Uncover the Advantages of Spot Trading: Understand What It Is and How to Harness Its Power.

Table of content

- Why Is Spot Trading So Important?

- Factors to Consider

- Spot Trading's Advantages

- Disadvantages of trading in the spot market

- Spot trading is a tremendously rewarding and widely adopted investment approach involving fast buying, selling, and exchanging financial instruments.

- Spot market types

- Trading Alternatives

- Risk management in spot markets

- In Conclusion

⚡️What is Cryptocurrency Trading?

Exchanges make ideal platforms for crypto traders to exchange digital currencies into more traditional forms of money, including US dollars, euros, Russian rubles and Chinese yuan. Not only can you purchase new cryptocurrencies on exchanges but they are also a great way to mine them too!

⚡️ What is included in the spot market?

A spot market is one in which the following three criteria are all satisfied – that of transaction simultaneity, buyer's title to the goods, and seller's title to the money. The stock market, bond market, as well as other global markets for precious metals and other raw materials are examples of spot markets.

⚡️ What does spot price mean?

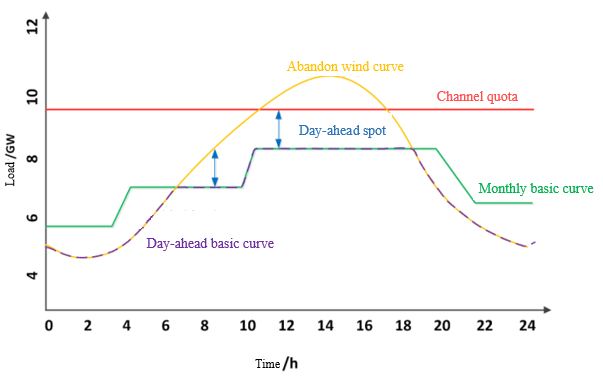

The (spot) price of products when they are delivered right away. It is opposed to forward and futures prices, which are for things to be delivered at a predetermined time.

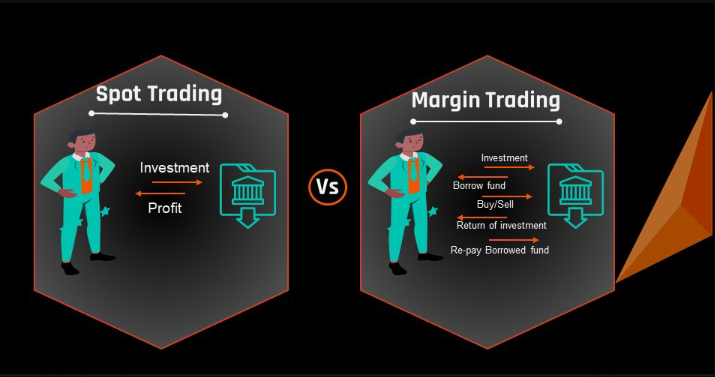

⚡️ What is the difference between a spot and a futures?

Futures contracts enable you to establish a position for 1 BTC with a fraction of the asset's value. In contrast, spot trading does not benefit from leverage. To purchase one bitcoin on the spot market, for example, you'll need hundreds of dollars.

A spot trade also called a spot transaction, is when you buy or sell an item for foreign currency with the agreement to have it delivered on an immediate date. The majority of spot contracts require that the currency, commodity, or instrument be physically delivered; meaning that there is a time value for payment in contrast to a futures or forward contract. Spot contracts are conducted in the spot market- which differentiates from future or forward markets. Forward or futures trading is the contrast to spot trading.

Why Is Spot Trading So Important?

Foreign exchange spot contracts are the most popular variety, and they are generally settled within two business days. Most other financial assets, on the other hand, settle on the following business day.

The foreign exchange spot market ( forex) is bought and sold electronically all over the world. It's the largest market in terms of volume, with more than $ trillion worth of transactions conducted daily.

Spot trading is advantageous because it is the most liquid market, with traders always buying and selling at present prices. When there are differences in spot prices between markets, savvy investors can do arbitrage trade for profit.

