What does the future hold for cryptocurrency?

Table of content

- Regulating cryptocurrencies

- What the new rule may imply for investors

- The approval of a cryptocurrency-based ETF

- What does it mean for investors if crypto-ETFs are allowed?

- Increased acceptability of blockchain among larger institutions

- What else does institutional adoption imply for investors?

- Bitcoin's Long-term Outlook

- How much will BTC be worth in 2025?

- The crypto future is bright

- Cryptocurrencies: a bright future

- Future of NFTs

⚡️ Which cryptocurrency has the best future?

✔️Bitcoin has a long history, and this will help you understand why it's so significant. Bitcoin is still a valuable investment today.

✔️Ethereum 2.0 revitalized the blockchain-based platform to provide an efficient and secure way for peer-to-peer transactions without relying on intermediaries.

✔️ Avalanche

✔️ US Dollar Coin

✔️Binance Coin

✔️Pulsation.

✔️Earth

✔️Cardano

⚡️ How much will bitcoin be worth in 2030?

In 2030, Bitcoin may be worth $1 million.

⚡️ What's the best cryptocurrency to invest in in 2022?

Bitcoin is poised to reach a remarkable $100 billion in market capitalization and there are more than 1,000 other digital currencies that could bring you even greater returns. Invest wisely as the potential for monumental profits awaits! Ethereum has shot up by nearly 600% in the past year alone. It remains the most popular altcoin amongst investors and enthusiasts; many view Ethereum as more than just another cryptocurrency.

⚡️ Why is XRP so low?

However, Ripple's price increases were extremely modest in comparison to other cryptocurrencies. After the US Securities and Exchange Commission filed a lawsuit against Ripple in November 2020, new XRP price spikes came somewhat late – just after the end of 2020 compared to most other cryptocurrencies. Despite the SEC lawsuit causing XRP's worth to dramatically decline from $0.70 to a mere $0.20, experts remain optimistic about its prospects and anticipate that it may escalate back up to $0.75 by 2021's close!

⚡️ Is PoS better than PoW?

The Proof-of-Stake approach is often called the ideal way to address crypto issues. The PoS method is used by a handful of cryptocurrencies, which is faster and more secure than PoW.

In the past year, we have seen bitcoin hit new all-time highs, followed by sharp drops and growing institutional interest from big businesses. Fall of 2017 saw Ethereum make history as it attained a remarkable peak and became the second-most valuable cryptocurrency in circulation. The Biden administration is taking an increasingly active interest in creating new rules around cryptocurrencies.

Interest in the crypto market has been rapidly increasing, making it a hot topic between not only investors but also celebrities and everyday people. From seasoned investors like Elon Musk to that guy from high school who always boasted about his Bitcoin wealth, cryptocurrency is becoming increasingly popular.

In many ways, 2021 was a “breakthrough year,” according to Dave Ebner, Gemini's head of worldwide development. [Cryptocurrency] is getting much attention and coverage these days, he adds.

This is one of the reasons why every new bitcoin high is typically followed by a substantial decline. It's difficult to anticipate where the industry will go years into the cryptocurrency future, but experts will be keeping an eye on subjects including regulation, institutional acceptance of cryptocurrencies, and more to better understand where the cryptocurrency market is headed.

We asked five experts what they're paying attention to in the crypto sector going forward, and although accurate predictions are difficult, we received some intriguing responses:

Regulating cryptocurrencies

Expectedly, the United States will be engaging in more talks about supervising cryptocurrency. Specifically, Stablecoin regulation has been a hot topic of debate.

The United States Congress is looking for ways to reinforce security measures and regulations that will make bitcoin more secure for investors, while also rendering it less attractive to cyber-criminals.

“Regulation is undoubtedly one of the most significant issues in the crypto sector all over the world,” Jeffrey Wang, CEO of Amber Group's US division, told CNBC. “We would enthusiastically embrace clear regulation.”

The US Federal Reserve Chair Jerome Powell has brought a sense of relief to the cryptocurrency community by announcing that he does not plan to prohibit digital currencies such as Ethereum in America.

Gensler has gone so far as to say that investors would “certainly” suffer if no extra regulation is implemented. Moreover, the IRS is devoted to making sure that investors comprehend how to list virtual currency on their tax filings. Powell and Gensler's remarks are congruent with the Biden administration‘s and other lawmakers' focus on cryptocurrency regulation in recent months.

