Crypto Boom: Investment Inflows Soar to 5-Week High

Cryptocurrency investors are showing a growing interest in purchasing Bitcoin-related exchange-traded products (ETPs), particularly in light of concerns about possible interest rate reductions that could occur in September.

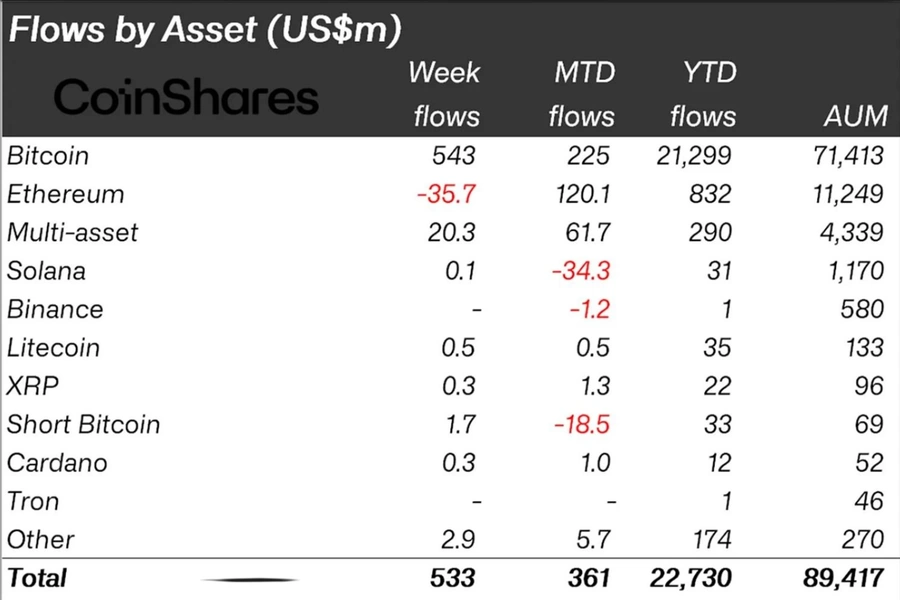

According to a report published by the crypto investment firm CoinShares on August 26, digital asset investment products experienced significant weekly inflows totaling $533 million between August 18 and August 24.

This surge represents the most substantial inflows observed in the past five weeks and is largely attributed to expectations of upcoming interest rate cuts in the United States. On August 21, U.S. Federal Reserve Chair Jerome Powell suggested that these cuts could potentially begin as early as September 2024.

Bitcoin Leads the Pack with $543 Million in Inflows

Within the various crypto investment products analyzed by CoinShares, Bitcoin-related ETPs attracted the highest level of investment last week, with inflows amounting to $543 million. Notably, BlackRock's iShares Bitcoin Trust (IBIT) was a major contributor to this trend, recording $318 million in new investments during the same period.

On the other hand, Ether-related crypto investment products saw outflows, with a total of $36 million being withdrawn. This occurred even as new Ethereum ETF issuers continued to see some inflows. However, these gains were overshadowed by the Grayscale Ethereum Trust (ETHE), which experienced significant outflows of $118 million.

Despite the considerable outflows from the Grayscale Ethereum Trust, the newly launched Ethereum ETFs have managed to attract $3.1 billion in inflows since their introduction on July 23. However, these inflows have been partially counterbalanced by the $2.5 billion in outflows from Grayscale's ETHE during the same period.

Bitcoin Gains 8% as Inflows Surge

As these inflows into Bitcoin-related products increased, the price of Bitcoin saw a noticeable rise. Bitcoin’s value grew by approximately 8%, climbing from $59,500 on August 18 to $64,300 by August 24. Nevertheless, despite this recent uptick, Bitcoin remains down by around 6% over the past 30 days, after having reached a peak of $69,900 on July 29, according to data from CoinGecko.

Although the recent surge in crypto inflows surpassing $500 million is noteworthy, it falls short of breaking historical records. The largest spike in inflows for 2024 occurred between March 11 and March 17, shortly after Bitcoin achieved its all-time high of $73,600 on March 14.

In a related analysis, the crypto financial services platform Matrixport highlighted that the recent rise in Bitcoin's price is largely driven by the active minting of new stablecoins, such as Tether. Matrixport stated in their August 26 update:

“Robust stablecoin minting is the main force behind Bitcoin rise, suggesting institutional influence surpasses macroeconomic factors.”