Ether ETFs Explode: $107M Inflows and $1B+ Trading Volume on Day One!

Investors traded over $1 billion worth of shares in the newly launched ether (ETH) exchange-traded fund (ETF) issuers on their first day of availability, according to data from Bloomberg.

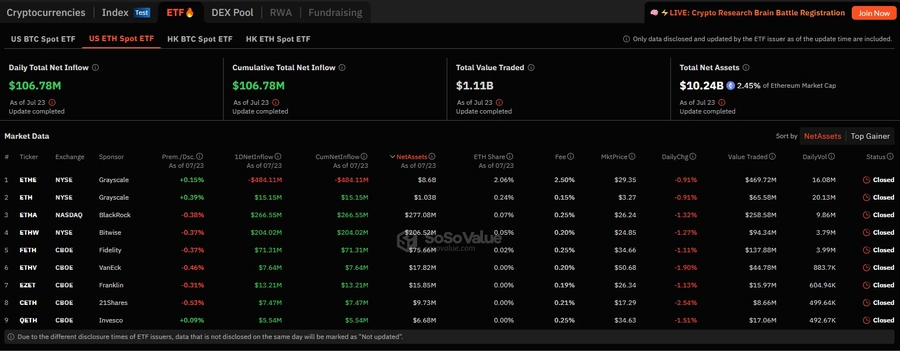

Out of this substantial amount, there was a net inflow of $106.7 million, as reported by the tracking service SoSoValue. The majority of the outflow, amounting to $484 million, came from Grayscale's Ethereum Trust (ETHE), highlighting a significant shift in investor interest.

In comparison, the spot bitcoin ETFs experienced a trading volume of $4.5 billion on their launch day, with approximately $600 million representing net inflows. This indicates a robust initial response to bitcoin ETFs compared to ether ETFs.

The BlackRock iShares Ethereum Trust ETF (ETHA) led the inflows with $266.5 million, followed closely by Bitwise's Ethereum ETF (ETHW), which saw $204 million in inflows. These figures demonstrate a notable interest in these specific ether ETFs among investors.

Overall, the total trading volume for the ether ETFs reached $1.077 billion. This volume is roughly 20% of the trading volume that the spot bitcoin ETFs experienced on their launch day in January.

Many market observers had speculated that the trading volume and net inflows for the ether ETFs would be underwhelming. This was largely due to the lack of a staking mechanism, which is a feature that could potentially attract more investors by offering additional returns on their holdings. Despite these predictions, the initial trading activity shows a significant level of engagement from the market.