How Much Can the Price of Bitcoin Drop?

Bitcoin (BTC), currently priced at $79,153, recently dipped to a four-month low of $74,500 on April 7, and there are concerns that the price could still drop further.

This decline is part of a broader market reaction to US President Donald Trump's recent decision to intensify global tariffs, which led to a $9.5 trillion loss in global equity markets. This, combined with growing fears of a US recession, has unsettled risk investors, while crypto traders are now speculating about how much further Bitcoin’s price could fall.

Table of content

Bitcoin’s Struggle with Key Technical Support

Bitcoin is now testing a crucial technical level—the 50-week exponential moving average (EMA)—which has historically marked the boundary between bullish and bearish trends. Analysts, including Ted Pillows, suggest that Bitcoin needs to recover above this level, currently around $77,500, to avoid more profound losses. If Bitcoin fails to break back above the 50-week EMA, there could be further declines toward the $69,000–$70,000 range, a price point that reflects the highs from the 2021 cycle. Some analysts are even predicting a potential drop to $67,000, which aligns with Michael Saylor's average entry price.

The $69,000 “Max Pain” Target

Bitcoin has found some short-term support around $74,000, an area where over 50,000 BTC are held. Data from Glassnode’s UTXO realized price distribution (URPD) heatmap reveals that this price range is significant because it represents the first central cluster of cost-based holders below $80,000. These holders have shown confidence in their positions since March 10, with little movement in their coins. A significant number of investors hold BTC between $74,000 and $70,000, and the largest concentration of this group is at $71,600, which could serve as the next support level if $74,000 breaks.

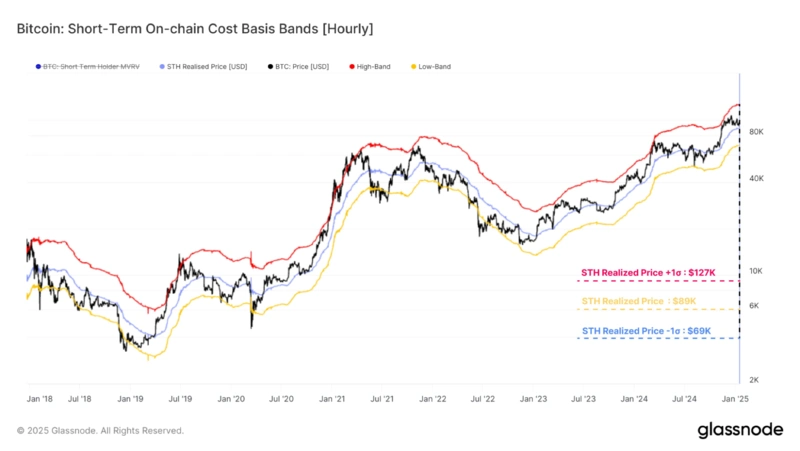

Glassnode’s Short-Term Holder (STH) realized price bands suggest that the average cost basis for short-term holders is around $89,000. Historically, the $69,000 range has served as a “max pain” zone where short-term investors tend to capitulate during market pullbacks, often leading to long-term investors stepping in and providing support.

Potential for a $50,000 Bitcoin Price Target

If Bitcoin fails to recover above the 50-week EMA, it could face a prolonged bear market. In similar previous instances, such breakdowns have resulted in price targets around the 200-week EMA, which currently aligns with a price level near $50,000. Bitcoin may see significant declines in the coming months if the pattern follows historical trends.

Blockchain Expert