Best Cryptocurrency Exchange Apps of 2026

The cryptocurrency market is constantly evolving, and with it, the number of platforms for buying, selling, and trading cryptocurrency. With so many options available, it can be difficult to choose the best cryptocurrency exchanges' apps.

In this article, we provide you with some of the most reputable and trustworthy options.

Table of content

- Best Crypto Exchanges Apps for 2026

- TOP 10 Cryptocurrency Exchanges and Apps

- How We Rate Crypto Exchange Apps?

- Crypto Exchange Guide

- How to Use Cryptocurrency Exchanges Apps?

- Cryptocurrency Exchange vs Cryptocurrency Wallet

- Crypto Exchange Benefits & Challenges

- Final Thoughts on the Best Cryptocurrency Exchanges Apps 2026

- FAQ About Crypto Exchanges and Apps

Best Crypto Exchanges Apps for 2026

- Best Mobile App: Crypto.com

- Best Decentralized Exchange: Bybit Web3

- Best for Security: Bybit

- Best for Bitcoin: Bitfinex

- Best for Beginners: Coinbase

- Best for Altcoins: Binance

- Best for Low Fees and Best for Experienced Traders: Kraken

TOP 10 Cryptocurrency Exchanges and Apps

We researched platforms' security, offerings, availability, fees, financial options, features, and mobile capabilities to find the best cryptocurrency exchange apps.

Crypto.com

Crypto.com offers one of the best apps with a user-friendly features for buying, selling, and trading over 250 cryptocurrencies. It is also one of the fastest-growing crypto exchanges, with over 10 million users in over 100 countries.

Fees: Variable fees (Crypto.com), 0.14%-0.40% (Crypto.com Pro)

Pros

- Large selection of cryptocurrencies

- Competitive fees

- User-friendly platform

- Wide range of products and services

Cons

- Complex platform for beginners

- Not available in all countries

- Customer support can be slow

Nexo

Nexo is a user-friendly app where you can buy, swap, and hold Bitcoin and various cryptocurrencies. With access to over 500 trading pairs, you can trade more than 70 digital currencies without any fees. The platform app also offers easy-to-use trading features like Swap, Trigger Swap, and Booster.

Fees: between 0.00% and 0.15%

Pros

- Strong security measures

- Wide range of financial products

- Innovative financial tools

- Attractive interest rates

- Multilingual customer support

- Very low fees

Cons

- Regulatory challenges

- Market risks

- Limited access

Bybit

Bybit is known for its user-friendly interface and extensive trading options. It allows free conversion between 4 cryptocurrencies and 62 fiat currencies, including USD. Getting started is easy with a quick sign-up and KYC process. The platform makes it simple to post ads for buying or selling crypto and complete transactions quickly.

Fees: No fees charged

Pros

- Offers zero transaction fees for both the buyer and seller

- Fast transactions, with a maximum confirmation time of 15 minutes

- Supports a wide variety of currencies

Cons

- Regulatory challenges

- Limited access

- Difficult interface for new users

Bitfinex

Bitfinex is recognized as a professional trading platform capable of managing a high volume of trades simultaneously. Its app provides various trading options, including direct currency swaps, margin trading, lending, and futures trading.

The exchange also holds a large amount of Bitcoin, with around 400,000 BTC in its digital wallet, making it the second-largest in the world.

Fees: Variable fees (start at 0.20% for trades of $0.00 or more)

Pros

- Competitive trading fees

- Comprehensive education center with diverse content

- Solid security practices

- Advanced trading features

- Email and chat support available

Cons

- No insurance fund for assets on the platform

- Doesn’t offer a crypto credit card

- No phone support

Coinbase

Coinbase is a U.S. cryptocurrency exchange that has a user-friendly app for buying, selling, and trading over 100 cryptocurrencies. Coinbase is one of the largest and most well-known cryptocurrency exchanges in the world, with over 73 million users in over 100 countries.

Fees: Variable fees (Coinbase), 0%-0.60% (Coinbase Advanced Trade)

Pros

- User-friendly app

- Wide range of cryptocurrencies

- Secure and reliable

- Good customer support

Cons

- Higher fees than some competitors

- Limited trading options

- Not available in all countries

Binance

Binance is a global cryptocurrency exchange offering various trading pairs for over 350 cryptocurrencies. Binance is one of the world's largest and most popular cryptocurrency exchanges, with over 120 million users in over 180 countries.

