Robert Kiyosaki Warns: China’s Stock Market on the Brink

Robert Kiyosaki, the renowned investor and celebrated author behind the massively successful personal finance masterpiece, “Rich Dad Poor Dad,” has long maintained a cautious stance towards both the U.S. economy and global financial systems, albeit with an underlying tone of optimism. His critics have consistently highlighted his perspective as a bear on these matters, yet he always manages to weave in a hopeful outlook.

On the date of Thursday, March 21st, Kiyosaki chose the social media platform X to express his viewpoints regarding the Chinese government's attempts, initiated early in the year 2024, to bring stability to its fluctuating stock market. He described these measures as misguided and reeking of desperation.

Delving deeper, Kiyosaki argued that the challenges plaguing the Chinese economy transcend the stock market downturn, which has led to a staggering loss of around $7 trillion since the year 2021. He pinpointed the crux of the issue to be a significant decline in global consumer demand.

Despite his critical analysis, Kiyosaki advises against purchasing stocks and bonds at this juncture. Instead, he advocates for investing in commodities like gold and silver, alongside the leading cryptocurrency, Bitcoin (BTC). His bullish stance on these assets has been unwavering for several years, with Kiyosaki continuously sharing insights on why they represent the most prudent investment choices. Notably, he has highlighted silver as an especially compelling investment opportunity as of March 2024.

Kiyosaki often discusses what he foresees as the “biggest crash in history,” yet his overarching message is imbued with optimism. He believes that economic downturns present unique opportunities for astute traders to acquire valuable assets at significantly reduced prices.

His predictions have begun to see validation; for instance, gold has shown a robust performance, steadily climbing and notably surpassing the $2,200 mark for the first time on March 20th. Furthermore, Bitcoin achieved a new all-time high, approaching the $73,000 threshold earlier in March.

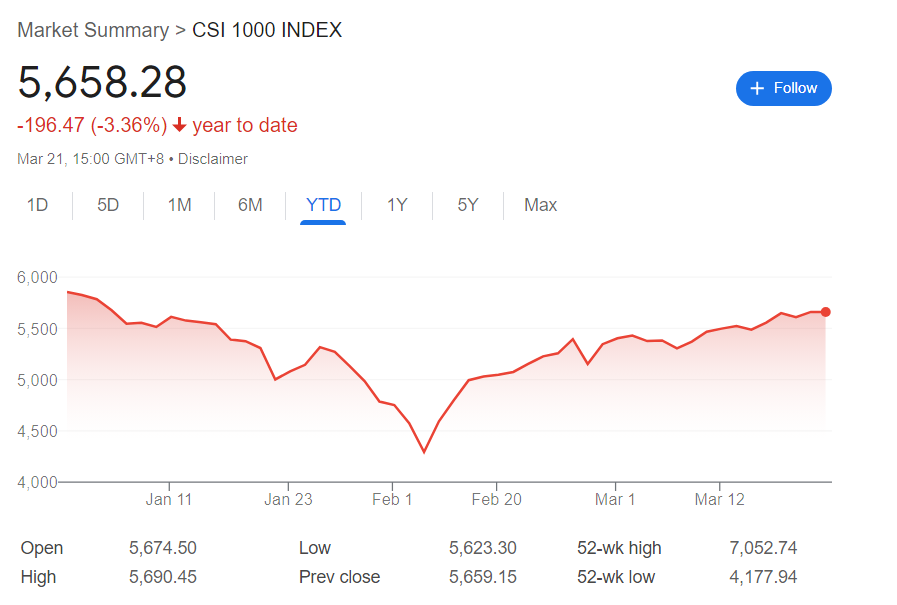

While Kiyosaki has voiced strong criticism of China's strategy to bolster its stock market, the initiative has exhibited signs of effectiveness. After a tumultuous January that saw the erasure of roughly $1 trillion from its stock market valuation, subsequent months have witnessed a remarkable turnaround. Specifically, one of the key benchmarks for mainland stocks, the CSI 1,000, experienced its most successful day to date on February 6th, although it has yet to fully recover from its losses in 2024.

Similarly, other significant indices, such as the CSI 300 and the HSI, have shown positive responses to the government's intervention, with year-to-date gains of 5.75% and 0.44%, respectively.