Types Of Crypto Orders

Table of content

- What is an exchange order book?

- What are the most frequent types of cryptocurrency transactions?

- Market Order Definition

- Instant order

- Limit orders

- Limit order vs. stop order

- Stop-loss orders

- The different types of stop-loss orders

- Stop-Limit Orders.

- Stop-Loss Order Definition

- What is the best time to place orders?

- Expiration times for various orders

- If you like, you can create your orders

⚡️ Is there a limit to selling cryptocurrency?

To reap the tangible benefits of your digital coins, you must exchange them for a more widely accepted currency such as the US dollar or euro. Then, transfer that amount to your bank account and/or gain additional types of cryptocurrency. There is no limit on how much crypto-money you can transform into hard cash!

⚡️ What is a stop loss order?

Stop orders are instructions to purchase or sell a stock when the price reaches a certain level, known as the stop price. When the stop price is reached, the stop order becomes an market order. A buy stop order is placed at a higher stop price than current market rate.On July 13, 2017, nIt was reported that the crypto market capitalization has exceeded $100 billion for the first time.

⚡️ What is the 1% rule in trading?

The 1% rule for intraday traders restricts the risk on any trade to no more than 1% of a trader's entire account value. Traders may put up to 1% of their assets into large bets with close stop-losses or tiny ones with faraway stop-losses.

⚡️ What is an example of a stop limit order?

When trading stocks, a stop price is a maximum amount you are willing to pay or the stock's market value, whichever is higher. On the other hand, your limit price represents how much you would be comfortable shelling out for it at most. If John wants to purchase ABC Limited stocks worth $50 and anticipate an increase in value today, he might establish a stop value of $55.

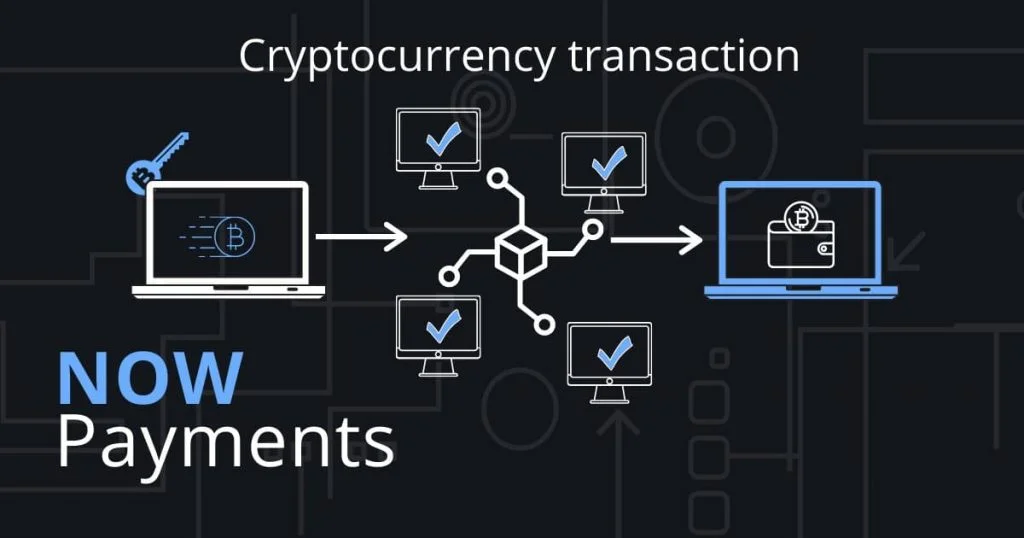

With the crypto exchange market becoming increasingly competitive, exchanges strive to make their platform stand out. To do that, they've introduced numerous tools and resources to help users maximize profits while reducing losses through smarter trades. From stop-limit orders to contingent orders — these order types allow traders to place an order at a specific price or better so they can get in and out of positions quickly with minimal risk involved.

With the introduction of automated systems and the internet, retail traders in the crypto market can now execute their buying and selling activities independently. Moreover, they are able to process orders swiftly with ease!

Say goodbye to the days when trading was an uphill task that might take hours or even days to finish.

Next, we will delve into order books in depth, helping to uncover how orders are exposed and their place within the marketplace.

