7 Best Technical Indicators for Crypto Assets and Stocks: How to Interpret, Calculate, and Use Them

Table of content

- Everything is discounted in the market.

- Every time a new trend is introduced, prices usually follow in the same direction.

- Technology has a particularly pronounced effect in this regard.

- What are technical indicators?

- The greatest technical indicators for cryptocurrencies and equities have been developed.

- Putting the two models together, one can construct a model for the accumulation/distribution channel.

- Average Directional Index (ADX).

- Aroon Indicator

- What is the AroonUp line, and how does it work?

- What is the AroonDown brand?

- What does the Aroon indicator represent?

- Moving Average Convergence-Divergence (MACD) Indicator

- Relative Strength Index (RSI)

- What is RSI and how do I calculate it?

- Stochastic Oscillator

- Unlock the Potent Power of Stochastic Oscillators with Exponential Smoothing! Learn How to Calculate this Important Business Tool.

- How do I use the stochastic oscillator?

- Conclusion

⚡️ Does technical analysis work in cryptocurrency?

technical analysis of cryptocurrency is the study of historical price patterns and technical indicators to forecast future prices. This may be utilized to analyze any market, including Bitcoin (BTC) cryptocurrencies.

⚡️ What are the indicators for crypto?

It will assist you a lot to comprehend the significance of important indicators like bitcoin dominance, overall market capitalization, or technical indicators like moving averages, Bollinger Bands, MACD, RSI if you are beginning to trade cryptocurrency assets or HODL.

⚡️ What is the MACD in Cryptocurrency?

The monthly moving average convergence-divergence histogram (MACD) for cryptocurrencies has crossed below zero, which is known as a “sell signal” on a longer price chart indicating a shift in trend from bullish to bearish.

⚡️ Which is better than the MACD or the RSI?

The RSI is a more accurate and frequent trading signal than the MACD. This study revealed that the RSI was a superior predictor than the MACD, according to this metric. In essence, this finding stems from the fact that in this research, over time, the RSI indicator provided fewer but more reliable trading signals than the MACD.

Trading or investment requires a thorough knowledge of the coin or stock's underlying value. You don't need to know every intricate detail about a protocol/business, like its debt-to-equity ratio. However, you should have general knowledge about the currency/stock, like:

- The price at which you can buy the coin/share when it is available for sale.

- Average potential annual yield or expected price appreciation

- The time it takes to achieve the projected price

The technique of crypto technical analysis (TA) is a well-known method for analyzing equities or cryptocurrencies based on comparable data points and components. This arrangement will teach you about TA as well as go into trading indicators before we conclude with the best indicators for you.

Everything is discounted in the market.

This assumption is based on the idea that every element connected with a stock/coin has been taken into account and reflected in its price. The notion is that everything, from dividend announcements to staff reductions, has been accounted for and reflected in the previous price of stocks. In cryptography, hashing complexity, government support, and even tweets are all assumed to impact price and have been “discounted” by the market.

Every time a new trend is introduced, prices usually follow in the same direction.

When neophyte traders view a trading chart for the first time, they will likely be stunned by a few unexpected price changes. Many people feel anxious seeing green and red lines or candlesticks, but experts in Technical Analysis advise that prices always move in the direction of a trend.

GUIDE TO CRYPTOCURRENCY TAXES IN 2022

Technology has a particularly pronounced effect in this regard.

The notion that stock prices are driven by people's buying and selling decisions is a psychological assumption that has been around since the early days of crypto technical analysis. When price changes in a specific direction, market participants frequently behave in the same way. Emotions take precedence over logic, as numerous bearish trends have seen significant selling, and likewise, during bull runs, buying takes over.

What are technical indicators?

Crypto technical analysis is a process that involves the use of mathematical formulae and charting tools to study past price patterns and predict future market behavior. A technical indicator is a mathematical calculation that can be used as a buying or selling signal.

