7 Effective Ways To Make Money With Cryptocurrencies

A Bitcoin investor who put $19,000 into the cryptocurrency at its peak in January 2018 had his investment fall around 75-80% when he tried to sell it. But patience pays off, and after a three-year break, he tripled his money.

Since then, people have been increasingly drawn to and investing in the cryptocurrency market. Cryptominati Capital states, “The crypto space attracts investors, entrepreneurs, and individuals who want to invest and create new projects.”

But that's not the case. It's no longer as simple as once, but a calm demeanor and analytical thinking will still provide a profit. The cryptocurrency market has now transformed into a turbulent Wild West, with unique elements that may cause significant swings in value.

In this blog, you'll learn what Crypto is and how to make money from them without taking on more risk than standard methods.

Table of content

- What Is Cryptocurrency?

- Are You Curious About The World of Dollars And Cryptocurrency?

- You'll Need Crypto to Buy, Trade, And Keep Cryptocurrencies

- 7 Strategies: How to Make Money with Cryptocurrency

- Some of the best tactics to optimize your earnings and increase profitability

- Which is Better, Long- or Short-term Investing?

- Conclusion: Analyze Market Charts Before You Start

What Is Cryptocurrency?

Investing in the revolutionary world of cryptocurrencies offers endless possibilities with many digital coins to choose from. With blockchain-based currencies, such as Bitcoin, Ethereum, Litecoin, Ripple, and Cardano, rapidly gaining traction in the online sphere globally; cryptocurrency is becoming an increasingly attractive option for safe and efficient decentralized digital payments.

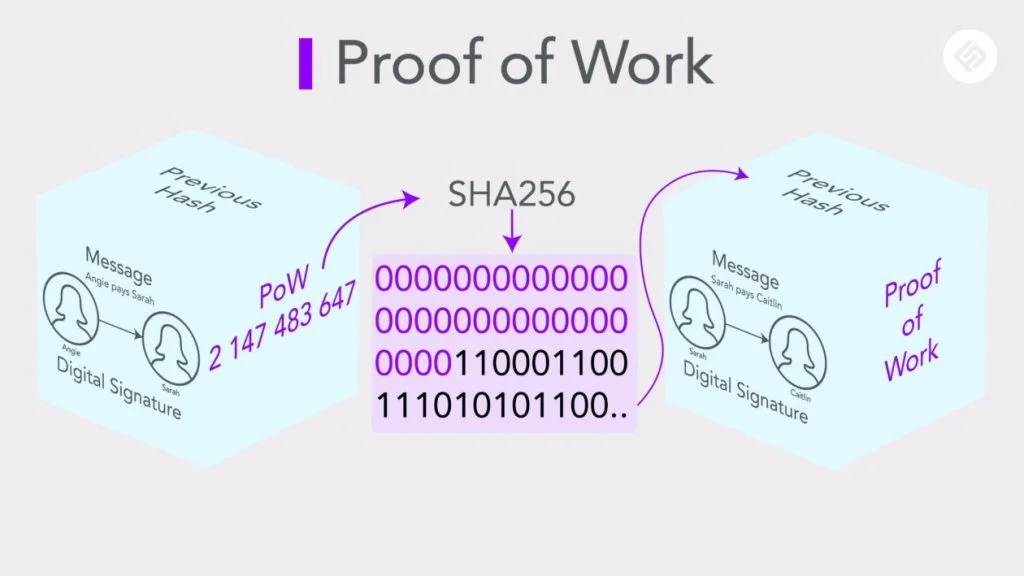

Bitcoin is a groundbreaking, revolutionary cryptocurrency based on an innovative blockchain platform. Unlike physical currency, no two bitcoins are alike, as each coin operates off of a unique blockchain ledger and cannot be counterfeit or used twice. This digital money system functions with thousands of computers connected to form an unstoppable network – allowing users to make transactions securely while earning rewards in Bitcoin for their efforts.

Computers work tirelessly to mine new coins by deciphering complex mathematical problems, thus authenticating any transaction on the blockchain.

Cryptocurrency is an investment that enables whole websites to track the value of a single bitcoin. People can use it for their purchases and invest in a cryptocurrency that provides complete site tracking systems.

Com, Coinbase, Coinmarketcap, and BlockFi expect to boost the value of their investments by converting dollars into cryptocurrency, just like investors do in stocks.

Your income for the previous tax year is from Bitcoin cash or other cryptocurrency. Any cryptocurrency profits are exempt from taxation if you earn less than $40,000 annually. Revenues between $441,150 and $464,850 will be subject to a 15% income tax rate; however, any sum over the latter is liable for an increased 20% taxation.

