Bitcoin’s Breakout Moment: Last Stand for a Massive Surge?

Bitcoin (BTC) is currently stabilizing below the $65,000 threshold, now considered the new resistance level. Market participants are actively exploring the potential for identifying a price floor that could stabilize the currency and potentially catalyze a fresh upward trend.

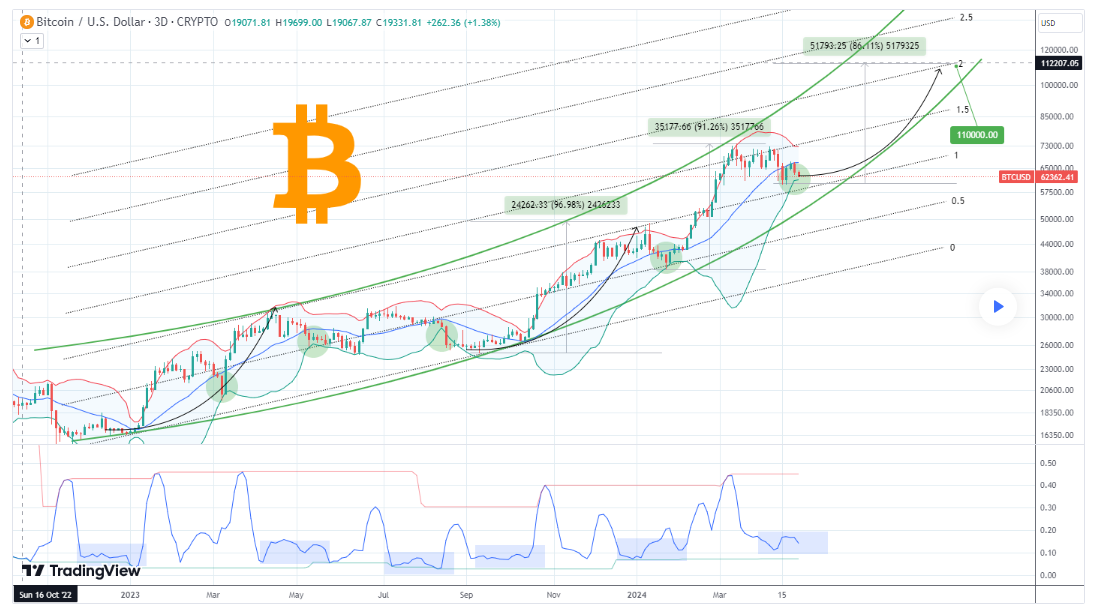

In this context, a notable cryptocurrency trading expert from TradingShot provided some detailed observations on Bitcoin’s present situation through a post on TradingView, dated April 29. The expert particularly highlighted the forthcoming evaluation of the lower boundary of the Bollinger Bands (BB) on a three-day chart.

This assessment, marking its first occurrence in three months, points to an increased compression between the BB and its lower limits, an event which has traditionally indicated a potential reversal point where prices begin to increase.

From the analysis, it appears that Bitcoin is demonstrating signs of a bullish outlook. The cryptocurrency has shown a steep upward trajectory beginning from its lows in November 2022, emphasizing a strong optimistic market sentiment.

Further detailed in the analysis, by applying Fibonacci extension levels, the analyst observed that Bitcoin’s upward movement has been robust, with a significant peak reached in mid-March 2024 that surpassed the 1.5 Fibonacci marker. Looking ahead, the expert predicts a continued bullish phase that could see Bitcoin not only reaching but possibly exceeding the 2.0 Fibonacci level.

Bitcoin’s potential 75% increase

Subsequently, the analyst suggested that these technical indicators are laying the groundwork for an ambitious price objective of $110,000, implying a potential increase of approximately 75% from its current market price.

“$110,000 is a very realistic target under these conditions and we shouldn’t neglect to mention also the BB Width (BBW) consolidating on its bottom, which again is related to high bullish activity and accumulation when performed on the BB green line,” the expert said.

Presently, advocates of Bitcoin are exerting efforts to maintain the cryptocurrency’s price above the $60,000 level. It’s noteworthy that some market analysts, including Alan Santana, believe that Bitcoin might face significant sell-offs as long as it remains under $64,560.

Nonetheless, amid Bitcoin’s ongoing consolidation, there's a palpable sense of uncertainty about whether it has truly found its lowest point. Concurrently, major market participants are expressing concern regarding the prevailing bearish trends affecting Bitcoin, attributing the current price movements to corrections following its latest halving.

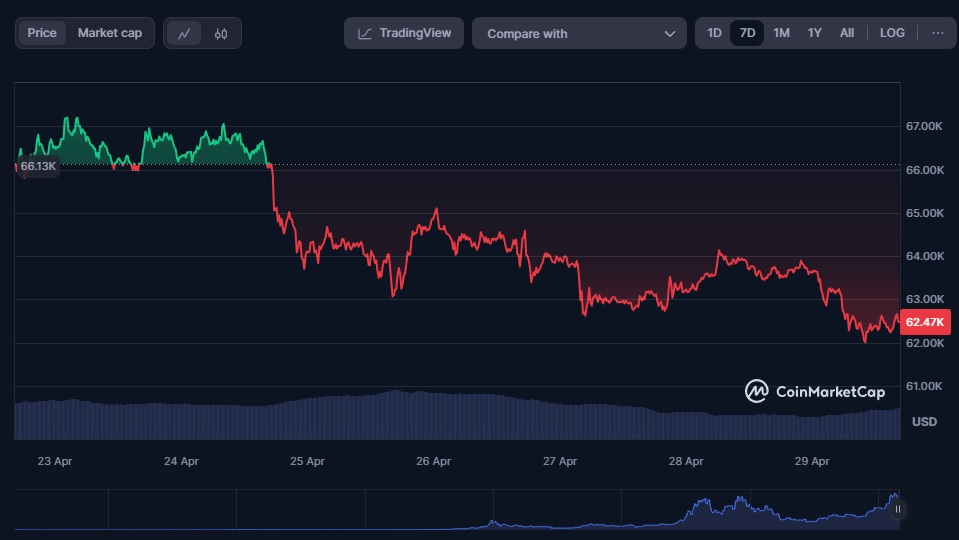

Bitcoin price analysis

As of the latest updates, the price of Bitcoin stands at $62,241, experiencing a nearly 2% decrease today alone. Over the past week, Bitcoin has seen a decline of more than 5%.

Amidst these conditions, both bulls and bears within the cryptocurrency market are keenly observing to ascertain which direction will dominate the momentum of Bitcoin in the near future.