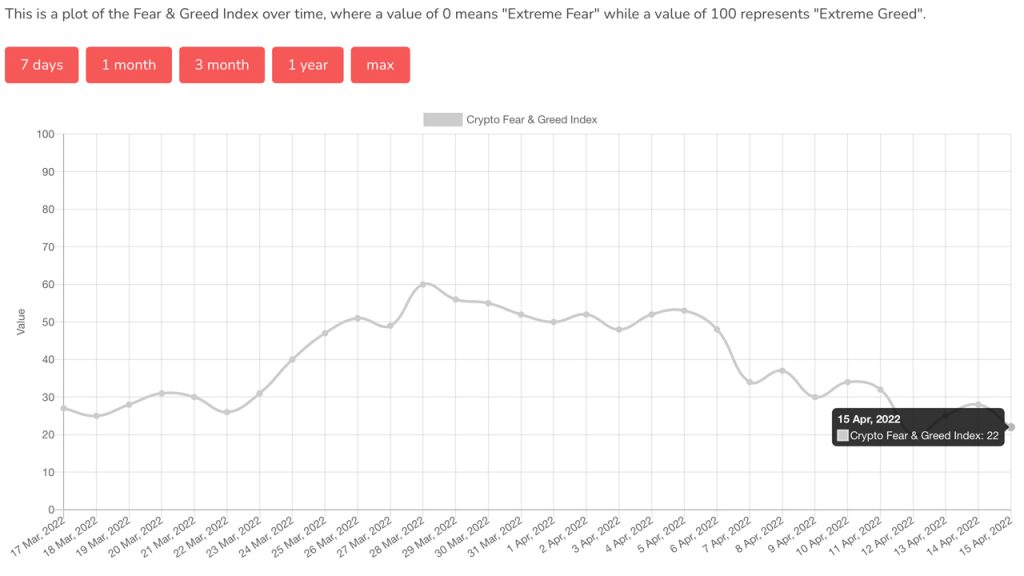

What is the Fear and Greed Index? What Influences Asset Price Movement? Crypto Sentiment Analysis

Table of content

- Visit our website to learn more about the Fear and Greed Index.

- What are the best ways to gauge investor sentiment that influences an asset's market value?

- The Crypto Fear and Greed Index measures investor sentiment to help bitcoin investors analyze market conditions.

- The Science Behind the CNNMoney Fear and Greed Index

- What does a high or low score on the Crypto Fear & Greed Index reveal to us?

- What Affects Crypto Fear and Greed?

- What Does the Fear and Greed Chart Tell You?

- We hope you enjoy this innovative and complimentary service

⚡️ How do I get fear coins?

✔️ Create a Coinbase Wallet. To acquire Fear, you'll need a wallet that supports self-storage, such as Coinbase Wallet.

✔️ Create a Coinbase Wallet account using your email address and the following information: ✔️ The name you want to use.

✔️ The recovery phrase should be securely stored.

✔️ Understand and plan for the expenses of running an Ethereum network.

✔️ Use a cryptocurrency exchange to buy and transfer your Ether to your Coinbase account.

✔️ Use your ETH to purchase Fear on the exchange page.

⚡️ How does the Fear and Greed Index work in cryptocurrency?