When a large firm agrees to accept Crypto as a payment method, the value of cryptocurrencies can rise. When mining procedures change, or celebrities like Elon Musk extol certain crypto-assets, the deal might grow. When demand increases and supply is restricted, it may also appreciate. Mining will end when there are 21 million bitcoins, projected to occur in 2040.

If a firm ceases approving cryptocurrencies as a mode of payment or if hordes of people simultaneously attempt to divest their holdings, the price of these digital assets can suffer declination.

Are You Curious About The World of Dollars And Cryptocurrency?

Here are some tips to get your journey into this enigmatic market started:

- Storing cryptocurrency in a software wallet is comparable to keeping money in a physical wallet. There it is, available and poised to be used.

- Similar to putting money into a savings account, depositing Crypto into a savings protocol is done by wiring it to the platform. A savings protocol, like banks, pays you interest for using it.

- Keeping cryptocurrency and borrowing it from yourself is similar to putting money into a retirement account or obtaining a loan.

- Like trading stocks on a stock exchange, transacting tokens in cryptocurrency platforms operates along the same principles. Blockchains and exchange protocols are similar to businesses, called “programs.”

You'll Need Crypto to Buy, Trade, And Keep Cryptocurrencies

You'll need somewhere to keep your cryptocurrency – a wallet. For secure storage of your cryptocurrencies, consider either a software wallet, like an app for your device, or a hardware wallet, which functions similarly to a flash drive.

- If you lose your phone, most software wallets, or “Hot Wallets,” are simple to restore.

- Hardware wallets, also known as “cold wallets,” are difficult to recover if you lose them.

Software wallets are quicker and easier to trade or spend on cryptocurrencies than their physical counterparts. They, however, are subject to online assaults that might result in the loss of money. Offline hardware wallets cannot hack, but there is always the danger of losing or stealing them, just like any other genuine wallet.

To install your Binance account, follow these steps: n1.Carefully choose the ETH wallet you want to use, and record its address and other necessary security instructions so that you can guarantee safe access if your computer is ever lost or stolen.

- Download the wallet app

- Create an account

- Get quick verification

- Transfer or deposit funds from your bank account to your cryptocurrency wallet

It is the most efficient method to get started buying and trading cryptocurrencies. Wallet assets are vulnerable because the exchange runs them. It's probably not worth hacking into significant exchanges to access thousands of wallets. In comparison, hacking into an individual's bank account is much more appealing to cyber criminals.

Expert Advice: How to invest in crypto without getting burned

Taking the plunge into investing can be a daunting prospect. However, none are more uncertain than cryptocurrency. However, despite its high-risk status, the digital currency remains overwhelmingly popular among investors.

Research Exchange

Learn about cryptocurrency exchanges before investing a single dollar. These platforms enable you to buy and sell cryptocurrencies. With over 500 options, Bitcoin.com offers many exchanges for you to select from! Before taking any steps, it is critical to perform your due diligence thoroughly. That means researching the topic in detail, gaining insight from those already using that specific product or service, and consulting with an industry expert. Various telegram groups also advise on getting started in the crypto market.

Expertise: You must be knowledgeable in adequately storing your digital currency.

When you acquire Crypto, you must keep them. You may use a cryptocurrency wallet to top up on an exchange or in a digital “wallet” (one of the cryptocurrency wallets described in the blog). Various wallets offer unique capabilities and security measures, from stylish leather wallets to hard-shell choices. Making the proper selection for your needs can take some research, as each wallet has its range of features, technical requirements, and safety standards. Before investing, do your research on which wallet is best for you.

Diversify Your Assets

Diversification is essential in any successful investing strategy, and it's also true with bitcoin investments. Don't be tempted to invest your wealth in the Bitcoin network simply because it has garnered some notoriety. There are numerous options; therefore, spreading your investment across several digital currencies might be brilliant.

Prepare For Big Changes

The cryptocurrency market is notoriously unpredictable, so you must anticipate the possibility of both spikes and dips. The price varies a lot. Delving into the world of cryptocurrencies can be an enriching experience; however, there may be better choices if you stay on top of your investments and safeguard your mental well-being.

Lately, Bitcoin, Ether, and other digital assets have been making headlines everywhere. Despite its groundbreaking advancements, cryptocurrency is still in its infant stages. It might be tough to invest in something new, so be prepared. If you're considering it, begin with research and a conservative investing approach.

7 Strategies: How to Make Money with Cryptocurrency

Lending/Loaning

Start cryptocurrency lending to make extra money from your crypto investments. Cryptocurrency lending is made up of borrowers and lenders, as well as agreements between them. Nexo, SALT Lending, BlockFi, Oasis, and Celsius are popular cryptocurrency exchanges offering this service.

Cryptocurrency loans involve contracts where borrowers put their crypto assets as collateral, lenders take the terms and offer cash or other cryptocurrencies, and borrowers agree to pay interest.

