All You Wanted to Know About Cryptoassets and Regulations

Table of content

- Cryptocurrency vs. crypto assets

- Why is the name “crypto assets”?

- How do crypto assets work?

- Types of Cryptoassets

- Cryptocurrencies

- Platform tokens

- Examples of platform tokens

- Utility tokens

- Examples of service tokens

- Transaction Tokens / Payment Tokens

- The Potential of Cryptoassets

- Examples of cryptocurrencies

- Examples of utility tokens

- Blockchain-based transaction tokens

- Examples of blockchain-based transaction tokens

- Transactional tokens based on the Internet of Things

- How is this crypto-asset different from those mentioned above?

- Do you have a good understanding of what's going on in the world?

- Are the cryptocurrency and non-monetary systems on their way out?

- The Control of Crypto Assets

- How does investing under regulation help investors?

- Risks

⚡️ What is the ecosystem in Cryptocurrency?

Cryptocurrency is a complex network involving miners, users, and exchanges united by one technology. Miners are the people who dedicate their time and resources to validating transactions on a blockchain network in return for cryptocurrency rewards. Users are anyone that buys, sells, trades or holds cryptocurrencies.

⚡️ What is a Blockchain system?

Blockchain technology is an invulnerable distributed database that makes it highly unlikely for anyone to hack, tamper with or deceive the system. It works by duplicating and distributing a digital record of transactions across many different computer systems. This offers superior data security than other similar databases due to its decentralized nature.

⚡️ What is mining in simple terms?

The creation of cryptocurrency as a result of computer technology. Central banks are responsible for the production and circulation of traditional currency. Cryptocurrencies are completely decentralized, meaning that no single governmental authority is responsible for regulating them. There is no centralized banking system that oversees their distribution or use. As a result, the only way to create one is through mining – where computers solve complex mathematical problems.

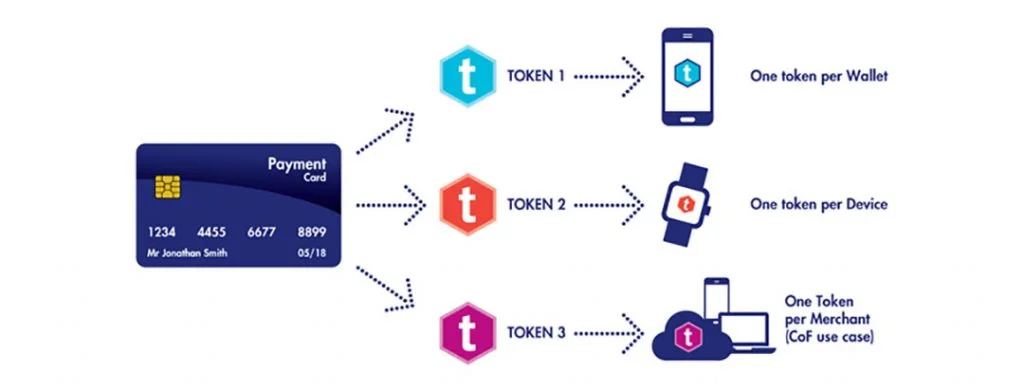

⚡️ Where are tokens used?

Tokens are multi-functional, and can be used to unlock digital services or products as well as store value on the blockchain. Tokens can be used for payments, loyalty programs, access control, crowdfunding, gaming and gambling, asset management, supply chain management, identity authentication and other use cases.

⚡️ What separates a token from a cryptocurrency?

One of the most fundamental differences between tokens and coins is that when people refer to a “coin”, it usually means an independent digital currency on its own blockchain – like Bitcoin or Ethereum. On the other hand, cryptocurrencies built upon another person's blockchain are known as tokens; this article focuses specifically on these types of assets. With many years of development in this area, both coins and tokens have become essential components within our increasingly digital economy.

Cryptoassets, a term used to describe an array of assets such as cryptocurrencies, platform tokens, utility tokens and transaction tokens, are digital or virtual units that call upon cryptography to ensure their transactions while managing the production of fresh units. Mining is the process responsible for creating new Bitcoin and Ethereum coins – further illustrating how cryptoassets come into existence.

Cryptocurrency vs. crypto assets

Cryptocurrencies are a type of crypto asset and are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units.

Cryptocurrencies are decentralized and not subject to government or financial institution control. In 2009, Bitcoin was founded—the pioneering and most renowned cryptocurrency.