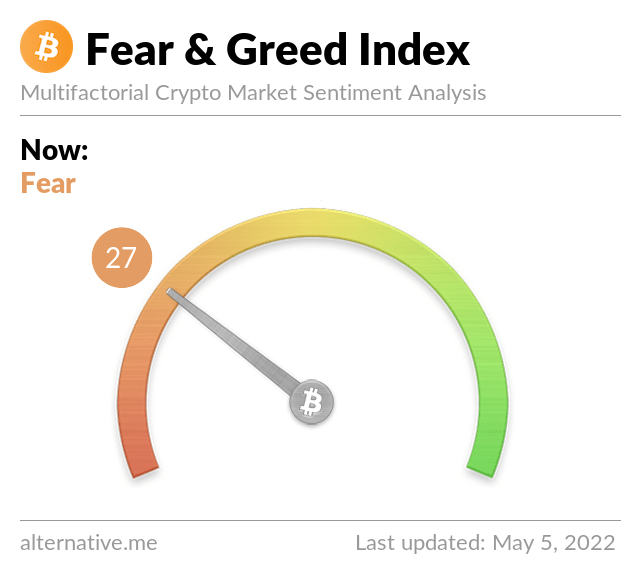

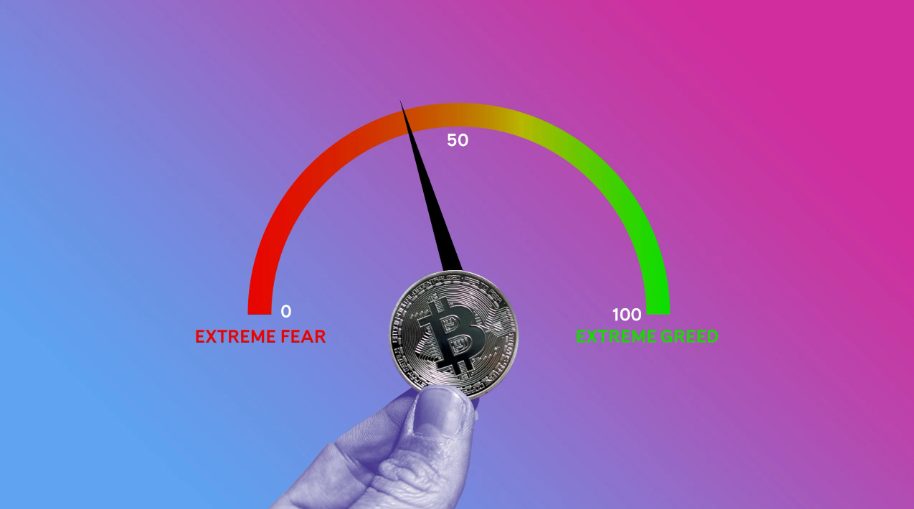

The fear and greed index crypto is a survey designed to evaluate market sentiment, which is quantified on a scale of 0 to 100. Fear resides in the lower range of this spectrum (0-49), while greed is found at its upper end (50-100).

⚡️ What does steaking in cryptocurrency mean?

Stacking allows cryptocurrency investors to use their digital assets and generate passive income without having to sell them. You might think of stacking as a crypto version of putting money into a high-yield savings account.

⚡️ Is it safe to bet?

The funds are most likely secure, since they're in a bank account. Nevertheless, it is essential to remember that even if your money appears “frozen” while you bet, this doesn't guarantee its total safety. While some exchanges claim to keep their frozen assets in cold storage, this is not always the case, and cybercriminals have taken bitcoins from major exchanges

Visit our website to learn more about the Fear and Greed Index.