In most cases, borrowers and lenders in cryptocurrency loans are individuals rather than businesses like banks. The bottom line is that cryptocurrencies are the foundation for loans, commonly used as collateral or the primary source of borrowed value.

Traditional Buying and Holding

People are confident enough to take risks, like generating money from cryptocurrency. It implies obtaining crypto assets of your choice on a cryptocurrency exchange and purchasing additional when prices fall, also known as “buying on the decline.”

After a few months or years, the owner can sell the asset at a price higher than the purchase price, resulting in a significant total profit.

While more novel cryptocurrencies, such as Chia, are susceptible to speculative price fluctuations because of the hype, powerful, well-known cryptocurrencies like Bitcoin, Ethereum, and Bitcoin rise and fall daily. When we look at the chart over the year, these coins have maintained an upward trend. On the other hand, new coins like Chia have had large spikes and drops in price.

Trading

Trading is a strategy that leverages current market conditions, while investing takes the form of a buy-and-hold approach for long-term gain.

The cryptocurrency market is a volatile place. In other words, the worth of assets can quickly increase or diminish within a brief timeframe.

You'll need the appropriate technical and analytical capabilities to be a successful trader. You'll have to examine the market performance chart of listed assets to make accurate predictions regarding price rises and falls.

Whether you anticipate an asset's worth will surge or plummet, you can purchase or trade cryptocurrency to cash in on it. It implies that you may make money regardless of whether the price rises or falls.

Some of the best tactics to optimize your earnings and increase profitability

There are various methods to reduce the hazards associated with cryptocurrency trading. Are you looking for ways to optimize your trading methodology? Look no further!

- Expand your trading horizons. Various currencies will help you reduce the daily risk associated with a specific cryptocurrency.

- To reduce trading expenses, choose a secure exchange with low fees.

- Keep an eye on your trading time. Make a timetable for yourself and stick to it.

- Stay ahead of the curve by following cryptocurrency news and developments.

- Technical analysis uses charts to evaluate a stock's price and volatility. Technical indicators assist you in justifying each trade.

- Set stop losses for each transaction. Use a 2:1 loss ratio as a starting point.

Because the energy required to run a PoW blockchain is exceptionally high, some blockchains have developed a seemingly better verification algorithm called Proof of Stake (PoS). Instead of using energy and hardware to solve complex cryptographic puzzles, the PoS algorithm forces users to block (staking) their tokens to verify Crypto.

Staking blocks digital assets that act as a validator in a decentralized cryptographic network to ensure the network's integrity, security, and continuity. Stakeholders protect their investments from serving as nodes and blocks of validation. Newly created cryptocurrency is used to incentivize stakeholders to protect the network. They receive this cryptocurrency as payment.

- Pros: This is a cheaper way to get money from cryptocurrencies.

- Cons: price fluctuations pose the greatest danger.

Airdrops

You can easily stay current on any airdrop project by researching it online. Users frequently advertise them on the company's website, social media, and other crypto news sites.

Of all the ways to get free cryptocurrency, airdrops pose the highest risk. It's more than you think it's worth to most investors. Developers run airdrops when they need support for new cryptocurrencies. In short, they give you a free coin to try to adopt.

It's critical to exercise caution with every new cryptocurrency project. Hackers employ widespread frauds such as the fake airdrop and ICO (Initial Coin Offering). Many air bubble coins are only worth a little as an investment vault. Experts advise newcomers to stick with well-known cryptos like Bitcoin and Ethereum, mainly because they have a more stable price.

Beware of phishing scams. Do not provide your personal information or crypto wallet address to anyone.

Airdrops do not exempt you from federal income taxes. Any cryptocurrencies received through airdrops are also taxable. The IRS requires that you record the fair market value as of the registration date in the distributed ledger (in most cases when you receive airdrops from digital wallets).

Ten influential Crypto is other than bitcoins.

Mining

Mining is a fundamental part of the Proof-of-Work consensus protocol, and it's one of the earliest ways to monetize cryptocurrencies. It verifies transactions and defends the PoW network through mining. Miners receive new coins for performing these functions with each block.

Initially, One could mine Bitcoin using a desktop computer; however, nowadays, it requires purchasing expensive ASICs (Application-Specific Integrated Circuits).

Running a controller node is also helpful in keeping the network running. A controller node is a wallet that supports a replica of the entire network.

Because of their high costs and technical requirements, both techniques demand a significant initial and continuing investment based on technical expertise.

Dividends

Another method to profit from your crypto funds is to get dividends. You probably understand tips if you've ever invested in equities or bonds. Said a bonus is a small cash payment made to shareholders. The company makes a profit during the quarter or year and shares the proceeds with its shareholders as dividends.

