Are Bitcoin Whales Backing Off?

Analytics firm IntoTheBlock has issued a warning about wealthy Bitcoin (BTC) investors showing signs of weariness. The firm shared on social media platform X that since March of this year, these Bitcoin “whales” have seized every chance to buy more BTC during price drops.

However, IntoTheBlock has observed a change in behavior among these large-scale investors. Whales who have more than 1000 BTC are showing less interest in buying more Bitcoin during price dips, particularly as the cryptocurrency struggles to maintain bullish momentum above the $60,000 level.

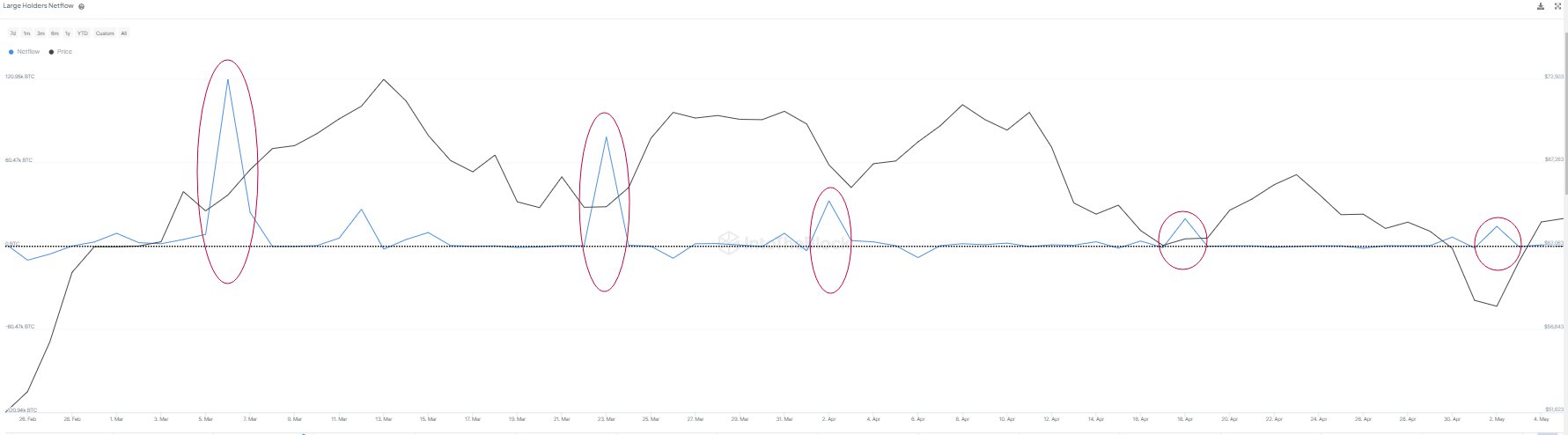

Furthermore, IntoTheBlock points out that the netflow of large holders, which measures the Bitcoin moving into and out of these whale wallets by calculating the difference between inflows and outflows, has significantly dropped since its peak in March.

“Whales are buying the dip, but is their conviction dwindling?

Addresses holding over 1,000 BTC have accumulated strongly in recent months, especially during dips.

Prices have increased shortly following every accumulation.

However, note that each spike in accumulation by these holders is smaller than the last.

Could this indicate that whales have less and less appetite to buy the dip?”

As of the latest update, Bitcoin's value stands at $62,671, showing a decrease of 1.31% over the past 24 hours.

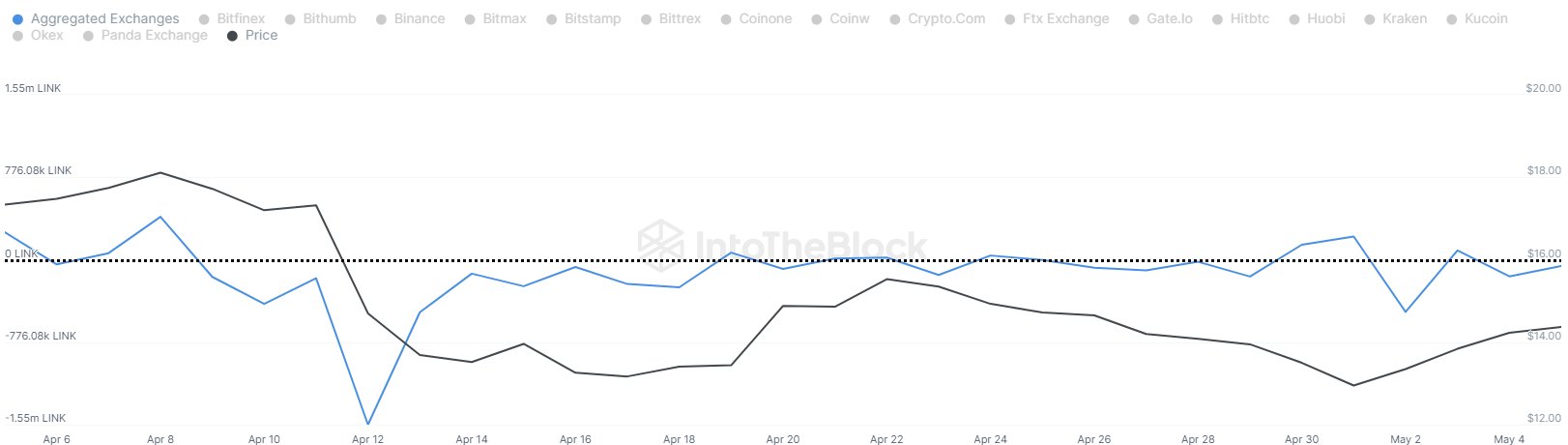

The analytics firm is also keeping an eye on Chainlink (LINK), a decentralized oracle network in the cryptocurrency sector. Despite recent downtrends in its price, market participants appear to be accumulating LINK, suggesting contrasting investor confidence compared to Bitcoin. IntoTheBlock suggests that these actions might indicate broader trends or shifts in investor strategies within the cryptocurrency market.

“Despite recent price movements, data from the past month shows a negative net flow from exchanges for LINK, indicating accumulation.

During this period, the total net outflow amounted to nearly 3.6 million LINK.”

At the time of writing, LINK is worth $14, down more than 3.6% on the day.