Tokenomics in Gaming | A Beginners Guide

Tokenomics are creating the economic structure and function of games. Tokenomics governs the creation, distribution, and use of in-game tokens, crucial for driving player engagement and ensuring a thriving in-game economy.

This guide offers a comprehensive overview for beginners seeking to understand the fundamentals of tokenomics in crypto gaming.

Table of content

What is Crypto Tokenomics?

Tokenomics is a term that refers to the design and economic structure of a cryptocurrency or token. It focuses on a wide range of factors, including supply and demand, the total number of tokens, the distribution of tokens, and the token's utility or purpose.

A well-designed tokenomics structure can provide the right incentives for people to use the token, which can help drive adoption and increase the value of the token.

Conversely, a poorly designed tokenomics structure can lead to a lack of user interest and a decline in the token's value.

Why is Tokenomics Important?

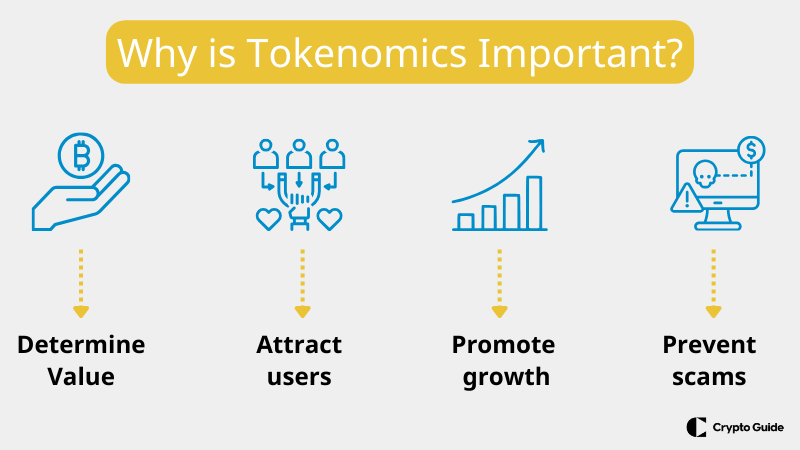

Tokenomics is important for a number of reasons:

- It helps to determine the value of a token. The tokenomics crypto structure can influence the supply and demand for the token, which in turn can affect its price. A well-designed tokenomics structure can make a token more valuable, while a poorly designed tokenomics can make a token less valuable.

- It helps to attract users and investors. A token with a strong tokenomics structure will attract users and investors more. This is because such a token is more likely to be valuable and have a clear purpose.

- It helps to promote sustainable growth. This is because such a structure can encourage users to continue using the token and can help prevent the token from becoming too volatile.

- It helps to prevent scams and fraud. A well-designed tokenomics structure can help to prevent scams and fraud by making it more difficult for bad actors to manipulate the token price or exploit the system.

In short, tokenomics in crypto is important because it can have a significant impact on the success or failure of a cryptocurrency or token. By understanding tokenomics, you can make informed decisions about your investments.

Basic Tokenomics Models

There are a number of basic tokenomics models that are commonly used in the cryptocurrency space. Each model has its own strengths and weaknesses, and the best model for a particular project will depend on its specific goals and objectives.