While you will see a tidal wave of dividends arrive in your account if you have a big balance sheet, it may be a method to generate money with the cryptocurrency you already own. However, before making this decision, you must research which cryptocurrencies pay dividends and whether they are worthwhile.

Decred, NAVCoin, Reddcoin, VeChain, NEO, and their annual dividends, in general, are some crypto that pays out in additional coins (or tokens). As a result, cryptocurrency dividends differ from stock dividends because they deliver extra tokens instead of cash.

Play Your Favorite Games and Earn Rewards in Crypto

Gaming enthusiasts can leverage cryptocurrency to generate profits. It might be a surprise, but the play-to-earn crypto game marketplace is now valued at billions of dollars. Many variations and types exist within this space; however, Decentraland is one of the best crypto games to consider playing. In short, Decentraland is an online world where players can build their avatars, chat with others, and buy land. The unique NFT (non-fungible token) represents the land you purchase, enabling you to make any real estate project you choose.

After that, you can sell your NFT in the open market. Even though it might appear unbelievable, some parcels of land in Decentraland have sold for millions recently. By investing early on, you can buy an NFT while the price is low.

Which is Better, Long- or Short-term Investing?

Investing for the long haul involves strategies that seek to provide sustainable and stable returns over some time, typically exceeding one year. Long-term investors are generally passive investors. Put another way; you don't only buy and sell substantial quantities in a short period. For those looking to invest for the future, buying stocks that show potential growth or investing in funds and exchange-traded funds may bring a steady return.

- Value investing is buying a cryptocurrency at a price less than its inherent value.

- Growth investing predicts a company's worth will exceed the overall market's.

- Dividend investing entails buying stocks from firms that pay dividends.

What Are Short-term Cryptocurrency Investments?

A one-year timeframe typically defines short-term investing. “active traders” and “active investors” are commonly used to describe individuals engaged in short-term investment activities. It implies you buy and sell much more regularly than long-term investors do. Depending on your needs, it could range from a few times annually to daily.

Short-term investors will also have long-term investment portfolios elsewhere. It's likely to be used for retirement or other firms that require investments and long-term holding.

Short-term Investing Techniques

Quick-turn investors habitually purchase and sell assets rapidly to gain a profit. So, here are some common short-term investing strategies:

- Scalping is making many small purchases or sales throughout the day or multiple times during the same trading day.

- Day trading – investing for minimal profits to amass a large sum.

How to invest in cryptocurrencies for the long and short term

- The first step in evaluating a cryptocurrency is to conduct a fundamental assessment. The problem is, how do we perform the actual analysis? We must also comprehend how much money we have put into cryptocurrencies. The most significant potential digital currencies exist in the existing market for long- and short-term investments.

- Use this analysis to examine a company's quarterly growth. Understand test levels of support and resistance for short-term or day trading.

Conclusion: Analyze Market Charts Before You Start

After perusing this article, you should understand how to make money with cryptocurrency. Before investing, you must study to create a secure investment and profit. The best source of information on the sector is, without a doubt, Twitter. For example, CyrptoMinati Capital recently posted its thoughts on investing in TheSandBox.

Do your research before investing in cryptocurrency. Scrutinize the market, learning about its triumphs and failures. Get your wallet ready to go before you start trading. Before you invest, make sure you've completed all of your approaches. Investing in cryptocurrency is a serious decision that demands extensive study and knowledge.

Before committing to a cryptocurrency trade, you must stay aware of its potential evolution in the market. Long- and short-term research is involved. As a result, it all boils down to meticulous study and monitoring of prior and current performance you wish to trade.

⚡️ Is it possible to lose money lending cryptocurrency?

Although you remain the owner of your cryptocurrency used as security, some rights are taken away, like trading or using it for transactions. Moreover, if the worth of your digital assets significantly declines, you could owe much more than what was initially lent to you, even if you don't pay back your loan in full.

⚡️ Is lending safer than betting?

Staking protects the net, but lending allows investors to passively gain interest by allowing them to trade more efficiently. Several DeFi or decentralized finance firms give the option of loaning your cryptocurrency and getting interested.

⚡️ How do you diversify your cryptocurrency?

Here are some of the most potent crypto diversification tactics:

It is a type of cryptocurrency. It is a typical diversification approach because of its basic structure.

Diversify by industry

Diversify by time

Diversify by geography

Use options

Analytical approach.

⚡️ How do cryptocurrencies work?

In Crypto, an airdrop is a marketing technique employed by blockchain-based firms to encourage people to use their platform. It entails giving away free coins or tokens to consumers with public cryptocurrency wallets to promote a new virtual currency.

⚡️ What is the best way to track cryptocurrency?

CoinTracker is a cryptocurrency portfolio value tracker with Ledger and Trezor wallets and 300 crypto exchanges. It also includes popular crypto exchanges such as Coinbase, Binance, and eToro.