Trading Order Types | Market Order, Limit Order & Advanced Types

This article explores the various trading order types investors and traders use in financial markets. We discuss market orders, limit orders, and more advanced types such as stop-limit and trailing-stop orders.

Also, their characteristics, advantages, and disadvantages help you make decisions and manage risk effectively.

Table of content

Key Takeaways

- Market orders are executed immediately without a guaranteed price, ideal for fast trades in liquid markets.

- Limit orders let traders set a desired price but may not always be filled.

- Buy stop-limit and sell stop-limit orders trigger at a set price and then turn into limit orders, helping traders enter rising markets or protect gains.

- Stop-loss orders become market orders to limit losses once a specific price is hit.

- Stop-loss limit orders offer precise selling prices but risk not being filled.

- Trailing-stop orders automatically adjust to lock in profits as prices move favorably.

Market Order

A market order is one of the fundamental trading order types used by investors and traders across various financial markets, including stock, forex, and cryptocurrency exchanges. Market orders are executed almost instantaneously and are used when speed is a priority over price.

Market Orders’ Characteristics

Here are some key characteristics of market orders:

- Immediate Execution: Market orders are executed as quickly as possible, which is ideal when you want to enter or exit a position immediately.

- No Price Guarantee: While market orders are filled quickly, there is no guarantee of the execution price, especially in fast-moving or illiquid markets.

- Best for Liquid Markets: They work best in highly liquid markets where the bid-ask spread is narrow, minimizing the cost associated with immediate execution.

Real-World Example

Imagine you want to purchase shares of Company XYZ, which is currently trading at $50. You place a market order for 100 shares. The order is executed immediately, and you receive the shares at the best available price, which might be slightly above or below $50, depending on the market's liquidity and current demand.

Advantages and Disadvantages

Below are some of the key advantages and disadvantages of using market orders:

Advantages:

- Simplicity: Market orders are straightforward to execute, making them accessible for all traders.

- Speed: They allow for rapid execution, crucial in volatile markets where prices change rapidly.

Disadvantages:

- Slippage: In volatile or illiquid markets, the final price might differ from the last traded price, resulting in slippage.

- No Control Over Price: Traders have no control over the execution price, which can be problematic in fast-moving markets.

Limit Order

Unlike market orders, which are executed immediately at the best available current market price, limit orders give more control over the price at which the trade will be executed. This type of order is beneficial in volatile markets or when trading securities with less liquidity.

How Do Limit Orders Work?

When placing a limit order, traders set a specific price limit – the maximum price they are willing to pay when buying stocks or the minimum price they are ready to accept when selling. The order can be executed if the market price meets or is better than the specified limit price.

Here are some key points about limit orders:

- Buy Limit Order: You set a purchase price below the current market price. The order is executed only if the cryptocurrency price exceeds your specified limit.

- Sell Limit Order: You set a selling price above the current market price. The order is executed only if the security's price rises to your specified limit or higher.

Advantages of Limit Orders

Below are some advantages and disadvantages of using limit orders in trading:

Advantages:

- Price Control: Traders have better control over the price at which the trade is executed.

- Cost-Efficient: Helps avoid slippage, which is the difference between the expected price and the price at which it is executed.

- No Unwanted Fills: Protects against buying for more or selling at a lower price than intended.

Disadvantages:

- No Execution Guarantee: The order may not be executed if the market price doesn't reach the limit.

- Partial Fills: In a fast-moving market, only a portion of your order might be executed, if at all.

- Opportunity Cost: You may miss other trading opportunities while waiting for the price to hit your limit.

Additional Order Types

When discussing trading order types, it is crucial to understand that beyond the basic market and limit orders, there are more advanced types that can offer traders greater control over their trades. These advanced orders are instrumental in volatile markets, such as cryptocurrency trading, where prices change rapidly.