The spot price is the current market price of a financial product. The spot price is the selling or purchase price that can be obtained right now. Buyers and sellers contribute to the spot price by placing buy and sell orders. In liquid markets, the spot price can vary on a second-by-second basis as outstanding bids are fulfilled and new orders are placed.

Factors to Consider

Forward Price Definition

When you pay for a product at an agreed-upon date in the future, it will cost more than its market value on that day due to compounded interest accrued until then. In forex, the difference in interest rates between the two currencies is accounted for.

Other spot markets

The next business day, bonds and options are typically traded with spot payment. This involves contracts between financial institutions or a firm and a financial institution. An interest rate swap is generally settled within two days – the nearest date being referred to as the spot date. By taking part in these transactions, firms can access capital quickly while managing risk levels effectively.

Boasting a prominent reputation in the industry, two of the most renowned commodity exchanges are The CME Group (formerly known as the Chicago Mercantile Exchange) and Intercontinental Exchange – New York Stock Exchange operator. Most commodity trading is for future delivery and does not result in immediate delivery; before maturity, the contract can be bought or sold on the spot market. Spot prices are used to determine the price of a futures contract.

Spot Trading's Advantages

Smart traders that are well-versed in the operations of their markets may use trading bots to exploit market trends while limiting their risks. Smart traders who pierce the market's surface and look into its depths will find a plethora of possibilities for profit.

- When you earn money from investing, it's essential to understand that taxes will likely be due. After all, with international transactions and currency exchange taking place regularly in the market, taxation is a definite factor. Sadly there isn’t a way to guarantee zero losses; however methods like leveraging or hedging can help minimize potential deficits incurred upon filing your tax return.

- With spot trading, traders enjoy a larger return on investment as they can purchase and sell assets instantly. This method of trading is exceptionally convenient for seizing potentially rewarding opportunities in the market quickly.

- Spot trading offers an intensely rewarding platform; buy low and sell high to unlock a hefty return on your investment. Cryptocurrencies provide traders with this golden opportunity, making spot trading one of the most lucrative investments in today's market!

- The spot market is accessible to all, making it the perfect trading arena for any type of investor. With just a bit of money and knowledge, you can take advantage of big price fluctuations in order to make huge profits!

The spot market facilitates fast exchanges of crypto-tokens for fiat and other digital currencies, enabling traders to make speedy transactions.

Disadvantages of trading in the spot market

- Faced with buying assets at a higher-than-normal price on the spot market, investors are exposed to vast risks, particularly for volatile resources. Acquiring these possessions prior to their “true value” could result in significant losses if the asset's cost subsequently drops.

- If a party spots any abnormalities in the transaction after the spot market trade has taken place, there may be no regression.

- A stop-loss order is a type of trade that does not involve planning, unlike forward and futures trades.

- Because the parties must make physical delivery on the spot, the spot market is not as adaptable in terms of timing.

- The spot market is inflexible in terms of timing, as the parties must complete physical delivery on the spot.

- Counterparty default risk has an impact on the spot market interest rate.

- Due to the market maker's solvency, counterparty risk is inherent in spot market trading.

Spot trading is a tremendously rewarding and widely adopted investment approach involving fast buying, selling, and exchanging financial instruments.

To give a concrete illustration of spot trading, suppose a trader opens a short position in the EUR/USD pair (start a spot trade). According to predictions by experts and traders' beliefs, the euro is expected to depreciate against the US dollar in the future.

He sells $10,000 at 1.070 and makes a profit of $500 when the euro falls against the dollar and he purchases $10,000 at 1.020 to finish the trade.

If the dollar weakens by 50 pips, and he decides to purchase at 1.120, he will lose $500 (1.120 – 1.070 x $10,000 = $500).