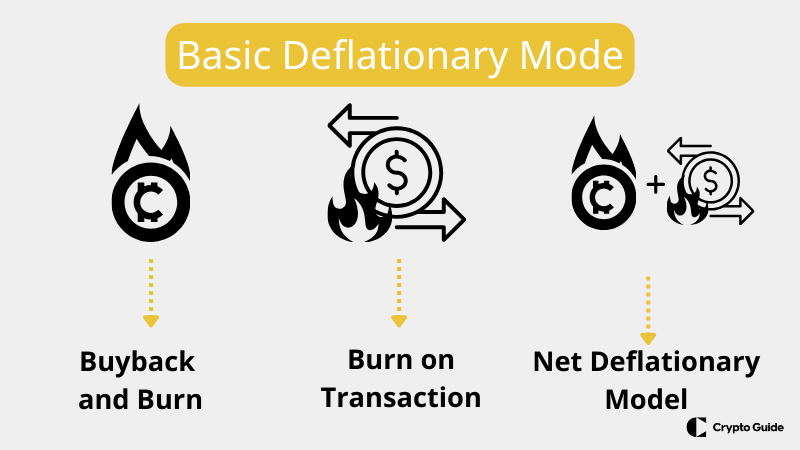

Basic Deflationary Mode

A basic deflationary model is a tokenomics model that aims to create scarcity by removing tokens from circulation. This is typically done by burning tokens, meaning they are permanently destroyed. Burning tokens can help increase the remaining tokens' value by reducing the supply. However, it can also make the token more volatile, as it will be more sensitive to changes in demand.

Buyback and Burn

In a buyback and burn model, the project team periodically buys back tokens from the market and then burns them. This is a way to increase the value of the remaining tokens by reducing their supply. It can also be a way to generate revenue for the project team.

Burn on Transaction

In a burn on transaction model, a small percentage of the tokens used in a transaction are burned. This is a way to create scarcity and increase the value of the token over time. It can also be a way to encourage people to use the token, as they will be rewarded for doing so.

Net Deflationary Model

A net deflationary model is a tokenomics example that combines two or more deflationary mechanisms. This can help to create even more scarcity and increase the value of the token. For example, a project could use a basic deflationary model and a buyback and burn model.

The best tokenomics model for a particular project will depend on its specific goals and objectives. However, all of the models discussed above can be effective in creating value for token holders.

Essential Token Mechanics

Essential token mechanics are the core elements that determine the value and functionality of a cryptocurrency or token. Below, we give a detailed explanation of each.

Coins & Tokens

Coins are native digital currencies built on their own blockchains, while tokens are digital assets created on existing blockchains (e.g., Ethereum) representing ownership of assets, utility, or access to services.

Fungibility

Fungibility refers to a token's ability to be readily interchanged with another token of the same type and value.

Fungible tokens, such as Solana (SOL) and Ethereum (ETH), are not unique and the market determines their value.

Non-fungible tokens (NFTs), however, are unique and cannot be interchanged. Each NFT has its own distinct characteristics and value, often associated with digital art, in-game items, or other collectibles.

Therefore, cryptocurrencies like Bitcoin and Ethereum are fungible, while NFTs are not.

Buyback and Burn

The buyback-and-burn mechanism is a tokenomics strategy used to reduce the circulating supply of a token by periodically purchasing the token on the open market and then destroying it, making the token more scarce.

This can be beneficial for the game economy as it can help to increase the value of the remaining tokens and make them more valuable to players.

Minting

Token minting refers to the creation of new tokens on a blockchain, typically through smart contracts. It involves generating and issuing tokens according to predefined rules, often requiring computational resources and validation mechanisms.

Issuance

Token issuance is the process of creating and distributing new tokens on a blockchain. This can be done through a variety of methods, including:

- Pre-sales. Developers can sell tokens to early investors before the token is publicly listed. This can help to raise capital for the project and generate interest.

- Initial Public Offerings (IPOs). Tokens can be listed on a cryptocurrency exchange, allowing anyone to buy or sell them. This is similar to how stocks are traded on traditional stock exchanges.

- Direct purchase. Developers can sell tokens directly to users through their website or other channels.

- Rewards. Tokens can be awarded to users for participating in certain activities, such as staking, playing games, or providing liquidity.

- Airdrops. Tokens can be given away for free to users, typically in the hope of generating interest and adoption.

Burning

Token burning is the process of permanently removing tokens from circulation, typically done to reduce supply and increase scarcity. This can be done either automatically through smart contracts or by sending them to an inaccessible wallet. The goal is to create a deflationary effect, making the remaining tokens more valuable to holders. Token burning can be used to incentivize token usage, reduce volatility, and create a more stable token economy.