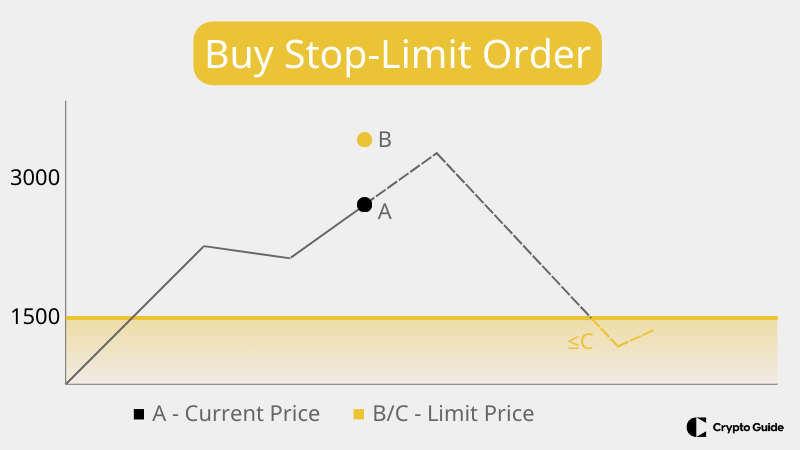

Buy Stop-Limit Order

A Buy Stop-Limit Order is an order to buy cryptocurrency for a specific price (the stop price) or higher, but only after a given stop price has been reached or passed. This order type is used when a trader expects that the cost of an asset will increase after it reaches a certain level.

Here's how it works:

- Activation: The order is inactive until the market price reaches the stop price.

- Execution: Once activated, it becomes a limited order to buy at a limited price.

Example: Imagine you are tracking a cryptocurrency that is currently trading at $200. You believe that if it starts to move above $210, it will continue to rise. You could set a Buy Stop-Limit Order with a stop price of $210 and a limit price of $215. If the price hits $210, your order is activated, but you will only purchase the asset if you can do so for $215 or less.

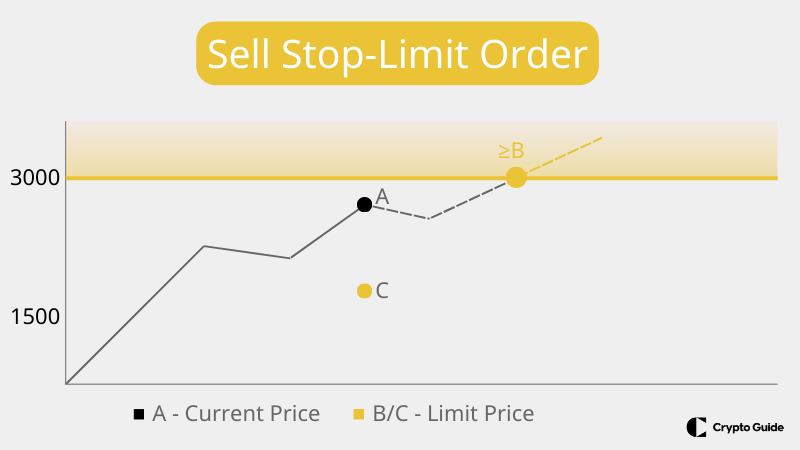

Sell Stop-Limit Order

Conversely, a Sell Stop-Limit Order is an order to trade security for a certain price (the limit price) or higher but only after a certain price level (the stop price) has been reached or crossed. This type of order helps traders protect profits or limit losses.

Here's how it operates:

- Activation: The order becomes active only when the market price hits the stop price.

- Execution: Once the order is active, it becomes a limit order to sell at the limit price or higher.

Example: Suppose you own a cryptocurrency currently trading at $300. To protect your investment, you place a Sell Stop-Limit Order with a stop price of $290 and a limit price of $285. If the price drops to $290, your order is activated, and the system will attempt to sell your asset for $285 or more.

