Biden Proposes Century-High Tax on Stocks and Crypto

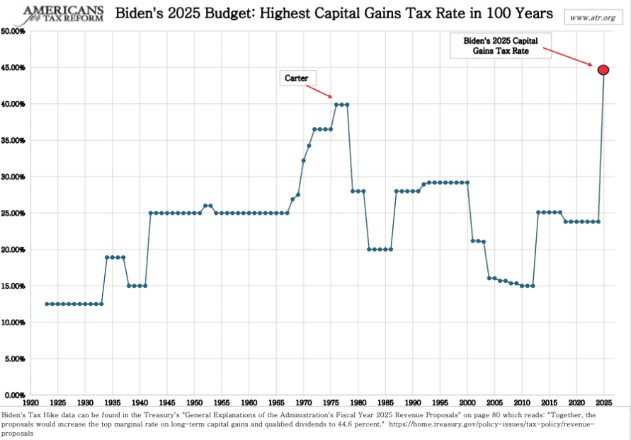

President Biden has recently put forward a proposal suggesting the most significant increase in the top capital gains tax rate seen in more than a century.

Under his plan, the highest marginal rate for long-term capital gains and dividends that qualify would be elevated to 44.6%. This substantial rise could notably affect the financial outcomes for investors who have stakes in both the stock market and cryptocurrencies.

In numerous states, this proposal would push the combined federal and state capital gains tax rates beyond 50%.

Moreover, the proposed increase in the capital gains tax does not take into account inflation adjustments, introducing an additional layer of complexity to the fiscal policy changes.

Capital gains taxes frequently lead to a scenario of double taxation, especially when it comes to investments in stocks, mutual funds holding stocks, or ETFs that track stock indices. This is due to the capital gains tax being imposed on top of the existing federal corporate income tax, which is currently fixed at 21%.

How will stock gains be affected?

At present, the rate for capital gains tax on long-term investments — those assets that are held for more than a year — stands at 20%. Capital gains are defined as the profits that are realized when an asset is sold or traded.

The specific tax rates applied to these gains can differ based on various factors, including the nature of the asset, the individual's taxable income, and how long the asset was held before it was sold.

For his fiscal year 2025 budget, President Biden is looking to nearly double the existing long-term capital gains tax rate to 39.6% for investors whose earnings exceed one million dollars per year.

Crypto taxes will also be revised

“Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

Additionally, the 2025 budget seeks to abolish a particular tax concession for cryptocurrency transactions, among others.

Currently, cryptocurrency investors are subject to different regulations than those investing in stocks or similar securities, potentially leading to the declaration of disproportionately large losses. For example, a cryptocurrency investor may sell their assets at a loss, claim a significant tax deduction to lessen their overall tax burden, and then promptly repurchase the same cryptocurrency assets.

The proposed budget intends to eliminate this tax break for cryptocurrencies by amending the tax code’s anti-abuse provisions to ensure that crypto assets are regulated in a manner akin to stocks and other securities.

This adjustment would mean that cryptocurrency investors, like their counterparts in stock trading, would not only pay the same rate of capital gains tax but also would no longer benefit from the specific tax subsidy previously available.