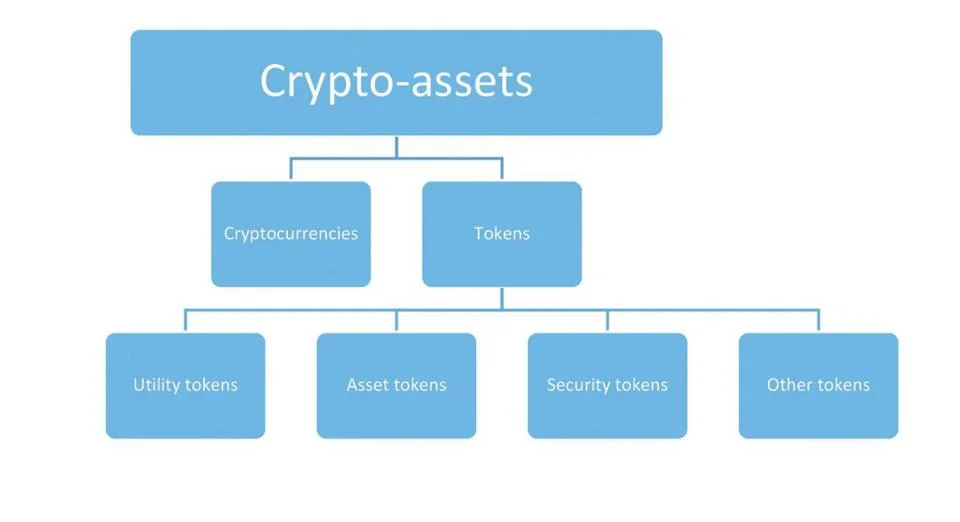

Cryptoassets, on the other hand, are a broader category that includes cryptocurrencies as well as other asset types. Platform tokens, utility tokens, and transaction tokens are all types of crypto assets.

Why is the name “crypto assets”?

Crypto assets encompass an array of resources, including cryptocurrencies, platform tokens, utility tokens, and transaction tokens. Crypto assets are birthed via a process dubbed mining that is the initiator of new Bitcoin and Ethereum production.

How do crypto assets work?

Cryptocurrencies leverage cryptography to secure their transactions and generate new units. Furthermore, they are decentralized – immune from governmental and banking influence. Bitcoin revolutionized the cryptocurrency industry since its debut in 2009, quickly establishing itself as the most recognizable digital currency. It has set an unprecedented standard for future digital currencies to come.

Types of Cryptoassets

Cryptocurrencies, platform tokens, and utility tokens make up the three distinct categories of crypto assets.

Digital currencies such as Bitcoin and Ethereum are powered by cryptography – the art of writing or solving codes – to ensure secure transactions, combat counterfeiting, and monitor ownership. These revolutionary cryptocurrencies operate on their own blockchain networks with decentralized ledgers that effectively track value transfer.

Cryptocurrencies

Cryptocurrencies are the ultimate guarantee of security, swiftness, and dependability in digital transactions. Utilizing sophisticated cryptography-based token systems guarantees that your data is safe from tampering or manipulation. Beyond this, their cryptographic principles make them incredibly dependable and resilient for both small-scale operations to large ones!

Platform tokens

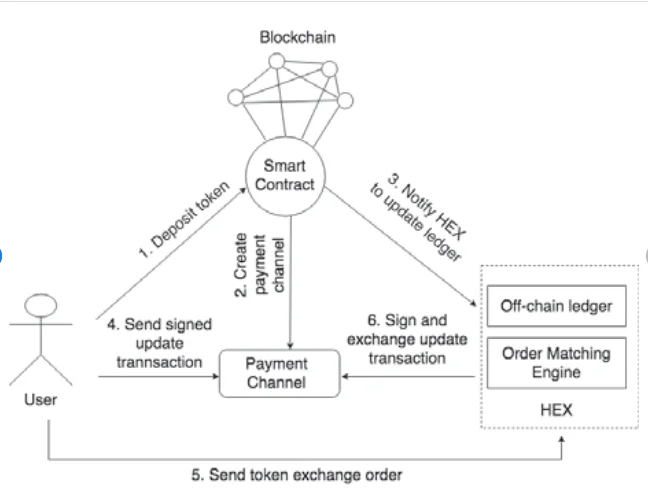

Investopedia explains that tokens are the driving force of the cryptocurrency market, and their existence allows for thousands of other crypto-assets to be born. These crypto assets are intended to be used as a platform for additional decentralized initiatives, as the name implies. In contrast to the current scenario, when data is kept on servers controlled from one location and maintained by one corporation, these crypto assets Because transactions in blockchain-based systems are distributed, they are not vulnerable to the same issues as centralized servers.

The database is unable to be disconnected or corrupted while computers participate in it since each transaction needs a different computer to check for any inconsistency.

Smart contracts are automated computer protocols that execute the terms of a contract when pre-agreed conditions have been met. These blockchain-based digital agreements guarantee trustworthiness and transparency in all transactions, ensuring maximum security for both parties involved.