Its a complex and risky technology, which is why many governments are hesitant to regulate it. “There are several agencies that may or may not have authority over everything,” says Wang. “It differs from state to state.”

The US should continue exploring the benefits of cryptocurrency and blockchain technology while implementing clear and concise regulations. This will allow businesses and investors to operate with certainty and help to further develop this innovative technology.

What the new rule may imply for investors

The $1.2 trillion infrastructure bill that the president signed into law in November includes cryptocurrency tax reporting provisions that may assist the IRS in monitoring American cryptocurrency activity. Experts believe that investors should maintain records of any gains or losses incurred from their crypto assets regardless of whether new legislation is approved.

The new regulations might also make it simpler for investors to correctly declare cryptocurrency transactions.

The $1.2 trillion infrastructure bill the president signed into law in November includes cryptocurrency tax reporting provisions that may assist the IRS in monitoring American cryptocurrency activity. Experts believe that investors should maintain records of any gains or losses incurred from their crypto assets regardless of whether new legislation is approved.

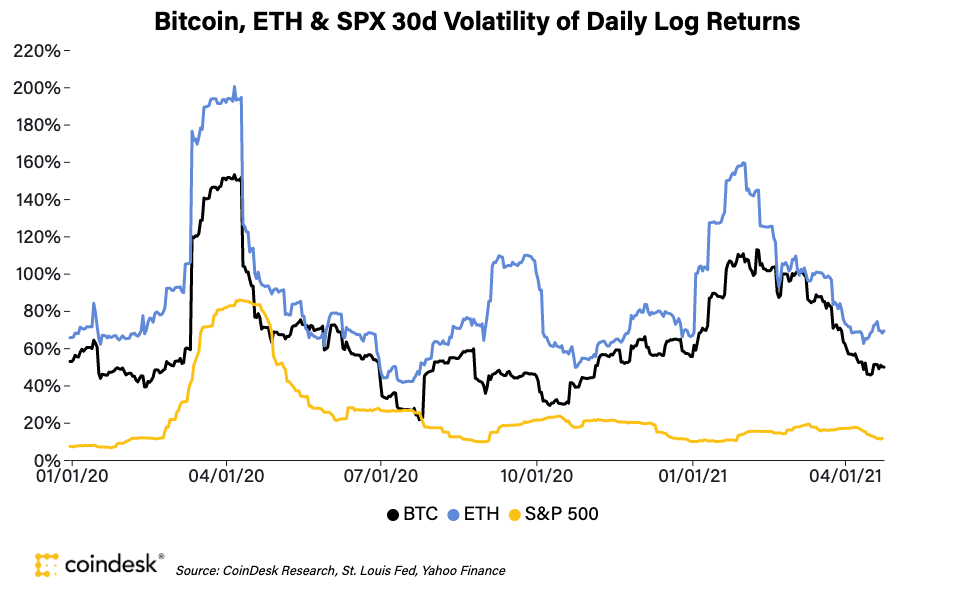

In already volatile markets, regulatory statements might send the price of cryptocurrency plummeting. It's due to market volatility that financial experts advise keeping any bitcoin investments under 5% of your whole portfolio and never putting money into something you can't afford to lose.

Many experts feel that regulation is ultimately beneficial to the sector. “Reasonable regulation is a win-win for everyone,” according to Ben Weiss, CEO, and co-founder of CoinFlip, a cryptocurrency purchasing platform and network of crypto ATMs. “It gives consumers greater trust in crypto, but I think we need to take our time and get it right.”

The approval of a cryptocurrency-based ETF

History has been made in the crypto field with the introduction of New York Stock Exchange's bitcoin-ETF (exchange-traded fund) last October. This is a turning point that will revolutionize cryptocurrency trading and investment opportunities. The advent of the Bitcoin-ETF represents a new and more conventional technique to buy cryptocurrency. BITO is the Bitcoin-ETF that allows investors to purchase cryptocurrencies directly from existing cryptocurrency exchanges. The cryptocurrency is stored in a trust and the investors don't need to worry about the cryptocurrency's price volatility or custody.

Gensler predicted that people will want to start trading in digital currencies this past summer at the Aspen Security Forum.

Some people, on the other hand, argue that the BITO ETF isn't sufficient because while it is linked to bitcoins, it does not own them directly. The fund, instead of holding bitcoin itself, holds bitcoin futures contracts. Although bitcoin futures reflect broad trends in real cryptocurrency similar to those observed in actual currency markets, experts claim that they may not be a perfect substitute.

