10 Risks of crypto investment: Why Bitcoin and Etherium Might Not Be Worth Investing

Table of content

- Is cryptocurrency secure?

- Cryptocurrency has several inherent dangers

- We are only just beginning to see a widespread embrace of cryptocurrency.

- Is cryptocurrency a viable long-term investment?

- Bitcoin is an attractive investment for cryptocurrency investors.

- Long-term investment in Etherium

- The verdict is still out on whether cryptocurrency is a wise investment.

- Is it worth investing in cryptocurrency?

- The stock market's meteoric ascent is driving the expansion of cryptocurrencies.

- Large businesses are increasingly involved in the cryptocurrency market.

- Cryptocurrency may produce capital gains and steady revenue.

⚡️ Is cryptocurrency safe?

⚡️ Is Bitcoin real money?

⚡️ Why is cryptocurrency so popular?

⚡️ What is the most purchasable cryptocurrency?

What is the smallest cryptocurrency?

If you want to invest in digital currency, buying shares of cryptocurrency-related firms is a safer but potentially less profitable alternative.

Is cryptocurrency secure?

Despite the legitimate apprehensions about the safety of cryptocurrencies, certain signifiers point to the permanence of cryptocurrency.

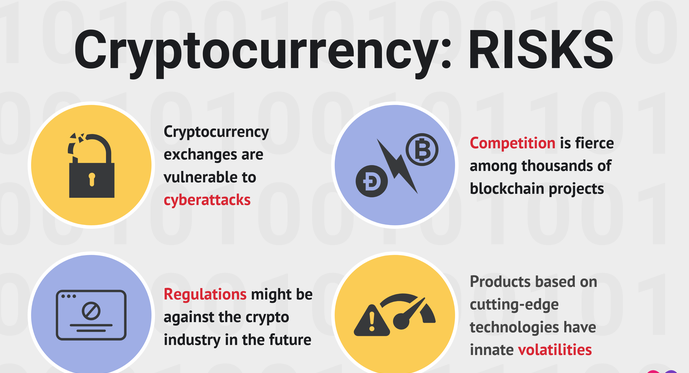

Cryptocurrency has several inherent dangers

Cryptocurrency exchanges are more prone to hacking and other criminal acts than stock exchanges. Security breaches have resulted in significant losses for investors who have had their digital assets stolen, prompting several exchanges and third-party insurance firms to start offering protection against hacking.

Storing cryptocurrencies is more difficult than keeping track of equities or bonds.Despite this, most people are unwilling to keep their digital resources in exchanges for the same rationale they wouldn't carry physical money around with them- fear of being robbed.

If you keep your digital currency on a centralized exchange, you are not the sole possessor of those resources. If the government orders a shutdown of exchanges, or if your chosen exchange becomes insolvent, it could be impossible for you to retrieve your funds.

Offline cold storage solutions, such as hardware wallets, are popular among cryptocurrency owners. Offline storage has its drawbacks, though. The most serious hazard is losing your private key; without it, you will be unable to access your crypto funds.

There's no assurance that the cryptocurrency project you crypto investment in will succeed. Only a select few crypto-based initiatives have managed to survive long enough to remain standing strong in this increasingly competitive landscape.

Regulators may also go after the crypto sector as a whole, especially if governments perceive cryptocurrencies as a potential danger rather than a cutting-edge technology.

The complex technological elements of cryptocurrency also increase investors' risks.

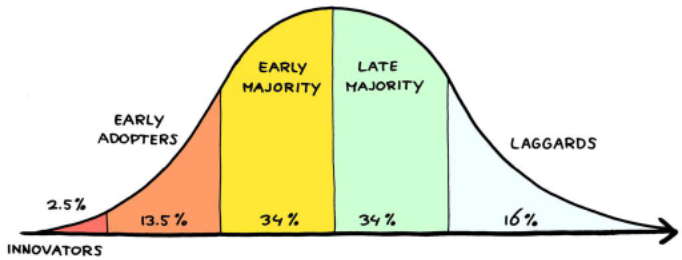

We are only just beginning to see a widespread embrace of cryptocurrency.

Adoption is one of the most important drivers of cryptocurrency prices. As the usage and acceptance of crypto assets increase, so too will their value.

Currently, cryptocurrency is in its pioneering phase. Taking into consideration the inherent risk, this investment opportunity has remarkable potential for increasing in value.

Cryptocurrency futures markets are being developed, and many businesses are gaining direct access to the sector. Financial behemoths such as Block ( NYSE: SQ ) and PayPal ( NASDAQ: PYPL ) are making it easier to purchase and trade crypto on their popular platforms.

