Mt. Gox Begins Repayments: What Awaits the Crypto Market?

Mt. Gox, the cryptocurrency exchange that collapsed in 2014 due to a massive hack, is beginning repayments to creditors in early July. These repayments, totalling about $9 billion, will be made in Bitcoin (BTC), Bitcoin Cash (BCH), and cash.

Table of content

Historical Context

Mt. Gox once processed over 70% of all Bitcoin transactions but declared bankruptcy in 2014 after losing 850,000 BTC. The incident exposed significant security flaws in the cryptocurrency market, leading to extensive legal proceedings and recovery efforts.

Market Concerns

Analysts are concerned that the sudden influx of BTC into the market could lead to a sell-off, causing increased volatility. However, some believe the market has already factored in this event, potentially reducing its impact. Many creditors might choose to hold their BTC, expecting future price appreciation.

Industry Reactions

Alex Thorn, head of research at Galaxy Digital, discussed the potential market impact on Twitter, sparking discussions about Bitcoin's future price stability.

What Will Happen to Bitcoin in July?

Mark Cullen predicts Bitcoin will continue to decline in July, possibly falling to $57,000 due to a liquidity pool acting as a magnet for the crypto rate.

Trader Doctor Profit agrees with Cullen's forecast but believes BTC is close to a local minimum and will soon reach a new all-time high. He recommends using the current dip to purchase more bitcoins.

Payout Impact on Bitcoin Price

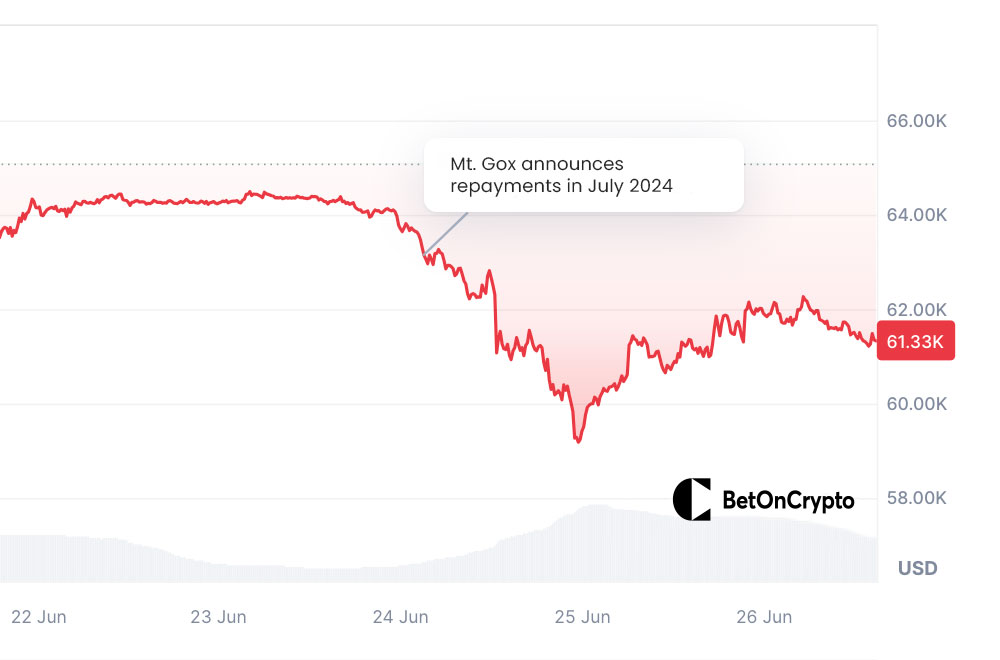

Following the announcement by the Mt. Gox exchange manager about the start of compensation payments, Bitcoin fell 3%, dropping below $58,000 before recovering above $61,000.

Broader Implications

The start of repayments by Mt. Gox is a significant event in the cryptocurrency world, resolving one of the biggest financial crises in crypto history. It will influence future regulatory and security measures and test the market's maturity and stability.

As repayments begin, the crypto community will closely monitor the market's reaction and the actions of newly compensated creditors. The lessons learned from this episode will be crucial for the future development of the cryptocurrency market.