The 2024 Bitcoin Halving: Boom or Bust for Miners?

As we dive into 2024, the excitement within the crypto community reaches a crescendo, particularly as the anticipation builds around Bitcoin's imminent halving – a pivotal event that could reshape the dynamics of its market. It's imperative to delve into this phenomenon, given its historical significance in catalyzing transformative shifts across the crypto landscape. Armed with insights gleaned from past halvings, we navigate forward with a discerning eye, ensuring our strategies are informed by these lessons. But what sets this upcoming halving apart? Let's delve deeper into the intricacies.

Table of content

Bitcoin's Journey: Evolving from Digital Gold to Rare Platinum

At the core of Bitcoin's design lies the deliberate effort to reduce its availability over time, effectively curbing inflation. With a finite cap of 21 million Bitcoins, we've already surpassed the 19.62 million milestone. This scarcity, coupled with the controlled release of Bitcoin into circulation, underpins its comparison to “digital gold,” both assets sharing a characteristic rarity.

Conceptualizing the Bitcoin blockchain as a ticking clock, we witness the occurrence of halving approximately every 210,000 blocks, equating to roughly four years, resulting in a halving of the block reward. This protocol has been in place since Bitcoin's inception in 2009, starting with a reward of 50 BTC per block and gradually decreasing to 3.125 BTC by 2024.

The Stock-to-Flow ratio, a metric comparing existing supply with the influx of new coins, indicates that Bitcoin is poised to become scarcer than platinum by 2032, following the 2024 and 2028 halvings, further solidifying its status as a coveted asset akin to gold.

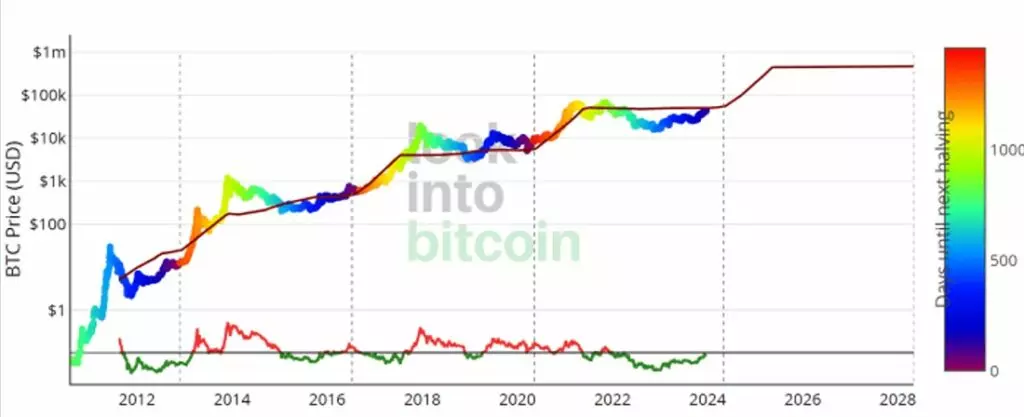

Patterns of Growth Post-Bitcoin Halvings

Reflecting on Bitcoin's historical trajectory post-halving events reveals a pattern of remarkable price surges. Following the 2012 halving, Bitcoin's market cap surged by 342% within 100 days, with the peak price soaring to $1,152 the subsequent year, marking an 8,761% increase. Similarly, after the 2016 halving, which halved the block rewards to 12.5 BTC, Bitcoin's price skyrocketed to $17,760 the following year, reflecting a 2,572% surge. The most recent halving in 2020, reducing the reward to 6.25 BTC, witnessed Bitcoin's price reaching $67,549 the following year, representing a substantial 594% growth.

Engaging in speculative projections based on past trends, considering the diminishing growth rates post-halving, suggests a potential growth rate of approximately 155.79% following the 2024 halving, potentially propelling Bitcoin's price to around $111,807 within one to one and a half years. However, it's crucial to emphasize that such projections are speculative and should not serve as the sole basis for investment decisions.

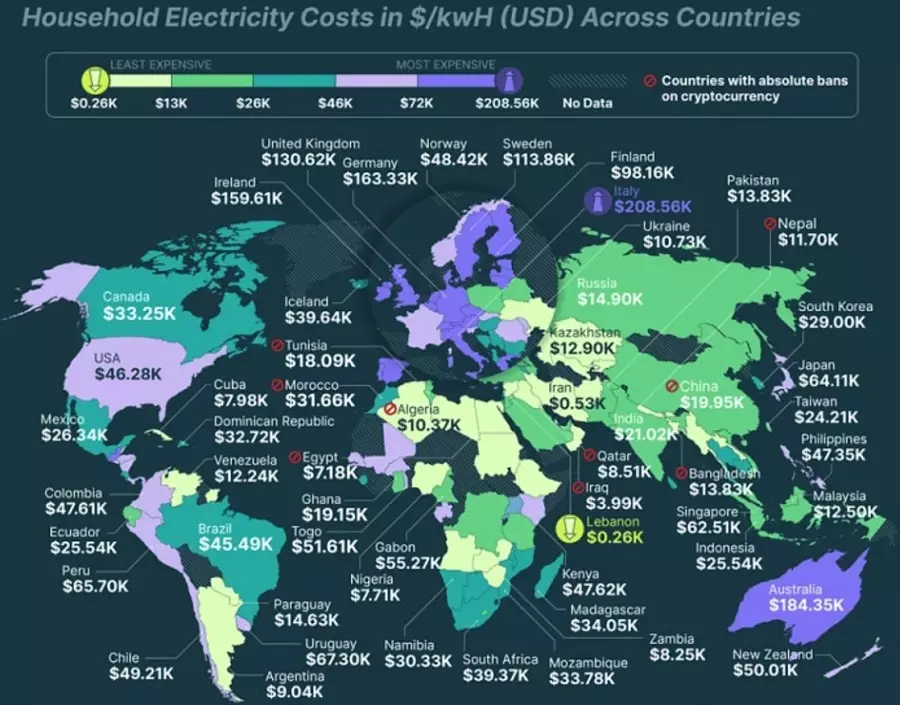

For Bitcoin miners, the 2024 halving poses significant challenges. With rewards halved, miners utilizing outdated equipment and facing exorbitant electricity costs find themselves in a precarious position. In certain regions like Italy, the cost of mining a single Bitcoin can rival that of luxury sports cars, reaching up to $208,560.

The 2024 halving is poised to reshape the mining landscape, resembling a high-stakes arena akin to “The Hunger Games,” where only the most efficient miners with access to affordable energy will thrive. It's a testament to the evolving dynamics of the crypto ecosystem, where strategic prowess and resilience determine success in this fiercely competitive arena.

In essence, the 2024 Bitcoin halving promises to be a seismic event, heralding significant shifts in mining operations and potentially catalyzing a substantial price swing. This convergence of economic theory and technological innovation encapsulates the allure of crypto space. Whether you're actively mining, holding, or simply observing from the sidelines, buckle up – this chapter is bound to make history!