$287 Million Fades Away in Bitcoin ETFs, The Most Significant Loss in Four Months

Tuesday was a difficult day for the U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs), as worries about growth and a sell-off in Nvidia (NVDA) weighed on investor mood.

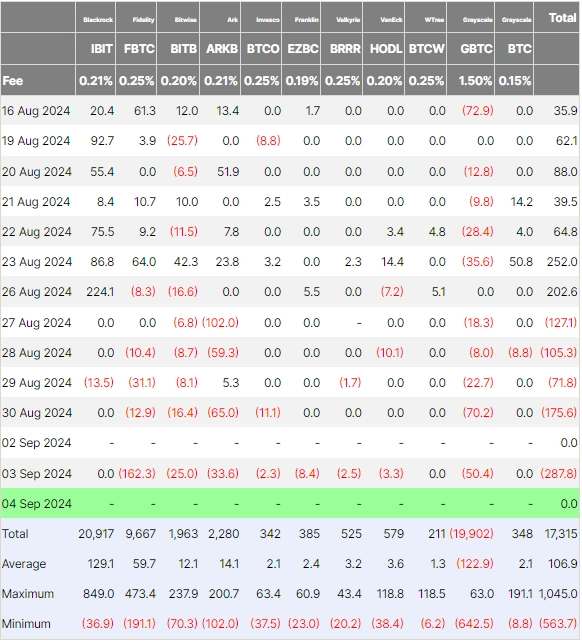

According to data monitored by Farside Investors, the 11 ETFs saw a cumulative net outflow of $287.8 million, the biggest one-day total since May 1, when the funds lost nearly $500 million.

Fidelity's FBTC was the most popular withdrawal option, with $162.3 million in withdrawals. Others accounted for the entire cumulative outflow, with Grayscale's GBTC recording an outflow of $50.4 million and BITB and ARK losing $25 million and $33.6 million, respectively. The IBIT for BlackRock closed at zero for the second day in a row.

Tuesday saw a 2.7% decline in Bitcoin's price to $57,500, reversing Monday's increase. The U.S. ISM manufacturing PMI fell below 50 in August, indicating a persistent decline in activity, which led to the losses. The statistics rekindled concerns about growth and put riskier assets, like cryptocurrencies, under pressure.

In a Telegram broadcast, the cryptocurrency OTC liquidity network Paradigm stated, “A miss in the manufacturing PMI rehashed fears of an economic slowdown, with Nvidia leading the sell-off, losing 9.54%.”

$47.4 million was also taken out of Ethereum ETFs. A $52.3 million withdrawal from Grayscale's ETHE fund was somewhat offset by an inflow of $4.9 million into Fidelity's FETH ETF. Farside statistics indicate that the cumulative outflows for Ethereum ETFs have now hit $524.8 million.

After four days of a 4% decline, the price of bitcoin is currently at $56,500.