Arthur Hayes Expects An Upcoming Market Collapse Due To Rate Cuts

Arthur Hayes, co-founder of BitMEX, has offered his thoughts on how the cryptocurrency market would be impacted by the US Federal Reserve's first rate cut in four years, which investors are expecting.

On September 18, Hayes gave the keynote address at Token2049 in Singapore, titled “Thoughts on Macroeconomics Current Events.”

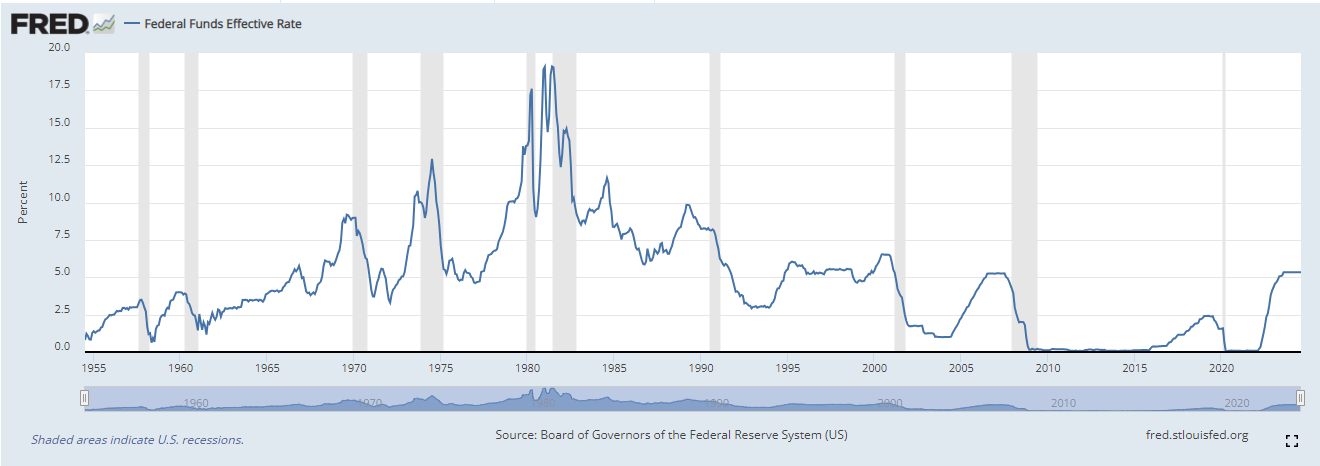

He discussed the pros and cons of investing in cryptocurrencies vs keeping 5%-yielding Treasury bills (T-bills) in light of prospective market alterations brought on by the Fed's anticipated rate-cut announcement on September 18.

Arthur Hayes Described Rate Cuts As a “Colossal Mistake”

Before discussing the consequences of possible rate cuts for cryptocurrency, Hayes attacked the Fed for thinking about lowering rates in the face of rising US dollar issuance and increasing government spending.

The businessman expressed his opinion, saying, “I think the Fed is making a colossal mistake cutting rates at a time when the US government is printing and spending as much money as they ever have in peacetime.”

Hayes examined the performance of Ether (ETH), Ethena (ENA), Pendle (PENDLE), and Ondo (ONDO) cryptocurrency pairs. He revealed that, except for ONDO, which he said he hasn't invested in, he possesses substantial holdings in each of the tokens listed.

Ethereum Bull Run Is Ahead?

Due to the near-zero interest rates, investors may start looking for yield elsewhere, which could spark a bull run in yield-producing areas of the cryptocurrency market like ether, Ethena's USDe, and Pendle's BTC staking.

Ether (ETH) would eventually profit from ultra-low rates, offering a 4% yearly staking reward.

According to Hayes, Ethena's USDe, which generates yield by mixing equal-value short perpetual futures positions with BTC and ETH as backing assets, and DeFi platform Pendle's BTC staking—which, as of last week, offered a floating yield of 45%—stand to gain as well.

Meanwhile, there may be less demand for tokenized treasuries, which depend on interest rates.