Leveraged and Margin Trading in Cryptocurrency: What You Need to Know

Table of content

- What exactly are leverage and margin trading?

- What is the meaning of “leverage”? Leverage allows you to trade more than you otherwise could

- What is leveraged trading in cryptocurrencies?

- How to Use Leverage and Margin Trading to Manage Risk

- Crypto Leverage Trading for both Long-Term and Short-Term Gains

- What Are the Pros and Cons of Using Leveraged Cryptocurrency Trading?

- Strategies for margin trading cryptocurrencies

- 6 Things to Know Before Investing in Leveraged Tokens

⚡️ What is the best leverage for beginners?

Leverage 1:10

What is the ideal level of leverage for a novice trader? If you're new to Forex, 1:10 leverage and $10,000 in cash are excellent places to start. As a result, the best leverage for a beginner is no more than a ratio of 1 to 10.

⚡️ Is leverage good or bad?

The term leverage has two meanings: a financial instrument that enables the investor to bet more than his money and a relationship between two parties in which one is dependent on the other. Its essence is neither beneficial nor harmful. The good or bad effects of our investments' income and performance are enhanced by leverage. Take into account the potential consequences of leverage inherent in every investment you make.

⚡️ What does 20x leverage mean?

$100 might be a good benchmark for evaluating how much money you need to cover your positions. When using 20x leverage, an investor may open a significant position with $100 and still keep their account balance modest enough to avoid being wiped out by negative market movements.

⚡️ How does leverage affect bitcoin?

On a market level, the use of leverage elevates asset prices. Due to the heightened volatility of Bitcoin, its price is less predictable; thus rendering it unable to serve as a dependable savings instrument. Leverage increases exposure and makes an investment impossible to profit from at the individual level.

Before you begin, conduct some study. Are you interested in mastering the intricate art of leveraged and margin trading? If so, our step-by-step tutorial can teach you everything from generating income to assessing risk. Let us provide you with all the necessary information to make informed decisions about your investments! It is an invaluable resource for those seeking financial success!

What exactly are leverage and margin trading?

What Is Margin Trading and How Does It Work?

Although the terms “margin” and “leverage” are familiar to many people, very few understand their significance. Margin trading simply involves using borrowed money to invest in cryptocurrency.

Because it is different from conventional trading in that it allows you to use considerably more money and leverage your position, margin trading has grown increasingly popular in recent years. In plain English, this means that margin trading provides you the opportunity to make nice profits on profitable trades. However, the danger of loss is also greater.

What is the meaning of “leverage”? Leverage allows you to trade more than you otherwise could

In margin trading, you only deposit a percentage of the total amount of the order into your account. The rest is debt leveraged from the broker. This allows traders to take on larger positions than they could if they were just using their personal funds.

With leverage, you can increase your buying power up to a 100:1 ratio! This means that with just $100 in your account, you are able to trade an amazing $10,000 worth of cryptocurrency – now that's what we call making the most of it.

CRYPTOCURRENCY FORECASTS FOR 2022 – Read more in the article

Because cryptocurrencies are so unpredictable, allowing individuals to potentially profit from significant and rapid swings, cryptocurrency CFDs have become extremely popular in tradinglike eToro because margin trading allows for the creation of both long and short positions. With crypto margin trading, you can bet on the future of any cryptocurrency; whether its value is increasing or decreasing. If your prediction proves to be accurate, you could make a considerable profit from the fluctuations in price.

What is leveraged trading in cryptocurrencies?

If you understand how to use leverage properly, it allows you to make a lot more money in the same period as compared with simply investing. When you deposit funds into your account, they're separated and allocated to provide the desired leverage for each individual position.

Now is the time to capitalize on this extraordinary 1:10 leverage ratio and make a $10,000 investment into the stock market. Don't miss out on this chance! By taking advantage of this opportunity, only 10% margin will be needed instead of the normal 100%. This means that your investment would only require $1,000 from you! With no leverage used in trading, you'd have to put down the full amount of cash upfront; this is significantly more than what's needed when leveraging.