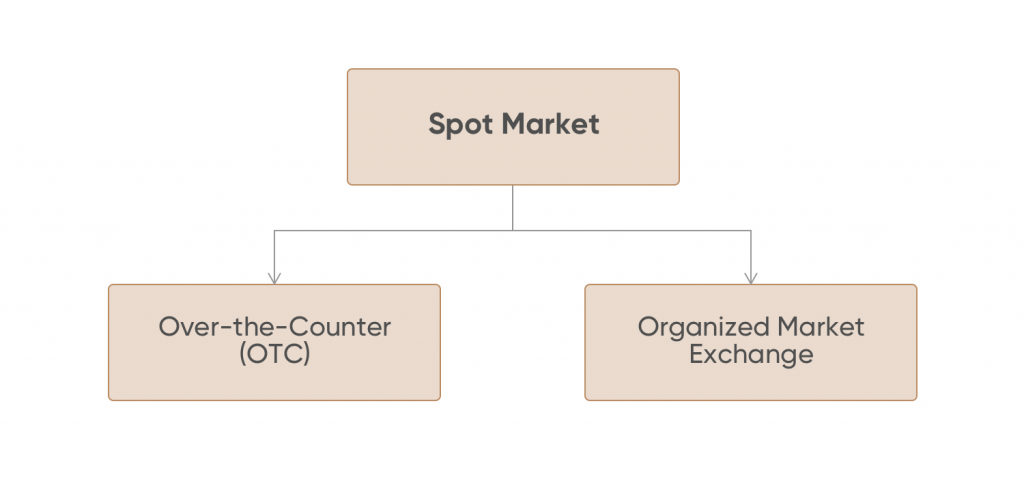

Spot market types

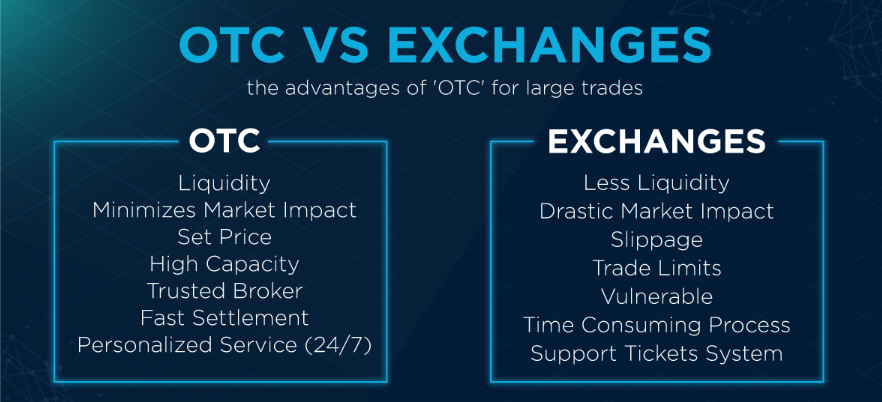

Spot exchanges come in two flavors: organized marketplaces and off-exchange, over-the-counter (OTC) markets.

An over-the-counter (OTC) market eliminates the need for a middleman, enabling buyers and sellers to connect directly and trade goods without third-party interference. The items traded in the OTC market may differ from those offered on established exchanges. OTC deals are generally private, and prices aren't always published.

A market exchange is a formalized trading floor where sellers and purchasers bid on and trade available financial assets. Investing may be performed in an open trading room or on a digital, electronic exchange. Because prices are determined instantly, thanks to electronic trading, the buying and selling procedure has been made simpler.