Technical indicators are remove uncertainty and provide a level playing field. These are mathematical computations used to create trend lines on a price chart and identify important price points for cryptocurrencies/stocks.

Consider trading indicators to be a map that will lead you through the uncertainty jungle. They may help you make better trade decisions if utilized with a little market psychology and an understanding of risk. These indicators are quantitative, therefore you can automate your trades using them.

Now that we know how TA works and how to use indicators to improve our trading skills, let's look at the seven best technical indicators.

The greatest technical indicators for cryptocurrencies and equities have been developed.

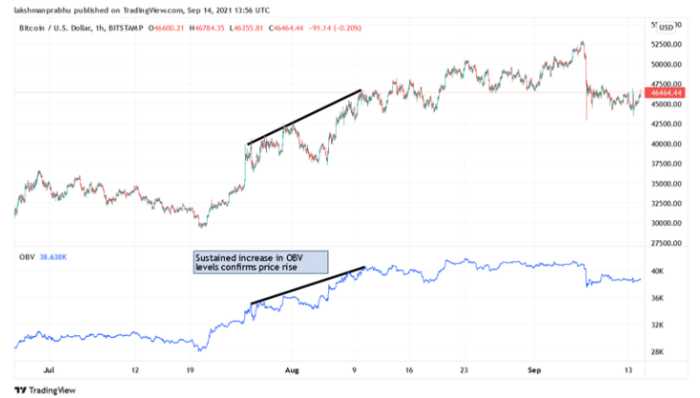

Balance Volume ( OBV )

The OCOVB is a technical indicator that measures volume by examining the coin/share's total trading volume over a set period. In other words, it quantifies the buying and selling power of a coin/share. The OBV is also used as an asset's liquidity metric due to its ability to incorporate volume data from different timeframes like days, weeks, or months. There are three ways to calculate the OBV:

The first method is to take the current day's volume and add it to the previous day's OBV. If the price closed higher than it did the day before, then all of that day's volume is considered up-volume.

- If the price closed lower than it did the day before, then all of that day's volume is considered down-volume.

- If the asset's price rises higher than yesterday's close,

The current OBV is derived by adding today's trading volume to yesterday's OBV.

- If the asset's value falls below yesterday's closing price,

The previous day's OBV is subtracted from today's trading volume to calculate the current OBV.

If the price stays constant, The previous day's OBV is the current one.

OBV is an indicator that suggests the willingness of buyers to make purchases of a certain asset at discounted rates.

- The OBV indicates sellers' pressure. This is often seen around previous highs when investors sell to ensure gains. This is the beginning of bearish market sentiment.

- When there's an increase in this value, it means more people are ready to buy and take advantage of these lowered prices.

The OBV indicates sellers' pressure. This is often seen around previous highs when investors sell to ensure gains. This is the beginning of bearish market sentiment. The trend is confirmed if the price movement is supported by volume, suggesting that it may be trusted to open trades. However, confusion in the market indicates that the price change is contrary to the OBV trend.

While some may disagree, the OBV is still considered a reliable momentum indicator for price breakout directions. In addition, traders can use it to track cash flows from institutional investors or major market participants.

Putting the two models together, one can construct a model for the accumulation/distribution channel.

Another well-known volume-based indicator is the accumulation/distribution line, which we move ahead with. It's used to determine an asset's trend direction based on the correspondence between price and trading volume.

The A/D line is a great tool to measure investor sentiment towards an asset as it tracks the influx and outflow of capital, thereby revealing if investors are buying or selling.

To establish the A/D line, we'll need two indicators:

- Cash Flow Multiplier (MFM)

- Cash Flow Volume (MFV).

Here are the calculations to obtain the metric's value.

- MFM = [(C – L) – (H – C)] / (H – L)

- MFV = Volume in a certain period * MFM

C – Conclusion

L – The best price is determined by the market.,

H – The highest price for that period.