Inflation

In the blockchain context, inflation refers to the gradual increase in the total supply of tokens over time. This can be caused by a variety of factors, such as token issuance, staking rewards, or transaction fees. While inflation can devalue tokens over time, it can also be used to encourage token usage and adoption.

Staking

Staking is a process where users lock up their coins or tokens in a cryptocurrency wallet to support the security and operation of a Proof-of-Stake (PoS) blockchain. In return for staking their coins, users receive rewards in the form of newly minted coins or a portion of transaction fees.

Treasury

A treasury is a specific address that holds a collection of tokens, and it manages the distribution of these tokens in a decentralized and transparent manner based on pre-defined rules. The purpose of a treasury is to ensure the sustainability and long-term growth of the project by providing a mechanism for funding future development, operations, and community initiatives.

Voting

Token governance pertains to the guidelines and protocols overseeing the management of tokens within a particular ecosystem. Having a transparent and well-defined governance model is crucial to safeguard users' interests. An illustration of such a model is Decentralized Autonomous Organizations (DAOs), enabling users to engage in the decision-making processes of an ecosystem through voting mechanisms.

Pegging

Price pegging is a mechanism in which the value of a token is tied to another asset, such as a fiat currency or a commodity. This is done to provide stability and predictability for the token, making it more attractive to investors and users. There are a number of different ways to implement price pegging, but they all share the same goal of maintaining a stable relationship between the value of the token and the value of the underlying asset.

Wrapping & Bridging

Wrapping involves converting a token on one blockchain into a corresponding token on another blockchain, keeping the value intact. Bridging, on the other hand, is the process of sending assets directly from one blockchain to another, often via smart contracts. These methods enable cross-chain compatibility, allowing users to utilise their assets across different blockchains.

Gaming Use Cases

- Axie Infinity is an NFT game, utilizing its native AXS token to incentivize players through a play-to-earn model. Players can earn AXS tokens through various activities, such as battling, breeding, and staking, fostering a vibrant in-game economy.

- CryptoKitties, is another NFT game, employing a unique breeding mechanism, allowing players to combine their NFT cats to create new, rarer ones. This sparked a craze for rare cats, driving up the value of the game's native ETH tokens.

- The Sandbox, a virtual world platform, utilizes its SAND tokens to facilitate in-game transactions and property ownership. Players can purchase virtual land, build on it, and monetize their creations through various means, creating a dynamic ecosystem.

Engaging Participants in Crypto Games

Engaging participants in crypto games hinges on a combination of factors, including compelling gameplay, innovative tokenomics, and a supportive community.

For Players

Play-to-earn (P2E) is a new gaming model that allows players to earn cryptocurrency or other digital assets by playing games. This has the potential to change the gaming industry by providing players with a way to monetize their time and effort.

Play-for-fun (P4F) is the traditional model of gaming, where players play games for enjoyment and entertainment. P4F games are typically not designed to be monetized, and players do not earn anything for their time or effort.

For Developers

Internal developers, typically employed by game studios or companies, possess a deep understanding of the studio's vision, target audience, and technical infrastructure. They contribute to the game's core design, gameplay mechanics, and overall user experience.

External developers, on the other hand, bring specialized skills and expertise to the table. They may specialize in blockchain development, NFT integration, or tokenomics design. Their contributions broaden the game's scope, ensuring it seamlessly integrates with the crypto ecosystem.

For Investors

- Backers are early-stage investors in crypto game projects, providing capital in exchange for equity or for lower price. They bear significant risks, banking on potential high returns. With a deep understanding of the crypto and gaming industries, they focus on a project's long-term potential.

- Portfolio investors, less risk-prone than backers, invest in a diversified range of successful crypto game projects. They seek moderate returns over time, relying on strong teams and tokenomics. Unlike backers, they take a more hands-off approach, evaluating market trends and potential returns rather than getting involved in day-to-day operations.

- Governors actively participate in crypto game governance, holding tokens with voting rights on crucial decisions. Passionate about the game and its community, they contribute to shaping the project's direction, aligning it with their vision for long-term sustainability.