What is an exchange order book?

A trading pair is a set of assets or commodities that are linked, such as Bitcoin and Ethereum.With the order book for a trading pair, anyone can join in on the fun – all it takes is bidding an asset or offering a price to sell. By doing so, you get access to two lists: one with buy orders (order purchases) and another showcasing sell orders (ask offers).

Until either the buyer or seller properly finalizes an open order, it will linger in the system and remain uncompleted.

Each trading pair, such as BTC/USD or BTC/Ether ( ETH ), will have its order book.

What are the most frequent types of cryptocurrency transactions?

As an active trader, you have the authority to almost tailor your buy and sell orders for cryptocurrency. You can set both a timeline and target price in order to get the most advantageous transaction possible.

Orders can be placed in the spot market, where cryptocurrencies are exchanged for immediate performance, or in the futures market, where contracts can stipulate when the order will be fulfilled.

Traders can use stop orders to reduce losses in the event of a substantial price drop for an asset. In most cases, stop orders are set to minimize stop loss.

Market Order Definition

Don't settle for less than the very best when it comes to crypto trading! Market orders are the perfect choice for experienced traders wanting to make a swift and profitable buy or sell. With guaranteed success, secure your market order without delay – get exactly what you need in no time at all!

Pros of

✅All the other orders are contingent on a price reaching a target, but market purchases for cryptocurrency are designed for traders who don't want to wait for one. Market purchases are certain to be carried out, unlike all the other orders that rely primarily on the price hitting a target.

✅A market order matches the best available limit order in the order book, taking liquidity away from it. As a result, markets are known as taker orders, and exchange fees for them are greater. Market orders can't be reversed since they're implemented instantly; however, limits and stops cannot.

Disadvantages

❌Market orders are prone to a host of slippages due to the large number of orders in an order book. Slippage takes place when an order is completed at a rate lower than expected; basically, it means you get less for your money. Consequently, high market orders can be impacted by considerable variation in prices.

❌When a trader attempts to purchase $6 million worth of assets at $250 per share, yet there is not enough liquidity in the market to support it, then the order will be automatically filled at the next lower price. This discrepancy might go unseen if the trade amount is small; however slippage can become a major issue when larger orders are placed.

❌Due to the high demand for cryptocurrencies, many exchanges lack the liquidity necessary to support it. This has led experts to believe that some reported volumes are likely inflated or even fabricated altogether.

Limit orders are a good option for traders who want more control over their trading strategy.

Instant order

The only major difference between instant orders and market orders is that the former uses traditional, government-issued currencies like USD, while the latter denotes all prices in cryptocurrency. Say you want to buy $10,000 worth of bitcoin. When you place an instant order, the exchange will look for sellers who can fulfill your trade. Your trade might come from multiple sellers; the exchange will keep trying to match your trade until it's been completely fulfilled. Each part of the trade will be executed at the current market price of the cryptocurrency.

Limit orders

When you instruct your broker to buy or sell a security, a market order is the go-to option as it acquires the best available price. If you want complete control over how much money changes hands in either direction, then limit orders are what you need. They set both maximum and minimum prices that will never be exceeded when selling or buying securities. With these handy tools at your disposal, easily guarantee that no one takes advantage of any trade situation!

If you are willing to wait for the ideal price, a limit order – an order placed to buy or sell cryptocurrency at a specified rate – might be just what you need.

Pros of order types crypto

✅ Limit orders in cryptocurrencies are very similar to limit orders in other assets. They give more freedom when it comes to price and quantity and allow traders to set a minimum price.

✅ Investors may either take another trader's open order on the exchange or place an open order that someone else can fill.

✅ Limit orders give traders more control over and management of their risk, allowing them to constantly adjust their positions.

Minuses

❌ The order can only be placed if the specified price is met, and even then execution is not guaranteed, or they may only be partially completed. Orders are ranked in order of price before being placed. As a result, when the purchase price is reached, the command may still not be fulfilled since other orders for an equal amount have been submitted.

❌ Setting a limit price somewhat above the market sell price or below the market buy price of psychological levels is a recommended strategy. Other traders may also employ this approach, so it's important to examine the order books to identify prices that don't represent many orders to enhance your chances of execution.

