The Dow Theory is a popular technique used in technical analysis.

Table of content

- What exactly is Dow Theory?

- What Is Dow Theory and How Does It Work? The Six Fundamental Postulates

- Trends in the market change in three ways.

- Three phases are included in the term trends.

- The initial trio of stages is commonly referred to as trends.

- Indices should confirm trends

- The volume should reflect current developments.

- Trading volume is a significant aspect of cryptocurrency trading

- Primary and Secondary Trends in Cryptocurrency Markets: How to Apply Dow Theory

- How to Apply Dow Theory to Crypto-Trends: Accumulation and Distribution

- Dow Theory's Weaknesses and How to Overcome Them

- The essence of Dow Theory

⚡️ What is the Dow Jones theory?

What is the definition of the Dow Theory? The Dow Theory is a market theory that states that a market is in an upswing if one of its averages (such as industrial or transportation) rises above a previous major high and is followed by a similar increase in another average.

⚡️ How do you recognize a false breakout?

When the price of a stock reaches an unprecedented height, it's coined as a breakout. For instance, if the cost rises beyond $100 that means there has been successful surge in prices and thus is seen as a positive sign. On the other hand, when false breakouts happen – where despite surpassing $100 mark initially- its momentum weakens with time thereby leading to depreciation in value: what was needed was more buying but wasn't received for some reason or another.

⚡️ How many principles does Dow theory contain?

Drawing upon six key principles, the Dow Theory offers investors an invaluable resource to gain greater insight into market trends.

⚡️ How accurate is Dow Theory?

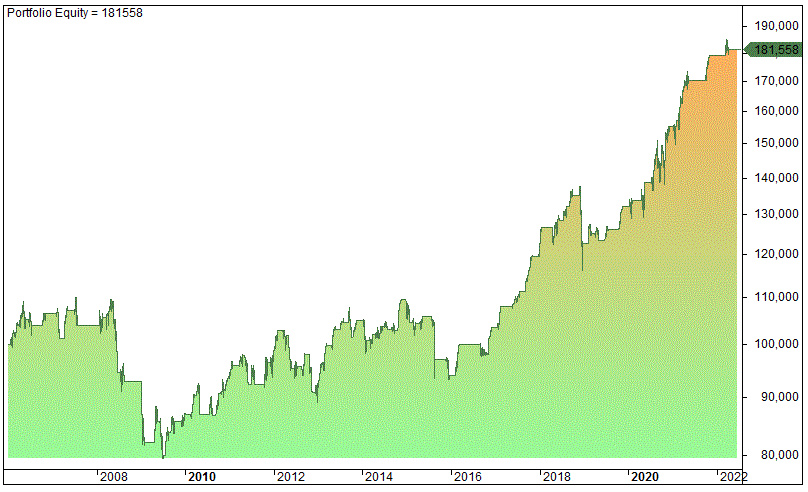

If you are unconvinced of the accuracy of Dow Theory, Bley demonstrated that since its inception in 1953, on average it has outpaced a buy-and-hold approach by 0.42%, achieving an 11.22% annual improvement over more than one hundred years.

The dow theory in technical analysis is based on Charles Henry Dow's writings about market theory. The Wall Street Journal was founded and edited by Dow and co-founder of the world's most extensive stock index, Dow Jones & Company.

Though it started as a hypothesis, the Dow Theory was not conceived of as such; rather, other authors compiled his thoughts and sharpened his views into Dow Theory after his death. Now one of the most basic ideas of technical analysis, which is utilized in financial markets, particularly the cryptocurrency market, is Dow theory.

This essay analyzes Dow's theory and the various market phases based on Dow's research. In addition, we'll discuss some practical chart reading methods inspired by Dow theory that can assist investors in trading any cryptocurrency asset.

What exactly is Dow Theory?

The most popular and basic form of technical analysis for trading any financial assets and commodities on the open market is Dow Theory. Charles Dow developed his ideas in a series of articles for The Wall Street Journal, which he founded in 1889.

Dow Jones & Company, which was founded by three prominent financial journalists in 1882—Dow, Edward Jones, and Charles Bergstresser—exists to this day as a leading financial news publication. The paper's major goal was to provide an unbiased market analysis. Furthermore, Dow and his fellow reporters wanted to establish a trading average for certain transportation stocks, which is how the Dow Jones Industrial Average (DJIA) was created.

In comparison, the Dow Jones Transportation Index wasn't launched until 1884 and has since been utilized as a benchmark for financial markets. Furthermore, analysts often examine both indices' correlation and capacity to foretell market trends.