Subsequently, a rise in your stock will significantly benefit you financially. In other words, leveraged bitcoin trading requires a lot less money to generate the same amount of money. Conversely, it is just as imperative to remember that if the stock value drops, your profits will be reduced.

How to Use Leverage and Margin Trading to Manage Risk

By using leverage and margin trading, investors can manage the risk of their portfolios.

Margin trading can be a lucrative endeavor, but it carries the potential to put your capital at risk. Arguably the most hazardous element of margin trading is its capacity to magnify losses in an instant. To mitigate these risks, I urge you to consider some preventative measures that may reduce danger and maximize rewards.

A stop loss is a risk management tool that allows you to close a trade at a certain point in case the market moves against you. Adopting this strategy is imperative in order to comprehend the potential financial risks posed.

We can all agree that losing money is not desirable. When it comes tomargin trading with Bitcoin, only invest an amount you're comfortable parting ways with if need be. If your losses surpass 5% of the account balance, you may be in too deep and should consider exiting the position right away. To guarantee a smooth ride when investing in cryptocurrency margin trading, ensure you have sufficient funds set aside for repayment of principal as needed.

Take Profit: You may put a Take Profit order in place to close your position when profits reach a certain amount, as opposed to using a stop loss. Since cryptocurrency is so unpredictable, it's often best to exit before the stock takes another tack.

Negative Equity Protection: Some trading platforms will absorb the loss and reset your equity to zero if market circumstances cause your equity to become negative for an unforeseen reason. This is eToro's protection mechanism.

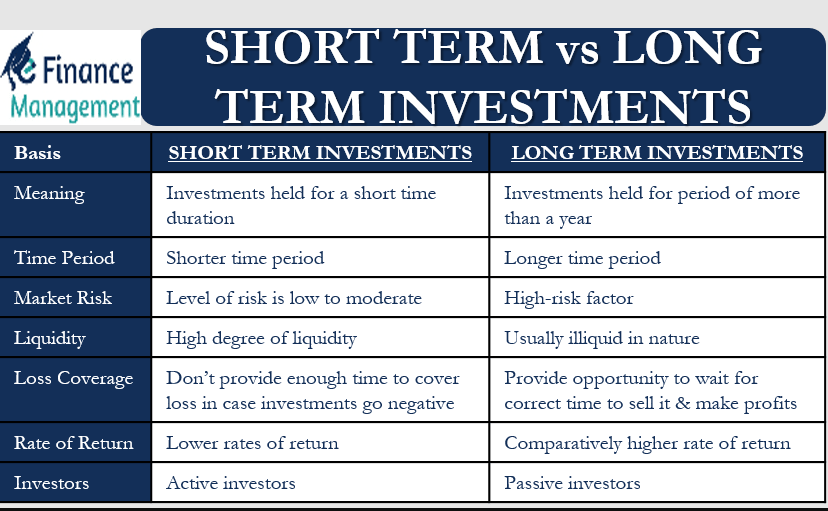

Crypto Leverage Trading for both Long-Term and Short-Term Gains

You can use leverage to trade both upward and downward trends. Taking a long position usually means that you expect the asset's price will go up. Conversely, opening a short position suggests your belief that the asset's value will drop.

Trading cryptocurrency with leverage and holding long positions.

To grasp crypto leverage trading and long positions, let's take a look at an example. Suppose you open up a long position on Bitcoin with $10,000 and 10x leveraging – in this case your collateral is merely $1,000. By taking advantage of the leverage feature, if the value of Bitcoin goes up by 20%, you will make profits of over ten times what you would have without leveraging: that's a whopping $2,000!

Nevertheless, if the worth of Bitcoin dips by 20%, you'll lose a total of $2,000. With your initial collateral at only $1,000 this would automatically terminate your position prior to the full amount being reached. Ultimately resulting in liquidation and ultimately reducing your balance to zero.

Margin trading and taking short positions on cryptocurrency.

Let's assume that you plan to initiate a $10,000 short position on Bitcoin with 10x leverage. You borrow Bitcoin from somebody and then sell it at the present market price. My pick to trade with 10x leverage, you can sell $10,000 worth of Bitcoin while only having a collateral of $1,000.