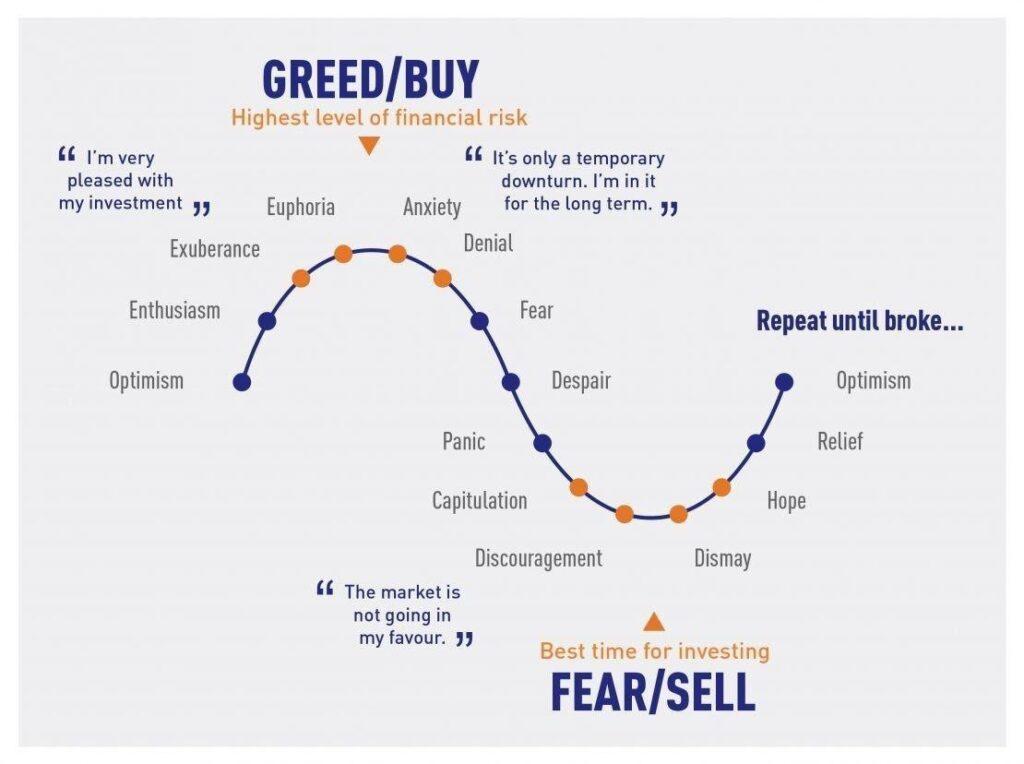

Have you ever thought that even if you have a strong investment strategy, it could be ruined in an instant by members of the market who act out of fear or greed?

Market sentiments can be influenced by a variety of incentives, such as “Fear of Missing Out,” or “FOMO” among public and private organizations and businesses who are looking into Bitcoin.

Many investors fear that the value of their investment will climb higher than it presently is, so they place a substantial number of purchase orders. As a result, the price rises.

When a mass of investors suddenly sells their assets due to panic or negative news, there is an evident change in how they feel about their investment.The market's reaction to such news is called the “fear and greed index.”

What are the best ways to gauge investor sentiment that influences an asset's market value?

Investors are concerned about preserving assets during a crisis, in which sellers in the markets put pressure on them. That's when investors use indexes as proxies to measure investor panic in the stock market.

The VIX index, commonly called the volatility index, is a reliable barometer for evaluating how turbulent or erratic the stock market has been. The trading volume of the derivatives market is used to create an index with this value.

The VIX's price action will reflect that of institutional and high-net-worth investors' investment ideas.

Another indicator that may be used to assess investor sentiment is the Cryptocurrency Fear and Greed Index, which also applies to the cryptocurrency market.

The Crypto Fear and Greed Index measures investor sentiment to help bitcoin investors analyze market conditions.

The cryptocurrency index is a tool to measure investor emotion in the bitcoin market, specifically greed and fear. It's used by analysts to study investor activity related to cryptocurrencies. Investors receive market news quickly and can make decisions immediately when significant events occur in the market, both good and bad.

Imagine if investors around the globe learned of this at the same time. It's far more likely to induce “buy FOMO” or “panic selling” in other markets than it is in equities.

When investors are panicking or greedy in this 24/7 market, the Cryptocurrencies Fear & Greed Index is used to study investor behavior and assist with decision-making.

In this manner, you are not reliant on or influenced by the market's mood, which may help investors to better execute their strategies. The index utilized in this example is taken from the alternative website.

The Crypto Fear and Greed Index is a score that investors use to understand whether the market is feeling extreme anxiety (0) or greed (100). A value of 100 implies that investors have become excessively greedy. FOMO might have sparked some buying momentum.

