Bitcoin’s Bull Run Continues: Can It Maintain the Momentum?

Bitcoin has just delivered its strongest week since May, gaining over 9% and climbing from $109,231 to a new all-time high of $123,000. This breakout from recent consolidation is sparking optimism—can the rally continue?

The surge reflects growing confidence in the market, with the Crypto Fear & Greed Index now at 72, firmly in the “greed” zone. Investors are clearly feeling bullish as institutional adoption gains speed.

On prediction platform Myriad (built by Decrypt's parent company Dastan), sentiment is also overwhelmingly positive. Users now estimate a 91% chance that Bitcoin stays above $100,000 throughout July, up from 70% just days earlier. They also believe there’s a 76% chance BTC will hit $125,000 before dipping back to $105,000.

In the short term, though, the outlook is slightly more cautious. As BTC hovers around $119K following a slight pullback, only 40% of Myriad users believe it will close the week above $122K.

Table of content

Macro Backdrop Supports Bitcoin’s Rally

Bitcoin’s breakout happened amid a complex economic environment. Oil prices have returned to a mild uptrend, trading near $67 per barrel, and gold remains elevated at over $3,300 an ounce. Both commodities suggest persistent inflationary concerns and ongoing geopolitical instability—factors that often drive investors toward alternative assets like Bitcoin.

Meanwhile, the S&P 500 is near record highs, reinforcing overall risk appetite in traditional markets. This kind of cross-market strength adds to Bitcoin’s case as both a growth asset and a portfolio hedge.

Technical Indicators Confirm a Strong Trend

Bitcoin’s weekly chart shows a clear bullish trend supported by several key indicators:

- RSI (Relative Strength Index) is at 71, signaling strong momentum. Although this suggests the asset is overbought, in bull markets, RSI can stay high for extended periods.

- ADX (Average Directional Index) at 27 confirms a strong trend. Anything above 25 typically indicates trend strength, and this move from development to confirmation points toward continuation.

- EMAs (Exponential Moving Averages) also support the trend. The 50-week EMA sits well above the 200-week EMA—a classic bullish formation indicating strong and growing upward pressure.

- Squeeze Momentum Indicator has “turned off,” signaling the end of the previous price compression phase. This confirms the breakout is legitimate and likely to continue.

After weeks of sideways action, this shift brings relief and clarity to the charts, with daily indicators now aligning with the weekly bullish outlook.

Where Does Bitcoin Go From Here?

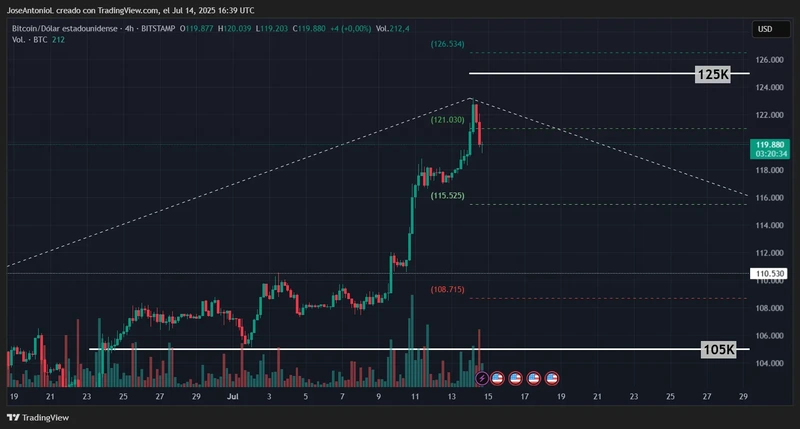

Now that BTC is in price discovery, the charts provide fewer reference points for upside targets. However, Fibonacci extension levels—tools used by traders to project future price zones—indicate resistance at:

- $126,554

- $134,371

Support levels are clearer:

- $115,575 – recent resistance turned support

- $110,500 – a more robust level tested in previous weeks

If BTC fails to hold above $115K, a revisit of lower levels around $110K is possible. But if bulls can maintain control, the path to $126K and beyond is open.

Volume data shows strong accumulation in the $90K–$110K range. This base provides a solid foundation for the current rally. In contrast, volume above $120K is thin—meaning less selling pressure and more room for upside if Bitcoin holds current levels.

For technical traders, two things are key to watch:

- ADX staying above 25 to confirm ongoing trend strength

- RSI approaching or exceeding 80, which could signal exhaustion or an upcoming pullback

Strategic traders may now begin tightening stop losses around recent highs to lock in gains while still leaving room for growth.

With Bitcoin in uncharted territory, caution is warranted, but momentum is clearly on the bulls’ side. If BTC can hold current levels, the next big move may be just around the corner.

Whether you're looking to ride the wave higher or just pop some champagne and enjoy the gains—this moment is historic.

Blockchain Expert