Best Low-Fee Crypto Exchanges of 2026

This guide helps you find low-fee crypto exchanges for cheaper trading, and become familiar with top exchanges and their lowest crypto exchange fees.

We simplify the understanding of trading, withdrawal, and deposit fees and provide essential tips for choosing the right exchange based on security, trading volume, and user feedback. This article is your quick reference for making informed decisions on the market for the best low-fee crypto exchanges.

Table of content

Key Facts

- Variety of Low-Fee Options: There are low-fee crypto exchanges like Bybit, Kraken, OKX, Binance, and HTX, each with competitive fee structures tailored to different traders.

- Fee Structures: Understanding the fee structures includes trading, withdrawal, and deposit fees, which can vary significantly between exchanges and impact overall trading costs.

- Trading Volume Discounts: Many exchanges offer tiered fee structures, providing lower fees for users with higher trading volumes, making them attractive for frequent traders.

- Native Cryptocurrencies for Discounts: Some low-fee crypto exchanges offer additional fee discounts when users transact using the exchange's native cryptocurrency, like Binance Coin (BNB) on Binance.

- Security is Paramount: Low fees are attractive, but security should not be compromised. Choosing low-fee crypto exchanges that employ strong security measures to protect user assets is essential.

- User Feedback and Reviews: Checking user reviews and feedback can provide valuable insights into an exchange's reliability and user experience.

- Trading Volume and Liquidity: High trading volume and liquidity are important for better prices and faster execution of trades.

Crypto Exchanges With Lowest Fees

| Exchange | Maker Fee | Taker Fee |

| Bybit | 0.0005%-0.1% | 0.02%-0.1% |

| Nexo | 0.04%-0.2% | 0.07%-0.2% |

| Crypto.com | 0.0%-0.75% | 0.05%-0.075% |

| Bitfinex | 0.02%-0.1% | 0.065%-0.2% |

| Kraken | 0.00%-0.25% | 0.10%-0.40% |

| OKX | 0.6%-0.08% | 0.08%-0.1% |

| Binance | 0.02%-0.1% | 0.04%-0.1% |

| HTX | 0.0126%-0.2% | 0.0218%-0.2% |

Bybit

Bybit stands as the best crypto exchange with low fees, having started in 2018 and quickly made a name in crypto trading. Based in Dubai, it follows the rules set by the local Virtual Asset Regulatory Authority and is also monitored by regulators in Cyprus. Bybit is known for allowing traders to use cryptocurrencies with the option to borrow up to 100 times more money to boost their trades. This can mean bigger profits, but it's riskier too.

The platform is easy to use, with a friendly design that supports many languages, such as English, Chinese, Korean, Japanese, and Russian. This makes it popular worldwide. Bybit doesn’t have its coin but created the BIT token for BitDAO.

Bybit lets you trade more than 600 different cryptocurrencies. Its trading fees are low: 0.1% for spot trading and slightly higher for other types of trading. If you trade a lot, you can get extra discounts. Copy trading is also possible there.

Safety is a big deal at Bybit. They use things like 2FA and wallets that need multiple signatures, and they keep most of the money offline to protect it. They even have a special fund to cover any losses in futures contract trading. You can put money into your Bybit account and take it out in over 16 currencies through bank transfers, cards, crypto, or other services.

Bybit isn't available in the USA, Syria, or Quebec in Canada, but it's open in many other places. They take the rules about knowing your customers and anti-money laundering very seriously to keep everything up.

Pros:

- Advanced trading platform

- Low fees

- Sophisticated features for traders

- Smooth web and mobile access

- Strong protection measures

- Bonuses and referral incentives

- Debit card available

Cons:

- Not ideal for beginners

Fee Structure:

- Maker Fee: 0.0005%-0.1%

- Min Taker Fee: 0.02%-0.1%

Nexo

Nexo was established in 2018 and is based in Zug, Switzerland. Nexo is a platform with nice features. Its prime services are cryptocurrency lending and borrowing, wherein one may get credit lines in cryptos at lightning speed or earn interest on cryptocurrency holdings.

The other great service on Nexo is for people who want to manage their crypto more actively: the swaps/exchange service, which allows the conversion of more than 50 crypto assets. This service is recognized for offering one of the lowest crypto exchange fees in the industry, making it an attractive option for traders.

The Nexo Card is cool because it lets you use your crypto to buy things worldwide. Plus, you can earn 2% cashback when you shop. There's also something called the Nexo Booster. It's like a power-up for your investments, tripling what you put in and giving you more chances to grow your money.

Through this, Nexo prides itself in supporting a multilingual user base, whereby it can avail its services to clients within its platform in more than one language.

