Bitcoin Transactions Plunge 30% – Is Interest Fading?

Bitcoin network activity has recently dropped to its lowest level in three years, reflecting a growing sense of “disinterest” across the cryptocurrency markets.

In a Quicktake blog post published on Sept. 4, CryptoQuant, a well-known onchain analytics platform, highlighted the increasing weakness in Bitcoin prices.

Bitcoin Transactions Drop by Nearly 400,000 Per Day

According to the data, Bitcoin transaction volumes have decreased significantly, mainly due to months of stagnant price action. The prolonged sideways movement in Bitcoin's value has impacted user engagement on the network.

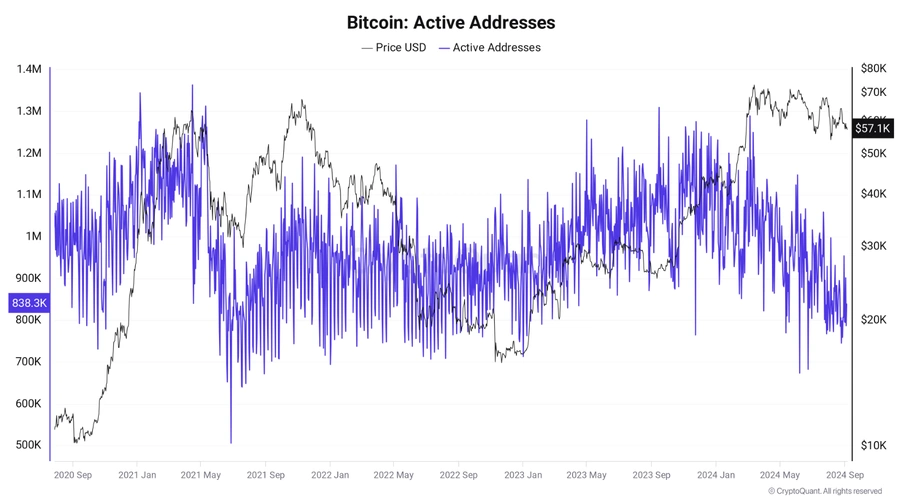

At its peak in mid-March, Bitcoin was performing much better. During that time, when BTC/USD reached a recent all-time high in terms of US dollar value, the number of daily active Bitcoin addresses surged to nearly 1.2 million.

However, that momentum has since faded. Currently, the number of active addresses has dropped to around 838,000. In late August, that figure hit a low of just 744,000. CryptoQuant noted that this is the lowest level of daily active addresses recorded since 2021.

“The total number of active addresses on the Bitcoin network hit new lows in 2024, reaching the same levels as three years ago, back when Bitcoin was priced at around $45,000,” contributor Gaah explained in the post.

A decline in active addresses indicates less overall activity on the Bitcoin network, i.e. fewer transactions are taking place, which may reflect less interest in using the network at this point in the market.

This data ties into a larger narrative of frustration that surrounds the current cryptocurrency landscape. Bitcoin has struggled to gain any clear momentum or establish a definitive trend. Instead, it remains locked in a period of indecisiveness and price stagnation.

Another key metric, the Puell Multiple, also highlights the lack of movement. The Puell Multiple compares the value of Bitcoin mined each day to its 365-day moving average. Like Bitcoin’s price activity, this metric shows little change, signaling that the market is in a holding pattern.

CryptoQuant suggests that these metrics may indicate a potential buying opportunity for long-term investors, as the market appears to be preparing for a future shift.

“For some investors, a drop in active addresses and Bitcoin’s price might be seen as an attractive opportunity to buy, with the anticipation that the market will rally in the future,” Gaah concluded.

However, if the decline is interpreted by investors as a sign of weakness or loss of relevance in the current macro scenario new supports should be formed increasing disinterest in the asset providing new entry opportunities

BTC ‘Chopsolidation' Suggests Imminent Breakout

The broader analytics community has also picked up on this trend, noting that Bitcoin’s price is behaving as if it’s trapped in a kind of “no-man’s land.”

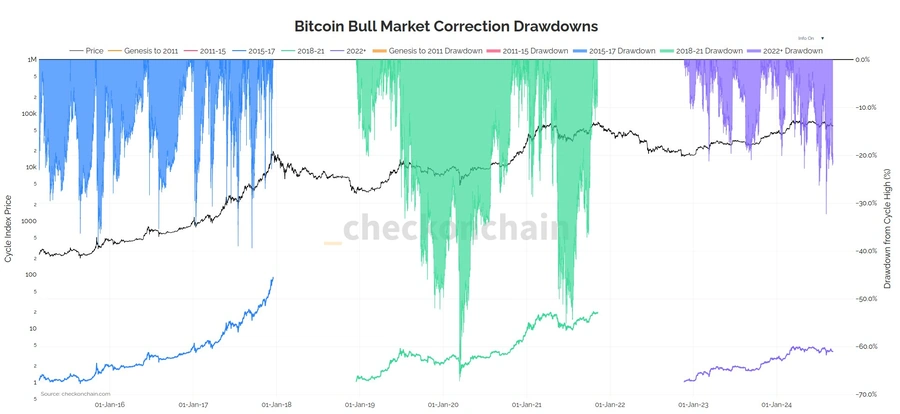

Checkmate, the pseudonymous creator behind the onchain analytics platform Checkonchain, has coined a term to describe the current market conditions: “chopsolidation.” This term is a blend of “consolidation” and “choppy” market movements. It refers to the erratic and unpredictable price swings Bitcoin has been experiencing within a tight range.

“The swings are becoming larger and more sustained,” Checkmate noted in a recent post on X. “To me, this signals that the current price range is becoming unstable, and the market is preparing to move in a new direction.”

Despite these long-term lows and erratic price patterns, Bitcoin has yet to undergo the kind of significant correction that was seen during previous bull markets. This leaves investors in a state of uncertainty, waiting to see whether the market will break out of its current range and start a new trend, or continue to drift in this volatile, stagnant phase.