Other businesses, including Block, have crypto investments of hundreds of millions of dollars in bitcoins and other digital assets. In early 2021, the tech giant Tesla made a bold purchase of 1.5 billion in bitcoin, demonstrating their confidence in cryptocurrency and blockchain technology. The electric automobile maker said it had over $2 billion in cryptocurrency by February 2022.

In 2020, Microstrategy (NASDAQ: MSTR) -a business intelligence software firm-began accumulated bitcoin. By the end of 2021, it had $5.7 billion in cryptocurrency and said it would use the extra money generated from operations to purchase more.

The growing rate of adoption is an indication of the industry's maturity, as is the rise in individual investors and businesses wanting direct access to cryptocurrency.

Despite its advancements, crypto still has a long journey ahead of it before becoming broadly accepted. Only a small percentage of the world's population currently owns any digital assets, and even fewer use crypto regularly.

Is cryptocurrency a viable long-term investment?

Cryptocurrencies like Bitcoin and Etherium have the capability to totally transform our economy, with a grand objective in mind. While it's impossible to predict whether any particular cryptocurrency will be successful, investors who get in early on a project that ends up succeeding can be rewarded handsomely down the line.

For a crypto project to gain widespread acceptance and long-term success, the public must perceive its potential.

Bitcoin is an attractive investment for cryptocurrency investors.

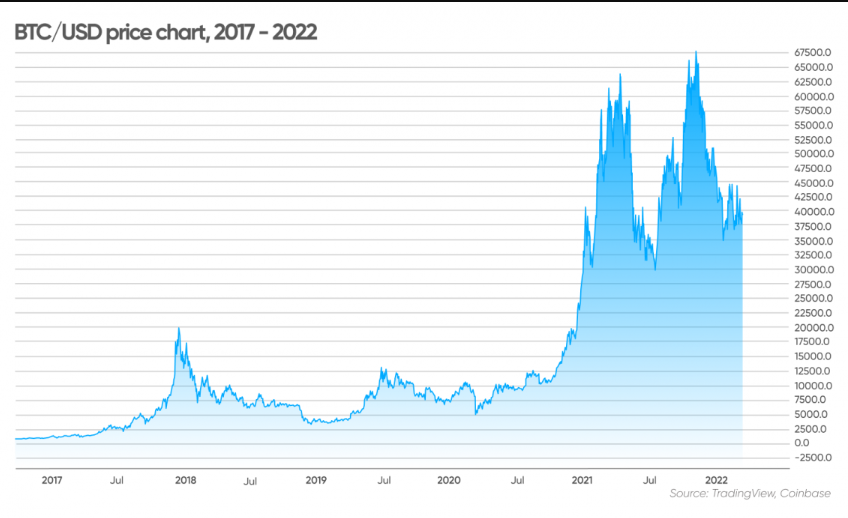

Because of the network effect, bitcoin benefits from it – more people want to own bitcoin because most individuals already do. Bitcoin has been dubbed “digital gold” by many investors due to its precious metal-like qualities, but it may also be used as a means of payment.

Bitcoiners anticipate that the crypto's market cap will ascend long-term due to its constrained supply, unlike most fiat currencies like the US dollar and Japanese yen which have a maximal sum. The quantity of bitcoin is restricted to less than 21 million units, whereas most currencies may be printed as many times as desired by central banks. Much crypto investment is buying bitcoin not to use it as a currency but because they expect its price will continue to rise.

Long-term investment in Etherium

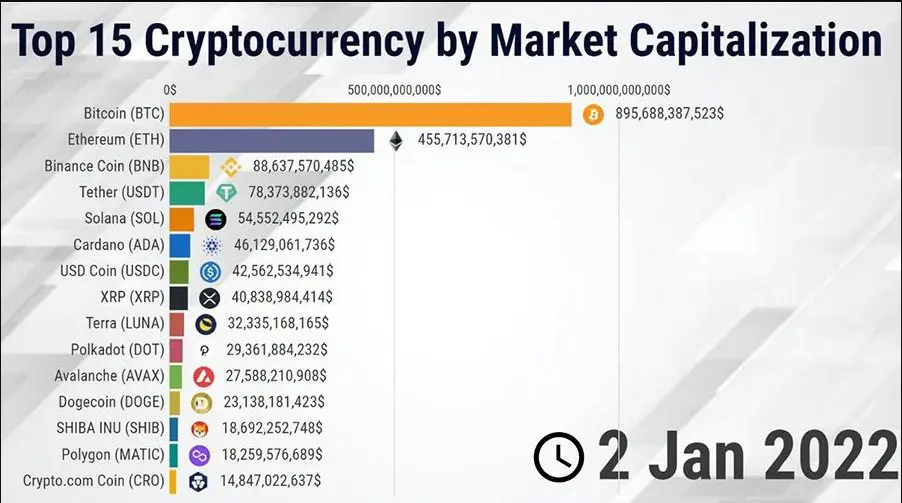

Ethereum is a decentralized platform that allows digital contracts, which may be executed automatically. The Ethereum network's native currency is called ether, and it can be acquired by investors interested in investing in the Ethereum portfolio. While Bitcoin is often associated with being virtual gold, Ethereum establishes an international computing architecture that supports many other cryptocurrencies as well as large ecosystems of decentralized applications.