This inclusivity is complemented by the Nexo Ambassador Program, where community members are included in advocating for Nexo services and blockchain technology. This program allows them to monetize while doing their bit to help improve the Nexo ecosystem.

Security forms the core of Nexo operations. Its platform uses first-class security measures, from partnerships with leading security firms like BitGo and Ledger Vault. This assures its users peace of mind from potential cyber threats and operational risks, insuring their funds up to $375 million.

Nexo has attractive interest rates for 32 cryptocurrencies, and they offer better rates for regular users. It's a good option for earning passive income from crypto. Nexo is also strict about following financial laws, ensuring safety and legality for users and the platform. This helps prevent legal or financial problems.

Pros:

- Strong regulatory compliance

- Diverse financial offerings

- Innovative financial tools

- Strong security

- Competitive interest rates

- Multilingual support

Cons:

- Regulatory challenges

- Market risks

- Limited access

Fee Structure:

- Maker fee: 0.04%-0.2%

- Taker Fee: 0.07%-0.2%

Crypto.com

Crypto.com exchange, known as the crypto exchange with lowest fees, moved its headquarters to Paris, France from Singapore. It's a big name in the crypto trading. The exchange started in 2019, three years after Crypto.com began in 2016. It offers many services for everyday people and big investors.

Crypto.com exchange follows strict rules to keep its users safe worldwide. It has important licenses that show it meets high standards:

- The Dubai Virtual Assets Regulatory Authority's approval

- Virtual Financial Asset (VFA) license

- Electronic Money Institution (EMI) license in Europe

- Australian Financial Services License

- Financial Institution License and Class 3 VFA license

- Digital Asset Service Provider status in France

- Additional licensing and registration in South Korea, Italy, Cyprus, the United Kingdom, and Dubai

Crypto.com exchange offers many trading options. You can trade over 200 cryptocurrencies, use margin trading with up to 10x leverage on more than 100 pairs, and trade in over 100 perpetual and 6 futures markets. Their cryptocurrency, Cronos (CRO), helps users save on trading fees and makes transactions easier on the platform.

The exchange takes security very seriously. To protect themselves, they use things like multi-factor authentication and keep most of the funds in cold storage, which means offline. They also check their security regularly to keep everything safe.

The Crypto.com exchange only uses USDC for bank transfers. However, the wider Crypto.com platform lets you use seven different currencies, which makes it easier for people all over the world. You'll mostly move your money in and out using cryptocurrencies and stablecoins, which are quick and secure.

Pros:

- Rated the safest exchange globally by Certified.

- Offers numerous cryptocurrencies.

- Lower costs for users who stake the native token, CRO.

- Includes limit, stop-loss, and market orders.

- Fast order execution with minimal slippage.

- Features 2FA, cold storage, and regular audits.

- Excellent mobile app experience.

Cons:

- DeFi Desktop Wallet and its Exchange are separate, which can confuse users.

- Users must complete KYC verification.

- Supports limited major fiat currencies.

Fee Structure:

- Maker Fees: 0.0%-0.75%

- Taker Fees: 0.05%-0.075%

Bitfinex

Bitfinex established in 2012 and now based in Paris, France, is a place where people can trade cryptocurrencies. It offers a variety of trading options, from regular trading to dealing with advanced contracts, making it suitable for both newbies and pros. With competitive rates, Bitfinex is recognized as one of the lowest transaction fee cryptocurrency exchanges, which appeals to a broad range of investors.

The Bitfinex trading platform is easy for beginners and experienced traders. It has advanced tools for charting and automated trading. New traders can practice with a demo account before using real money.

However, Bitfinex has had some legal problems. Regulators have fined it, and the New York Attorney General has accused it of not being honest about Tether's cash reserves. These issues raise questions about how the platform is run.

Security is very important to Bitfinex, especially after past problems with hacking. To protect users' funds, they now use things like two-factor authentication and keep most of the money in cold storage.

Bitfinex's trading platform is on the web and an app for trading on the go. The design is simple and works for everyone, no matter their trading experience.

Bitfinex uses a ticket system for customer service. They don't have a phone or live chat support, which might be a problem if someone needs help immediately.

Pros:

- Includes margin trading, staking, and futures trading.

- Offers industry-leading security measures and customer support.

- Ideal for beginners.

- Good for advanced traders with sophisticated trading needs.

- Provides educational materials.

- Charges low trading fees.

- Features a wide range of assets.

- Accessible in most countries.

Cons:

- Not accessible in all U.S.

- Limited options for funding accounts.

