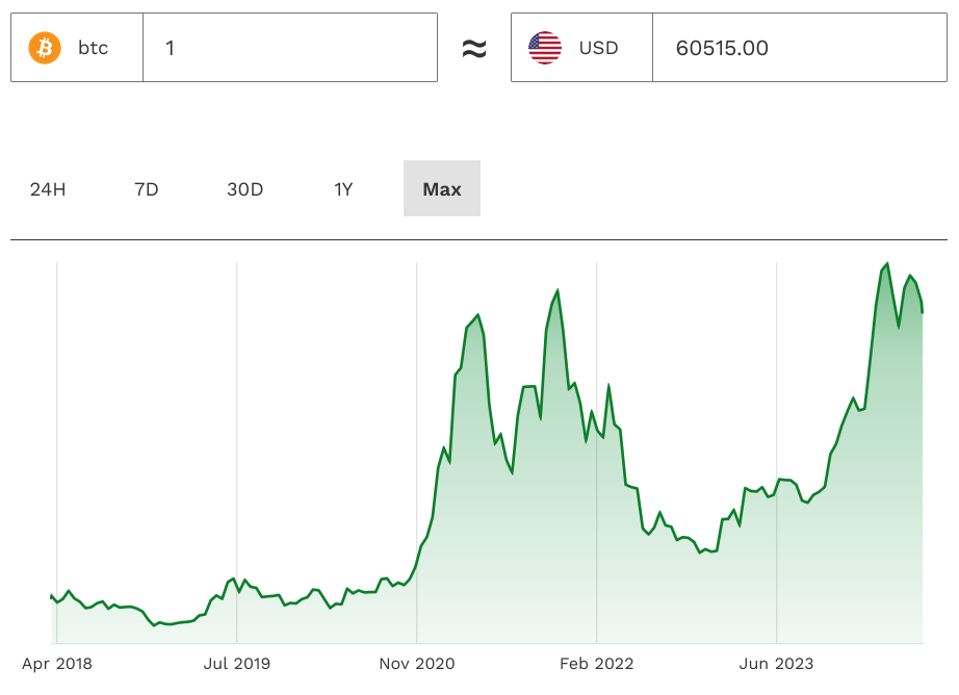

Fed Chair Powell Issues ‘Critical’ Warning, Sparking Sudden $60,000 Bitcoin Price And Crypto Crash

Bitcoin’s value has sharply declined, dropping 3.1% to approach the $60,000 mark, following a key billionaire’s reversal on the cryptocurrency. Over the past month, bitcoin has decreased by nearly 15% amid concerns of an impending “true correction.”

This decline is influenced by remarks from a major Bitcoin proponent who suggested that Bitcoin could eventually replace the U.S. dollar. Meanwhile, Federal Reserve Chair Jerome Powell has highlighted a “critical period” for the Fed, citing unsustainable deficit levels.

At the European Central Bank’s conference in Portugal, Powell remarked, “The level of debt we have is completely sustainable, but the path we are on is unsustainable.” He criticized the Biden administration’s fiscal policy, emphasizing the risks of maintaining a large deficit during full employment, and warned that such levels are unsustainable in prosperous economic times.

In May, Treasury Secretary Janet Yellen raised alarms about the burgeoning $34 trillion U.S. debt, which some believe could drive Bitcoin’s price to $1 million within the next 18 months.

Bitcoin, crypto, and stock market traders have been closely watching the Federal Reserve for signs of potential interest rate cuts. Analysts have recently adjusted their expectations from seven cuts in 2024 to just one or two.

Powell expressed his concerns about balancing monetary policy during this crucial period, stating, “Getting the balance on monetary policy right during this critical period, that’s really what I think about in the wee hours.” This follows the Fed's decision last month to leave interest rates unchanged and signal only one cut in 2024, with more anticipated in 2025. The Fed faces pressure to cut rates following aggressive hikes post-Covid stimulus measures that fueled inflation.

Russ Mould, investment director at AJ Bell, commented, “Powell said the U.S. was back on a ‘disinflationary path’ but added that more data was required before the Fed would consider cutting rates.” Mould noted that while Powell's remarks might sound repetitive to the market, his mention of disinflation suggests a stronger case for potential rate cuts soon.

Attention is now on the upcoming release of the Fed’s June meeting minutes and the Friday jobs report, which could solidify expectations for a September interest rate cut if it indicates a slowdown in hiring.

Michael Brown, senior research strategist at Pepperstone, mentioned, “A softer-than-expected jobs report on Friday, were it to come to pass, would likely further cement the case for said cut, to which markets assign a roughly 70% chance—perhaps, a touch underdone.”

The sustained higher interest rate environment has led analysts at BlackRock, the world’s largest asset manager, to issue a warning about its impact on the bitcoin and crypto markets. They foresee central banks maintaining higher rates than pre-pandemic levels to combat ongoing inflationary pressures. This comes as BlackRock, which has driven a bitcoin price surge this year through a spot bitcoin ETF initiative on Wall Street, reported an “unprecedented” scenario that could affect bitcoin’s price and the broader crypto market.