Smart contracts enable parties to interact securely and safely without the aid of third-parties like lawyers or banks. Agreeing on terms is easy, as there's no need for lengthy dispute resolution in court! Smart contracts are becoming a more popular choice due to their expeditiousness and ability to reduce costs – it's a great solution for any transaction.

Examples of platform tokens

Platform tokens are the most popular type of cryptocurrency asset. Here are a few examples of platform crypto-assets:

- Ethereum

- Ethereum Classic

- Neo

- EOS

- The New Economy Movement

Utility tokens

Utility tokens are a type of crypto asset that gives holders access to a product or service. Filecoin, a decentralized storage network, is an example of a utility token.

Examples of service tokens

include airline miles, frequent shopper points with a particular retailer, and mobile phone minutes. Service tokens are usually redeemable for goods or services within the network that issued them. For example, an individual may be able to use their airline miles to purchase tickets on their preferred airline or receive discounts when shopping at certain stores associated with their frequent shopper program. Additionally, mobile phone companies often use service tokens as a type of currency for their customers to purchase prepaid minutes or upgrade plans.

- Golem

- Sonm

- Siacoin

- OmiseGo

- Augur

Transaction Tokens / Payment Tokens

Transaction tokens, more commonly called payment tokens, are specific digital assets used for making payments on blockchain networks. Bitcoin is the most famous example – the very first cryptocurrency investment fund in existence. Payment tokens enable users to transfer money more quickly, safely, and affordably than conventional systems. With tokenization technology, your financial transactions are secure, seamless, and cost-effective! They are also often used in decentralized applications (DApps) on blockchain networks, such as gaming platforms or online marketplaces.

The Potential of Cryptoassets

Cryptoassets hold the potential to disrupt our digital world by unlocking possibilities that were previously unimaginable. Using cryptography, these assets offer us a securer and more efficient way of transacting as well as managing data. Even better yet, since cryptoassets are decentralized they grant users unprecedented control over their information while cutting down reliance on centralized sources. Cryptoassets could very well be the missing puzzle piece in this ever-evolving landscape we find ourselves in!

Cryptocurrency is an emerging and thrilling concept that may completely revolutionize the way we navigate the digital sphere.

The value of cryptocurrencies depends on:

- The team behind it

- How often it's used

- How secure it is

- What problem it solves

How are cryptocurrencies regulated?

https://www.forbes.com/uk/advisor/investing/cryptocurrency/what-is-cryptocurrency/

Examples of cryptocurrencies

✅ Bitcoin: Pioneering the cryptocurrency movement in 2009, Bitcoin remains a leader and is widely-recognized as the first digital currency.

✅ Launched in 2015, Ethereum has quickly become the second-largest digital currency by market cap, revolutionizing the cryptocurrency landscape.

✅ In 2011, Litecoin forked the Bitcoin blockchain to reveal a brand new cryptocurrency.

Examples of platform tokens

✅ Ethereum, the cryptocurrency of preference on its blockchain network, is used to fuel transactions and interactions.

✅ Filecoin is a revolutionary decentralized storage network, allowing users to securely store and retrieve data. Filecoin provides the native token of this cutting-edge technology for customers, who can use it to purchase storage on the network.

Examples of utility tokens

✅ Siacoin: The native token of the Sia decentralized storage platform, used to purchase storage on the network.

✅ Golem: The native token of the Golem decentralized computing platform, used to purchase computing power on the network.

✅Augur is the native token of the decentralized prediction market platform, and it's used to purchase accurate predictions within this network. By staking Augur tokens in a prediction market, users can make informed decisions based on crowd-sourced forecasting. With Augur's blockchain-based system, you get access to limitless potential insights from around the world – without having to worry about data security or accuracy issues.

For those seeking to make digital payments, several options are available. Bitcoin is a popular choice for the native token of the Bitcoin blockchain; similarly, Litecoin and Ethereum offer tickets that can be used on their respective networks. These transaction tokens give users the freedom to make secure purchases without relying solely on traditional fiat currency.What is the difference between cryptocurrency and crypto assets?

Blockchain-based transaction tokens

Blockchain-based transaction tokens are 1st and 2nd generation blockchain tokens that function only via the blockchain to conduct, execute and safeguard transactions.

Examples of blockchain-based transaction tokens

Transactional tokens based on the Internet of Things

There should be a new category for IoT-based tokens since they have opened up a whole new dimension of the decentralized economy by concentrating on machine-to-machine transactions and microtransactions.

How is this crypto-asset different from those mentioned above?

This technology, unlike blockchain technology, uses a directed acyclic graph (tangle) to process each transaction. According to groundbreaking new research, in the next five years, it's anticipated that there will be an astonishing 75 billion Internet of Things devices connected and operational. This technology utilizes the existing web of things to handle all transactions, offering the following advantages:

- Zero transaction fees.