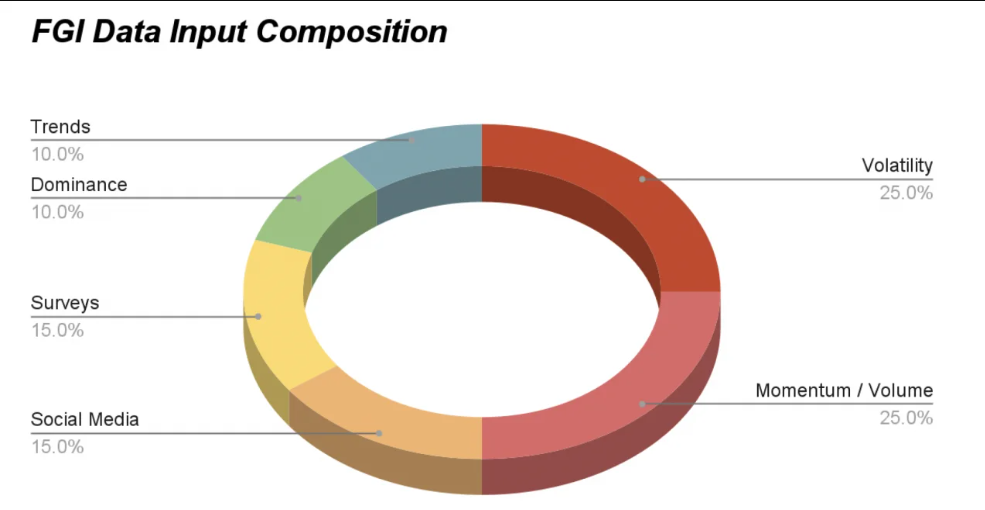

The Cryptostrategy and Greed Index are based on data from five sources, according to the website.

These sources are:

- social media (Twitter)

- Google Trends

- market capitalization

- trading volume

- price volatility.

The social media part of the index looks for mentions of “buy,” “sell,” and “hold” in tweets.

Look up certain keywords related to bitcoin on Google Trends in order to track global search interest. For example, “bitcoin price” will give you an idea of how often this particular keyword is being searched for worldwide.

CoinMarketCap.com provides us with market capitalization and trading volume data that we can rely on.

And finally, the price volatility is based on data from BitVol.info.

Regularly, the index is recalculated every hour, and you can view its performance concerning any previous week, month, or year on our website.

The Science Behind the CNNMoney Fear and Greed Index

The fear and greed index is a tool that some investors use to measure the market. This indicates that when investors are too fearful, stocks tend to be undervalued, but when they become overly confident and greedy, the stocks often go for more than their actual value. Some skeptics don't think it's a helpful investment tool because it tells you to buy or sell based on how other people feel rather than giving objective criteria. The CNN fear and greed index measures seven factors to establish the amount of fear or greed in the market, which are:

- Stock Price Momentum: The S&P 500's average price over 125 days compared to its current value.

- The NYSE is experiencing an abundance of stocks reaching 52-week highs when compared to those hitting 52-week lows.

- A technical analysis tool that compares the number of rising stocks to declining stocks.

- The differences between put options and call options can help investors understand what people are feeling in the market. Generally, if put options are lagging behind call options, it means that people are greedier. When put options surpass call option prices, this is often an indication of fear among investors.

- By gauging the spread between yields on investment-grade bonds and junk bonds, we can get a better understanding of how much appetite there is for higher risk strategies.

- The Market Volatility: CNN measures the Cboe's Volatility Index (VIX) with a focus on the 50-day MA.

- Differentiating Returns for stocks versus treasuries.

On a scale from 0 to 100, these seven indicators are classified. The index is then computed by taking the average of all the indicators, with 50 being neutral and anything higher signifying more greed than normal.

What does a high or low score on the Crypto Fear & Greed Index reveal to us?

When the index drops below 50, it could be an indication that investors have moved into a state of fear and thus present a great buying opportunity.

If the index rises above 50, it might be an indication that investors are getting greedy, which could be a sell signal.

Research is an essential step for making informed decisions, and a single measure should not be the sole factor when deciding.

Despite past achievements, there is no promise of future success. Therefore, be mindful that your results may differ from the previous outcomes.

But if you're looking for another tool to help you with your crypto trading, the crypto fear and greed index might be worth considering.

What Affects Crypto Fear and Greed?

Indexes must meet some specific criteria.

Taking into account the fact that Bitcoin's market fluctuations can have widespread ramifications, a specific set of criteria was created to ensure proper indexing. Currently, only Bitcoin is included in said index due to these parameters; however, such stipulations include:

- Gold, silver, and platinum have a combined volatility of 25%.

The figure is calculated based on volatility and the maximum bitcoin price fall-down versus the 30-day and 90-day average volatility. When volatility rises, it indicates market enthusiasm.

- 25% of a stock's market momentum/volume is irrelevant.