Conversely, if you had borrowed 0.25 Bitcoin and sold it when the price was $40,000, then at a 20% drop to $32,000 – you could repurchase your asset for an unbelievable amount of only $8k! You would have made a profit of $2,4000.

If Bitcoin jumps by 20% to $48,000 though, you would need an extra $2,000 to repurchase the 0.25 BTC. But with only $1,000 left in your account at that point, your position will be forcibly closed instead.

What Are the Pros and Cons of Using Leveraged Cryptocurrency Trading?

Both advantages and disadvantages are inherent in every trading strategy, including margin trading cryptocurrencies. Overall, this approach has advantages and disadvantages that balance each other out.

The allure of higher profits is sure to captivate you, yet there's an increased likelihood that you may suffer greater losses if your trades turn sour. Similarly, you may easily and expeditiously diversify your portfolio at the expense of considerably more risk than other trading strategies allow. The table below provides additional instances:

Advantages

- ✔️ Increased profits

- ✔️ Diversification

- ✔️ Given the limited amount of money, you can only afford to speculate on low-risk ventures.

- ✔️ It teaches you how to be patient and cautious.

Disadvantages

- ❌ Extreme losses

- ❌ Trading at a high risk

- ❌ highly volatile Markets can rapidly deplete your assets.

- ❌ for novices, it's a lot more difficult

Strategies for margin trading cryptocurrencies

There are several methods for margin and credit trading in cryptocurrency. Here are some of them to consider:

- A possible way to limit risk when you're just starting is, to begin with, small positions and then increase leverage as you gain experience.

- Practice trading with a demo account. You may learn the ins and outs of trading with leverage using a so-called demo account, such as eToro's, which allows you to practice without risking any real money.

- Set objectives clearly and minimize risk. Having a solid risk management plan as well as clear profit targets can go a long way in assisting you to avoid making emotional judgments that might result in losses.

- Split up your bets. Taking steps to reduce risk is another approach to minimizing it. You can, for example, make a series of profit orders to take profits gradually rather than all at once when your single profit threshold is met.

- Limit the time you trade – Consider limiting how long you keep any position to protect against unexpected price drops and long-term market corrections.

6 Things to Know Before Investing in Leveraged Tokens

You should only feel comfortable acquiring cryptocurrencies when the value is around $4,200. However, high-risk assets like leveraged tokens should not be taken on lightly – before considering them familiarize yourself with the most crucial facts.

As cryptocurrency investing has become more popular, it has opened opportunities for people to explore trading in new types of assets. Investors with a high-risk tolerance are interested in ftx leveraged tokens.

Rebalancing leveraged tokens to keep the target leverage constant

Tokens that are leveraged have a designated amount of leverage, like three times the worth of the underlying asset. The token automatically regulates itself to preserve this level of leverage. For example, if it starts making money, it will reinvest those profits. However, should the company experience a monetary decline, it will be forced to liquidate some of its assets.

Every day, leveraged tokens are usually rebalanced. During periods of high volatility, the exchange that issues the token may have mechanisms that require it to be rebalanced as soon as possible.

The greatest risk of an investment being underwater is when a company goes bankrupt. It's tough to forecast if and how much of the value of their prior investments will be regained by investors. Leveraged tokens on Binance, on the other hand, operate differently (and more safely). Instead of having a specific

Their ease of use has made them widely popular.

Margin trading is usually complicated and needs constant attention from the trader. In comparison, leveraging tokens is an uncomplicated solution that requires minimal effort on your part.

You don't have to worry about collateral or margin (borrowed funds from a broker or crypto exchange). Rebalancing ensures that your company won't have to liquidate its assets, even if the token value falls. If the price of the tokens drops, selling some of them will raise enough cash to cover operational costs.

3. they are subject to declining volatility.

One of the most significant dangers of using levered tokens is volatility reduction, which can have a detrimental influence on investments. The finest way to grasp this idea is through comparison.