In 1896, Dow Jones & Co. revolutionized the stock market by introducing the very first industrial stocks average: The Dow Jones Industrial Average (DJIA). By now, this index has become a worldwide symbol of trustworthiness and an accurate measure of U.S financial conditions. Just three years later in 1889, three journalists took it upon themselves to create “An afternoon customer letter” that eventually transformed into one of today's most influential publications: The Wall Street Journal.

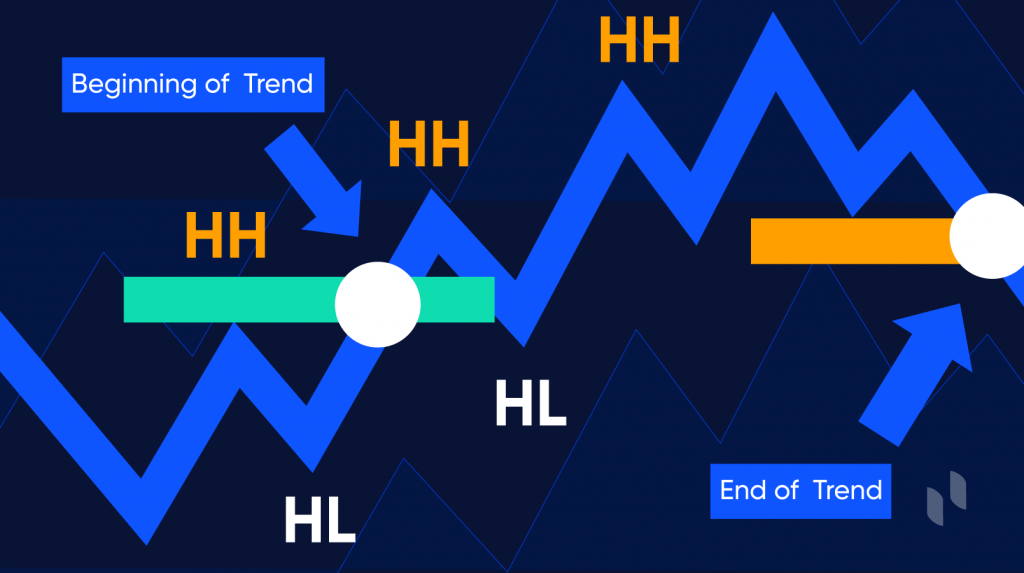

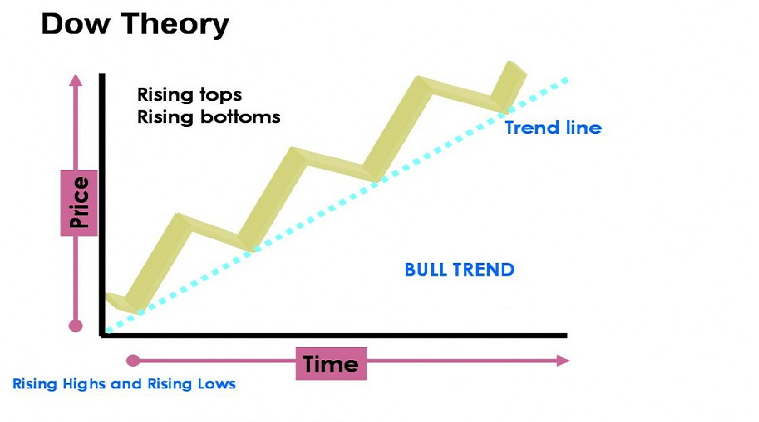

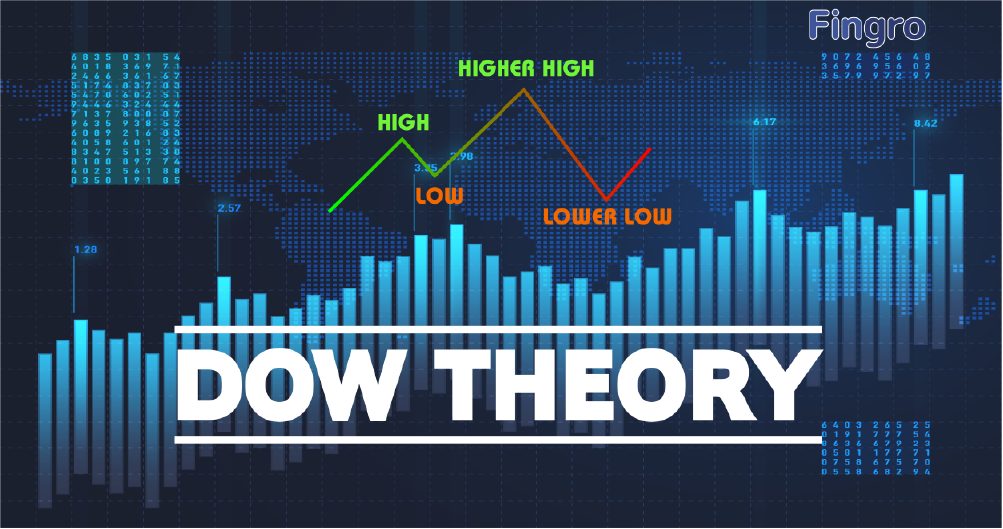

Dow theory predicts the direction of a trend by analyzing the movements of the DJIA and DJTA indices. The trend is characterized as bullish if the two indices move in the same direction, establishing a succession of higher low highs followed by new peaks.

Conversely, Dow theory states that a market is in a downtrend if one of its averages breaks below a previous important low, followed by a similar decline in other averages.