Fees: Variable fees (Binance), 0.01%-0.10% (Binance Pro)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

Kraken

Kraken also works globally has trading pairs for over 160 cryptocurrencies. It is a well-established exchange with a strong reputation for security and reliability, and it is a popular choice for traders who are looking for a sophisticated trading platform.

Fees: Variable fees (Kraken), 0.16%-0.26% (Kraken Pro)

Pros

- Wide range of cryptocurrencies

- Low fees for high-volume traders

- Secure and reliable

- Advanced trading features

Cons

- Complex platform for beginners

- Not available in all countries

- Customer support can be slow

OKX

OKX is one of the best cryptocurrency exchanges app with trading pairs for over 500 cryptocurrencies. It is large and very popular platform, with over 20 million users in over 160 countries.

Fees: Variable fees (OKEx), 0.10%-0.02% (Pro)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

- Margin trading

- Futures trading

- Staking and lending

- NFT platform

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

KuCoin

KuCoin offers trading pairs for over 700 cryptocurrencies. It is one of the largest cryptocurrency exchanges in the world, with over 18 million users in over 200 countries.

Fees: Variable fees (KuCoin)

Pros

- Low fees

- Wide range of cryptocurrencies

- Advanced trading features

- Margin trading

- Futures trading

- Staking and lending

Cons

- Not available in all countries

- Some regulatory scrutiny

eToro

eToro is a leading global multi-asset trading platform offering various products and services, including stocks, ETFs, forex, commodities, indices, cryptocurrencies, and more.

Fees: Variable fees (eToro), 0%-0.75% (Cryptoasset spread)

Pros

- Social investing (CopyTrader feature)

- User-friendly platform

- Wide range of products and services

Cons

- Fees for some transactions (withdrawals, currency conversions)

- Minimum deposit requirement of $50

- Margin trading is not available for all users

Gemini

Gemini has a user-friendly app for buying, selling, and trading over 70 cryptocurrencies. It is one of the most secure and reliable cryptocurrency exchanges, with a strong focus on compliance and security.

Fees: Variable fees (Gemini), 0.50%-4.50% (Gemini ActiveTrader)

Pros

- User-friendly platform

- Wide range of cryptocurrencies

- Secure and reliable

- Advanced trading features

- Margin trading

Cons

- Higher fees than some competitors

- Limited trading options

- Not available in all countries

Fidelity Crypto

Fidelity Crypto is a cryptocurrency platform by Fidelity Investments, a well-established and respected financial services company. It offers a simple and user-friendly application for buying and selling cryptocurrencies, and it is a good choice for beginners.

Fees: 0.95% (Fidelity Crypto), 0.1% (Fidelity ActiveTrader)

Pros

- Simple and user-friendly platform

- Wide range of cryptocurrencies

- Secure and reliable

- Low fees

- Trusted brand

Cons

- Limited trading options

- Not available in all countries

- Not as advanced as some other exchanges

Gate.io

Gate.io provides a wide range of trading pairs for over 1,300 cryptocurrencies. It is one of the largest and best cryptocurrency exchanges, with over 10 million users in over 200 countries.

Fees: Variable fees (Gate.io), 0.2%-0.02% (Margin Trading)

