JPMorgan’s $42K Bitcoin Plunge Prediction After Halving

The impending Bitcoin halving event, slated for April, is poised to catalyze a significant downturn in Bitcoin's value, as outlined by analysts at JPMorgan.

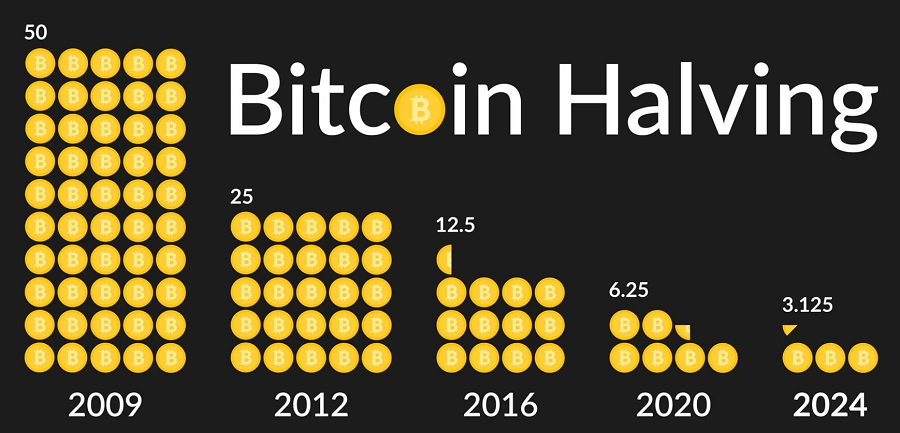

In their comprehensive report released on Wednesday, the analysts, spearheaded by Nikolaos Panigirtzoglou, delve into the ramifications of this halving event. The event will effectively slash Bitcoin miners' rewards from the current 6.25 BTC per block to a mere 3.125 BTC. This reduction, the analysts posit, will reverberate through the mining ecosystem, denting miners' profitability and inflating the production cost of Bitcoin.

“The bitcoin production cost has empirically acted as a lower bound for bitcoin prices,” the analysts said. “The central point of our estimated production cost range stands at $26,500 currently, which would mechanically double post-halving event to $53,000.”

However, the analysts aren't blind to potential headwinds. They speculate a plausible 20% downturn in the Bitcoin network's hash rate post-halving, attributing it largely to the anticipated exodus of less efficient mining rigs owing to diminished profitability. This anticipated decline, coupled with an assumed average electricity cost of 0.05 $/kWh, could deflate the estimated production cost range to a more modest $42,000, the analysts elaborated.

“This $42,000 estimate is also the level we envisage bitcoin prices drifting towards once bitcoin-halving-induced euphoria subsides after April,” the analysts said.

At present, Bitcoin is commanding a price in the vicinity of $62,730.

Concentration in the Bitcoin Mining Sector

Looking beyond the halving, the analysts prognosticate a landscape where Bitcoin miners with below-average electricity expenses and technologically superior equipment stand a better chance of weathering the storm. Conversely, those burdened with high production costs may find themselves on shaky ground.

Consequently, consolidation within the Bitcoin mining sector is on the horizon, the analysts opined, with publicly listed miners poised to seize a larger market share by streamlining costs to safeguard profitability.

“There could be also some horizontal integration via mergers and acquisitions among bitcoin miners across regions to take advantage of synergies in their businesses,” the analysts concluded.