Differences Between DeFi and Web3

There are some differences between DeFi and Web3 as they focus on different aspects. DeFi is all about financial activities, and Web3 is about building a more user-controlled internet.

This article highlights the characteristics of Web3 and DeFi, and their unique roles.

Table of content

The Main Differences Between DeFi and Web3

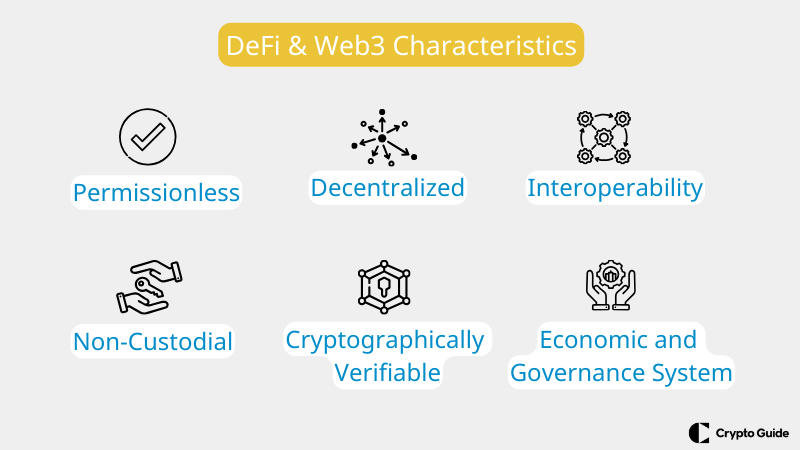

Here's a comparison of DeFi and Web3 characteristics:

Permissionless

DeFi

In DeFi, anyone can join in financial activities without central approval. You can use DeFi platforms like lending or exchange without permission or ID checks.

Web3

In Web3, permissionless means anyone can use DApps freely. You're free to interact with services and protocols online without approval.

Decentralized

DeFi

Control and decision-making are spread out across many nodes instead of one central authority. DeFi platforms work on blockchains, where transactions are checked by lots of people. It makes things transparent and resistant to censorship.

Web3

Decentralization is key in Web3, where data and services are spread out across lots of nodes, not controlled by one group. This setup makes things more secure, tough, and private for users by reducing reliance on central intermediaries.

Interoperability

DeFi

Different finance platforms can work together smoothly, sharing value. This lets developers mix and match DeFi pieces to make new financial stuff.

Web3

Interoperability in Web3 is about different blockchain networks and apps talking to each other easily. It lets assets and data move around different platforms.

Non-Custodial

DeFi

Non-custodial means users keep control and ownership of their assets when using DeFi platforms. They hold onto their private keys and assets, removing the need to trust centralized middlemen with their funds.

Web3

Non-custodial services in Web3 mean users have complete control over their data and online identities. They own their personal info and can choose to share it with apps without giving up control to big platforms.

Cryptographically Verifiable

DeFi

They are cryptographically verifiable, so anyone on the blockchain can check that they're legit. Cryptographic signatures ensure transactions are secure and transparent.

Web3

Cryptographically verifiable data on the decentralized web ensures info is genuine. Techniques like digital signatures let users confirm data and transactions without authorities.

Economic and Governance System

DeFi

DeFi platforms often use token-based systems for both economics and governance. Users with tokens can join in decision-making and governance by holding and staking tokens. Token holders may get voting rights to suggest and decide on changes or upgrades.

Web3

Web3 projects also use token-based systems to encourage involvement and align incentives. These systems let stakeholders control the development of decentralized apps and protocols.

What Is DeFi and How Does It Work?

DeFi uses smart contracts to move money without banks. These contracts are written in code and can do things by themselves. This could change how we use money every day.

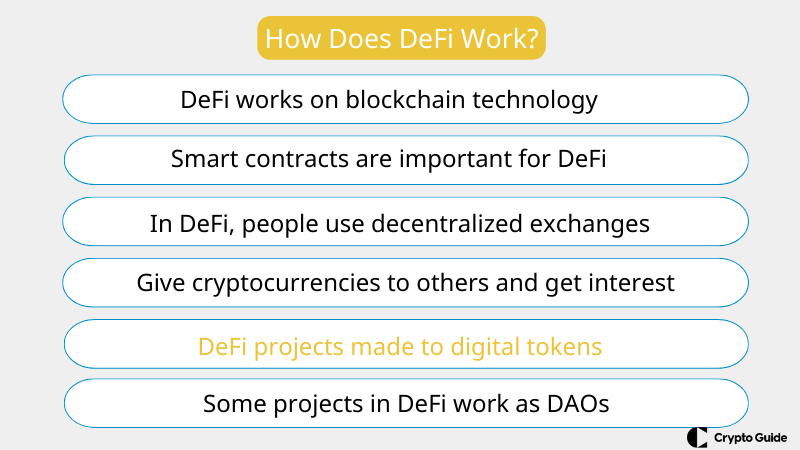

Here's how DeFi works:

Blockchain Record-Keeping for DeFi

DeFi works on blockchain technology. Ethereum is often used here because it has smart contract capabilities. The blockchains offer a safe and clear record-keeping method for transactions.

