What is Total Blocked Value (TVL)?

Table of content

- What is the meaning of "locked-in value"?

- Why is TVL important for decentralized finance?

- What is the formula for cryptoTVL?

- Which cryptocurrency has a high total blocked value (TVL)?

- DeFi TVL’s largest network.

- What are some ways that individual cryptocurrency projects can support total value locked-in (TVL)?

- What factors influence TVL’s price?

- How significant is the TVL/market capitalization ratio?

- How can crypto projects monitor their Total Value Locked (TVL)?

- What is the largest television station in terms of viewership?

- How can TVL affect the price?

- How can cryptocurrency projects increase their total value locked?

⚡️ Have you ever wondered what “total blocked value” in the cryptocurrency world refers to?

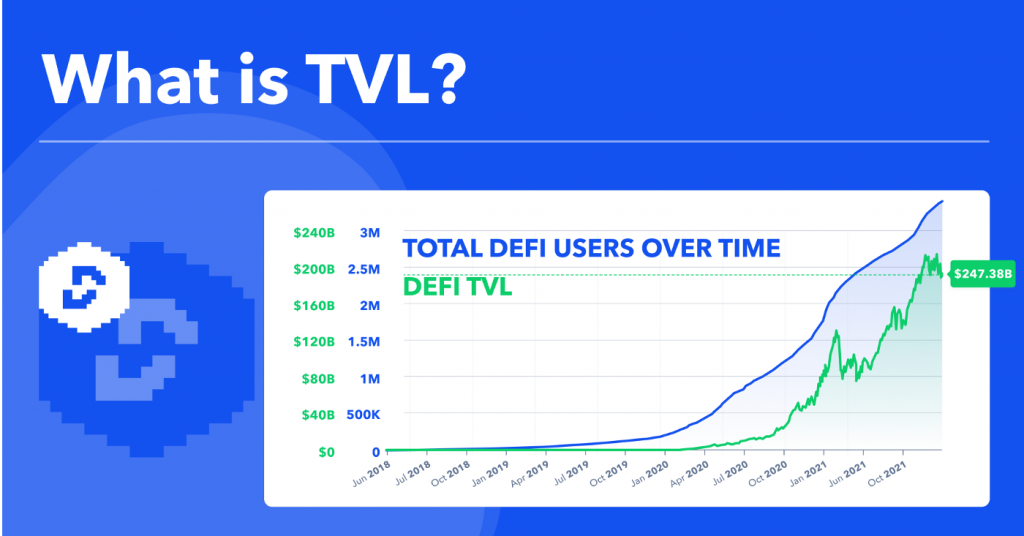

The total value locked (TVL) calculated from all released digital assets, like dividends and interest, has dropped 16% since the beginning of December 2021. Despite this slight dip, industry players remain confident that Defi still has immense potential for growth and a rosy future ahead of it.

⚡️ What's locked into Ethereum's value?

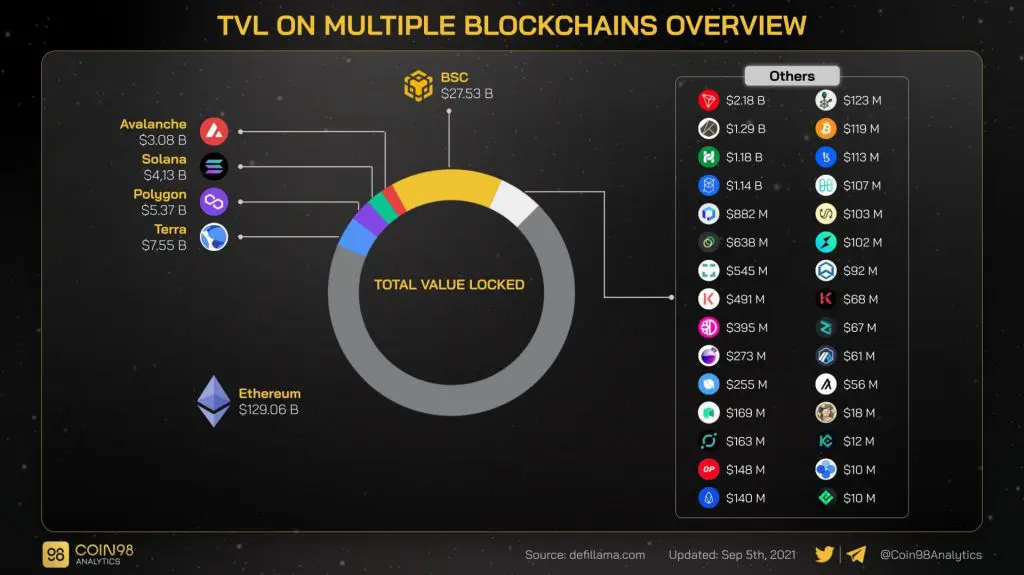

On the blockchain side, Ethereum continues to dominate TVL in terms of total value with 54.31 percent or $125.7 billion blocked.

