Fidelity’s New Move: Staking in Ethereum ETF

Financial titan Fidelity Investments has made notable modifications to its application for a spot ether Exchange-Traded Fund (ETF), incorporating specific clauses that allow for the staking of the digital currency, ether. This strategic update was elucidated in a detailed amendment to the firm's initial filing, dated March 18. Fidelity outlined its potential strategy, stating:

“In consideration for any staking activity in which the Fund may engage, the Fund would receive certain network rewards of ether tokens, which may be treated as income to the Fund as compensation for services provided”.

This amendment clearly indicates the company's intention to partake in staking operations, wherein it expects to earn network rewards in the form of ether tokens. These rewards could potentially be recognized as income for the Fund, serving as remuneration for the staking services rendered.

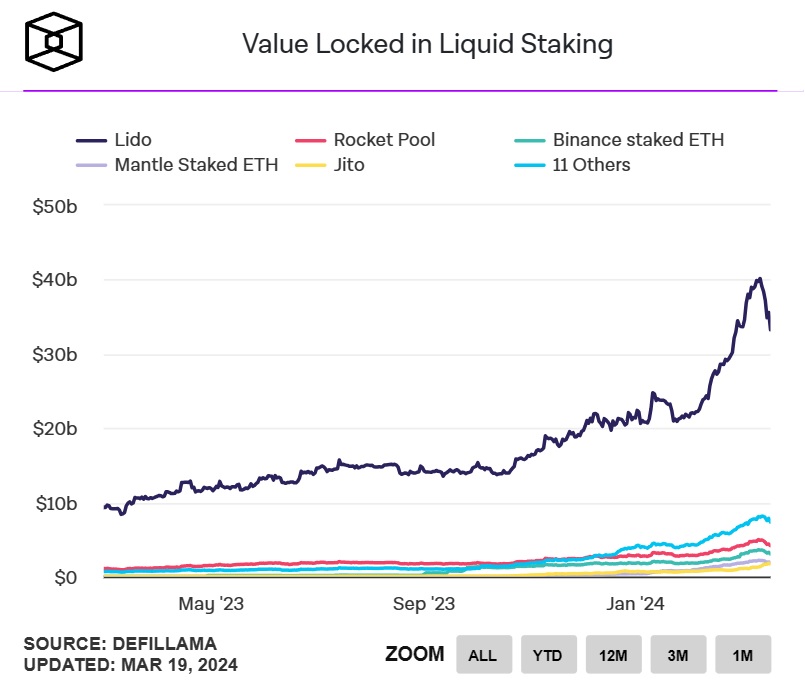

One of the premier entities in this domain, Lido, currently oversees staking operations for ether valued at approximately $35 billion, highlighting the significant scale of staking activities within the Ethereum network.

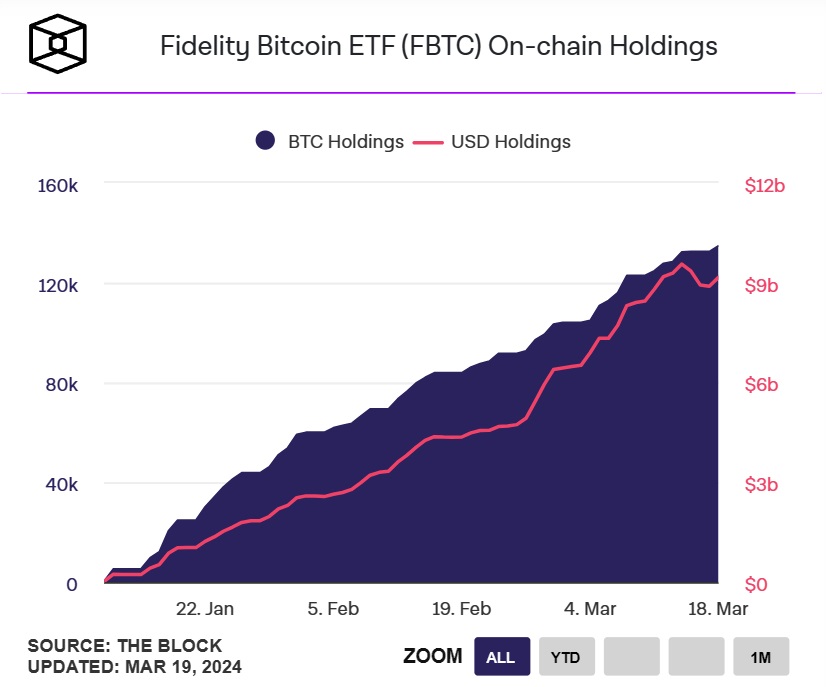

Following the approval of its spot bitcoin ETF in January, Fidelity has successfully accumulated an impressive 132,570 bitcoins, which translates to an asset value exceeding $9 billion, marking its inaugural venture into the realm of spot cryptocurrency exchange-traded products.

Staking involves active engagement in the validation of transactions on a blockchain that operates on a proof-of-stake (PoS) mechanism. Participants, or ‘stakers', commit their cryptocurrency holdings to support network security and operations, in return for rewards.

Given Fidelity's stature as a financial behemoth with multi-billion dollar investments, its foray into ether staking has the potential to significantly influence the dynamics of the Ethereum ecosystem, possibly altering its operational and economic landscape.