Smart Contracts, the Foundation of DeFi

Smart contracts are like automatic agreements in computer code. They are important for DeFi. These contracts do things by themselves when certain rules are met. In DeFi, they help with money tasks. This includes lending money, borrowing, and trading.

Decentralized Exchanges (DEXs) in DeFi

In DeFi, people use decentralized exchanges rather than centralized ones. This happens because they do not want to lose anonymity or go through KYC process. DEXs let people make trades of their cryptocurrency directly between themselves.

Lending and Borrowing in DeFi

Lending and borrowing in DeFi means people can give their cryptocurrencies to others for some time and get interest. Also, they can take loans by giving something valuable as security. You can use Bitcoin can as collateral to take out a stablecoin loan.

Tokenization in DeFi

Tokenization in DeFi projects means taking assets from the real world and making them into digital tokens on the blockchain.

Decentralized Autonomous Organizations (DAOs) in DeFi

In DeFi, some initiatives are structured as DAOs. They allow token owners to govern by casting votes, reflecting the core concepts of how DAOs operate in the decentralized finance.

Impact of DeFi on the Financial Industry

DeFi is changing the financial industry by making it easier for everyone to use financial services.

Challenges and Growth of DeFi

It is important to know that DeFi is at the beginning phase and has issues like safety measures and following government rules.

What Is Web3 and How Does It Work?

Web3 is the name for the next phase of the internet. It focuses on using decentralized systems. These systems put privacy and ownership of data in the hands of users.

Unlike the current internet, Web3 doesn't rely on big companies' servers. It uses networks and blockchain technology to give control to individual people.

Here's how Web3 works:

Decentralized Storage and Control

Web3 works on a system that is not centralized, using blockchain often. It doesn't depend on just one place for data; instead, the information is in many nodes in the network. That helps against control from others and reduces risk if one part fails.

Blockchain as Foundation of Web3

Blockchain technology is the base that supports applications on Web3. It offers a safe and clear record-keeping system for all transactions and data storage. Every block within the blockchain holds a special hash that comes from the one before it, making a chain of blocks that cannot be changed.

Smart Contracts, the Self-executing Agreements

Smart contracts run themselves because the agreement's details are coded directly. They make transactions possible when certain agreed-upon conditions happen.

Smart Contracts in DeFi

Smart contracts form a part of Web3 applications, especially decentralized finance, known as DeFi.

Decentralized Applications (DApps)

Web3 allows the creation and use of DApps, which function on blockchain systems. DApps work of any authority. They depend on smart contracts to manage how users interact with each other.

Various Forms of Web3 DApps

Web3 DApps come in various forms. It can be exchanges that operate without central control (known as DEXs). It can also be social networks where decentralization is key.

User Empowerment and Data Ownership

In Web3, people have more power over their own information and online identity. They do not give their data to central services but use private keys to communicate with decentralized applications. It lets users own their data and decide who gets to see it.

Blockchain Systems

Web3 lets blockchain systems and protocols work together so money and data can move around. This helps people be more creative and work together better online.

Fairness and Inclusivity

Web3 is all about making the internet more fair, clear, and focused on the people using it. It uses blockchain and the idea that no person or group should control everything. So everyone can have a say, and new things can happen. It's like creating a digital world where everyone can join in and do their thing.

Is DeFi a Part of Web3?

Yes, DeFi is part of Web3. Web3 is the new version of the Internet that focuses on spreading control. DeFi is about decentralized applications, and it uses blockchain technology as its foundation.

Web3 is all about using new technology to make financial services better. DeFi is a big part of this. It lets people borrow and lend money, trade things of value, and get insurance, all without using traditional banks.

In short, DeFi is a new way to manage your money using the internet. It's all about making financial services open to everyone without needing banks or other middlemen.

DeFi projects work on open blockchain networks, such as Ethereum. Smart contracts help manage transactions automatically and keep the rules in place. It lets users use financial services immediately without middlemen like banks or brokers.

So, DeFi is an important part of the Web3. It changes financial services so they are easier for everyone to use, work better, and include more people.

What is The Future of DeFi and Web3?

The future of DeFi and Web3 can change how we use finance and the internet. Here are some important trends experts see:

Increased Integration

DeFi apps will blend more with Web3 tech, making it easier for users. Picture managing your investments from your Web3 browser.

More Security

Expect better security in DeFi to tackle the hacking issues seen in its early days.

Cross-Platform Functionality

The platforms can work better together, letting users move assets.

Mainstream

As DeFi and Web3 improve, more people, including traditional financial firms, can use them.

While DeFi and Web3 are new, they face challenges like regulations and scalability. Yet, the potential benefits are huge, and innovation is happening fast.

DeFi vs. Web3 Summarized

There are some differences between DeFi and Web3. DeFi changes finance by removing the middlemen and using blockchain technology. It offers decentralized services like lending and trading.

Web3 decentralizes the internet. Utilizing blockchain to improve security and user freedom gives users more control over their online activities.