⚡️ Which three Defi coins are the most popular?

Ethereum (ETH), Chainlink (LINK) and Uniswap (UNI): these three top-ranking Defi coins are sure to have you wanting in on the action. Ethereum, as the largest, oldest and most well-known of them all is responsible for powering many of our world’s foremost smart contracts and decentralized applications; whereas Chainlink serves as a middleware protocol that links blockchain networks with real-world data – another essential component used by so many DeFi apps.

⚡️ Is XRP DeFi?

Last Thursday (April 14), Ripple made a major announcement, stating that one of its partners providing asset conversion services had integrated support for the XRP Ledger. The XRPL is an innovative public blockchain platform specifically designed to facilitate fast and secure money transfers with minimal costs.

What is the meaning of “locked-in value”?

When investors safeguard their wealth in stocks, bonds, mutual funds, and retirement accounts for the long haul by preserving value, they guarantee that their capital is well-protected from short-term market volatility. This type of investment safeguards a set amount of funds until an event or date stipulated at the time of purchase occurs – meaning you won't be able to access this sum before then. Investing with locked-in value provides peace of mind as well as potential upside in markets over time.

Furthermore, locking in value can safeguard investors against market turbulence and potential losses. Essentially, it offers protection for their initial investment and ensures that the investor retains a certain amount of wealth.

Defi assets include revenue and interest from standard services such as lending, betting, and liquidity pools provided in the form of smart contracts. TVL in staking is an excellent sign for investors looking to back DeFi platforms with the greatest rewards. It is the total value recorded in DeFi’s betting protocols, which is made up of the assets placed in wagers.

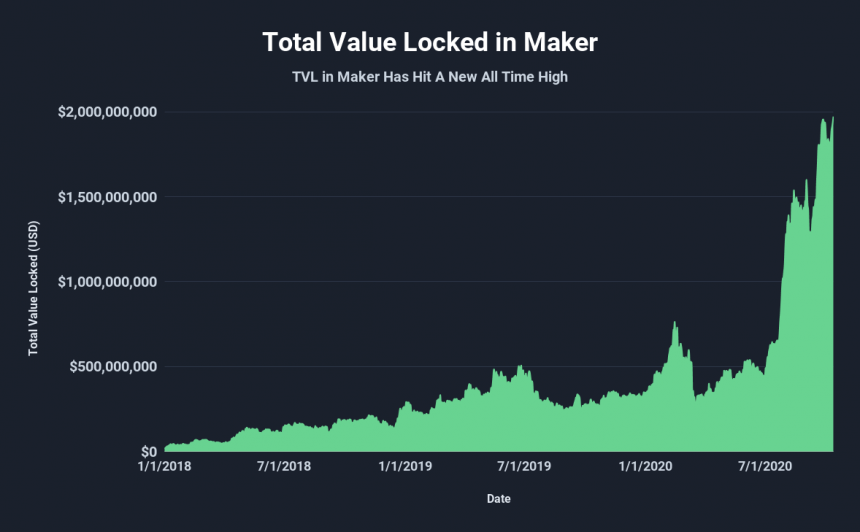

TVL has achieved remarkable expansion and growth in the past two years – from its inaugural market value of $400 million to an estimated over $2 billion by 2022. This is due in part to opening new offices worldwide and hiring hundreds of employees. The company's rapid success can be largely attributed to its proficient leadership, cutting-edge technology solutions, and dedication towards customer satisfaction.

With businesses today seeking efficient technological advancements that will revolutionize their operations, TVL stands out as an organization that continues on a path toward innovation while ensuring client loyalty through outstanding service.

While the term “TVL” is simply defined as the entire value of cryptocurrency held in a smart contract, certain variables may have an impact on DeFi projects’ valuations.

Deposits, withdrawals, and the amount held by the protocol are not the only factors that support TVL’s value. TVL is also impacted by changes in fiat currency or native token value. The TVL of a protocol may be denominated in the project’s own cryptocurrency, which means it is influenced by its value. If the value of the project’s cryptocurrency plummets, the TVL of the protocol will also drop.

Why is TVL important for decentralized finance?

To operate, DeFi platforms need capital to be deposited as collateral for credit or liquidity in trading pools. TVL is significant because it indicates the influence of money on profits and the usefulness of DeFi apps for traders and investors.

An increase in TVL is often followed by increased liquidity, popularity, and usage on a DeFi platform. These factors work together to help ensure the project's success. More money becomes locked into DeFi protocols when the TVL rises; conversely, less money is available–and returns are lower-when the TVL falls.