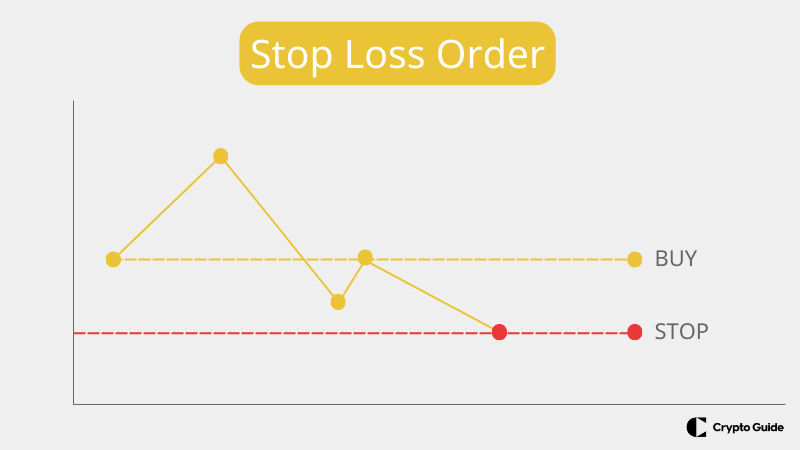

Stop-Loss Order

A stop-loss order is an essential risk management tool that allows investors to limit their potential losses on a position. It is a trading order designed to sell an asset at a certain price point, known as the stop price. This order type is widely used across various markets, including stock, forex, and cryptocurrency trading.

Key Characteristics of a Stop-Loss Order:

- Automatic Execution: Once the stop price is reached, the stop-loss order becomes a market order and executes at the next available price.

- Risk Management: It helps traders manage risk by capping potential losses.

- Emotion Control: Prevents emotional decision-making by setting predetermined exit points.

Stop-Loss Limit

A stop-loss limit order is a variation of the stop-loss order that specifies two prices: the stop price and the limit price. When the stop price is active, the order becomes a limit order, not a market order. This means the asset will only be sold at the limit price or, better, preventing slippage when an order is filled at the lowest price than expected.

Advantages:

- Precision: Ensures that the asset is sold at a specific price or better.

- Control: Offers more control over the price at which the order is executed.

Disadvantages:

- No Guarantee of Execution: The order may not be executed if the market price skips over the limit price.

- Less Useful in Fast-Moving Markets: In highly volatile markets, the price can move quickly past the limit price, leading to unexecuted orders.

Trailing-Stop Order

A trailing-stop order is a special stop-loss order that changes automatically. It keeps the stop price a certain percentage or dollar amount below the market price, adjusting as the price moves in your favor. This allows traders to protect profits while giving the position room to grow.

Benefits of Trailing-Stop Orders:

- Locks in Profits: Automatically raises the stop price as the asset's price increases, securing profits.

- Flexibility: Allows the asset to appreciate without setting a cap on potential gains.

Final Words on Crypto Order Types

Traders have different order options when buying or selling cryptocurrencies, each with pros and cons. Market orders are quick but don't guarantee a price, while limit orders set a price but might not execute. Stop-limit and trailing-stop orders help manage risk and lock in profits.

Traders must understand these orders to make smart decisions based on their strategy, risk level, and the market. Using these orders wisely can help traders control their trades, manage risks, and do better in trading.

FAQ About Crypto Order Types

What do the terms “order types” mean in crypto trading?

Order types in crypto trading refer to the instructions traders can use to buy or sell cryptocurrencies on an exchange. Common order types include market orders, limit orders, stop orders, and stop-limit orders, each with specific conditions for execution.

Which order type is most commonly used when people buy cryptocurrency?

The most commonly used order type when buying cryptocurrency is a market order.

Are there more advanced order types in the world of crypto trading?

Yes, there are advanced order types in crypto trading, such as stop-loss, take-profit, trailing stop, iceberg, and OCO (one-cancels-the-other) orders.

What's a market order vs limit order?

A market order is an instruction to buy or sell a security immediately at the current price. A limit order is an instruction to buy or sell only at a price specified by the investor.

What is the disadvantage of a market order?

A market order's disadvantage is it can't guarantee the trade price, potentially leading to buying higher or selling lower than expected in volatile markets.