When you order an item with a particular price and quantity, this is referred to as a “limit order.” This type of order enters the market immediately and provides more liquidity.

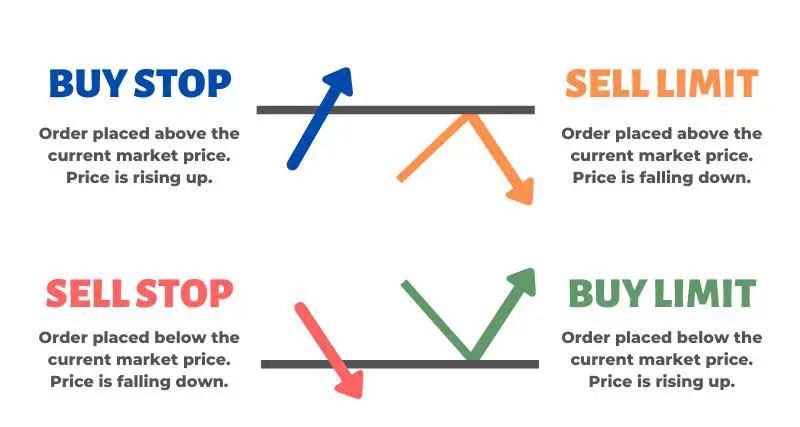

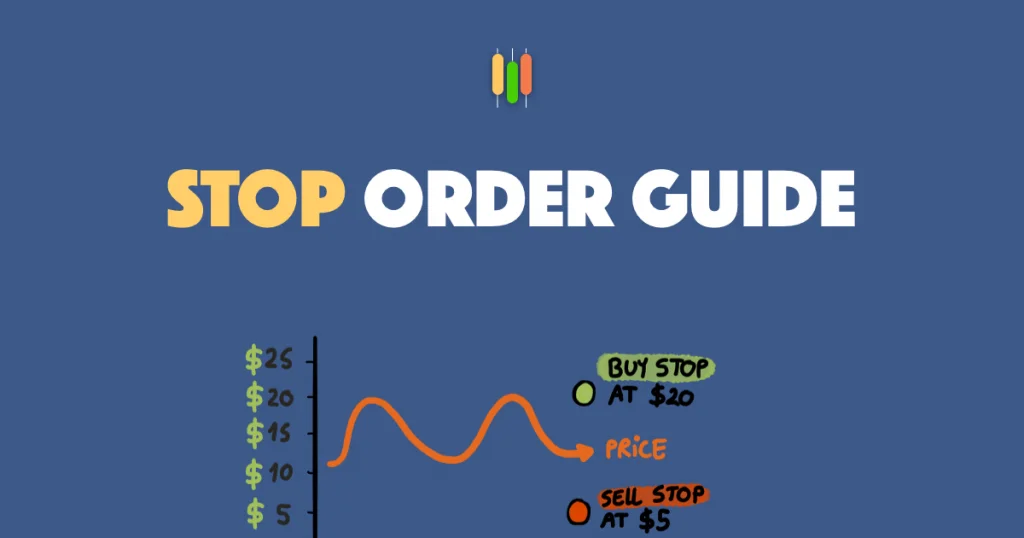

Limit order vs. stop order

Unlike a limit order, which can only be seen after it is triggered, the stop order has a pre-determined price that becomes visible once it's reached. Additionally, unlike a limit order – whose visibility remains unseen until activated – market participants can spot the stop price before its activation takes place.

Stop-loss orders

A stop order is designed to buy or sell a cryptocurrency at the market price as soon as it reaches the stop price. The instruction becomes a market order and is executed at the next available market rate.

A stop-loss order is a type of trade that protects assets and limits losses. They may, however, fall short to execute even if the target price is achieved, much like limit orders.

There are two types of stop orders: market and limit. A market stop order is triggered when the price reaches a certain goal (the stop price), at which point it is executed immediately. Stop-limit orders are more complicated, so we'll explain them in detail below.