With its long history of nearly a hundred years, the Dow principle that we observe today has been perfected by traders over time. This doctrine is still applicable in modern times when trading cryptocurrency and their derivative assets.

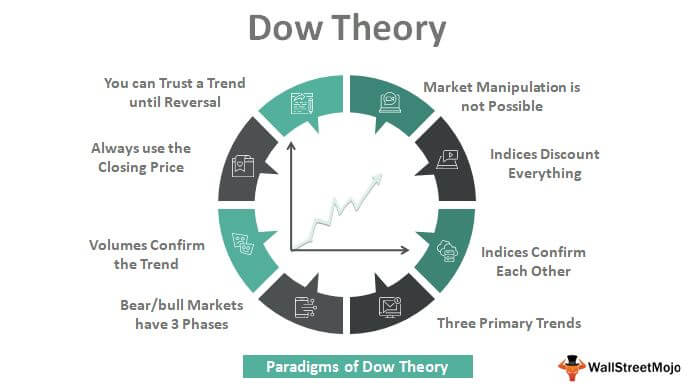

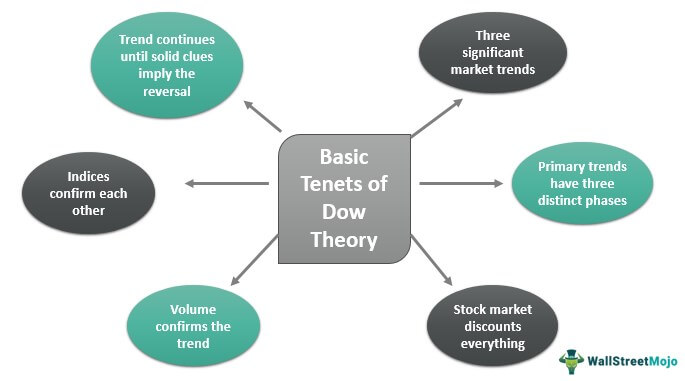

What Is Dow Theory and How Does It Work? The Six Fundamental Postulates

The Dow Theory is a set of guidelines for traders that instruct them in how to construct the market. These six basic principles of the Dow Jones Industrial Average can aid investors in making more accurate trading decisions in both bull and bear markets.

Trends in the market change in three ways.

Based on their duration, the Dow divides market trends into three categories.

- The beginning of a trend that can last one, two, or more years is known as the primary trend.

- Secondary Trend: Part of the primary trend, but moving in the opposing direction. This trend can last anything from three weeks to three months.

- A short swing is a price movement of fewer than three weeks in duration.

A daily chart of BTC/USDT reveals a bullish trend, as seen in the graphic above. A bearish correction is noted as a secondary trend within the main trend.

