair and equitable financial transactions.

Decentralized model

Unlike standard money that is managed by a central organization, Bitcoin operates independently on the decentralized network and has no authoritative power. Individual user-maintainers maintain the network. Furthermore, the decentralized system shields you from the danger of having your bitcoins seized. Only those who have access to your key may access your bitcoins. This is 100 percent protection, in theory. The most important aspect is to keep your keys safe.

Double spending is impossible

Although the issue was not experienced by everyone, fraudsters are often responsible for it in the financial world.

Preventing double spending is a vital principle of the Bitcoin network that sets it apart from more traditional financial institutions. On the bitcoin blockchain, users are unable to spend their bitcoins multiple times in contrast with banks that allow this form of transaction. As such, individuals can be assured that when they send money over the Bitcoin platform it will only reach its designated recipient once – allowing for peace of mind while handling digital payments securely and efficiently.

While the Bitcoin network verifies transaction #1, it will not be possible to send transaction #2 until the network accepts transaction #1. On the one hand, this exposes you to danger, but it equally levels the playing field for all paid participants.

Bitcoin transactions are irreversible. Once you have secured the required number of approvals, you can be confident that your bitcoins are securely recorded and will only transfer to other wallets with your authorization.

Anonymity and continuous access to the network

While bitcoin transactions are anonymous, you may always follow the origin, destination, and several bitcoins sent – today, yesterday, and 12 years ago.

All data is kept on the blockchain network. The FBI has already discovered how to trace wallet ownership, but the objective of blockchain is not anonymity. Rather, it is to log every action on the network without manipulation or falsification.

Bitcoin may not be switched off

Bitcoin is a dynamic network that operates 24/7 – an always-on feature with no predetermined fees, making it the perfect investment option for any savvy investor. If you send a large sum of money, your commission is practically nothing.

There is a notion that bitcoin may be destroyed by cutting off the internet. (It's doubtful anyone will do this.)

The network does not need high speeds to operate; it will suffice to use the existing phone network and radio waves to broadcast information regarding bitcoin crypto transactions and continue the blockchain.

The only way to destroy bitcoin is through a successful 51% attack.

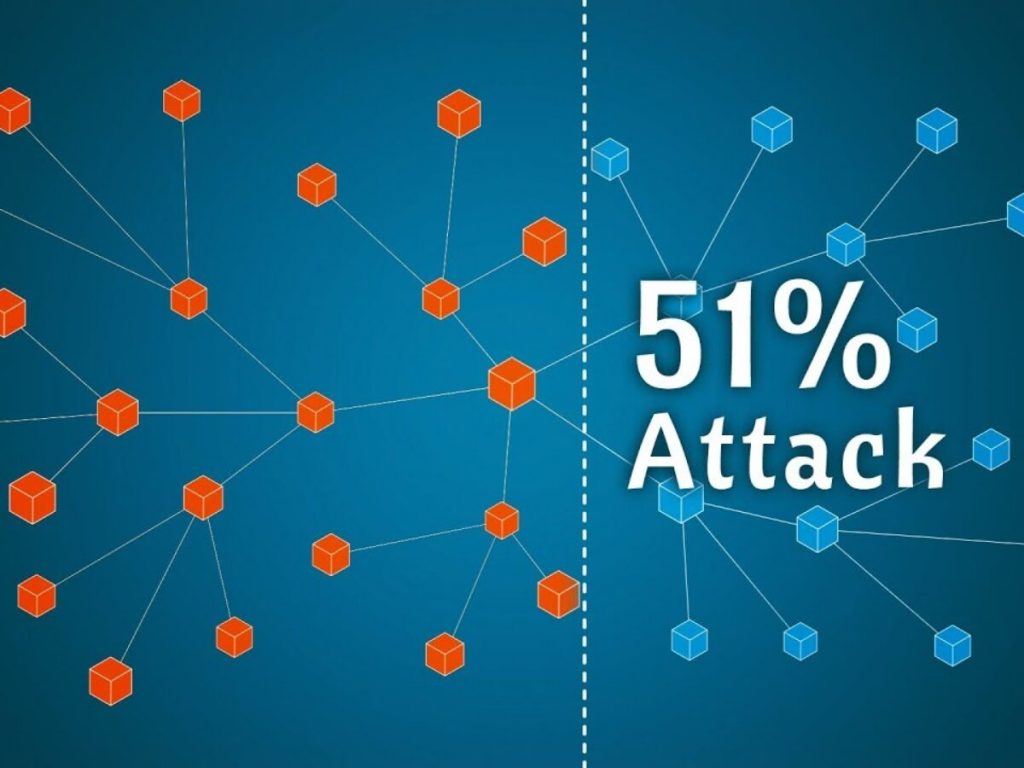

What is a 51% attack?