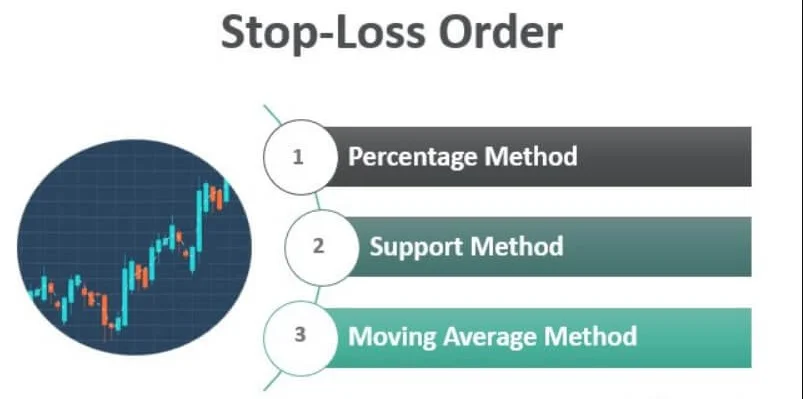

The different types of stop-loss orders

When it comes to stop-loss orders, there are three distinctive types. Dive in to discover what exactly they are, how they operate and when the best time is for utilizing them!

Complete stop-loss

With a full stop-loss order, the exchange will get rid of all units of the asset once it reaches a particular price. This strategy is typically used by traders or investors in a stable market with high price volatility, as predicted price drops are relatively modest.

Stopping before you hit your limit

A partial stop-loss order instructs you to only sell off a portion of your assets when their value reaches a specific point. This strategy is usually used with riskier investments, like cryptocurrencies, so that if the price dips and rebounds quickly you don't lose all of it. However, there's never any assurance that the asset will rebound or drop even further. Therefore, be warned: this type of stop-loss carries higher risks than more traditional strategies do!

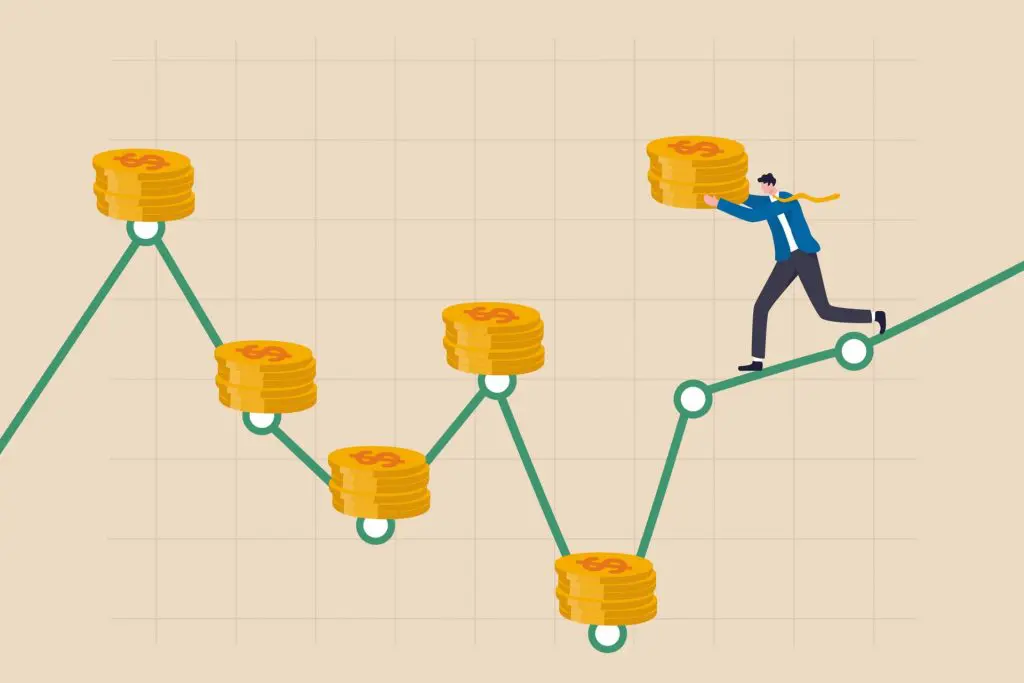

Trailing stop-loss

In the first two types of contracts, traders agree on the specific point at which an asset should be liquidated. Trailing stop-losses have a dynamic set price point for liquidation, meaning that the designated price will increase along with an asset's prices, but not fall. A stop-loss order trails behind an asset's price when it starts to increase. To employ this strategy, you must first figure out the trailing distance, or the difference between the current asset price and what your stop-loss is valued at.