When the stock market inclines, this strategy requires checking out the 30-day and 90-day moving averages to determine if there's an abundance of selling activity on a specific share. This leads to investor greed in the market.

- According to the report, social media only accounts for 15% of B2B lead creation.

If you want to analyze cryptocurrencies, use a hashtag for each one. For example, #XRP. The calculation is based on the rate and number of replies.

- Surveys only result in a 15% success rate.

Opinions on a temporarily shut-down website

- My experience with this strain has been fantastic; I'm writing this review while high on it

The percentage of market capitalization is based on the price. Bitcoins and altcoins are viewed as a haven when marketing anxiety spikes, while altcoins are only used for speculative purposes.

Though analyzing Market Cap. share might give some indication of investor attitude, it's hard to say for certain as the growth in altcoin market capitalization could be from real investor interest.

- The number of brands using the phrase “like a fish to water” has increased from zero to 70 percent. The use of these words is not only popular among businesses, but also with consumers.

Google Trends is a Google tool that analyzes keywords connected to bitcoins. When the number of queries for bitcoin-related terms rises, it indicates that investors are becoming more interested in the cryptocurrency market.

What Does the Fear and Greed Chart Tell You?

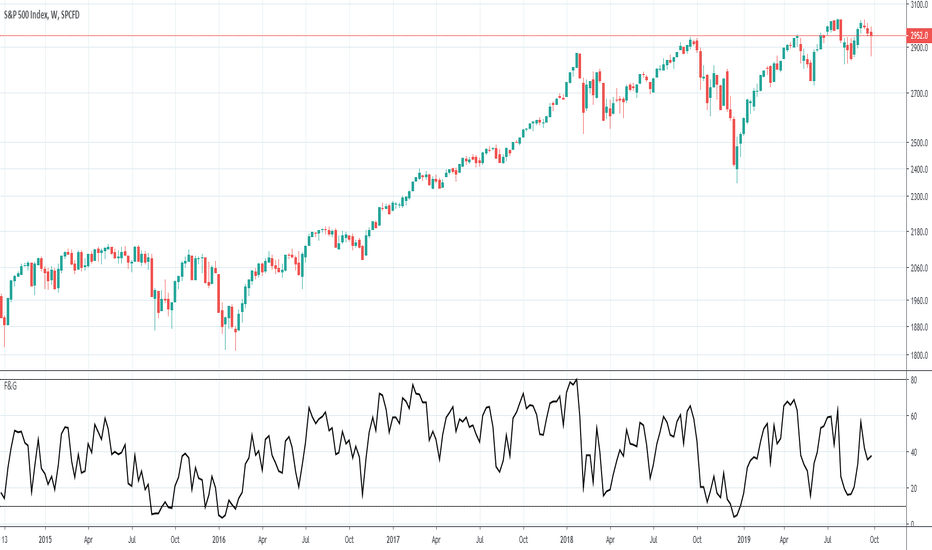

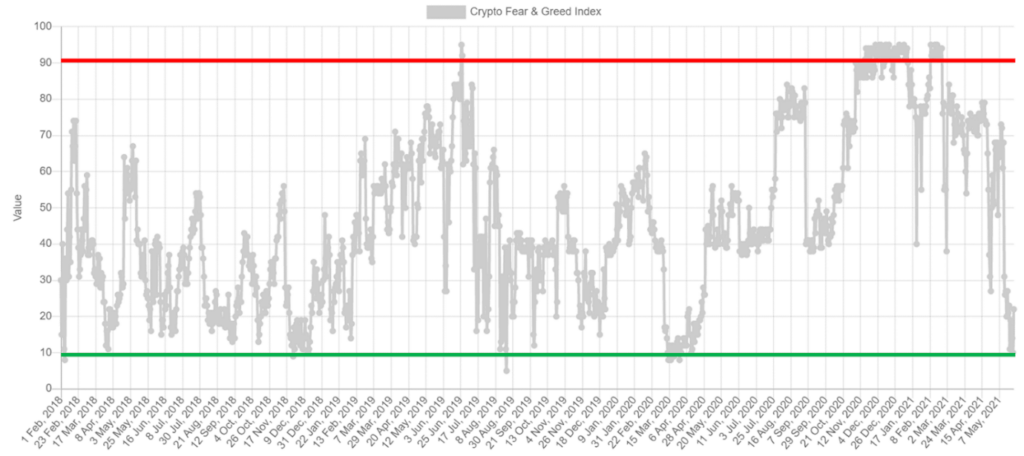

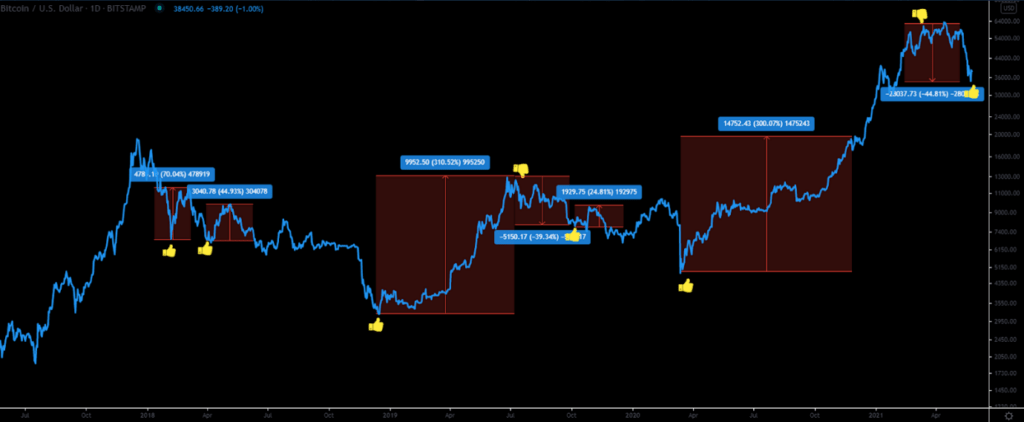

You can observe more than the current value by overlaying the bitcoin index on top of the bitcoin price graph. You will be able to see how the valuation has changed as its price shifted throughout time. This is a great tool for observing and tracking fluctuations in terms of trends or investment opportunities.

By adding this new, unique dimension to the Bitcoin Cryptocurrency Fear and Greed Index, investors can more accurately assess how the index has reacted in the past to price changes. This precious find is exclusive to this site, and no other website discussing the Fear and Greed Index can lay claim to it.