When a person or group obtains control over 50% of the computing power in the Bitcoin network, it can result in them having the ability to modify transactions and even establish a mining monopoly.

However, this may only be achieved if the major mining pools agree. Because the Bitcoin network is already so large, such assaults require a high degree of coordination in computing power.

Through alterations applied to the bitcoin software, a 51% attack can be prevented and disallowed by the crypto community.

So what about fees?

When sending payments, the sender is subject to a cost varying in size. This amount isn't fixed or dictated by any authority; it solely depends upon your chosen payment method and how quickly you can process the transaction. While some services may offer zero percent commissions, this won’t make much of a difference as commission rates are still determined based on how fast you're able to complete them.

What are altcoins?

It's rather straightforward:

Altcoins are all other crypto-currencies existing and emerging apart from Bitcoin. Examples of altcoins include Ether, Dogecoin, etc. There is an immeasurable assortment of them swirling around the globe with countless new ones popping up daily – yet not everyone has actual value or purpose for that matter.

Altcoins such as bitcoin, while created to benefit their developers financially, are unfortunately often referred to disparagingly by terms like ‘shitholes' and ‘shits'.

While some altcoins simply help to line the pockets of the developers, others exist to solve major issues within the cryptocurrency economy that bitcoin cannot yet address (or does so with difficulty). This was especially true in the case of smart contracts, decentralized application deployment, and ecosystem development.

Second, due to high network fees, micropayments are not viable. Third, while low transaction amounts on the bitcoin network still incur high costs, some altcoins can be sent at no charge.

Several approaches may be used to mine cryptocurrencies. While bitcoin crypto mines with electricity and processing power (using a PoW algorithm), altcoins can employ various methods, including PoS, DPoS, and so on (using an alternative algorithm).

The advantages and disadvantages of both systems are comparable. The distinction between them is minor for the average person, with the main difference being based on the quantity of commission they pay.

How and where to store bitcoins?

Ultimately, several avenues exist for obtaining bitcoins. Yet the method of safeguarding them will ultimately define who owns them – you or someone else.

The difference between dry and wet bitcoin storage is made clear.

Online wallets must always be connected to the Internet. Exchanges, internet services, and mobile applications are all examples of this. They're useful, but they have a major drawback: they might be hacked.

The most significant thing to consider is that it will not disrupt the bitcoin crypto network; instead, it will impact a middleman who gives you a wallet.

Store your cryptocurrency in a hardware wallet for safety. If you keep it in a software wallet, it's more vulnerable to attacks (or staged hacks). With a hardware wallet, you will have access to the platform where you trust to store your crypto as well as the actual physical wallets. In comparison, if there is any future hacking with software wallets (or staged hack), then all of your money could be gone.

Exchanges are by far the most common way to store cryptocurrency. This is advantageous since, if the exchange rate improves, you can quickly accomplish a transaction by selling or purchasing cryptocurrencies. It's worth noting that exchanges may be classified as centralized or decentralized. We won't go through it again, but in general, centralized exchanges have a control center while decentralized ones don't.

Because of this, if you utilize dexes (decentralized trading), your cryptocurrency is safer; nevertheless, both are vulnerable to hacking. Decentralized exchange is better for the long-term storage of cryptocurrency.

If you don't want to deal with every drawdown and rate hike, hardware cold wallets are a better option. While buying cryptocurrency is a major trend right now, it is a volatile and risky investment choice.

Unlike hot wallets, controller nodes do not rely on an internet connection. They can be described as flash drives with enhanced safeguards, while hardware cold wallets provide several security levels. The wallet's software must be installed onto a hardware device to function correctly. It's essential to keep in mind that different wallets aren't compatible with each and every cryptocurrency, so make sure you choose the one which best suits your needs.