There is potential for Ethereum to profit from network effects and create long-term value due to the number of cryptocurrencies created on its platform, as well as its open-source decentralized app design. “Smart contracts” which are automatically carried out depending on pre-set criteria embedded in the contract code, are possible thanks to the Ethereum platform.

Ether is generated as a reward for executing smart contracts on the Ethereum network. Smart contract technology is capable of revolutionizing whole industries, like real estate and banking. Furthermore, it possesses the power to create unpredictable business models which are broader and larger than ever before.

With Ethereum rapidly gaining traction globally, the Ether token is becoming increasingly valuable daily. Investors confident in the long-term prospects of the Ethereum platform may profit immediately by purchasing Ether.

Ether needs to have apparent competition. Several “Ethereum killers,” such as Solana ( CRYPTO: SOL ), Polygon ( CRYPTO: MATIC ), and Avalanche ( CRYPTO: AVAX ), are built to process smart contracts and use a blockchain system that can handle more transactions per second. Speed not only drives efficiency, but it also benefits consumers through cost savings. Ethereum stands out as the most popular platform for deploying smart contracts.

The verdict is still out on whether cryptocurrency is a wise investment.

Cryptocurrency is Gamble- Although it has the potential to turn into a large sum of money, cryptocurrency is still a very unreliable investment.

By investing in a variety of cryptocurrencies, you can protect yourself from potential losses in one holding. Prices for different digital assets may change at various rates and over time, so owning several types of crypto provides some insulation against a decline in any single investment.

Is it worth investing in cryptocurrency?

cryptocurrency stocks market in the past, buying some cryptocurrency may help diversify your portfolio. If cryptocurrency usage increases over time, investing in crypto directly as part of a well-diversified portfolio is probably beneficial.

Always have an investment thesis for each cryptocurrency you invest in, especially if it is your first time. Have an end goal or plan for how long to keep each investment. You can manage and reduce your overall risk by learning as much as possible about cryptocurrencies before investing.

The stock market's meteoric ascent is driving the expansion of cryptocurrencies.

Even though classic stocks remain the benchmark of investment returns, crypto investments possess the potential to generate much higher profits.

The S&P 500 index skyrocketed by a staggering 94%, while the NASDAQ Composite Index surged even higher to reach 144%. These markets are experiencing tremendous growth and success!

However, bitcoin isn't the most successful cryptocurrency in the space; many other tokens have achieved greater gains than it has.

Don't limit your crypto investment potential to just Bitcoin – there are plenty of other digital currencies that offer equal or even greater returns! Ethereum and BNB have seen tremendous increases of 7000% and 10,000%, respectively! For those wanting to spend their ETH next year, our guide on the best Ethereum wallets is just right for 2022. Don't miss out on capitalizing on this lucrative opportunity; check it out now!

If you look at some of the top Metaverse cryptocurrencies on the market, the returns get even more impressive. Decentraland and its MANA token, for example, have increased by more than 25,000 percent since their introduction.

Large businesses are increasingly involved in the cryptocurrency market.

Some of the world's largest and most potent businesses now use bitcoin, validating that the sector will continue in the long run.

By the end of 2020, Tesla had stormed onto the market with a powerful $1 trillion worth and began adding bitcoin transactions to its balance sheet totaling an impressive $1.5 billion!

Cryptocurrency has become mainstream with businesses like Starbucks, Microsoft, PayPal and Overstock leading the charge. With just a few clicks you can make transactions in seconds – paying for everyday needs is now easier than ever with Bitcoin!

Cryptocurrency may produce capital gains and steady revenue.

Another key factor driving interest in cryptocurrency is that digital assets enable you to profit both online and offline.

Initially, as mentioned before, if you possess crypto and the price of that crypto rises on the open market, then your cryptocurrency holdings will be profitable.

However, you can also deposit your digital tokens into cryptocurrency savings accounts to earn passive income on top of that. If your crypto invests your bitcoin in Aqru, for example, you will receive a yearly return of 7 percent.

If you invest in a cryptocurrency and store your tokens securely, you will keep profiting as the token's value increases.

If investing in cryptocurrency feels daunting to you, there are several other ways for you to benefit from its growth. You may invest in companies like Coinbase, Block, and PayPal or exchanges like CME Group (NASDAQ: CME), which enables bitcoin future trading. While investing in these businesses might be lucrative, they don't have the same potential as buying cryptocurrency.