Bitcoin’s Pre-Halving All-Time High: Is It Possible?

The current state of Bitcoin's price sees it hovering above the $60,000 mark, positioning itself tantalizingly close to achieving a new all-time high. Such a feat would mark an unprecedented milestone for the leading cryptocurrency by market cap, historically known for establishing new price records only after each halving event.

Could Bitcoin, then, break records in more ways than one? Is there a possibility that it could reach a new all-time high before the halving event for the first time ever? This intriguing prospect prompts us to delve deeper into the available data and explore the dynamics at play.

Table of content

Why Bitcoin's Halving Event Holds Significance

The Bitcoin halving stands as one of the most eagerly anticipated and impactful occurrences within the cryptocurrency realm. This event serves to curtail the influx of new coins into circulation by halving the reward miners receive for processing blocks, thereby reducing the overall supply.

This reduction in supply, when coupled with sustained or growing demand, typically translates into upward pressure on prices in accordance with basic economic principles. Many investors view halving events as potential catalysts for bullish market cycles.

However, the current landscape presents a departure from conventional market cycles. Unlike previous instances where price surges followed halving events with significant margins, Bitcoin now finds itself within striking distance of its previous all-time highs even before the halving arrives. This deviation from the norm raises questions about the factors influencing supply and demand in 2024.

What's Driving the Shift in Dynamics?

One notable development is China's injection of liquidity into the global economy in an effort to stabilize its financial markets. Additionally, the emergence of new spot Bitcoin exchange-traded funds (ETFs) is exerting a substantial impact on demand and net flows.

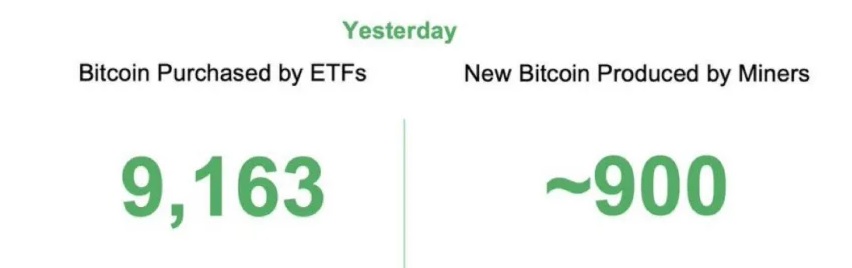

These ETFs, driven by investor demand for shares, necessitate the purchase of corresponding amounts of Bitcoin. Recent data indicates a substantial surge in ETF purchases, with the demand vastly outpacing the daily production of new BTC by miners.

If the current trend persists, with ETFs absorbing exponentially more Bitcoin than is being mined, the upcoming halving event in April could further exacerbate the supply shortage. With supply dwindling and demand remaining robust, the imbalance suggests a potential scenario where prices could skyrocket.

Solidifying Strength in the Crypto Market

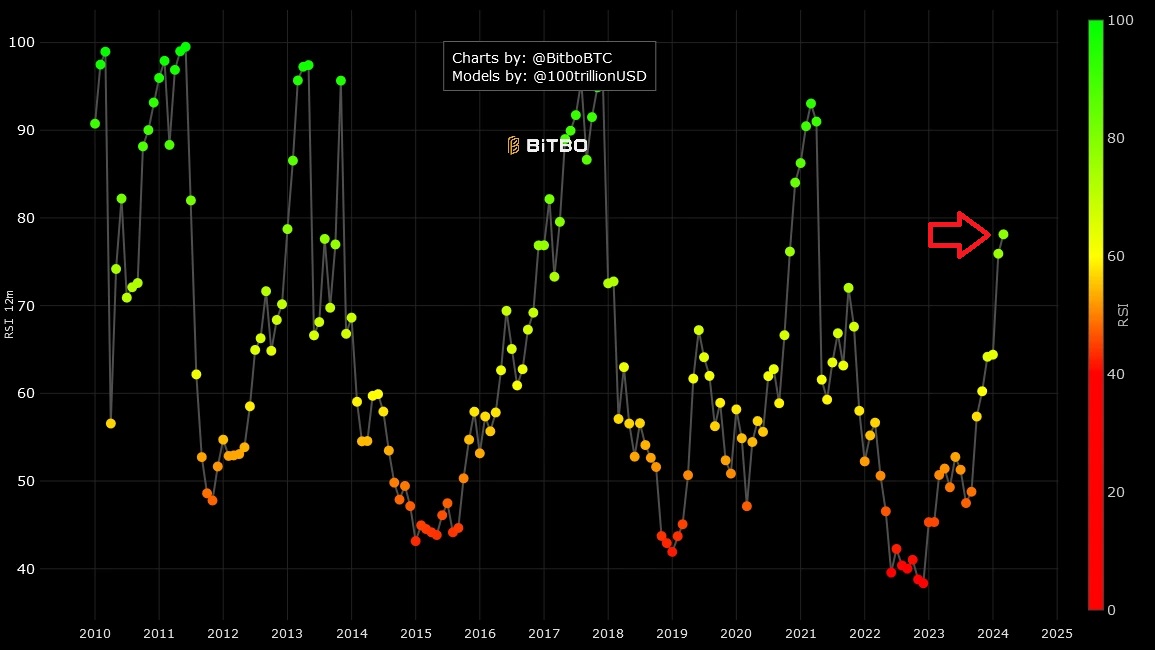

This surge in demand is reflected in Bitcoin's monthly Relative Strength Index (RSI), which has surpassed the key bullish threshold of 70, indicating overbought conditions. While traditionally viewed as a signal for potential market correction, historical precedent suggests that BTC can remain overbought for extended periods during strong bull runs.

Notably, instances where the RSI climbed above 70 have often coincided with significant price surges, with gains exceeding 40% in a single month.

As Bitcoin continues to defy conventional market norms and exhibit unprecedented price dynamics, the stage is set for a potentially transformative year, with the full extent of its price potential yet to be realized.