- Higher fees when not utilizing Kraken Pro.

Fee Structure:

- Maker Fees: 0.02%-0.1%

- Taker Fees: 0.065%-0.2%

Kraken

Kraken was founded in 2011 and based in San Francisco, has become a trusted global cryptocurrency exchange known for strong security and a variety of options. Both new and seasoned traders use Kraken to manage their digital currencies.

Kraken takes rules very seriously. It follows the laws in many countries, including Canada, the UK, Australia, and Japan. By doing this, Kraken makes sure it's a safe place for people to trade and earns their trust all over the world.

Here, you can trade 137 different cryptocurrencies. It's good for spreading your investments across various coins. Although Kraken doesn't have its token, its trading fees are low.

Kraken takes security very seriously. It uses two-factor authentication and sends email confirmations for any transactions. Users can set specific permissions for API keys and receive encrypted emails for extra safety. The website also uses SSL encryption to protect data.

Kraken constantly monitors its platform for unusual activity, has a timeout feature for accounts, and allows users to lock their settings to prevent others from making changes. These features help make Kraken a very secure place to trade cryptocurrencies.

The platform requires verification of KYC (Know Your Customer) and AML (Anti-Money Laundering). It ensures the platform's integrity and the safety of its users’ assets.

Kraken lets you use different types of money like US dollars, euros, and Japanese yen to fund your account or take money out. You can add money to your account or withdraw it using bank transfers, wire transfers, or your credit/debit card. You can even use Apple and Google Pay in some places, making it easy. Plus, you can also deposit and withdraw cryptocurrencies.

Pros:

- Includes margin trading, staking, and futures trading.

- Offers industry-leading security measures and customer support.

- Ideal for beginners.

- Good for advanced traders with sophisticated trading needs.

- Provides educational materials.

- Charges low trading fees.

- Features a wide range of assets.

- Accessible in most countries.

Cons:

- Not accessible in all U.S.

- Limited options for funding accounts.

- Higher fees when not utilizing Kraken Pro.

Fee Structure:

- Maker Fees: 0.02%-0.1%

- Taker Fees: 0.065%-0.2%

OKX

OKX, once called OKEX, started in 2016. It's now much more than just a trading platform. As a leading low fee crypto exchange, OKX has expanded into the Web3 world, including DeFi (decentralized finance) and NFTs (non-fungible tokens). It serves a wide range of users from over 100 countries.

Users can trade futures, perpetual swaps, and options. There's also an Earn section where people can lend their crypto, buy and sell NFTs, and get involved in DOT slot auctions. With all these options, OKX gives users many ways to use and grow their cryptocurrency.

OKX offers a wide variety of cryptocurrencies for trading and keeps adding new ones. It has advanced tools for trading and analyzing the market, which are useful for beginners and seasoned traders.

OKX takes security very seriously and keeps most of its money in secure offline storage that needs several people to agree before it can be accessed. The platform also has strong risk management with an insurance fund to cover any trading losses.

The exchange supports a strong community by connecting people in different ways and provides lots of learning materials with the OKX Academy. This helps everyone get a better grasp of the tricky world of cryptocurrencies.

Pros:

- Variety of cryptocurrencies and trading modes.

- Established and trusted.

- Competitive fees.

- Comprehensive security measures.

- Suitable for new and seasoned traders.

- Educational resources.

Cons:

- All users must complete KYC verification.

- Few options for direct bank transfers.

- Not available in the US and UK.

Fee Structure:

- Maker Fees: 0.6%-0.08%

- Taker Fees: 0.08%-0.1%

Binance

Binance is a leading platform in the world of cryptocurrency trading. It lets users trade more than 380 different cryptocurrencies in almost 1,248 pairs. With such a large range of altcoins, it's a key place for traders. Binance also makes it easy to use regular money, supporting over 65 national currencies and offering various pay methods.

Binance stands out for its low trading fees. It even offers some Bitcoin and Ethereum trades without any fees, which is great for traders looking to save money. People all over the world use Binance because it works on many devices. You can trade on their website, download programs for Windows and Mac computers, or use their apps on Android and iOS phones. Plus, Binance has tools for setting up your trading tactics, too.

The exchange offers more than just regular trading. You can trade futures with leverage as high as 125 times your investment, and you can also borrow money to trade with up to three times your original amount. Plus, if you need help, Binance has a customer support team available all day, every day.

Binance doesn't just handle trades; it also helps new cryptocurrencies get started. Their Binance Launchpad is where these new digital currencies can launch, and it's become a popular choice instead of the older method called ICOs. Many new cryptocurrencies have kicked off successfully there, making it a go-to spot for finding exciting new crypto projects.