The SEC has considered ETFs several times in the last several years, but BITO was the first to be approved.

What does it mean for investors if crypto-ETFs are allowed?

It's impossible to determine how many investors will join BITO at this time, but the fund has already seen a lot of trading activity in the first several weeks. In general, the more accessible cryptocurrency assets are available within traditional investments, the more Americans may invest and have an impact on the cryptocurrency market.

You can add cryptocurrency to your portfolio right away from the same broker you have a retirement or other investment account with, instead of learning how to trade on a cryptocurrency exchange.

However, investing in crypto-ETFs, like BITO, still has the same risk as any other cryptocurrency investment. It's still a speculative and volatile investment. If you are determined to safeguard your investment in Bitcoin, there may be more prudent choices than trading it on a cryptocurrency exchange. Therefore, investing in a crypto fund could be your best bet. Consider carefully if you are willing to take the chance that the cryptocurrency market might collapse, taking your investment with it.

Increased acceptability of blockchain among larger institutions

In 2021, several large businesses in a variety of sectors expressed interest and, in certain cases, invested in cryptocurrency and blockchain technology. By the conclusion of 2021, AMC has declared that it will be able to accept bitcoin payments.

Cryptocurrency is rapidly becoming a staple of our economy, with renowned companies such as PayPal and Square allowing customers to make payments in digital currency. This trend is revolutionizing the way we think about money and shows no signs of slowing down anytime soon. Despite having billions of dollars in LOSSES from their bitcoin investments so far this year, Tesla continues to take bitcoin payments.

THE BEST NEW CRYPTOCURRENCIES TO BUY IN 2022

According to experts, by the second half of 2018, even larger international businesses may accelerate the adoption process even more. “What we're seeing is institutions getting involved in cryptocurrencies, such as Amazon or big banks,” Weiss adds. A large retailer like Amazon might “start a chain reaction and provide legitimacy” by adopting it.

In fact, according to Business Insider, Amazon has been advertising for a “digital currency and blockchain product manager” in recent weeks. Walmart is also looking for a blockchain specialist to lead its strategy.

What else does institutional adoption imply for investors?

More shops accepting cryptocurrencies won't make much sense for most customers right now, but more merchants will likely start doing so in the cryptocurrency future. It'll be a long time before someone decides to spend Bitcoin on items or services, but further institutional adoption may lead to additional use cases for common individuals, which would subsequently influence Bitcoin rates.

Bitcoin's Long-term Outlook

By far the largest cryptocurrency by market capitalization, Bitcoin offers us a valuable look at where the digital currency industry stands now and gives clues about its future. Because of its influence, other cryptos often follow its lead – making it an excellent indicator of what to expect from each sector.

2021 was a monumental year for Bitcoin, with its price achieving an unprecedented peak of $68,000 in November! This rise exceeds past milestones of $60,000 set during April and October as well as the downward spiral to below $30,000 witnessed in July. Financial advisors recommend allocating only 5% to 20% quota from your portfolio towards cryptocurrency investments since it is still considered highly speculative.