Example:

Sally buys NEAR Protocol (NEAR) at US$30 and stipulates her trailing distance at US$0.10. Thus, her stop-loss order is set for US$29.90. When the NEAR price reaches $35, Sally's stop-loss order automatically becomes $34.90. If NEAR falls below $30, her order will still stay at 34.90.

By constantly readjusting the stop-loss order, investors can limit their losses while still benefiting from trades. For this reason, it is also called a “protect stop.”

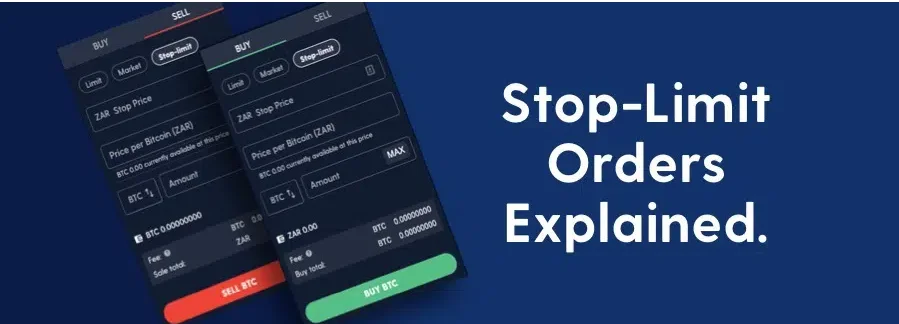

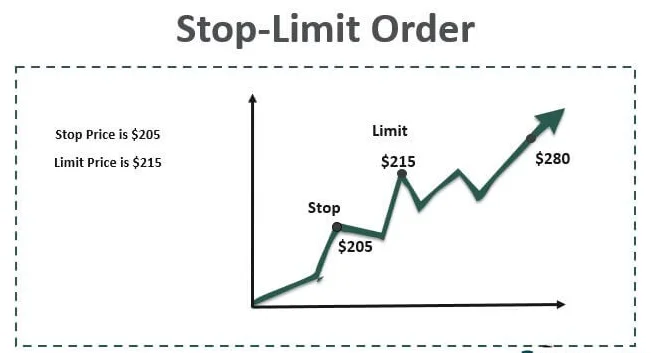

Stop-Limit Orders.

A stop-limit order is a more complex sort of order. It's a stop and a-limit order combined to minimize risk. Stop-limit orders are frequently used by traders to lock in profits or prevent losses.

A stop-limit order does not execute immediately and involves two price levels:

- The stop price converts the order to a buy or sell order;

- When investing in cryptocurrency, the limit price sets a ceiling for buyers and a floor for sellers. This is an upper boundary that investors are willing to pay when buying or a lower bound they accept should they choose to sell.

Stop-limit orders are similar to limit orders, but they provide the trader with even more freedom.

A stop-limit order executes once the stop price is met, and trading activity continues until the whole order is completed. The benefit of setting a stop price is that the order will not be executed at a lower price, allowing traders to have precise control over how their purchase or sale on the exchange proceeds.

The stop price is the price at which an order to buy bitcoins is activated. For example, the stop price to purchase bitcoins is set at $60,000, which is when the order enters force. If a trader feels that the price of an asset will rise, they may create a maximum stop limit of $60,100, or the highest

Let's suppose that the stop price for bitcoin sales is set at $50,000. This would be the sell order's activation price, and if the trader thinks the price may fall significantly, they could establish a minimum stop price of $49,500, which would be the lowest possible selling price to avoid large losses.

Pros

✅ A stop-limit sell order informs a trader about the lowest price at which he or she is willing to accept. If the entire order is not filled, the remainder of the amount is placed as an open order for $49,500.

✅ Stop-limit orders are useful in cryptocurrency markets since they assist manage the characteristic high volatility, allowing the trader to reduce risk.

Cons

❌Stop-limit orders are not immediately entered into the order book, unlike limit orders. The order will only be put in the order book once a certain price has been reached, as with limit orders. Stop-losses may either fail to execute or execute partially.