Every day, we'll update this live chart to show how the Bitcoin Fear and Greed Index changes alongside Bitcoin's price.

We also offer a Twitter bot that tweets out the current Fear and Greed Index value every day.

The Fear Scale ranges from 0 to 100, 0 meaning “Extreme Fear” and 100 signifying “Extreme Greed”.

We hope you enjoy this innovative and complimentary service

When used with bitcoins. Taking the crypto stress and greed index, as well as the bitcoin price, we see that when the crypto stress and greed index reached the green line in Figure 1 at 10, the bitcoin price rose five times.

- Increase 1 +70%.

- Increase 2 +45%

- Increase 3 +310%

- Increase 4 +25%

- Increase 5 +300% .

The combination of the crypto-strategy and greed index at 90 (the red line in Figure 1) implies that the bitcoin price will decrease twice from its peak, as follows:

- Decrease 1 -40%.

- Decrease 2 -45%.

Looking at the test results, it appears that we may utilize the Crypto Fear and Greed Index as part of our crypto investment analysis.

While an index's second purpose is to measure investor sentiment, it should not be used as a buy-sell sign. If we rely on this method, however, users may become overwhelmed by market sentiments. We may measure investor anxiety and greed in the cryptocurrency market with the Crypto Fear and Greed Index. However, it should only be used to track investor sentiment in the market, while selling recommendations based on it should be taken into account with additional criteria.

Now that you are well-versed in the Fear and Greed Index use your newfound knowledge to make more informed investing decisions. With a little research, you can double check facts to guarantee success with every purchase. That's when Zipmex comes to the rescue. To begin trading, go on the exchange!

As always, happy trading!

The Crypto Fear and Greed Index is a new tool that can be used to measure investor sentiment in the cryptocurrency market. The index is based on the price of Bitcoin, as well as other conditions like the number of Google searches for terms related to Bitcoin. You can use the index to monitor market