$9.6B Bitcoin Move: Are Mt. Gox Creditors Finally Getting Paid?

Mt. Gox, a collapsed cryptocurrency exchange, moved $9.62 billion worth of Bitcoin into a new wallet, raising creditors' hopes.

The 141,686 Bitcoins were consolidated into wallet “1Jbez” from various other cold wallets linked to Mt. Gox.

These transfers suggest that users, who have been unable to access their funds since 2014 when Mt. Gox suspended trading and withdrawals, might finally be repaid.

This is the first on-chain movement of funds from the exchange in over five years. It aligns with Mt. Gox’s plans to repay creditors by the end of October 2024.

The consolidation likely points to Mt. Gox’s intent to repay its users, according to Anndy Lian, a blockchain expert and author. Lian told:

“This is the first movement of assets from Mt. Gox’s cold wallets in over five years. It is likely part of the plan to distribute the assets back to creditors before the promised deadline of Oct. 31, 2024, in my humble opinion.”

Shortly after the reports, Mt. Gox rehabilitation trustee Nobuaki Kobayashi confirmed that the consolidation is part of the exchange's repayment plans. However, he did not specify when repayments will start. Kobayashi wrote in a May 28 announcement:

“The Rehabilitation Trustee is preparing to make repayment for the portion of cryptocurrency rehabilitation claims to which cryptocurrency is allocated. As the Rehabilitation Trustee is proceeding with the preparation for the above repayments, please wait for a while until the repayments are made.”

However, the current deadline might face further delays. It was set in September 2023, a month before Mt. Gox was initially scheduled to repay creditors by October 31, 2023.

Mt. Gox owes over $9.4 billion worth of Bitcoin to about 127,000 creditors. They have waited over 10 years to get their funds back after the exchange collapsed in 2014 due to multiple unnoticed hacks.

Mt. Gox was one of the first cryptocurrency exchanges and once handled more than 70% of all blockchain trades.

A major hack in 2011 led to the site collapsing in 2014. This affected about 24,000 creditors and resulted in the loss of 850,000 BTC.

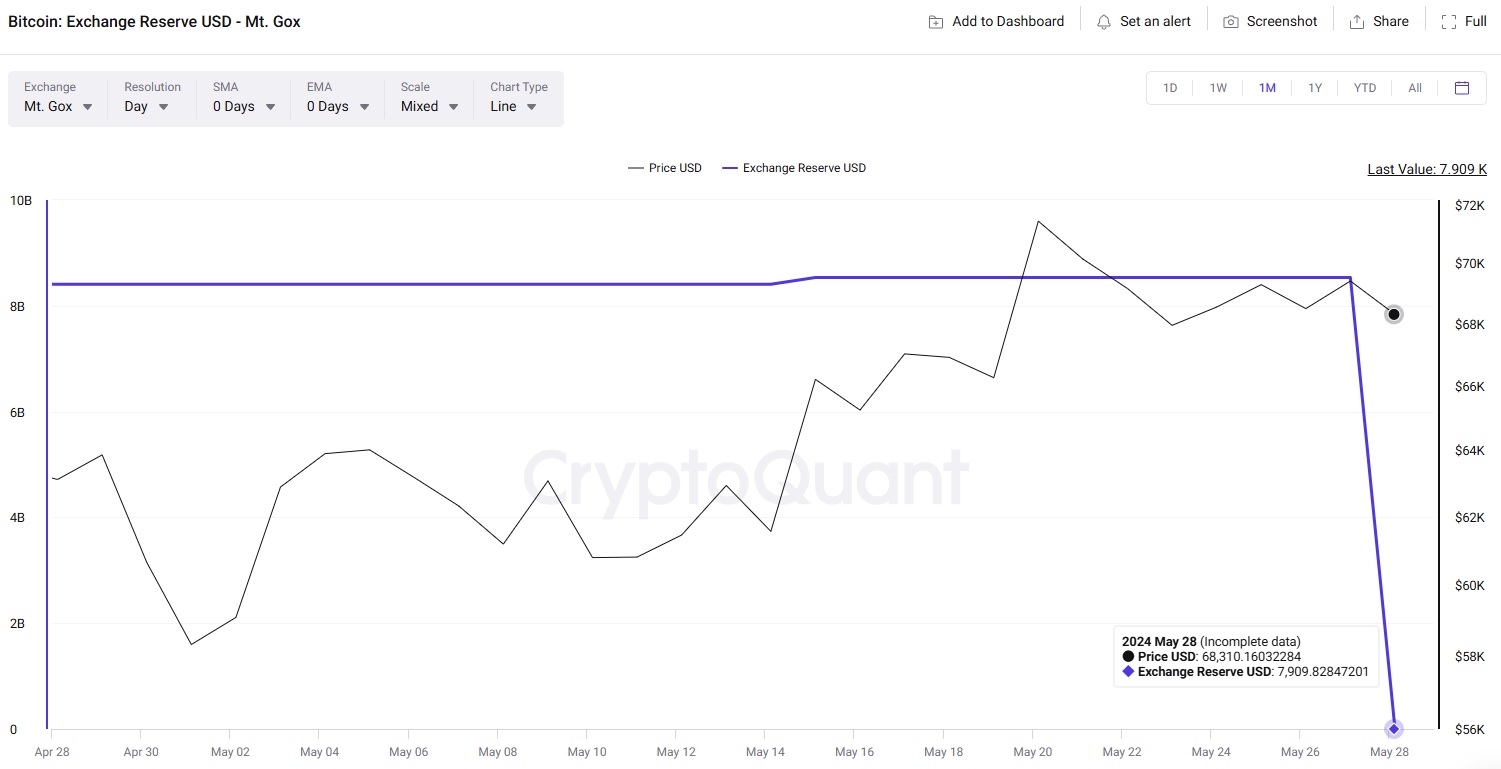

Markets Reacts to Potential Mt. Gox Repayment

After the first batch of Mt. Gox transfers, Bitcoin's price dipped 2% on May 28, dropping to a daily low below $67,500 before recovering to just above $68,000, according to CoinMarketCap.

This dip might indicate the market is factoring in a potential repayment by Mt. Gox, according to Lian:

“The market reacted to these movements with a slight bearish sentiment, as Bitcoin’s price dropped around 2.1% to as low as $67,505 after the transfer. This could be due to expectations of selling pressure from creditors once they receive their repayments.”

Despite the slight price dip, Lian said that a potential repayment would resolve one of the crypto industry's most pressing, long-standing issues.