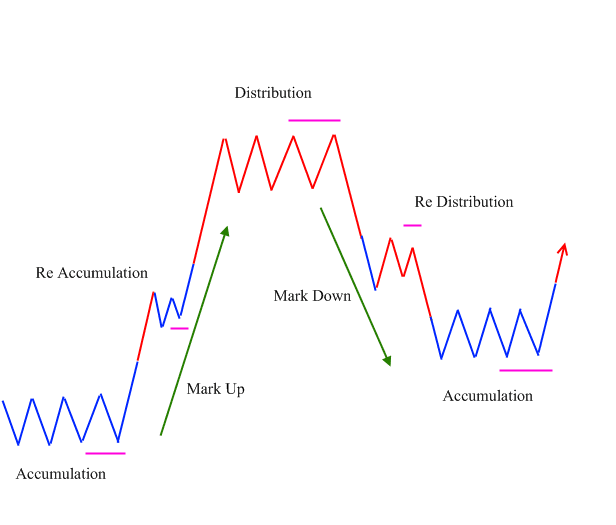

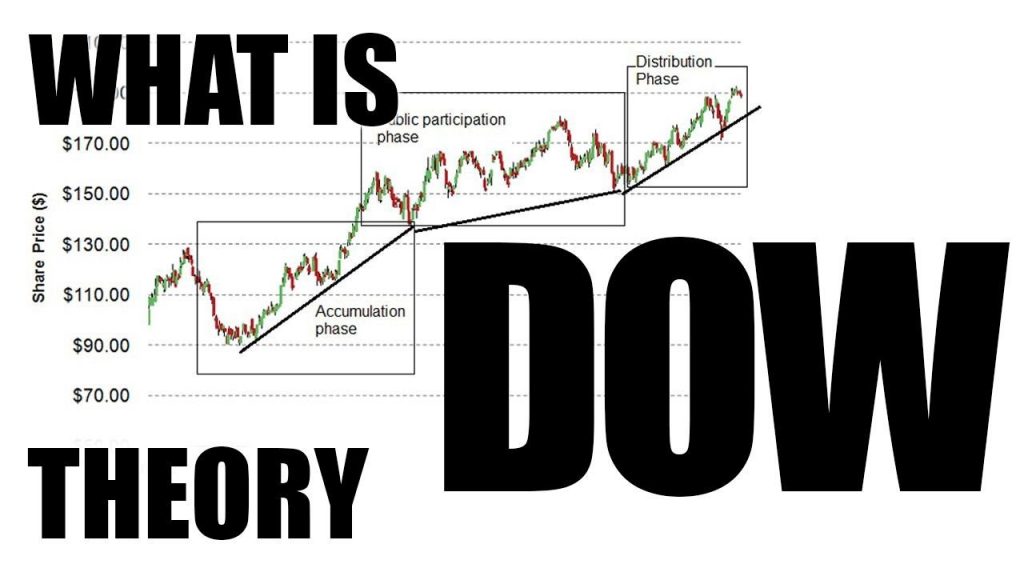

Three phases are included in the term trends.

The following are the primary phases of the trend:

- Accumulation: when bearish sentiment is present, the value of the asset tends to drop during the accumulation stage. Smart investors gradually invest their money in order to acquire the asset during this period. As a consequence, prices begin to rise little by little.

- After a trend has been established, the public becomes involved and starts following the trend. Unfortunately, newly-arrived individuals will likely generate a different income level than those just starting.

- The distribution phase is when a trader first understands that the trend is weakening and that it's time to sell. As a result, once they complete their position, the market will inevitably turn around.

The initial trio of stages is commonly referred to as trends.

According to the Efficient Market Hypothesis (EMH), existing asset valuations are constantly updated and accurately reflect all accessible public information. This means that regardless of whether one looks at market data or not, any relevant news will shape future trends for this asset. Hence, assessing its potential success or failure involves both proactive and reactive analysis in line with Dow Theory.

Dow Theory has two branches: classical and modern.

In an efficient market, the price of a crypto-asset will react immediately to significant news, demonstrating the influence of that news on market sentiment.

In mid-October, the stock market experienced a remarkable nadir that caused trepidation among investors.

Indices should confirm trends

The principle of correspondence states that the average Dow indices for industry and transportation should be in sync.

This idea is based on the belief that indices derived from the production and sale of products are linked. Transportation must, for example, transport manufactured goods from warehouses to accomplish its purpose. As a result, if transportation stocks decrease, so will industrial inventories as a consequence.

Ideally, the industrial and transportation indices should move in tandem to show that market optimism is steady. A divergence occurs when one of the indices rises while the other declines, indicating a possible precursor to a reversal in the current market trend.

On the other hand, businesses have not yet used railroads to transport products in recent years. Instead, they utilize air, sea, and other methods. Even technology firms like Microsoft, Apple, and Google may not require such deliveries. Investors can utilize alternative indices like the S&P 500 or FTSE 100 to forecast the market's Dow theory.

The DJIA and the S&P 500 shows a strong positive relationship in this chart, as both indexes move upwards in tandem. This illustrates that there is a powerful connection between them.

The volume should reflect current developments.

When prices rise, it is essential to consider trading volume as a guide. A high-volume indicates that more people are investing in the trend, which increases its resiliency. When there's an unexpected reversal of price direction, you should be able to observe a decrease in trading activity beginning from the start.

