Bitcoin ETFs See $900M+ Inflows for Second Day in a Row

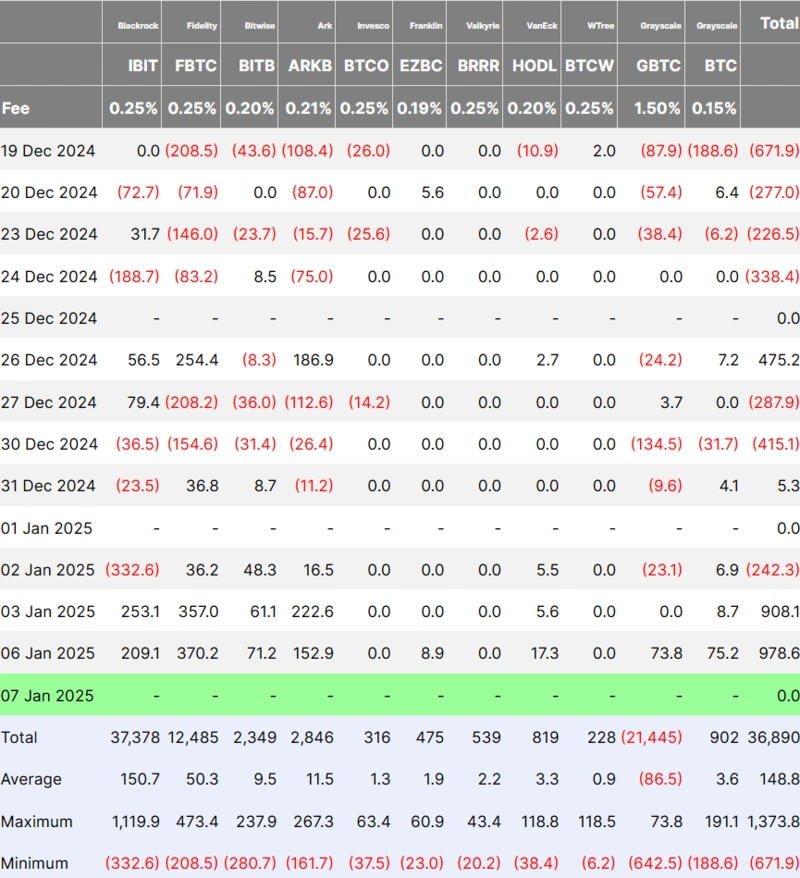

After a rocky end to 2024, spot Bitcoin exchange-traded funds (ETFs) in the United States bounced back strongly in early 2025. On January 3 and January 6, these ETFs saw combined net inflows of nearly $1.9 billion, reversing a trend of outflows that marked the final weeks of December.

On January 6 alone, Bitcoin ETFs attracted $978.6 million in new investments. Fidelity’s Wise Origin Bitcoin Fund led the pack with $370.2 million inflows. BlackRock’s iShares Bitcoin ETF followed with $209 million, while the ARK 21Shares Bitcoin ETF secured $153 million, according to data from Farside Investors.

Other ETFs also gained ground. Bitwise’s Bitcoin ETF and Grayscale’s GBTC and BTC products collectively brought in over $70 million. VanEck and Franklin Bitcoin ETFs added $17.3 million and $8.9 million, respectively. Meanwhile, Invesco, Valkyrie, and WisdomTree ETFs recorded no inflows on January 6.

These recent surges nearly offset the $1.9 billion outflows observed between December 19 and January 2. Since their debut roughly a year ago, spot Bitcoin ETFs have accumulated $36.9 billion in net inflows.

BlackRock’s iShares Bitcoin ETF holds the lead with $37.4 billion in total net inflows, followed by Fidelity’s Wise Origin Bitcoin Fund with $12.4 billion. In contrast, Grayscale’s GBTC has experienced significant outflows, losing $21.4 billion since its conversion to an ETF.

According to an October report by Binance, nearly 80% of the demand for these ETFs has come from retail investors rather than institutions. Industry experts, including Bitwise’s Chief Investment Officer Matt Hougan, anticipate a shift in 2025 as more spot Bitcoin ETF trading clearinghouses become operational.

This increased institutional activity is one reason Bitwise has forecasted Bitcoin prices to reach $200,000 by 2025. Similarly, VanEck predicts the cryptocurrency could surpass $180,000 in the same timeframe.