$30 Trillion? Analyst Says Tokenized Assets Will Only Hit $1.3 Trillion by 2030

A crypto analyst is questioning a bold prediction that tokenized real-world assets (RWAs) could be valued at $30 trillion by 2030. He argues that a more realistic target would be closer to $1.5 trillion.

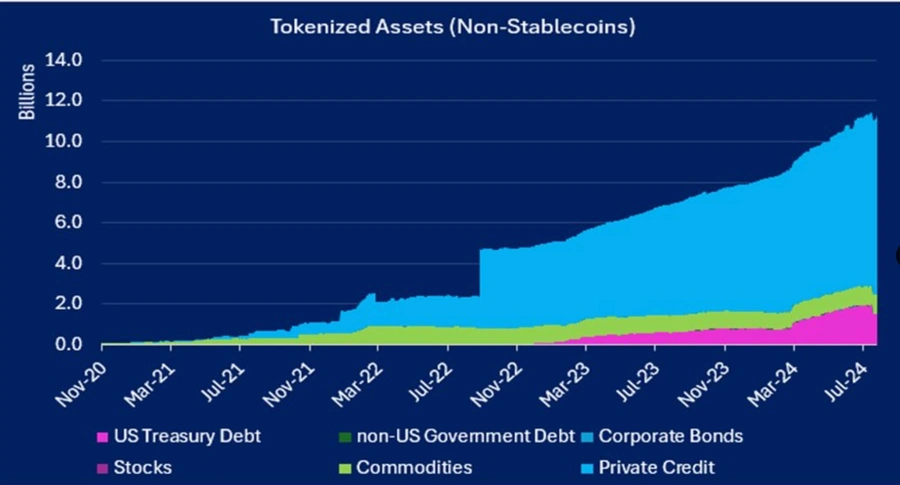

Jamie Coutts, the chief crypto analyst at Real Vision, shared his perspective in a post on August 27. He explained that if the current two-year compound annual growth rate (CAGR) of 121% continues, we could see tokenized traditional assets reaching approximately $1.3 trillion by 2030.

Tokenization refers to the process of creating security tokens, which are a type of blockchain-based digital asset. These tokens represent real-world assets such as real estate, bonds, artwork, and stocks, making them tradable in digital form.

Back in June, Standard Chartered Bank and Synpulse made headlines with their forecast that tokenized RWAs could soar to $30.1 trillion by 2034. This projection caught the attention of many, but Coutts remains skeptical. He believes that this figure is overly optimistic and likely unattainable. However, even if his more conservative estimate of $1.3 trillion materializes, it could still have a profound impact on the Web3 ecosystem.

Coutts suggests that if $1.3 trillion worth of RWAs were to be brought onto the blockchain, it could create a significant ripple effect across various sectors of the crypto space, including non-fungible tokens (NFTs), social platforms, and gaming. This could lead to substantial growth and innovation in these areas.

However, Coutts also highlighted a challenge in estimating the value that would accrue to Ethereum, which is the preferred platform for early issuers of traditional financial assets in the crypto space. The difficulty lies in predicting how much market share will be captured by layer-2 networks compared to Ethereum's base network.

He noted that layer-2 networks, which operate on top of Ethereum, might capture 95-99% of the revenue generated, leaving only a small portion for Ethereum as settlement fees. Coutts expressed doubts that these layer-2 networks would willingly sacrifice their profitable positions to allow Ethereum's base layer to scale further.

“If Ethereum manages to scale its base layer, it could capture a much larger share of the opportunity,” Coutts remarked, referring to this issue as “the Ethereum dilemma.”

In June, consulting firm McKinsey & Company weighed in on the topic, stating that tokenized financial assets have experienced a “cold start” but are expected to reach a market size of about $2 trillion by 2030. This slower start reflects the challenges and uncertainties that tokenization still faces.

McKinsey's analysts also emphasized that for tokenization to gain widespread adoption, it needs to offer clear advantages over traditional financial systems. One promising area is the tokenization of bonds, which has been gaining traction. According to the analysts, barely a week goes by without a new announcement of a tokenized bond issuance.

Meanwhile, in April, RippleX senior vice president Markus Infanger pointed to research suggesting that the future value of tokenized markets could reach $16 trillion, which would be roughly eight times larger than the current market capitalization of the entire cryptocurrency sector.

This growing interest in tokenization, despite some skepticism and challenges, suggests that it could play a transformative role in the future of finance and the broader digital economy.