- Microtransaction capability

- Examples of IoT-based platform tokens

- IOTA

- VeChain

What Is the Spot Exchange Rate? https://www.investopedia.com/

Do you have a good understanding of what's going on in the world?

Bitcoin may not replace gold, but crypto assets are here to stay. Currently, most of these digital currencies are still developing and have a lot of growth potential. For example, Golem is a project that transforms unused computing power into one massive supercomputer; IOTA has created an ecosystem in which everything from shoes to heavy machinery can communicate with each other as well as collect data and facilitate microtransactions; Stellar and Ripple have revolutionized how banks do international transactions!

Are the cryptocurrency and non-monetary systems on their way out?

Today, a rapidly increasing population is investing in cryptocurrencies as an alternative to the conventional banking system. Simultaneously, bartering and community currency can remain productive for specific individuals under unique situations. Ultimately, it’s hard to say which system will survive long term.

The Control of Crypto Assets

Unless an exemption applies, under New Brunswick securities law, any individual or firm who trades or advises in securities or derivatives in New Brunswick must be registered with FCNB.

The regulatory framework surrounding crypto assets and crypto asset trading platforms is constantly evolving.

Cryptocurrency investors, buyers, and speculators can sometimes be confused about whether or not securities regulations apply. In some instances, the crypto asset is a security – like a security token with rights that are traditionally attached to common shares, like voting rights and the right to receive dividends. In other scenarios, the crypto asset may be more of a derivative – for example, a token whose worth is derived from an intrinsic asset like stocks in a publicly traded company.

Recently, the CSA and IIROC unveiled new information on how securities regulations apply to crypto assets. Here are some scenarios where securities law would be applicable:

- If a crypto asset trading platform (CTP) trades securities or derivative contracts based on crypto assets, the CTP would be subject to securities legislation.

- If a user's crypto assets are stored in a wallet controlled by the CTP platform, this creates an ongoing reliance on the CTP to trade or transfer the crypto assets, thereby making it a contract subject to securities law.

- If an ICO issues security tokens, then securities laws may apply.

The following is not an all-inclusive list. Other potential situations could cause securities legislation to come into play, and usually, it depends on the specific details of each case.

How does investing under regulation help investors?

CTPs that are registered or recognized as securities or derivatives marketplaces or exchanges will be subject to certain requirements designed to protect users. These include risk management, disclosure, and treating clients fairly and in good faith. You can check registration using the free National Registration Search tool from the Canadian Securities Administrators. Although registration somewhat protects investors, it does not mean no risks are involved.

You should always study each opportunity and make sure you comprehend the asset and any potential risks before investing or speculating in cryptocurrency or other crypto assets. To avoid any legal complications, always reach out to FCNB for guidance on regulatory requirements before making any final decisions about purchasing crypto assets or CTPs.

Risks

Several risks are associated with crypto assets, including volatility, liquidity risk, and potential fraud. Before trading crypto assets, understand the asset and the risks involved.

Cryptocurrencies can be unpredictable, often shooting up or plunging in cost based on media coverage or social buzz. There are few restraints on price manipulation, which can make investing in cryptocurrencies a risky proposition.

Liquidity: One of the risks when trading on a crypto asset platform is that the CTP may not have enough assets to cover your order. Also, there are no guarantees that demand for any given crypto asset will continue, which could make it difficult to convert your assets into fiat money.

Online Risk: You may have difficulty identifying or locating a crypto asset service provider or intermediary if you encounter a problem. They exist worldwide, so it may take time to take action.

The uncertainty of new technology: Public interest in or demand for crypto assets may not continue to grow or be sustainable because it is a relatively new technology. When For example, when a new crypto asset launches, it's often based on an idea – not a proven business model. So there's no guarantee the project will succeed even if launched successfully. Also, no certainty existing crypto assets will weather future changes and challenges related to technological development and advancement, regulatory changes, or political conditions.

The potential for fraud is high with CTPs because any company that deals in securities or derivatives must be registered with the FCNB. Depending on how it operates, a CTP may fall under securities regulation. Also, cybersecurity threats and hacking are common for platforms used for crypto assets, such as online wallet companies and exchanges. This puts your deposit at risk of being stolen. Lastly, transactions involving crypto assets have a higher chance of delayed or failed transactions and loss of access to your digital wallet if you need to remember your password.

lately, there has been an influx of scammers promising guaranteed returns and recruitment bonuses in return for investments. More often than not, these are warning signs of fraudulent behavior and should be handled with care. Crypto assets are highly unstable, so it's unrealistic to expect guaranteed returns from crypto-related investments. Immediately report fraud using our Submit a Complaint tool. You should also be aware of how the CRA views cryptocurrency in terms of taxes.