Pros

- Wide range of cryptocurrencies

- Low fees

- Advanced trading features

- Staking and lending

- Margin trading

Cons

- Complex platform for beginners

- Not available in all countries

- Some regulatory scrutiny

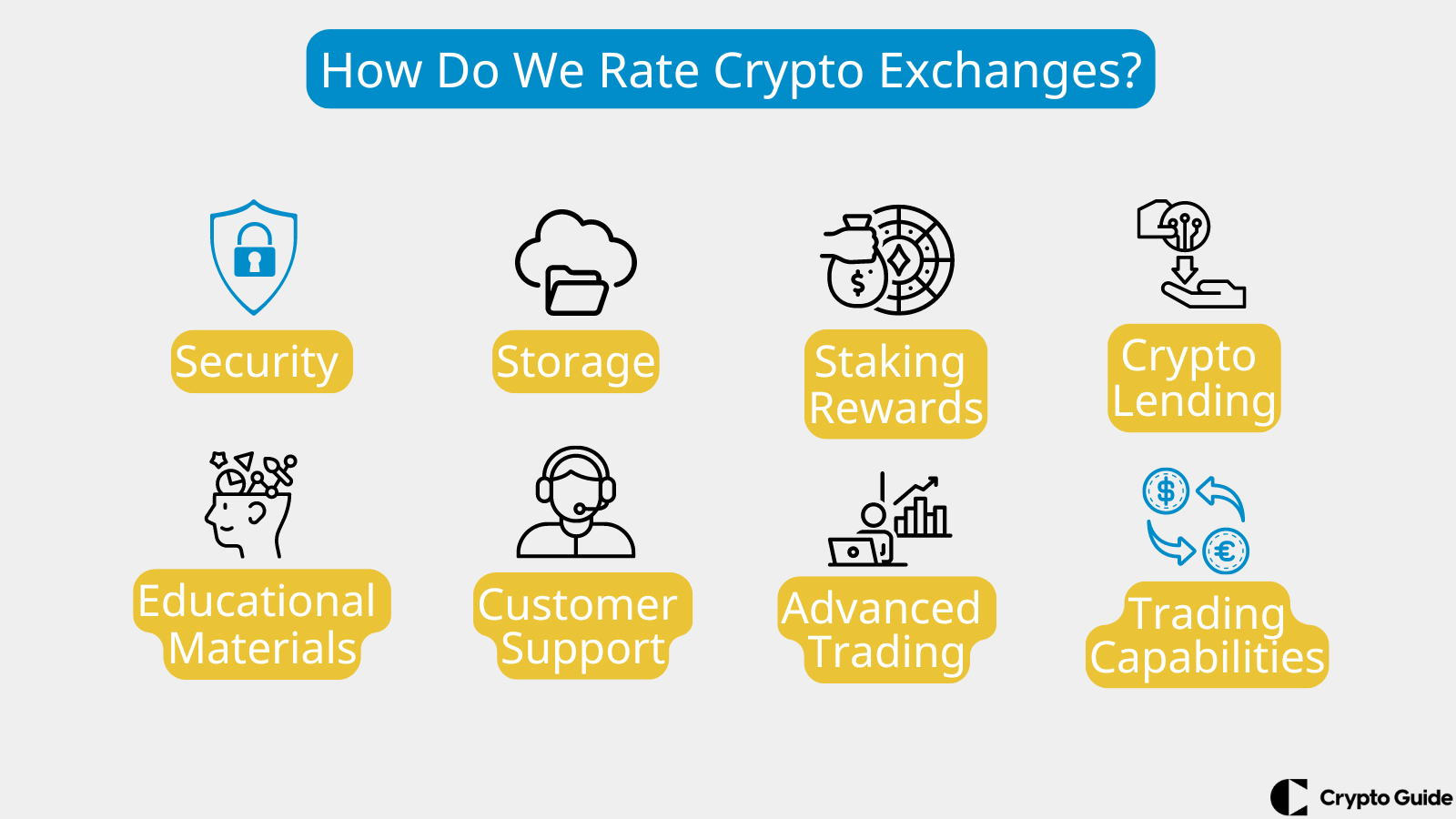

How We Rate Crypto Exchange Apps?

Our experts focus on helping you make informed decisions about the best different crypto exchange apps. Here's how we assess different aspects of these apps:

Trading Capabilities

To find reliable apps, we examine the platform’s financial health, security, liquidity, and regulatory compliance. We also consider factors like transaction speeds, fees, and the quality of customer support.

Advanced Trading

Our experts know that smart tools make a difference. We value advanced app features like different types of trading orders, automated trading support, and live market data. We also prioritize exchanges with margin trading, derivatives, and customizable interfaces for better control.

Customer Support

A platform with good support is essential. Our team looks for exchange apps that help through live chat, email, and phone calls, with teams available 24/7. We believe support staff should know technical issues, security, and multi-language services for a better user experience.

Educational Materials

We favor exchanges and apps with easy-to-understand lessons, live classes, and guides. The best cryptocurrency exchange apps offer market tips and trade analysis tools to help users make better decisions.

Security and Storage

Safety is a top priority. Our experts look for apps that use two-factor authentication, encryption, and offline storage. Regular security audits and compliance with standards make an app even stronger.