- Crypto traders engage in buying and selling crypto game tokens, aiming to profit from short-term price fluctuations. While not directly involved in the games, they play a vital role in providing market liquidity and facilitating token exchanges, relying on technical analysis and market sentiment for decision-making.

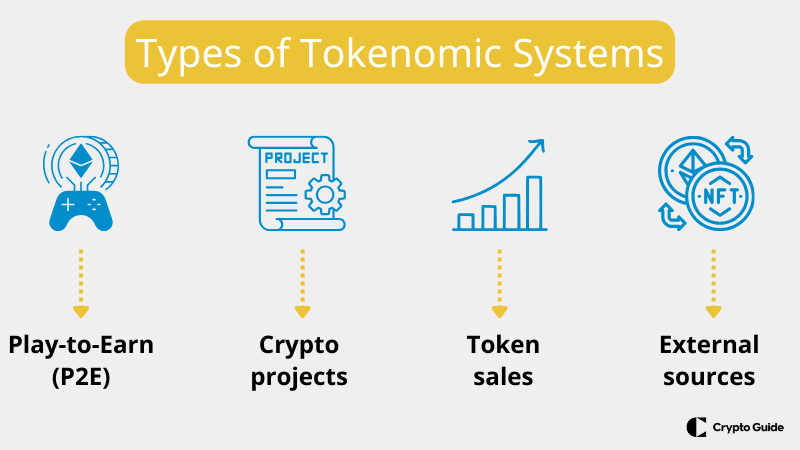

Types of Tokenomic Systems

Play-to-Earn (P2E) changes gaming by allowing players to earn cryptocurrency or digital assets during gameplay. In P2E games, tasks like winning battles or completing quests yield tokens, tradable for real-world money. These competitive, skill-based games offer players achievement and ownership, fostering a vibrant community.

Crypto projects often use tokenomics to allow holders to vote on decisions like development roadmaps and fund allocation. Token holders may receive extra tokens, a share of project profits, creating a passive income stream and encouraging token retention.

Token sales, where projects sell tokens to raise capital, are common in the crypto space. While they provide funding, they carry risks for investors, emphasizing the importance of thorough research before participation.

External Sources. Some crypto projects generate revenue by integrating with external dApps or NFT marketplaces. This not only introduces a new income stream but also enhances token liquidity for the project.

Challenges and Risks in Gaming Tokenomics

- Tokenomics Challenges. Creating fair and sustainable tokenomics systems is critical, facing issues like price volatility, short-term player focus, and potential centralization. Balancing the needs of players, developers, and investors adds complexity.

- Gameplay Challenges. Integrating blockchain and tokenomics poses gameplay challenges, requiring interactions with smart contracts and crypto wallets. Some systems may lead to less enjoyable gaming experiences.

- Regulation and Governance. Regulatory uncertainty and intricate governance structures present hurdles for blockchain-based games. Developers face challenges navigating regulations, while diverse stakeholder interests complicate governance.

- Community Challenges. Building a thriving community is crucial but faces skepticism from players unwilling to manage crypto wallets. The speculative nature of cryptocurrency markets hinders trust-building.

- General Risks. Beyond specific challenges, risks include security vulnerabilities, evolving legal status, and market volatility. Potential hacking, legal actions, and token value fluctuations impact players and investors.

FAQ About Tokenomics in Gaming

What is tokenomics for a game economy?

Tokenomics for a game economy is the economic design of the game, determining how tokens are created, distributed, and used within the game.

What are the tokenomics problems?

Tokenomics problems include price volatility, short-termism, centralization, and gameplay complexities.

What is good tokenomics?

Good tokenomics is fair, sustainable, and incentivizes player participation and enjoyment.

Why do we need tokenomics?

We need tokenomics to create a thriving in-game economy and balance the interests of various stakeholders.

What are the key factors to consider when looking at tokenomics?

Key factors to consider when looking at tokenomics include token distribution, utility, governance, and economic sustainability.