How to Purchase Bitcoin Utilizing PayPal

You have the option to buy bitcoin through a payment processor like PayPal Holdings, Inc. (PYPL). There are two methods of purchasing bitcoin using PayPal: connecting your account to a debit card or bank account or utilizing the funds in your PayPal account balance to buy cryptocurrencies from a third-party provider. Cryptocurrencies like Bitcoin, Ethereum, Litecoin and Bitcoin Cash can all be acquired effortlessly from PayPal- except for those residing in Hawaii. If you need to spend your digital currency on goods or services, the “Checkout With Crypto” feature is available for just that purpose.

Whenever you buy bitcoin via PayPal, it earns a small amount of money from the ‘crypto spread' or the difference between Bitcoin's market price and what exchange rate it has with USD. Also, for each purchase, there is a set transaction fee that changes depending on the dollar value spent in that one specific purchase. One downside to buying cryptocurrencies through PayPal is that an investor can't move the crypto off of the payment processor's platform and into an external wallet or personal account. Few exchanges and online traders allow PayPal as a form of purchase, but eToro is one of them.

The Tutorial: How to Buy Bitcoin With a Credit Card

Although using credit cards to buy bitcoin is similar to using debit cards or ACH transfers, not all exchanges allow it because of the fees and risks that are associated with processing.

Credit card processing can add additional fees to transactions. In addition to paying transaction fees, you may also have to pay processing fees that the exchange passes onto buyers. Credit card issuers treat bitcoin purchases as cash advances and charge high fees and interest rates on these advances. Bitcoin rewards credit cards work like any other rewards card, except they offer rewards in the form of Bitcoin. For example, the BlockFi Bitcoin Rewards Credit Card offers 1.5% back in BTC on every purchase made with the card. There are some limitations to be aware of though – American Express users will pay a cash advance fee plus an annual percentage fee of 25%. Furthermore, credit card companies cap users to a monthly maximum of $1,000 worth of bitcoin purchases.

When should you buy bitcoin?

Are you planning to invest in your first bitcoin? It can appear difficult to comprehend what cryptocurrency is and how it works with its various methods of purchasing or spending. Quite a few countries have made bitcoin their official currency, while more are giving serious consideration to doing the same thing. Now that we understand the positive potential of investing in crypto such as bitcoin, it’s time for us to start buying some bitcoins! But when should you buy them?

Ultimately, there is no single answer that works in all cases. Yet, some general guidelines can be helpful and provide a foundation for many scenarios.

Rate and trend

Look at both the rate and the trend when determining how expensive a machine is.

It is critical to comprehend the present market environment while purchasing bitcoin. The most frequent blunder made by newcomers is to get caught up in a hype wave. So-called “hawks” in bitcoin generate a lot of buzzes and drive the price up. If bitcoin were a pyramid scheme, its price would only rise. However, since bitcoin isn't a pyramid, when “dumb money” enters it, it rises, then drops rapidly. This happened for example in 2017. Bitcoin rose 20 times in a year, and the vast majority of it came in the final two months, from November to December. What happened next? Bitcoin fell from 19,000 to 3.5 between late January and mid-May.

What is the definition of a downplay?

Making money through a declining bitcoin crypto market is simple. Simply purchase cryptocurrency and wait for the value to drop before selling it off for cash. If you believe that now is not the right time, put in a short-term investment and observe as the bitcoin exchange rate declines; then reap your rewards when you sell at an opportune moment!

Investing in short trades might seem like a great idea, however, much like longs, short sellers are more likely to take losses on dramatic market movements. To avoid devastating losses from wild price swings investors should always use protective stops.

Historically, more people opt to short sell than long trade. Despite the market's optimism, playing against it could be incredibly rewarding – but only if your prediction is correct!

What will the bitcoin value be in 2024?

It is paramount to remember that experts can only guarantee the accuracy of their forecasts. Although it's difficult to accurately predict Bitcoin's long-term goal of 250,000+ due to the unpredictable price changes, predictions for the near and mid future are still uncertain.