Staking Rewards

We appreciate exchanges with rewarding staking programs. The better the rewards, the more attractive the platform. Our experts evaluate how long users stake their crypto and the variety of tokens offered, ensuring the exchange meets user expectations.

Crypto Lending

Our team recommends exchanges with easy-to-use lending services offering competitive interest rates. Exchange apps that let users lend cryptocurrency with flexible terms and secure processes stand out in our reviews.

Crypto Exchange Guide

In this part, we provide a detailed explanation on what crypto exchanges are and how they work.

What is Crypto Exchange?

A crypto exchange is an online platform where users can buy, sell, or trade cryptocurrencies. It acts as a marketplace for crypto assets, helping buyers and sellers complete transactions.

Crypto exchanges handle order matching, price discovery, and liquidity, allowing users to swap one cryptocurrency for another or exchange crypto for fiat currency.

Crypto exchanges fall into two main types: centralized exchanges (CEX) and decentralized exchanges (DEX). Each type has its own features and benefits. Users usually create accounts, deposit funds, and start trading, which keeps the cryptocurrency market active and dynamic.

Types of Cryptocurrency Exchanges

Centralized (CEX)

Centralized Exchanges (CEX) are traditional platforms where users trade cryptocurrencies through an intermediary. Exchanges such as Binance and Coinbase provide high liquidity, ease of use, and centralized management of transactions. However, users must trust the exchange to securely handle their funds.

Decentralized (DEX)

Decentralized Exchanges (DEX) are platforms where users trade cryptocurrencies directly without a central authority. Using blockchain technology, DEXs like Uniswap and SushiSwap provide greater privacy, security, and control over funds. There are even more well-rated decentralized exchanges to check.

Cryptocurrency Exchange Fees

Fees are charged when you buy or sell cryptocurrencies. They are typically a percentage of the transaction amount. The exact fee structure varies from exchange to exchange, but users usually prefer apps that offer the most competitive rates or low-fee crypto exchanges.

Trading Fees

The exact trading fee structure varies from exchange to exchange, but some common examples include:

Maker fees are charged to traders who place limit orders, which are used to buy or sell a cryptocurrency at a specific price or better. These fees are usually lower than taker fees because they help add liquidity to the market.

Taker fees are charged to traders who place market orders, which are filled instantly at the best available price. These fees are generally higher than maker fees because they remove liquidity from the market.

Some exchanges offer tiered fees, meaning that the fees you pay will depend on the cryptocurrency you trade. Higher-volume traders will typically pay lower fees than lower-volume traders.

Deposit and Withdrawal Fees

Deposit and withdrawal fees are charged when you move funds into or out of your exchange account. The exact fee structure will vary from exchange to exchange, but some common examples include:

Some exchanges offer free deposits for certain fiat currencies or cryptocurrencies.

Others charge a flat fee for withdrawals, regardless of the amount of cryptocurrency being withdrawn.

Some exchanges charge a percentage fee for withdrawals, a percentage of the amount of cryptocurrency being withdrawn.

Listing Fees

Listing fees are charged to cryptocurrency projects that want to be listed on an exchange. The fee structure varies from exchange to exchange, but it typically includes a flat fee and a percentage of the project's market capitalization.

Fiat-to-crypto Conversion Fees

Fiat-to-crypto conversion fees are charged when you convert fiat currency (like US dollars or euros) into cryptocurrency. The fee structure will vary from exchange to exchange, but it will typically be a percentage of the converted amount.

Subscription Fees

Subscription fees are charged to users who want to access premium features on an exchange. These features may include:

Margin trading allows you to borrow funds from the exchange to trade with.

Futures trading lets you buy and sell cryptocurrency contracts that will expire at a certain time.

Crypto-backed loans let you use your cryptocurrency as collateral to borrow funds.

Other Fees

Other fees may include:

Some exchanges charge inactivity fees if you don't trade or deposit funds into your account for a certain time.

Others charge security fees to cover the costs of their security measures.

Some may charge premium support fees for users who want faster or more personalized customer support.

How to Use Cryptocurrency Exchanges Apps?

Step 1: Create an account on the exchange app and complete any necessary identity verification.

Step 2: Choose the cryptocurrency pair you wish to trade (e.g., BTC/ETH).