Data analytics platforms, such as Defi Pulse and DefiLlama, can provide detailed information on the number of crypto assets that have been secured in their smart contracts. This data can then be used to estimate the market share held by different Defi protocols.

Members of the Defi Pulse network should be aware that the platform simply tracks intelligent protocol contracts on the Ethereum blockchain by taking the total amount of Ether tokens ( ETH ) and ERC-20. DefiLlama, on the other hand, measures TVL by calculating each chain’s overall balance together with all other Defi chains or each platform’s TVL ratio.

What is the formula for cryptoTVL?

Because new blockchain-based techniques are being created all the time, determining a precise TVL for the overall market and determining if a specific Defi platform is a safe choice for end users may be difficult.

Protocols with a massive $1 billion TVL create an implicit promise of reliability and sustainability. A strong development team, plus practical use case applications for investors and contributors, further light the way to increased demand – ultimately resulting in higher market capitalization for the project overall.

Although, you should be cautious of DeFi protocols with TVLs (Total Value Locked) as low as 1. On the other hand, take note of high returns on low-TVL DeFi systems; these could be marketing ploys used by new platforms attempting to gain market share. They might also be scams since few or no participants have entrusted their assets to them yet.

Assessing the risk of a platform requires more than just observing its Total Value Locked (TVL). It is essential to compare it against other critical metrics, such as Daily Active Users (DAU) and Transactions per Day (TXD). The TVL/market capitalization ratio is also significant. If the TVL is close to

To calculate a project's TVL, first find the market capitalization by multiplying the DeFi project supply by the current price. Then, divide that number by the maximum circulating supply to get the TVL.

The TVL ratio is calculated by dividing the total market capitalization of the blocked asset by the overall blocked value. We get the TVL ratio by dividing the total market capitalization of a blocked asset by its entire value. The TVL ratio can help determine whether or not an asset is DeFi undervalued.

Which cryptocurrency has a high total blocked value (TVL)?

Bitcoin (BTC) is the most popular cryptocurrency with the highest total blocked value (TVL). As of 2021, Bitcoin's TVL stands at around $1.2 trillion. Ethereum (ETH), the second-most popular cryptocurrency, also has a high TVL, standing at around $170 billion as of 2021. Other large cryptocurrencies that have a high TVL include Tether (USDT) ($41 billion), Binance Coin (BNB) ($35.3 billion), Polkadot (DOT) ($34 billion). Litecoin (LTC) and Cardano (ADA) also have significant TVLs of $14 billion and $11.4

DefiLlama has recently reported that the Defi platform industry is experiencing unprecedented growth, with its market value skyrocketing from a mere $630 million in early 2020 to an impressive $172 billion by Q1 2022. This significant surge proves the sector's unwavering success and remarkable potential for future expansion.

The entrance of the SEC's crypto enforcement arm has caused massive changes in the market. Despite wild peaks and valleys, Bitcoin is still setting itself apart as a leader. An example? When it bottomed out at $3000 for some time in February 2018 – only to soar back up above $4000 shortly afterward! Its resilience continues to amaze us all.

Since the start of 2020, Ethereum has witnessed a remarkable rise in cost per unit – an increase from $127 to approximately $500 by May; that's 300% growth! This phenomenal surge demonstrates Ethereum is one of the most dependable and reliable cryptocurrencies in today’s market. ETH holds second place for largest virtual currency concerning market capitalization- further proof as if it were needed, that this prominent digital asset is here to stay.

DeFi TVL’s largest network.

Ethereum was the most popular DeFi TVL network in 2022, accounting for roughly half of the global DeFi market.

In case you're wondering, the Ethereum DeFi network consists of approximately 500 protocols. Its TVL is a whopping $73 billion, which equals 64% of the market share. That's compared to BNB Smart Chain’s malnourished $8.74 billion and measly 7.7 percent market share, Avalanche’s paltry $5.21 billion and teensy 4.5 percent market share, Solana’s itsy-bitsy

$0.614 billion and wee 0.53 percent market share, TRON’S itsier-bitsiest

$05760 million coughed up a measly 050 pecent market shear

TVL’s animation is simple to understand and comprehend. It shows the entire DeFi market in terms of TVL, expressed in US dollars, with current percentage movement and a more dominant cryptocurrency.

The observation that Ethereum has the most total blocked values among all chains suggests that it is probably the most frequented network in DeFi cryptocurrency. TVL, or total value locked, is a decisive metric for judging market growth and health. It's important to note though, that while a jump in TVL often points to positive circumstances within a market, it shouldn't be given too much credit as being the sole focus.

The value of locked-in assets can be volatile, especially when the Ethereum (ETH) price is concerned. The price of ETH has been affected by increased volatility in both positive and negative ways. Starting with the price of ETH, which is where most of the assets reside on the platform, volatility is one of the main options that may significantly affect the TVL.