Yet it permits to invest in alternative currencies, as well as the developing sectors of DeFI and NFT.

What else to invest in besides bitcoin?

ETH and Binance Coin are the first two rows.

It all makes sense in this context. The second most capitalized crypto, ETH, is experiencing a surge in developer and user interest.

What's amusing is that ETH was little-known at the start of 2017. It was a cryptocurrency for creating decentralized apps. It sounded appealing. The only problem was that no one knew how to accomplish it or what to develop. But the potential appeared to be there.

In early 2017, one ether was worth $10. Ether rose to $1,350 in 2017 during the bull run and hype surrounding the ICO, then fell back to bitcoin's level.

While other cryptocurrencies may boast lower transaction costs or faster processing times, ether continues to evolve and remain competitive. But there is no alternative right now.

The present price of ETH is $4,350.

Binance's second unique advantage is its Smart Chain. Binance's Smart Chain is essentially the blockchain equivalent of ether. It may eventually replace ether in the future, as more and more projects are launched and operate exactly on BSC.

Now that the competition is getting more competitive by the day. Both ETH and BNB have a token-burning function. There's also a chance that BNB will implement something similar to ether's mechanism.

DOT

This project aims to develop a decentralized Web 3.0 internet. The project has a good news background (e.g., auctions), and buying DOT looks like an excellent investment against the backdrop of a large decline. The emphasis is on technology and future development in this case.

The rate is 28.30 at the time of this writing.

LINK

The second-tier coin from the preceding list. The defining feature of this technology is its ability to unite multiple blockchains, creating a bridge between them. This allows you to build databases without being limited by a single technology. To put it another way, the project destroys the barriers between different blockchain networks and ecosystems.

The LINK exchange rate at the time of writing is 22.05

CAKE

Pancake Swap's trade token CAKE has been a major success in the DeFi space and is one of the most actively traded tokens on Uniswap. CAKE can be used to enable liquidity pool staking, governance voting and yield farming. Pancake Swap also offers users access to various yield farming strategies that can help them maximize their returns from their investments.

At the time of writing, CAKE is worth $11.86.

Conclusion

We must accept the reality that bitcoin conceivably carries vast growth potential. Bitcoin's design is built to urge miners forward and, as a sweetener, its reward rate decreases steadily with each passing day.

Investing in Bitcoin is an optimal choice for long-term investors. By investing and holding the world's first digital currency, you can experience substantial returns that far exceed trading profits over time. In other words, your ROI could increase tenfold!

There are several options for purchasing bitcoin. You can go with any method you choose, from exchangers to bitcoin exchangers. It's vital to note that, wherever you may be in the world, you're not safe from bitcoin price history fluctuations (volatility).

Bitcoin's volatility has been on the decline due, in part, to bigger investors and an increase market capitalization. The more expansive the market becomes, generally speaking, the harder it is for Bitcoin (or any cryptocurrency) to have significant value fluctuations. Meanwhile, when looking at stock markets as a whole they are much steadier than Bitcoin; though this can be said of most cryptocurrencies when compared against established stocks and securities

⚡️ How do newbies buy bitcoin?

Here's how to invest in bitcoin in 5 easy steps:

✔️ Join a bitcoin exchange.

✔️ Get a bitcoin wallet.

✔️ Connect your wallet to your bank account.

✔️ Place a bitcoin order.

✔️ Manage your bitcoin investments.

⚡️ What is the minimum amount to invest in bitcoin?

The current minimum amount that you can send or receive is 5,460 satoshi (0.0000546 BTC), which is set to keep fraudulent transactions at bay.

⚡️ Who owns the most bitcoins?

The person at the pinnacle of bitcoin development is Satoshi Nakamoto, who allegedly owns approximately 1.1 million BTC across multiple wallets. Such an impressive wealth makes him an icon in cryptocurrency circles and a figure to look up to for many aspiring enthusiasts.

⚡️ Do you pay taxes when you withdraw bitcoins?

No matter the location of a Bitcoin transaction – whether it be in an overseas exchange or virtual wallet – all taxes pertaining to any sale must be submitted and paid according to the law of one's own country. This is true globally, regardless of where Bitcoins are purchased or sold.