The current value of the A/D line is set at the previous day's A/D line + MFC, and this continues every day. To determine the A/D line, we add together tomorrow's MFC and today's current value of the A/D line. Then, this total is used to plot out our next day’s trendline on a chart.

The interpretation of the A/D line is often made about the price movement of the asset. And, as a whole:

- When both of these indicators are increasing, bullish sentiment is likely to remain.

- If both indicators are in a decline, bearish sentiment towards the asset is likely to dominate.

- If the A/D line is in a downtrend and prices are increasing, this indicates strong seller pressure in the market. This implies that the asset will most likely break and undergo a bearish reversal (distribution).

- When the A/D line is rising as prices are declining, it indicates a spike in buying pressure among market participants who are continuing to buy the asset.

- An A/D line indicator is a fantastic tool for confirming an existing trend, as well as detecting significant buyer/seller pressure. Utilizing it as a standalone solution is not recommended. You'll be a better trader if you combine it with other technical elements.

Despite the declining A/D line, the price increased. This was because there was greater selling pressure from the sellers. As a result, a large negative price break occurred.

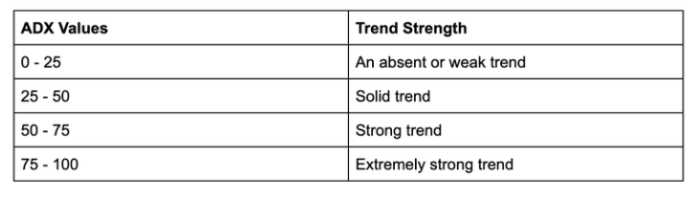

Average Directional Index (ADX).

Our next step will be to examine the Average Directional Index (ADX), a trend-based indicator that can offer insights into market trends. As its name suggests, this key technical factor focuses on the direction or trend of an asset.

- When the market is up, there will be a +DI in place to signal that it's in a positive direction.,

- When there is a bearish move, look for the -DI (or Negative Direction Indicator) to appear, which indicates a downtrend.

The ADX, which is usually accompanied by two associated indicators, measures the current trend in an asset. Traders/investors can wager on whether or not to purchase or sell an asset based on its strength.

The length of time represented by a 14-bar period is used to calculate the ADX. The ADX, on the other hand, can also be calculated for periods ranging from 7 bars to 30 bars. The former makes the ADX line too jumpy, whereas the latter is lengthy and inaccurate when trading.

The ADX is a difficult calculation to understand. TradingView, however, includes a built-in ADX indicator that may help you save time. You may apply it to a variety of assets including ETFs, futures, stocks, and cryptocurrencies.

The ADX indicator works in the same way, but it adds another element to the equation. The final value is always the primary consideration when you use the ADX indicator. The line represented by values from 0 to 100 is known as an ADX line.

The ADX is a momentum indicator that, interpreted over time, can determine the size and direction of price change. Values below 25 indicate accumulation or distribution within the market during this stage–perplexity about an asset's potential value. Confirmation occurs from 25 to 50, whereupon the market sets out in search of support and resistance levels for the asset.

It's indispensable to understand that when an asset is valued at or below 50, it has the potential for a sustained price rise. In this case, the help reaches extreme pricing levels in its push toward higher prices. This is an indication of caution since the ADX > 50 indicates that investors who are pining for a return to lower prices will eventually get their wish.

ADX is a trend-following indicator, which makes it unsuitable for use alone. When used in tandem with price movement indicators such as moving averages or support and resistance, ADX may help you be a better trend trader.

ADX levels for Bitcoin have been between 30 and 60 since mid-2014, with a peak of over 80 in early 2016. Bitcoin's price was unaffected by this. However, as we zoom out on the chart, the price rises as the trend mature and gathers strength and momentum.

Aroon Indicator

A popular trend-based indicator is the Aroon indicator, which was created by stock market expert Tushar Chande. It helps in identifying trends as well as measuring trend strength, similar to the ADX. The Aroon indicator has two Aroon lines: AroonUp and AroonDown. Both of these lines are the difference between AroonUp and AroonDown.

