Bitcoin Whales Gear Up for Halving

As the anticipated Bitcoin halving event draws near, there has been a notable increase in the acquisition of significant quantities of Bitcoin by whales in the past week. With approximately one week remaining until the fourth Bitcoin halving—which will reduce the block reward to 3.125 BTC—there is an observable surge in demand from these large holders, signalling a bullish outlook for the market.

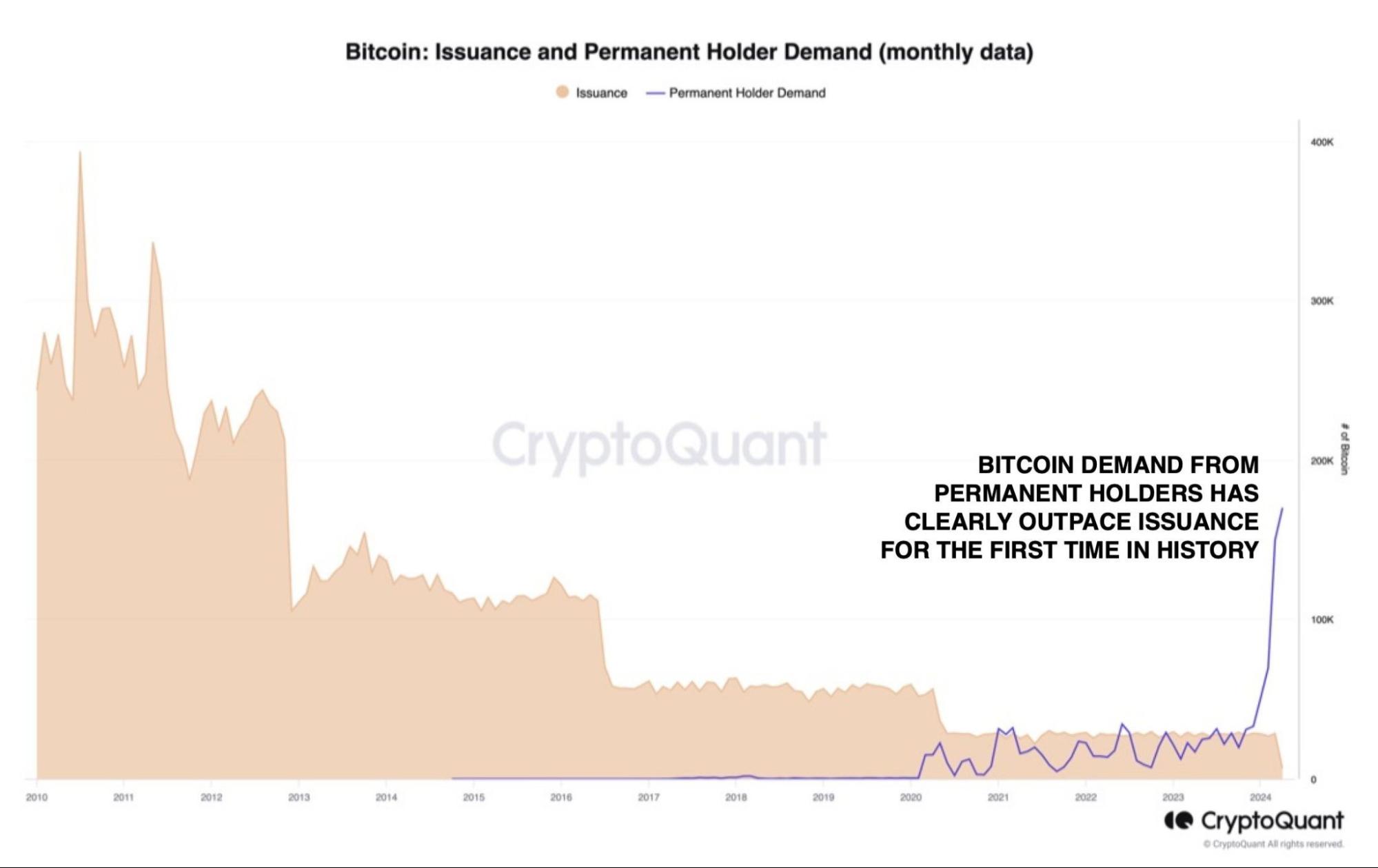

Data provided by the cryptocurrency analytics company CryptoQuant reveals that the demand from Bitcoin whales has reached unprecedented levels.

For the first time, the demand from “permanent holders” has surpassed the supply of newly mined Bitcoin. This development suggests that the production rate of new Bitcoin through mining activities is inadequate to satisfy the needs of cryptocurrency investors, pointing to a growing scarcity that is expected to intensify following the Bitcoin halving.

This escalating demand from BTC whales, combined with increased spot Bitcoin inflows, is likely to exert upward pressure on the price of this leading cryptocurrency. Over the medium to long term, this trend could significantly elevate the value of Bitcoin.

The Bitcoin halving is a pivotal event in the cryptocurrency ecosystem, typically marked by substantial price fluctuations before and after the event.

Historically, bull runs have commenced several months prior to the halving, driven by anticipation of a dwindling BTC supply. Following the halving, Bitcoin prices have historically soared, amplified by the reduced supply and an expanding gap between supply and demand.

In addition to affecting the direct supply of Bitcoin, BTC halvings also influence miners who verify transactions and add new blocks to the blockchain.

Each halving event halves the Bitcoin earnings for miners, thereby escalating the costs associated with mining new Bitcoin. As a result, Bitcoin prices need to reach a certain threshold to maintain the profitability of mining operations.

Currently, the average cost to mine one Bitcoin stands at approximately $49,000, which remains profitable with the current trading price hovering around $70,000. However, following the halving, Bitcoin prices need to surpass $80,000 for mining operations to remain financially viable.

The phase of whale accumulation is a positive indicator for the cryptocurrency market, suggesting that major Bitcoin holders are transferring their assets to cold wallets in anticipation of future price increases.