Bitcoin Speculators Panic Sell as Price Dips: Is This a Good Time for Accumulation?

Bitcoin speculators have been panicking as the cryptocurrency’s price falls to $92,000, causing a 4% weekly loss. The market has been volatile this month, and Bitcoin bulls have failed to maintain the $100,000 threshold. As a result, investor sentiment has been hit hard, particularly among short-term traders who react more quickly to price fluctuations.

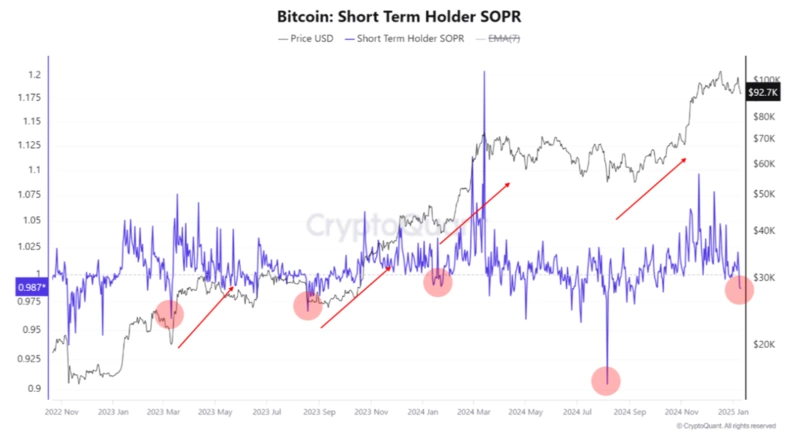

One key sign of market capitulation is a drop in the spent output profit ratio (SOPR). SOPR tracks whether Bitcoin is being sold at a profit or loss, based on when the coins last moved. A decrease in SOPR shows that a more significant portion of Bitcoin transactions is being made at a loss, signaling panic selling among speculative investors. While this might seem like a bearish indicator, it can also be seen as a potential buying opportunity for long-term holders. Historically, capitulation among short-term traders has often marked a bottom in Bitcoin’s price, making it an ideal time for accumulation.

In August 2024, the SOPR for short-term holders (STH), or those holding Bitcoin for 155 days or less, dropped to its lowest level in over three years. This coincided with Bitcoin’s price falling to around $55,000, a level that has since remained a support point. Data suggests that when short-term investors are forced to sell at a loss, the market often experiences a recovery, allowing long-term investors to buy at a more favorable price.

Despite the negative sentiment, some analysts see this as a potential buying opportunity. The Crypto Fear & Greed Index, a sentiment gauge for Bitcoin, recently dropped to “Neutral” territory, its lowest level since October. While this signals some anxiety in the market, the index is still higher than traditional markets, where fear dominates with a lower reading of 32/100. This contrast suggests that Bitcoin investors are more optimistic than conventional markets, further supporting the idea that now could be a good time to accumulate Bitcoin.

Large-volume investors, or Bitcoin whales, have increased their exposure to Bitcoin after the holiday lull. According to data from CryptoQuant, whales have added 34,000 BTC in just 30 days through January 8. This shows that while short-term traders may be experiencing losses, long-term investors are still confident in Bitcoin’s future potential. This accumulation by whales often occurs during market downturns, suggesting that it could be a good time for those with a long-term perspective to increase their holdings.

Currently, the SOPR for short-term holders is below 1, indicating that most Bitcoin transactions are being made at a loss. This drop in SOPR is accompanied by increased negative media coverage, signaling a bearish shift in sentiment. However, historical trends suggest market bottoms often follow periods of panic selling, presenting buying opportunities for long-term holders. As more investors sell off their holdings, those who remain patient and strategic may benefit from the market’s eventual rebound.