What is the AroonUp line, and how does it work?

The AroonUp indicator measures an asset's price relative to its previous 25-day high. As the time required for an asset's price to return to its peak increases, the worth of that asset diminishes. If the uptrend is weak, then the value will be lower.

It's calculated as follows: [((number of periods) – (number of periods since the highest peak)) / (number of periods)] x 100.

What is the AroonDown brand?

The line on the right of this chart measures how many days it has been since the price of an asset hit its 25-day low, a representation of market pessimism. The stronger the sentiment, as indicated by AroonDown's proximity to 100, the closer the value of AroonDown is to 100.

The Aroon down line is the baseline price calculated using a formula that subtracts the number of periods from the lowest minimum period, then divides it by the total number of periods.

What does the Aroon indicator represent?

- If AroonUp is between 70 and 100, and AroonDown is between 0 and 30, this signifies a bull market in which new highs are expected for the asset.

- When AroonUp is sustained at the low end of the 0 to 30 range while AroonDown is increasing, the market mood is negative and the asset drops steadily at cheap levels.

- When the asset consolidates at a specific price, AroonUp and AroonDown tend to remain parallel.

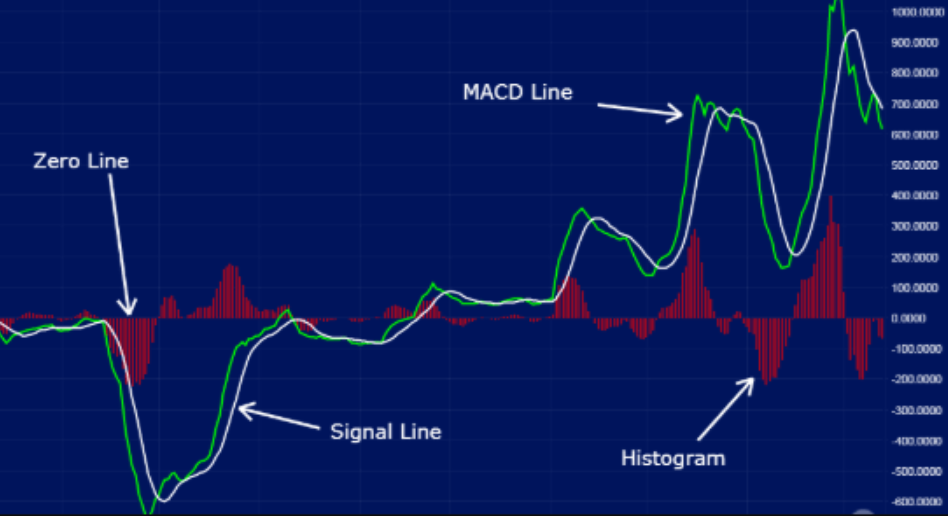

Moving Average Convergence-Divergence (MACD) Indicator

The MACD is a technical tool that was created in the 1970s to help traders visualize an asset's momentum. The MACD consists of three elements:

- MACD = 12-period EMA – 26-period EMA

- Signal line = 9-period EMA MACD.

- MACD Histogram = MACD – Signal Line

An exponential moving average, such as the Exponential Moving Average (EMA), is used to smooth recent data.

Moving averages, i.e., prior prices, are used in the calculation of the MACD, thus ensuring that it is a lag indicator. Despite this, because of its excellent fundamentals, the MACD indicator's accuracy and dependability are excellent.

The following are some of the most common MACD interpretations:

- A positive MACD indicates that the price is rising in an uptrend, which is a good sign.

- A negative MACD implies that there is a growing momentum of a downtrend (falling price).

- It's a sign that the MACD has changed direction and moved above the signal line, implying that the price is about to rise.

- When the MACD falls below the signal line, it is a negative crossover.

