Bitcoin Could Hit $1.5 Million by 2030, Says Cathie Wood

Cathie Wood, CEO of ARK Invest, believes Bitcoin has a strong chance of reaching $1.5 million per coin by 2030. She attributes this to growing institutional interest and increasing recognition of Bitcoin as a valuable asset.

Bitcoin is trading below $100,000, affected by global market uncertainties, including new trade tariffs from the US and China. Despite this, Wood remains confident that Bitcoin’s long-term outlook is improving as large financial institutions start including Bitcoin in their portfolios.

Wood stated in a video released on February 11 that the chances of Bitcoin reaching $1.5 million have increased. She emphasized that institutions are beginning to see Bitcoin differently from traditional assets due to its unique risk and return characteristics. As a result, many are considering adding Bitcoin to their investment strategies.

Table of content

Institutional Investments and Bitcoin’s Future Growth

Institutional backing plays a significant role in Bitcoin’s price movements. When large financial players invest, they inject significant capital into the market, potentially driving prices higher. Bitcoin Exchange-Traded Funds (ETFs) have already gained traction, making it easier for institutional investors to participate in the crypto market. Bitcoin’s price could grow substantially in the coming years if this trend continues.

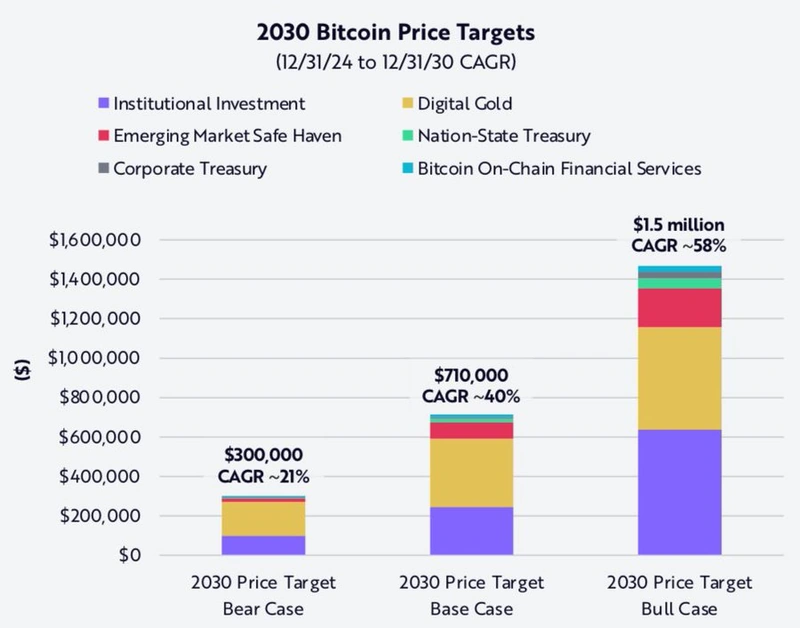

ARK Invest has outlined three possible price scenarios for Bitcoin by 2030:

- Bull Case: Bitcoin reaches $1.5 million, assuming an average annual growth rate of 58%.

- Base Case: Bitcoin grows at 40% per year, pushing its price to around $710,000.

- Bear Case: Even with slower growth of 21% annually, Bitcoin could still hit $300,000.

Bitcoin's Short-Term Outlook and Market Trends

While the long-term forecast is optimistic, Bitcoin still faces challenges in the short term. Analysts suggest a break above $100,000 is crucial for continued upward momentum. Iliya Kalchev, an analyst at Nexo, stated that if Bitcoin fails to surpass this level, it could face short-term selling pressure, potentially dropping back to $95,000. However, if Bitcoin breaks through $100,000, the next resistance level would be around $106,500.

Another factor influencing Bitcoin’s price is its limited supply. Only 2.5 million BTC remain available on exchanges, meaning that as demand increases, the scarcity of Bitcoin could cause a supply shock. When many buyers compete for a shrinking supply, prices typically rise.

Conclusion

Cathie Wood and ARK Invest maintain that Bitcoin has immense growth potential, especially as institutional adoption expands. If the market follows ARK’s bull case, Bitcoin could be valued at over $1.5 million per coin by 2030. However, short-term price movements remain uncertain, with traders watching closely for Bitcoin’s ability to break past $100,000. While risks remain, Bitcoin’s role as a long-term investment continues to strengthen.

Blockchain Expert