On February 12th, 2018, ETH reached an impressive peak of $13.92 billion in total value locked within its blockchain-based smart contracts – a new high for the world's second-largest cryptocurrency by market capitalization. This underscores the continued growth of the decentralized finance (DeFi) sector built on Ethereum.

Because DeFi’s services are decentralized and trustless, money may swiftly move from one account to another, resulting in incorrect liquidity calculations. TVL, like any other indicator, only indicates market circumstances and should not be used as a basis for investment decisions because of its limitations and approximations.

What are some ways that individual cryptocurrency projects can support total value locked-in (TVL)?

Swaps between TVL and Bitcoin are generated in blocks by the Bitcoin network. This can be done at any time, bringing additional liquidity to the ecosystem. Adding extra liquidity pools to encourage users to deposit and block more coins on the platform is a common practice among cryptocurrency projects that wish to boost TVL. Setting appropriate borrowing rates to stimulate crop farmers to take out loans and buy more assets is another way to increase TVL.

Rate

Staking is the process of locking cryptocurrency into a wallet to support transactions and blockchain security and getting rewarded for it. The total value trapped in the protocol due to staking is calculated over the length of the vesting period. Vaults allow users to store cryptocurrency similarly to wallets, but they add extra steps before allowing immediate withdrawal. Trusted individuals must be online to confirm a transaction, and the process usually takes place over several days.

Vaults

After a vault is established, it applies secure withdrawal procedures and the protocol controls unauthorized withdrawals from the vault during the day. Liquidity pools are cryptocurrencies that are kept in smart contracts to provide liquidity for decentralized exchanges.

Quarantining is an essential precautionary step to ensure that you have the greatest liquidity potential. Liquidity pools are another method of increasing liquidity through intelligent hedging.

Pools provide a quicker way to trade by cutting out the need for buyers and sellers to match. Instead of waiting for people looking to buy or sell what you have, you can use an existing liquidity pool. People who contribute their liquidity make money from it and help increase TVL.

When TVL is in projects like Uniswap, where it has assets in the project’s liquidity pools, the value can rise dramatically during price rises and give false expectations of asset inflows and liquidity availability.

What factors influence TVL’s price?

TVL increases when the price of a digital asset rises, showing the network’s rising popularity. Ethereum is one of TVL’s major drivers because most smart contracts and DeFi apps are built on it. The disadvantage of TVL is that it tends to overvalue assets in a bull market and that it does the same thing when there is bearish pressure.

How significant is the TVL/market capitalization ratio?

This ratio is used to compare the total value locked in a project to its market capitalization. If there is a high TVL/market cap ratio, it indicates that escrow might be holding most of the project's market cap, which could lead to price manipulation. A low TVL/marketcap ratio may mean that not many people are using the project.

How can crypto projects monitor their Total Value Locked (TVL)?

Monitoring a project's Total Value Locked (TVL) can be done in multiple ways. Block explorers such as DeFi Pulse and Code Data are the most widely used methods for quickly accessing real-time data about TVL figures. Additionally, crypto exchanges typically have an Application Programming Interface that also offers TVL information. With these various options at your disposal, you'll always stay up to date on exactly how much value is locked into any given project!

While TVL is certainly a worthwhile metric for gauging the success of any given project, it should not be considered in isolation. It's beneficial to take into account other measures such as active users, transaction volume and developer activity as well when evaluating the soundness of a venture. Doing so gives one an overall better understanding of its progress and potential longevity.

What is the largest television station in terms of viewership?

As of September 2020, the Ethereum network has the largest TVL with over $13 billion locked in DeFi protocols. Other large TVL networks include TRON, EOS, and Polkadot.

How can TVL affect the price?

TVL crypto can both increase the demand for a digital asset, and overvalue assets in a bull market. When more people use a project, the demand for that project’s native token increases; this results in an overall price increase. However, TVL can also inflate prices during bullish periods to the point of manipulation

How can cryptocurrency projects increase their total value locked?

There are several ways crypto projects can increase TVL:

- by providing liquidity to liquidity pools

- by quarantining assets in vaults

- by increasing the price of the project’s native token

- by overvaluing assets in a bull market.

Providing liquidity to liquidity pools is a great way to increase TVL. Liquidity providers earn a fee for providing liquidity, which contributes to the project’s TVL. Additionally, quarantining assets in vaults protects them from price volatility and increases the project’s TVL. Finally, increasing the price of the project’s native token attracts new users and increases TVL.

In conclusion, TVL is a valuable tool for measuring project advancement but should not be considered the most critical metric. It's just as vital to examine other metrics, such as active users, transaction volume, and developer action, to perceive a project's success accurately. During bull markets, when prices flourish, TVL can cause assets' values to become exaggerated beyond their genuine market price.