The MACD has evolved into a popular but trustworthy trading signal owing to its combination of trend and momentum. It's also quite adaptable since the MACD may be used on a variety of time frame charts.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that helps traders pinpoint potential buying or selling opportunities. The RSI ranges from 0 to 100, indicating whether the asset may be overbought or oversold. With this knowledge, investors can prepare for market movements and make informed investment decisions.

What is RSI and how do I calculate it?

RS = Average Profit / Average Loss

This is a simple calculation of RSI. However, the indicator has several iterations. Instead, use TradingView's built-in RSI indicator to make trading simpler.

Historically, the RSI values have been interpreted as follows:

- If RSI is greater than 70, the asset is considered overvalued and vulnerable to a market downturn or trend reversal.

- It is important to remember that although the RSI provides insight into market momentum, more is needed to give a complete picture. Many investors neglect or misunderstand this fact to gain a trading advantage over others.

- When the RSI rises above 30 degrees, it indicates a bullish sentiment.

- In addition, an RSI reading below the horizontal reference level of 70 is a bearish signal.

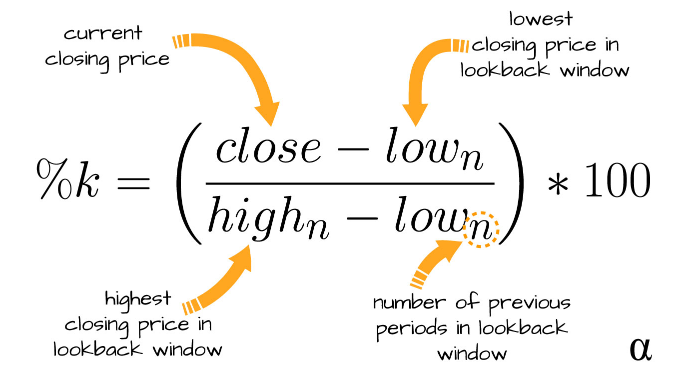

Stochastic Oscillator

In comparison to the other trading indicators, the Stochastic Oscillator is last on our list. It was created to measure the price's momentum or velocity; this is based on the well-known concept that momentum changes direction before price does.

The momentum indicator changes its value between 0 and 100, representing the momentum of an asset. Depending on the analyst's aim, the usual time frame is 14 periods, which may be days or weeks, or even months long.

Unlock the Potent Power of Stochastic Oscillators with Exponential Smoothing! Learn How to Calculate this Important Business Tool.

The stochastic oscillator is built using the following formula:

- %K = (Current close – Lowest low)/(Highest high – Lowest low) * 100

- The 3-day SMA of the %D period is located near the previous day's close, which is a buy signal. This line can be used as a signal/trigger to determine if it's time to start selling or not. The lowest low is the minimum monthly price during a given period.

- Highest High = highest high for this timeframe

- The K in the equation above must be increased to two digits by dividing it by 100 because both sides of the fraction are multiplied by 100.

How do I use the stochastic oscillator?

- If the reading is less than 20, it's assumed that the asset's current price is approaching its minimum for that period.

- If the reading is greater than 80, the asset is approaching its maximum price for that period.

- The accepted overbought limit, like the RSI, is 80; a value above that is considered overbought and signals a sell signal.

- The oversold threshold is a value of 20, which implies that the market is considered oversold and that a buy signal has been triggered.

A stochastic oscillator should not be used alone as an indicator. As a result, it's best to use it in conjunction with the moving average indicator to build a complete trading strategy.

Conclusion

This post is dedicated to teaching you about crypto technical analysis, trading indicators, and their significance. Additionally, we've gone through the expertise and usage of the top 7 trading indicators. Before employing any indicators, it's crucial to comprehend what trading indicators are, how they may aid you in your trading endeavors, and where they come with limitations. To make money as a trader, you must understand the financial markets in-depth. By using technical analysis and indicators, you can supplement your market knowledge and increase your chances of making successful trades.