On the other hand, low volume against the primary trend indicates lesser market participation and a lower chance of trade.

Trading volume is a significant aspect of cryptocurrency trading

Dow hypothesizes that the underlying trend will continue until an important event occurs, which reverses market sentiment in the other direction. Nonetheless, you should always trust the main trend during potential short-term reversals.

Even if there is a 30-50 percent sell-off, the price on the BTC/USDT daily chart is rising in a solid uptrend, as seen in the image above.

This provides further proof of the idea of taking a long trade in the main trend and disregarding any potential to take a position against it.

Primary and Secondary Trends in Cryptocurrency Markets: How to Apply Dow Theory

The Dow Theory is based on century-old ideas. Due to this, numerous investors remain skeptical of its efficacy in the current financial markets, especially regarding cryptocurrency.

Today's financial markets are dominated by high-frequency trading algorithms, but the human mind still maintains a logical basis for market making. As a result, Dow's thinking may still be utilized to cryptocurrency markets; however, investors should adopt it differently.

In today's market, where technology equities have supplanted DJTA in the NASDAQ 100, the concept of reading a larger trend is no longer applicable. So we can't utilize DJTA together with the DJIA, but the notion of interpreting a bigger market trend remains valid.

Let's apply Dow theory to the cryptocurrency market to discover a lucrative price trend.

The first step is for investors to find a significant trend. Finding a major trend in the cryptocurrency market is not difficult. This is because the cryptocurrency market when compared to the traditional forex market, is rather young, and most large cryptocurrencies tend to start optimistically.

The overall primary market, as revealed by the BTC/USDT chart below, is still optimistic, generating swing highs from the start.

The image above depicts a BTC/USDT daily chart showing a bullish primary trend and a negative secondary trend.

According to Dow's logic, we should only trade in the direction of the primary trend. In this example, investors should wait for the secondary trend to conclude. As soon as the price rises above the swing high, a bearish secondary trend will come to an end (as shown in the illustration below).

In the second wave, the price falls in the second half before quickly recovering after breaking above the most recent upswing. As a result, the price rises with impulsive bullish momentum.

How to Apply Dow Theory to Crypto-Trends: Accumulation and Distribution

Investors should consider the accumulation and distribution phases of a stock's price movement using volume data assistance to get a more accurate trading entry.

On the 1-day BTC/USDT chart, a buy entry is marked by the following confirmations:

- The majority of the time, the price trend is up.

- The distribution phase has ended, and the accumulation period has begun.

- In the accumulation area, the secondary trend is bearish and has recently reached a new swing high.

- Buyers have supported the price.

Dow Theory's Weaknesses and How to Overcome Them

To forecast price movement, the Dow Theory needs at least two years of data. It is typically tough to acquire trustworthy data with more than two years of history in cryptocurrency markets. In addition, even if we do discover such data, its trustworthiness is debatable because cryptocurrency markets have a high degree of volatility.

Another consideration is that determining the long-term dependability of the current market trend is difficult. Dow's hypothesis claims that an upswing can continue despite nearing a swing low. Similarly, a downturn is considered active if the price is at the swing maximum in the short term. In time, it's feasible to adhere to Dow's theory if only a higher

Support and resistance levels are commonly regarded as vital by investors: bulls start buy orders from support and bears from resistance. When a support or resistance level is broken, however, the position is reversed: support becomes resistance and vice versa in Dow's theory. When a short-term swing level is broken in Dow theory, the support/resistance levels change their

Because of this, investors must supplement their charts with other components to improve the chances of trade. If you use tools such as moving average, MACD, stochastic oscillator, or even VWAP for more efficient trading, Dow theory is still applicable and effective. The price will likely move in that direction if various indicators indicate the same trend.

The essence of Dow Theory

This information will help you understand Dow Theory and its relation to the cryptocurrency market. When employing Dow Theory for swing trading or intraday trading in cryptocurrency markets, the main risk is correlated indices. The cryptocurrency market is still relatively young, and it uses blockchain technology to follow pure supply and demand.

Investors can now sidestep intermediaries and transmit their funds directly to a wallet address of their preference. This is a new idea that makes comparing several indices difficult. On the other hand, investors may combine the price action of similar assets such as Bitcoin and Etherium to determine present market sentiment.

Despite an understanding of Dow Theory, cryptocurrency traders must prioritize establishing a reliable trading strategy. The crypto market remains highly volatile and is yet to be fully compliant with regulatory standards — thus, investors should tread carefully even when utilizing sound money management approaches.