Let's assume you're trying to purchase bitcoins. You spend $100 to acquire them. The price has risen by 10% the next day, giving your investment a value of $110. However, the price falls by 10% the next day, reducing your stake by $11. Your investment will be worth $99.

If you invested $100 in a levered cryptocurrency, your investment would go up by 300% if the bitcoin price rose by 10%. A seemingly minor decrease in price can have a huge effect on your investment if it is leveraged properly. For instance, with the 30% drop of your original purchase, you would lose $39 dollars and be left with only $91! It's crucial to remember that even small adjustments in pricing can bring dramatic results.

Even if your buy and sell prices fluctuate significantly, the volatility fall destroys your investment.

4. Some crypto exchanges don't sell them.

Buying leveraged tokens might be a lengthy process, especially for US residents. These tokens are only accessible on a few crypto trading platforms and unfortunately, some of them don’t accept cash deposits.

So, how can you get leveraged tokens? Using another cryptocurrency exchange as a “entry” to deposit money and then sending the funds to an exchange that sells leveraged tokens is a popular strategy. Here's how it would work:

- Make a trade on an exchange that supports this, such as Coinbase.

- To make your move a breeze, I'm giving you the link to Coinbase so that you can quickly purchase any cryptocurrency of your preference. Stable coins such as USD Coin (USDC) are often chosen because they are steady in value.

- Exchanges like KuCoin and Gate.io may allow you to convert your cryptocurrency into a leveraged token, allowing you to profit from the rise in the value of either.

- You'll need to withdraw the cryptocurrency you sent before launching this process.

5. There may be additional costs.

There are a few risks associated with holding leveraged tokens, such as higher volatility and extra management fees. For example, here are the current management costs for two common types of leveraged tokens:

- Binance charges a fee for each day that the user maintains holdings in any of its six leveraged cryptocurrency tokens.

- The cost of maintaining leveraged FTX tokens with a 0.03% daily fee is one-hundredth the price of managing regular funds.

Because these are monthly charges, it may not appear to be significant. Consider how much money you will waste if you continue using the same bank account over a year. Binance's leveraged tokens will cost 3.65 percent, and FTX's management fees will be higher than 10 percent.

6. These are short-term investments for advanced traders.

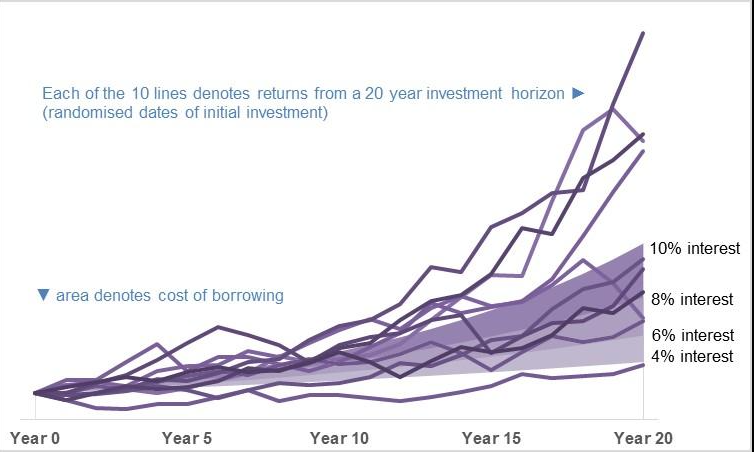

Leveraged tokens are inappropriate for long-term investments as a result of both their decreased volatility and management costs. Given that cryptocurrency is unstable if you maintain leveraged tokens, there's a chance you could end up losing money.

Gambling on cryptocurrency can be a precarious situation, nevertheless if you trust that the value of a particular digital currency will soon skyrocket or plummet in worth, then it is surely something to consider. Buying a leveraged token may significantly boost your earnings, but it's a short-term strategy for advanced traders.

The combined danger implies that levered tokens are not for novices. You could end up squandering the majority of your funds in a mere matter of days.

In most cases, cryptocurrencies are preferable to buy and hold for investors. They're already volatile enough as it is; adding leverage just adds to their volatility. If you're interested in leveraged tokens, do plenty of research and only invest money you'd be willing to lose.