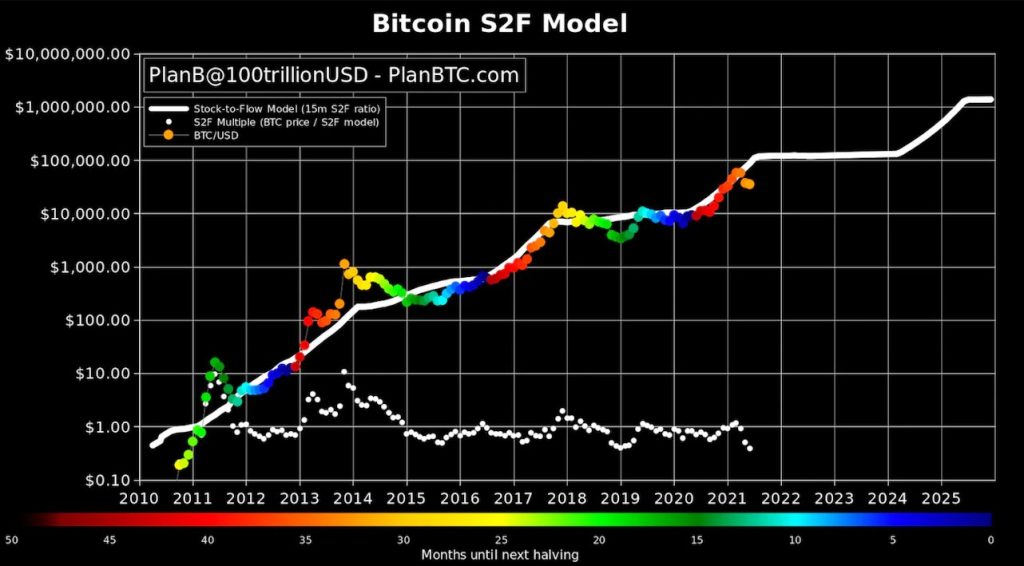

How much could the value of bitcoins increase over the coming months? Experts predict that it could skyrocket to an impressive $100,000! Kiana Danyal, author of “Cryptocurrency Investing for Dummies,” claims Bitcoin's past may provide clues to its potential future growth. Get ready; this cryptocurrency is on track to become even more valuable!

According to Danyal, there have been numerous substantial increases in the price of Bitcoin throughout 2011, with subsequent pullbacks. “I anticipate that bitcoin will experience volatility in the short term and growth in the long run.”

How much will BTC be worth in 2025?

Another cause for investors to have a long-term perspective is Bitcoin's volatility. Don't be concerned about short-term fluctuations if you're buying with long-term growth potential in mind. The greatest thing you can do is not look at your cryptocurrency investments or “set and forget.” Experts continue to advise us that when the price moves up or down, don't check your account balance every day.

Another cause for investors to have a long-term perspective is Bitcoin's volatility. When you purchase with the goal of long-term growth, don't worry about any momentary instability.The greatest thing you can do is not look at your cryptocurrency investments or “set and forget.” Experts continue to advise us that when the price moves up or down, don't check your account balance every day.

The crypto future is bright

It is true that perspectives can differ on the prospect of cryptocurrencies, but we must not forget it remains a new and speculative form of investing. Before deciding to invest in cryptoassets, remember there are no guarantees; be sure to only spend what you're OK with possibly losing and take an extended outlook on your investment.

Cryptocurrencies: a bright future

“If you awoke one morning to discover that cryptocurrencies had been banned by developed countries and had lost their value, would you be O.K?” According to Frederick Stanild of Lifewater Wealth Management in Atlanta, Georgia, “Wouldn't it suck?”

Keep your investments tiny and avoid putting cryptocurrency investments ahead of other financial objectives like retirement funds and debt paydowns.

NFTs, or non-fungible tokens, are a type of cryptocurrency that is unique and non-replicable. This makes them perfect for representing digital assets or virtual collectibles. Unlike other cryptocurrencies, NFTs cannot be divided or combined, making each one entirely unique.

Future of NFTs

However, individuals remain uncertain whether NFTs are here for the long run or are just a fad. According to DappRadar data, in June, NFT sales lowered to less than 1 billion dollars—the first time it has fallen below that mark in 12 months.

Many experts disagree about whether the recent increase in popularity for NFTs is a result of a bubble or because of the valuable intelligent contracts on blockchain technology. Though some may see this as a shameless cash-grab, others are convinced that there is far more to it.

Humphrey Yang, personal finance expert, and creator of HumphreyTalks believes that NFTs are especially trendy right now but thinks they'll stick around for the long haul. “In 10 or 20 years, I think they’ll still be around. How much we use them — that I don’t know,” he says. “People will still always find some value in communities, but the broader applications of NFTs will be more interesting.”

Recent evidence suggests that the market may be entering a cool-down period. According to a report by Chainalysis, early this year approximately one million accounts were actively buying or selling NFTs, but that number has decreased significantly to only 491 thousand. Many experts anticipate that the NFT market will continue declining due to various reasons such as falling cryptocurrency prices, inflation rates,…etc.

According to Chainalysis, the growth of NFTs slowed down after an explosive year in 2021.

What implications does NFT decline has for investors

Over the past year, people bought NFTs for a variety of reasons: some as investments while others found them simply fun or joyful. Unfortunately, the digital assets have been significantly devalued given that the crypto market has recently plummeted in value.

According to Yang, investing in NFTs is more dangerous than cryptocurrency because people are buying them with leverage. He states that people don't realize they're gambling and buy them for entertainment value.

NFTs are more risky and speculative than crypto, so you should probably stay away from them. Financial specialists suggest that long-term investors keep their cryptocurrency investment portion to a minimum (ideally no more than 5%), allocating it between Bitcoin and Ethereum, instead of NFTs.