Stop-Loss Order Definition

A stop-loss order in cryptocurrency is a crucial risk management tool because it instantly terminates a position when the price reaches a specified level.

Pros

✅By having a Stop-loss order set up, you can have the assurance that your resources are secured as it will be instantly adjusted to an already established mark once the price reaches there. In a highly unpredictable cryptocurrency market like we have now, establishing stop-loss orders is key for those who want their investments protected.

✅ Professional traders use stop-limit orders, which are set to remain active for a certain period after price activity drifts and then automatically close.

✅ Stop losses can be used to restrict profits as well. Suppose traders wish to offload a digital currency when the prevailing trend indicates that its value is rapidly declining, they should set an exit price of $50,000 and a loss level at $49,500 in order to minimize any potential financial harm.

✅ Experienced traders are adept at adjusting the stop loss level depending on whether the market is going up or down. An adaptive trade management system can help limit losses, allowing for risk-averse trading and more successful outcomes.

Cons

❌Stop orders may have some drawbacks, such as having a balance that can't be used for other purposes and being automatically disabled when the market reaches a certain price. To avoid this issue, you should consider allocating part of your funds to setting up stop-loss orders and using the rest for various transactions.

❌ Stop-loss orders are also susceptible to slippage, just like market orders.

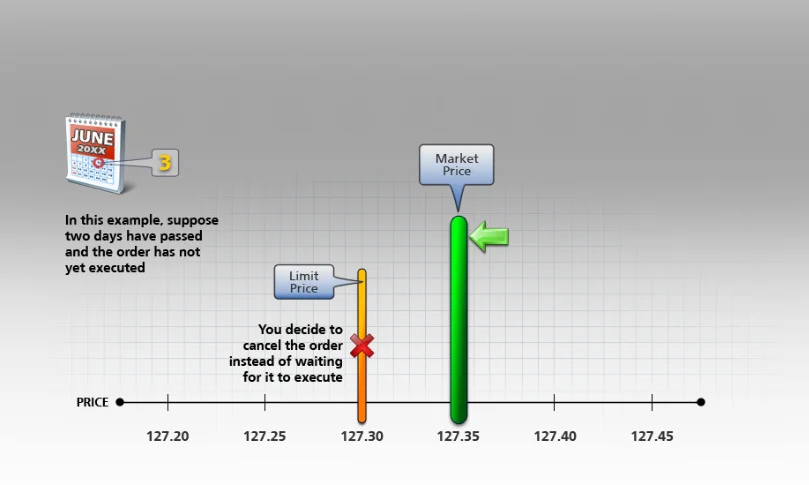

What is the best time to place orders?

The validity time of a crypto order specifies how long the command will be active before it is executed or expires. Setting up an order based on specific time parameters allows traders to track cryptocurrency market patterns and predictions, especially if they use critical trading indicators such as moving averages, which are extremely tempo-sensitive.

Expiration times for various orders

- This is when the trader specifies an expiration date for the trade. It's also referred to as a “GTC” or “Good Til Canceled” order. Until that time, it will be recorded in the order book and remain active.

- Instantaneous or cancel (IOC): cryptocurrency traders may make this buy for immediate delivery. If it is not filled out immediately, it will be automatically canceled and removed from the order book. This order type allows the trader to utilize the minimal amount of available liquidity for rapid execution, with any remaining unfulfilled portion being instantly canceled.

- Order Cancel or Remove (FOC): The previous IOC order implies that the cryptocurrency transaction will be completed if the whole amount can be matched; whereas, execute or cancel implies that the purchase will only happen if all of the conditions are met. If not, it will be automatically canceled.

Crypto traders who don't wish to expose themselves to the risk of a partial transaction can opt for this type of order. To ensure your safety and peace of mind, should any part of the order not be able to be fulfilled immediately, it will be canceled without delay.

If you like, you can create your orders

If you are interested in entering the world of crypto trading and getting up to speed quickly, then mastering the four main order types is a must. Limit orders, market orders, stop-limit trades and take profit instructions will all serve as valuable tools when navigating around cryptocurrency exchanges – helping you make informed decisions that get maximum results.