$3 Billion ETH Vanishes from Exchanges Post-SEC ETF Approval

In just over a week since the United States Securities and Exchange Commission (SEC) approved spot Ethereum (ETH) exchange-traded funds (ETFs), cryptocurrency exchanges have experienced notable ETH outflows. This highlights the influence of regulatory decisions on market behavior.

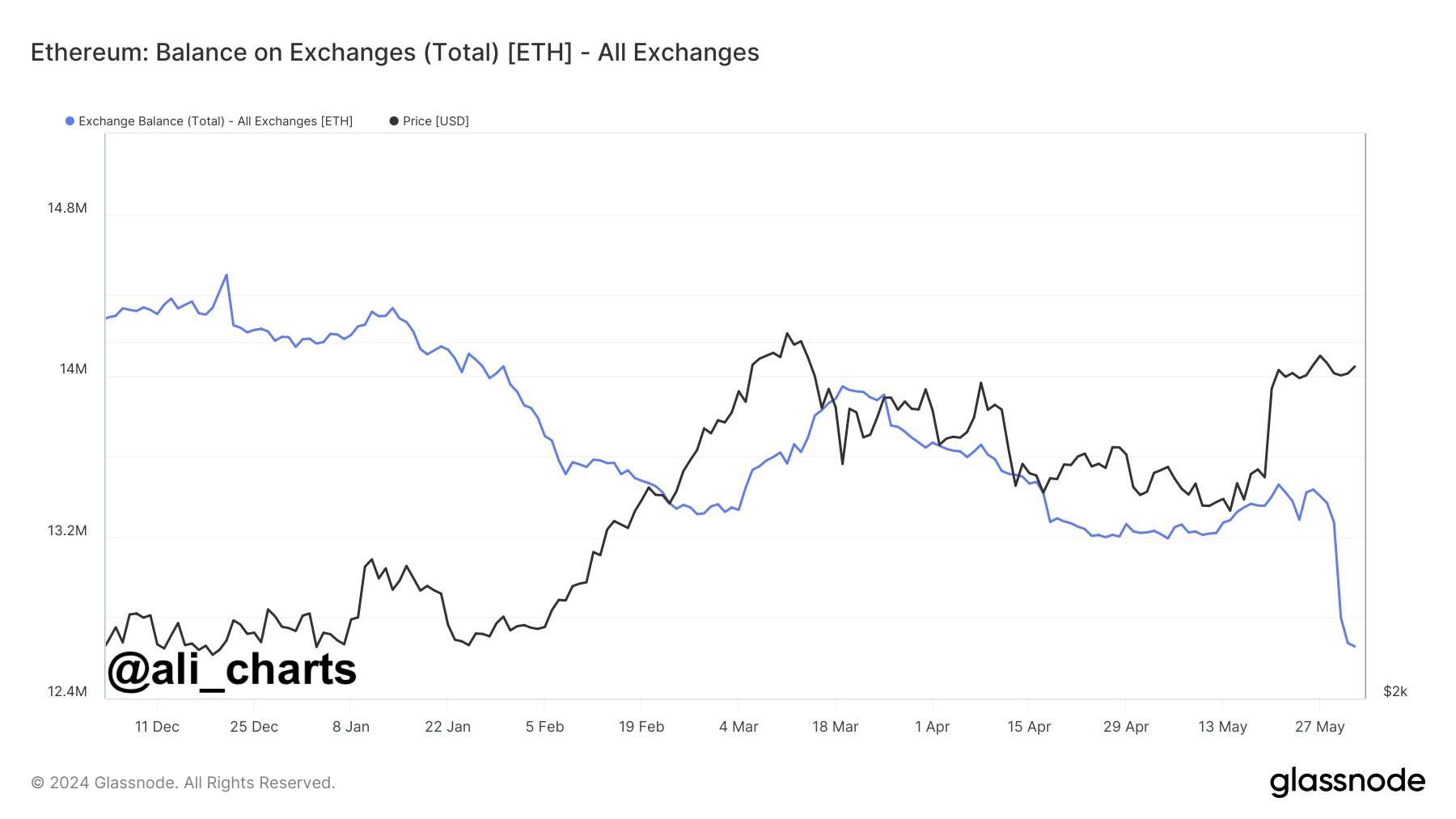

Following the SEC's approval of Ethereum spot ETFs on May 23, 2024, approximately 777,000 ETH, valued at around $3 billion, has been withdrawn from crypto exchanges. Crypto trading expert Ali Martinez shared this data in a post on June 2.

The Glassnode chart presented by Martinez shows a substantial decrease in the total Ethereum balance across all crypto exchanges. The balance dropped to about 12.5 million ETH, coinciding with a rise in price after the ETF approval.

Impact of Ethereum ETF

The price of Ethereum began to increase on May 20. This was shortly after Bloomberg’s senior ETF analyst Eric Balchunas and his colleague James Seyffart estimated a 75% chance of the spot Ethereum ETF being approved, up from an earlier 25%.

During this time, Martinez also noted that Ethereum whales purchased 110,000 ETH, worth about $341 million. This buying spree occurred within 24 hours leading up to his post on May 20, indicating heightened interest from major holders in anticipation of the ETF approval.

Overall, the significant withdrawal of Ethereum from exchanges suggests that crypto traders and investors are looking to secure their assets. This expectation of further price increases and reduced selling pressure on exchanges is generally seen as a bullish indicator.