Bitcoin’s Next Bull Run: Key Signs It’s Just Beginning

In early August, Bitcoin’s price dropped below $50,000, and by the beginning of September, it had fallen further to under $53,000. This isn't unusual, as September has traditionally been a challenging month for Bitcoin and other cryptocurrencies.

However, despite this downward trend, Bitcoin managed to bounce back. Several indicators now suggest a more positive outlook for its price in the upcoming months. These factors are contributing to a more optimistic perspective for the largest cryptocurrency.

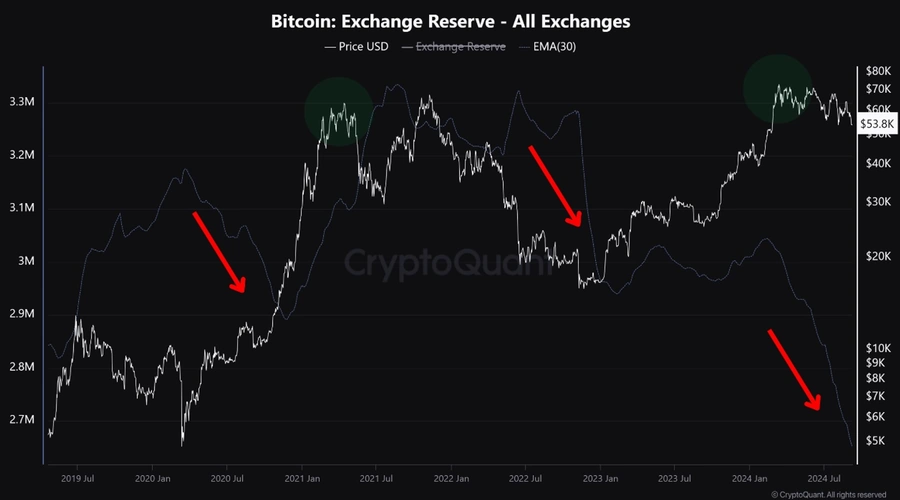

Decreasing Exchange Reserves

One of the main insights from CryptoQuant's analysis is the decrease in the amount of Bitcoin stored on cryptocurrency exchanges. This drop is significant because it signals that investors are pulling their funds off trading platforms.

When Bitcoin is moved off exchanges, it usually means there is less pressure to sell, which can help stabilize or increase the price. Historically, this type of activity has often led to price increases and new highs.

For example, in late 2020, the amount of Bitcoin on exchanges saw a sharp decline. Soon after, Bitcoin's price surged to new all-time highs at the start of 2021. A similar pattern occurred in early 2023, though the peak took about a year to materialize. This shows that while the current developments are positive, it may still take several months, or even longer, for Bitcoin to reach a new peak in this cycle.

Surging Stablecoin Reserves

Another important factor that CryptoQuant highlights is the rising reserves of stablecoins on exchanges. Just before Bitcoin’s significant $4,000 rally on September 9 and 10, $300 million worth of stablecoins flowed into trading platforms. This inflow of stablecoins is a strong indicator that investors are preparing to buy more Bitcoin or other digital assets. When stablecoin reserves increase, it often means that buyers are waiting for the right moment to enter the market.

CryptoQuant’s report emphasizes that the rise in stablecoin reserves suggests there is “ready-to-deploy” capital waiting to invest in Bitcoin. This signals a strong potential for future buying interest.

Growing Bullish Sentiment

While tools like the Fear and Greed Index still show that the market is in “fear” mode, the combination of these factors could mean that the market is on the verge of a significant shift toward a more positive sentiment.

Moreover, historically, October and November have been more favorable months for Bitcoin, often marked by price gains. These seasonal trends, combined with potential macroeconomic factors such as upcoming interest rate hikes in the U.S. and the potential outcome of the presidential elections—especially if Donald Trump wins—could create conditions for a major breakout in Bitcoin’s price. This could result in new price highs by the end of 2024 or the early part of 2025.

In summary, while Bitcoin’s price has faced some challenges recently, several key indicators point to a more favorable outlook in the near future. The reduction in Bitcoin held on exchanges and the rising stablecoin reserves suggest that investors are preparing for potential price increases, although it may take time for the market to fully reflect these changes.