Step 3: Submit your order, and the exchange will match it with others in the market based on price.

Step 4: Check your wallet to confirm updated balances after executing the trade.

Step 5: If desired, withdraw your funds by converting cryptocurrency into fiat or transferring to an external wallet.

Step 6: Enable security measures like two-factor authentication and encryption.

Step 7: Ensure you comply with any local regulations for trading cryptocurrencies.

Cryptocurrency Exchange vs Cryptocurrency Wallet

| Feature | Cryptocurrency Exchange | Cryptocurrency Wallet |

|---|---|---|

| Purpose | Buying, selling, and trading cryptocurrencies | Storing cryptocurrency |

| Key Functions | Order placement, market data, fiat conversion, margin trading, futures trading, collateral lending | Secure private keys, sending/receiving, transaction history, multi-currency support, offline storage (hardware only) |

| Types | Centralized, decentralized | Hardware, software |

| Security | Varies based on exchange | Hardware wallets offer higher security due to offline storage |

| Accessibility | Typically require internet connection | Hardware wallets require physical access, software wallets can be accessed from any internet-connected device |

| Features | Trading tools, leverage, advanced features | Basic functions, additional features like integration with exchanges (software wallets) |

Crypto Exchange Benefits & Challenges

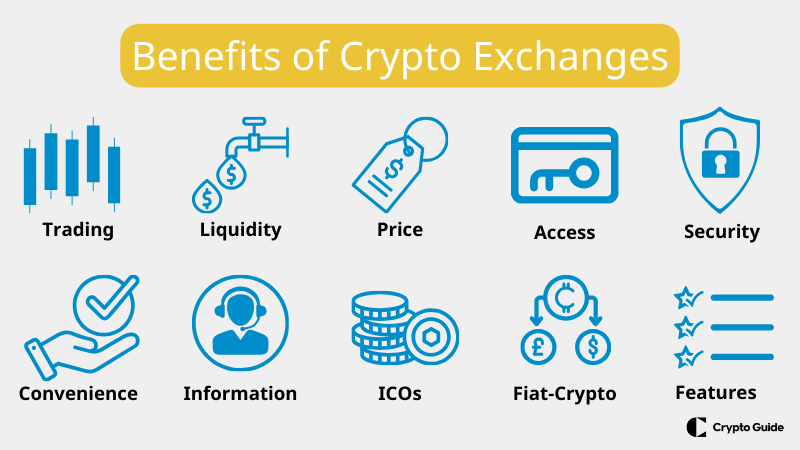

Crypto exchange apps make it easy for users to buy, sell, and trade cryptocurrencies; they boost market liquidity and help set prices through supply and demand. Such apps provide access to various cryptocurrencies, allowing users to diversify their portfolios, and use security measures to protect funds.

With user-friendly apps and real-time market data, trading is accessible worldwide. Exchanges also support new projects through ICOs and offer advanced features like margin trading for experienced users.

However, challenges include the risk of hacks, evolving regulations, low liquidity for some coins, and market manipulation. Technical issues like server outages can also disrupt trading and reduce trust in the platform.

Final Thoughts on the Best Cryptocurrency Exchanges Apps 2026

The best cryptocurrency exchanges apps offer many benefits, like the chance to trade, lots of liquidity, and a big selection of cryptocurrencies. But they also have some challenges, such as keeping things secure, dealing with unclear rules, and managing risks in their operations.

As the crypto market keeps changing, exchanges need to work on making things more secure, following the rules, and helping users better. Doing these things will help people trust them more which is important for crypto to keep growing and become a normal part of finance.

FAQ About Crypto Exchanges and Apps

Which crypto exchange is the safest?

Binance is considered as one of the safest crypto exchanges.

What are the best cryptocurrency exchanges for beginners?

Coinbase is considered one of the best crypto exchanges for beginners.

Which is better, Coinbase or Kraken?

Coinbase is better for beginners, while Kraken is better for experienced traders.

Which crypto exchange has never been hacked?

Kraken is frequently recognized as the most secure exchange, thanks to its long history and record of never being hacked.

Which are the best cryptocurrency exchanges apps?

The best cryptocurrency app depends on your needs; for beginners, Coinbase offers a user-friendly interface, while experienced traders might prefer Binance for its advanced features and low fees.