Binance Finance provides different ways to make money without actively trading, like lending out their crypto, staking, and other services. These options help people get more from their cryptocurrencies. With these services, Binance stands out as a leading exchange for everyone, whether they trade a lot or invest for the long term.

Pros:

- Suitable for all skill levels, from beginner to expert.

- Low trading fees with free options for many pairs.

- Multiple fiat currencies for deposits and withdrawals.

- Various ways to earn passive income.

- Strong security and reliability.

Cons:

- Not accessible in the US.

- Faces regulatory challenges.

Fees Structure:

- Maker Fees: 0.6%-0.08%

- Taker Fees: 0.08%-0.1%

HTX

HTX stands as top crypto trading platform with lowest fees that started in 2013 and is based in the Seychelles. It's known for having a lot of trading options and being very liquid, which means it's easy to buy and sell. Although it's mostly unregulated, HTX has important licenses from places like Thailand, Japan, Gibraltar, and Hong Kong that let it operate legally in those areas.

The platform offers a wide selection of over 650 cryptocurrencies for trading. Users can enjoy lower fees by using the exchange's own Huobi Token (HT). The fees on HTX are also quite competitive.

HTX takes security very seriously, keeping most user funds in cold storage to prevent hacking. While the platform isn't easy for beginners because of its complex design, you can use some features without proving your identity. But if you want to trade and withdraw more money, you must go through identity checks.

The Exchange accepts many currencies like the US dollar, British pound, euro, Russian ruble, Ukrainian hryvnia, and Kazakhstani tenge, making it easy for people worldwide to use. Users can deposit and withdraw money in different ways, including cryptocurrency, credit or debit cards, bank transfers, and online payment services such as AdvCash, Banxa, and Apple Pay.

Pros:

- Many trading options with deep liquidity.

- Includes futures, options, and discounts with Huobi Token.

- Strong security.

- Available in many countries.

Cons:

- Recently suffered a security breach.

- Not regulated in key markets like the U.S. and U.K.

- Not beginner-friendly.

- Full access requires completing KYC.

Fee Structure:

- Maker Fees: 0.0126%-0.2%

- Taker Fees: 0.0218%-0.2%

Crypto Exchange Types

There are two categories of crypto exchanges: centralized exchanges and decentralized exchanges. Each category comes with its own advantages and disadvantages.

Centralized Exchanges

Centralized exchanges (like Coinbase and Binance) are run by one company. They're easy to use, letting you change regular money into crypto. But, there's a risk of hackers stealing digital money because it's all kept in one place. These exchanges work hard to be safer, storing most of the money offline and getting insurance to protect against theft. To be extra safe, you can move your crypto to your own wallet that's not part of the exchange.

Decentralized Exchanges (DEXs)

Decentralized exchanges are different. They spread out the job of managing trades to many people, kind of like a group project. This can make things more open and keep the exchange running no matter what happens to the company that started it. But they can be tricky to use. You usually can't just use regular money to buy crypto. You might need to start with a centralized exchange like Bybit to get some crypto first, then you can trade on a DEX.

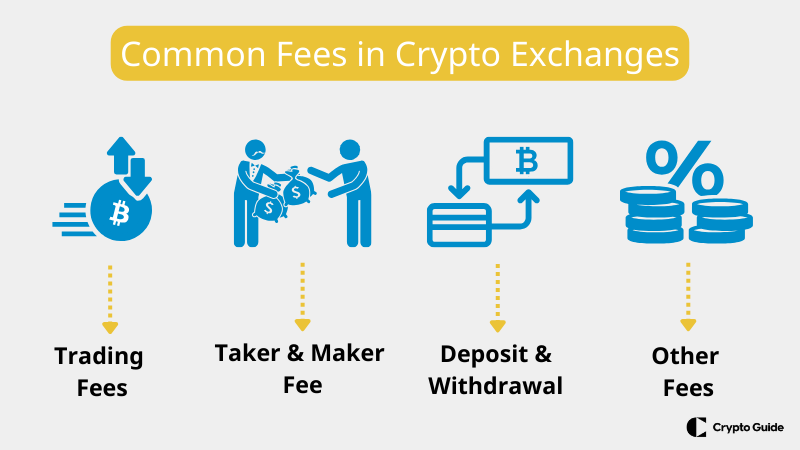

Common Fees in Crypto Exchanges

Understanding the various fees associated with trading on crypto exchanges is essential, especially if you're considering exchanges with lowest fees. These fees can significantly affect your investment returns, so being well-informed is crucial. Below, we'll break down the most common fees you might come across.

