Crypto ETFs See Billions in Inflows as Bitcoin Hits New Highs

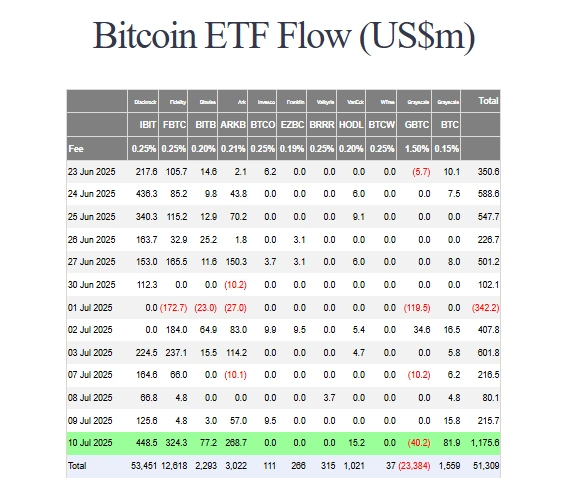

Bitcoin and Ethereum ETFs experienced massive inflows, with Bitcoin ETFs bringing in $1.17 billion and Ethereum ETFs attracting $383.1 million. These inflows were sparked by Bitcoin reaching a new high of $113,800, leading to over $1 billion in short liquidations. Accumulation by long-term holders also surged, reflecting strong bullish sentiment.

Spot Bitcoin ETFs have accumulated a staggering $28.22 billion in 2025 alone, while miners have only produced $7.85 billion in new supply. This supply-demand imbalance could further fuel Bitcoin's rally. Ethereum experienced a similar dynamic, with $383.1 million flowing into Ethereum ETFs, far exceeding its daily issuance.

Bitcoin’s surge resulted in over $1 billion in short liquidations across the crypto market, affecting 232,149 traders. Of the liquidations, $678 million came from Bitcoin shorts, and $258 million from Ethereum shorts. Analysts have labeled this a “massive short squeeze.”

Bitcoin Accumulation Indicates Long-Term Bullishness

Long-term Bitcoin holders, particularly those identified as accumulation addresses, are showing increased demand. This is supported by data from CryptoQuant, which reported a 71% rise in demand over the last 30 days. Strategic buyers are taking advantage of the current market, and their activity suggests confidence in Bitcoin’s future performance.

Bitcoin's realized cap has increased by $4.4 billion, reflecting new capital entering the market rather than speculative gains. This further reinforces the bullish outlook, as fresh capital suggests long-term confidence.

Despite some skepticism earlier in the week, the market has reacted positively to Bitcoin’s new highs. Analysts, including Kyle Reidhead, are maintaining a $150,000 price target for Bitcoin due to the ongoing bullish momentum and a strong technical pattern.

Blockchain Expert