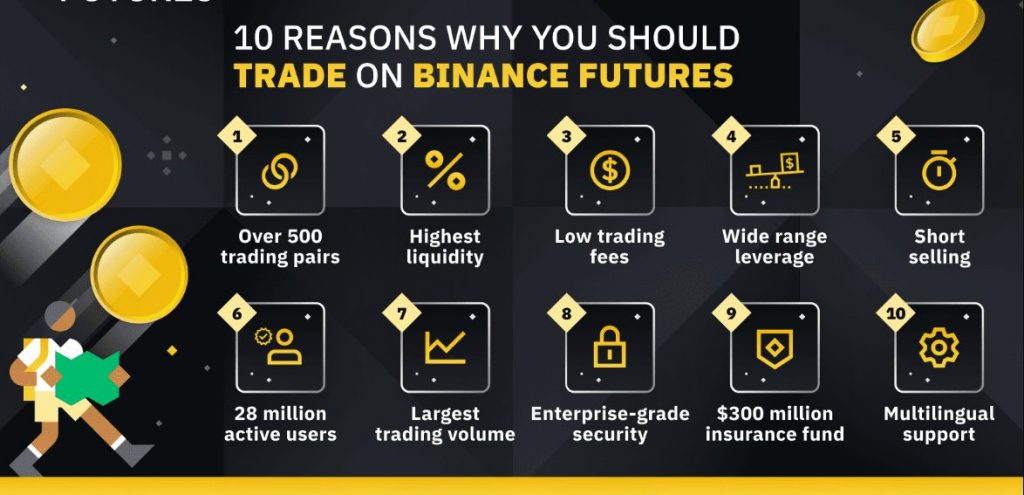

Technical traders who prefer options or futures contracts to spot trades, often look for derivatives. Spot trades are settled at the current market rate. However, derivatives provide a wide range of options which enable traders to benefit from future market movements without risking the full amount of capital they would have to commit if they were buying and selling spot trades. Options and futures contracts allow traders to hedge their positions, trade on margin and even speculate using leverage.

Trading Alternatives

A trade where neither payment nor delivery of the investment is immediate is called a non-spot trade. If traders only want to invest at specific prices and times, they can do so by using derivative contracts such as these:

It's essential for investors desiring to diversify their portfolios by taking advantage of a variety of investment options so that they understand the distinctions between spot trades and other transaction types to use them effectively.

Risk management in spot markets

Understanding the Market

Understanding how it functions is imperative to maximize your success in the spot market. This includes learning about supply and demand, price discovery mechanisms, trading conditions, and common jargon. You also need to know what other participants are likely to do as well as the regulations that govern operations on the exchange.

In OTC spot markets, traders must assess the counterparty to reduce their risk of counterparty default. It's easier to minimize spot risks by comprehending how the market works.

Determine a trading strategy

It is critical for parties trading in the spot market to adopt a trading strategy before they decide to make a trade. Traders should determine their entry and exit points for specific assets before opening a position.

Stop-loss and limit orders are used to protect against potential financial losses. Other strategies include price limits, minimum prices, and the ability to rapidly identify risk in a trade or counterparty. Stops and restrictions can help traders decide whether to continue trading, hold and wait, or end the transaction more effectively. The following are some examples of useful stops

- A limit order is designed to close your position when the price reaches and surpasses the predetermined level you established.

- Regular stop: If the market were to move against your position, On Balance will automatically close it.

- Ensure success with the ATR indicator, which adjusts your stop-loss level for you and tells you exactly when to assume a position.

- The trailing stop is a security that allows you the option of closing a trade if the price begins to move against your target position. It follows a positive price movement and closes when the price deviates from your target position.

Manage your emotions

As you trade in the spot market, it's vital to keep your emotions under check because they can influence your decisions. Fear, doubt, greed and anxiety are all examples of negative sentiments that could lead to detrimental choices which might derail your success. Remember – maintaining a composed outlook is essential for prosperous trading!

Stay informed about the latest news when subscribing to our complimentary weekly updates!

It's also critical to remain informed about current events and developments in issues that influence spot market instruments or commodities, especially when making a trade.

Spot market investors must pay attention to market sentiment, keep up with economic and financial developments, and stay informed on political and regulatory announcements. When making a spot trading decision, any news that may influence the price of a target asset should be considered.

In Conclusion

Spot markets are a great way for beginner and experienced traders alike to conduct transactions. Its immense popularity is rooted in its user-friendly design. Although spot trading is mostly easy to understand, you should still stay up-to-date with the small details listed above. In this manner, you can gain insight into this action's crucial benefits and drawbacks.

Not only should you understand the basics, but it would benefit your trading skills overall to touch up on technical, fundamental, and sentiments analysis.