Trading Fees

Trading fees are the primary costs you'll incur when buying or selling cryptocurrencies. They are charged as a percentage of the trade's value and can vary widely among low-fee crypto exchanges. Typically, these fees range from 0.1% to 1% per trade. Some platforms offer volume-based discounts, so the more you trade, the lower your fees per transaction.

For example, Binance, known for being one of the crypto exchanges with the lowest fees, charges a standard 0.1% trading fee, which can be further reduced by 25% if you use their native BNB token to pay the fees.

Taker and Maker Fee Difference

When you place an order filled immediately, you are considered a ‘taker,' and you'll often pay a higher fee for this instant service. On the other hand, ‘maker' fees apply when you place an order that doesn't fill immediately, such as a limit order set at a specific price. This adds liquidity to the market, and as a reward, exchanges typically charge lower fees for makers.

Some low-fee crypto exchanges clearly distinguish between taker and maker fees, with maker fees being notably lower. This motivates traders to add liquidity to the market.

Deposit and Withdrawal Fee

In addition to trading fees, most exchanges charge fees for depositing and withdrawing funds. Deposit fees can vary depending on the payment method, with bank transfers usually being the cheapest option. Cryptocurrency deposits are often free, but only sometimes.

Withdrawal fees are typically fixed amounts of the withdrawn currency, which can also vary. For example, withdrawing Bitcoin might cost 0.0005 BTC regardless of the amount. It's worth noting that some platforms, like the lowest-cost crypto exchange Bybit, don't charge any fees for depositing or withdrawing funds.

Other Fees

Other fees can include inactivity fees, where an exchange charges for dormant accounts, and conversion fees if you're trading in a currency different from the one your account is denominated in.

It's also important to consider network fees, which are not determined by the exchange but by the blockchain network itself. These fees are paid to miners or validators who process the transactions and can fluctuate based on network congestion.

When looking for the lowest trading fee crypto exchange, it's crucial to consider all types of fees to understand the total cost of trading. For instance, an exchange might advertise low trading fees but make up for it with high withdrawal fees.

Guide Choosing Low Fee Crypto Exchanges

By carefully considering these factors, you can choose low-fee crypto exchanges that offer these benefits without sacrificing security or liquidity, ensuring a more cost-effective and secure trading experience.

- Understanding Cryptocurrency Exchange Fees

Typically, three kinds of fees are trading, withdrawal, and deposit. Trading fees are charged for each transaction you make, which can vary widely among exchanges.

Some exchanges offer a flat fee, while others have a maker-taker fee model, where the fee depends on whether you're creating a new order (maker) or filling an existing one (taker).

Withdrawal fees are incurred when you take your digital assets out of the exchange, and deposit fees might apply when you add funds to your account, although many exchanges offer free deposits.

- Researching Exchange Options

To find a low-fee cryptocurrency exchange, start by listing available options. Look for reviews and user experiences online to shortlist reputable platforms.

Websites and forums like Reddit, Trustpilot, and Bitcointalk can be valuable resources for unfiltered user feedback. Keep an eye out for any consistent complaints or praise regarding fees.

- Comparing Fee Structures

Once you have a list of potential exchanges, compare their fee structures. Some exchanges offer a tiered fee structure based on your trading volume, which can benefit frequent traders.

Others might offer lower fees if you use their native cryptocurrency to pay for transaction costs. For example, Binance users can use BNB (Binance Coin) to pay for trading fees at a discounted rate.

- Evaluating Liquidity and Trading Volume

Low fees are among many considerations; the exchange's liquidity and trading volume are also crucial. High liquidity means many buyers and sellers, typically resulting in tighter spreads and better prices for your trades.

An exchange with a high trading volume is likely to offer more liquidity. CoinMarketCap ranks exchanges by volume, which can be valuable for evaluating this aspect.

- Considering Security Measures

Finally, always maintain security for lower fees. An exchange that offers rock-bottom fees but needs more security measures can cost you much more if your funds are compromised.

Look for exchanges that employ robust security practices such as two-factor authentication (2FA), cold storage for most funds, and insurance policies to protect users' assets.

Final Thoughts on Low-Fee Crypto Exchanges

In 2024, crypto exchanges with the lowest fees offer a variety of choices for traders, each boasting unique fee structures and services. By understanding the different types of fees and considering factors like trading volume, security, and user feedback, traders can select the most suitable exchange for their needs.

While low fees are essential, choosing a secure and reliable exchange for a good trading experience is just as important. This guide is designed to help traders find exchanges with low fees and make smart choices to improve their trading success and profits.