In a week, Ethereum DApp volume increased by 36%. ETH Price Not Following Yet

Since dropping to $2,396 on August 27, Ethereum has increased by 7.5%; nonetheless, the 22% decrease in the last 30 days suggests that investors are still concerned about their positions. The price of Ether has yet to indicate that it will return to the $3,800 levels observed in early June, even though network activity on Ethereum is growing.

Given that Ether has underperformed its peers and that the market value of altcoins has dropped by 13% in the last 30 days, the situation is even more worrying. The excessive anticipation surrounding the planned July 24 debut of a spot exchange-traded fund (ETF) in the US is partially to blame for this shift. But there's more to the story—as of April 24, Ether was trading at $3,200.

The recent decline in Ethereum's average transaction cost, which dropped below $1 for the first time in four years, is what ether bulls are banking on. When combined with the effective use of layer-2 solutions for larger throughput projects, Ethereum continues to dominate decentralized apps (DApps).

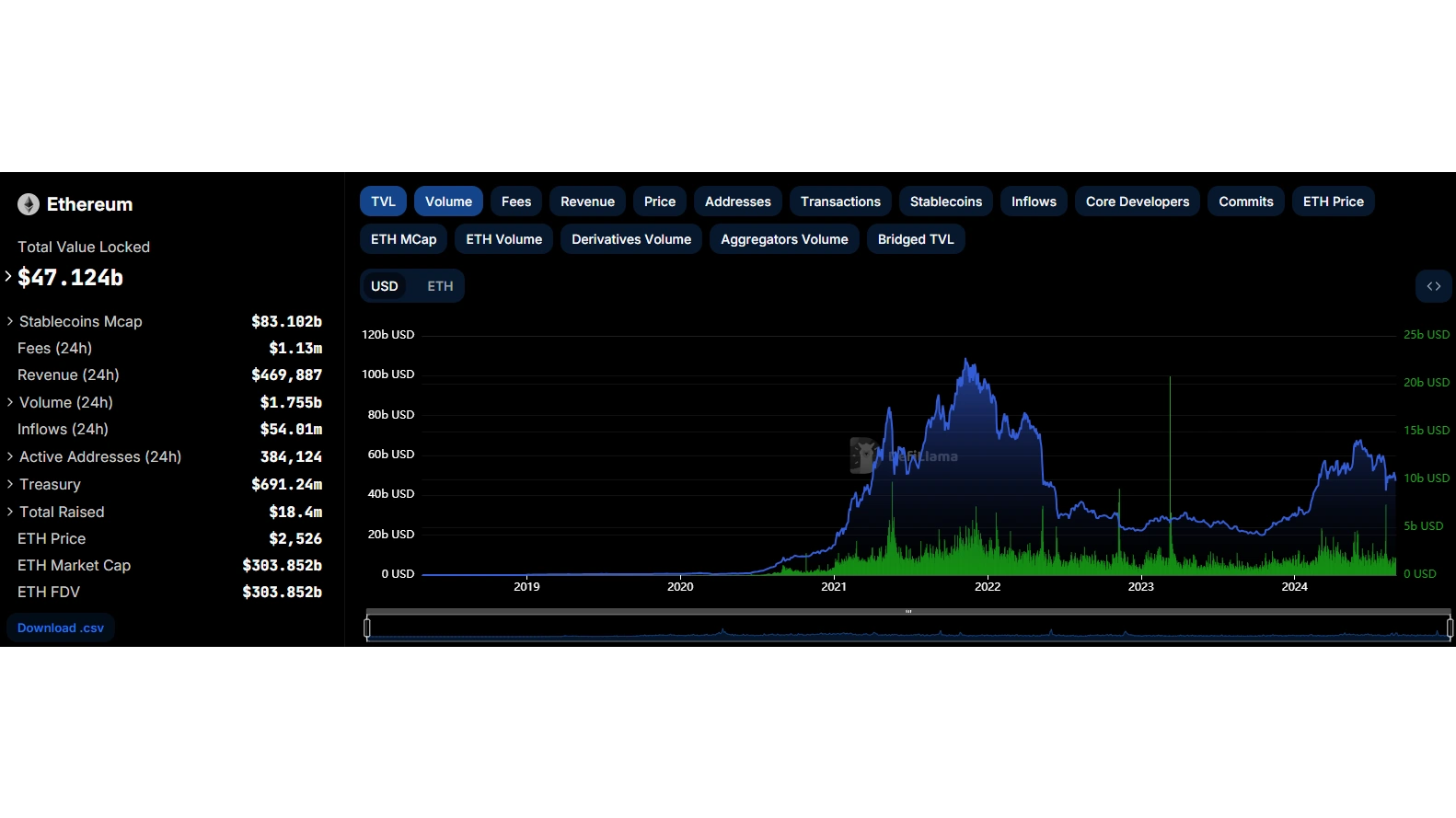

No matter if Ether's layer-2 ecosystem contributes to its price, the total value locked (TVL) on the Ethereum network has been increasing. DefiLlama reports that the total money deposited in Ethereum DApps rose to 18.9 million ETH, a 4% increase over the previous two weeks. On the other hand, deposits on Avalanche decreased by 4% during the same period, but Tron's TVL decreased by 10% in TRX terms.

The most notable TVL increase over the previous two weeks was seen by Symbiotic, a recently established staking project on the Ethereum network, which increased 83% to 640,310 ETH. Similarly, there was a 15% increase in total deposits on Ether.fi's liquid staking technology. However, to say that Ethereum's network activity has increased just because its TVL has been analyzed would be incorrect because most DApps do not require large deposit bases.

According to DappRadar, between July 22 and July 29, Ethereum's DApp volumes increased by 36% in terms of network activity. The decentralized exchange Uniswap saw a 35% increase in volume to $30.8 billion, while the automated market maker Balancer saw a 46% increase to $18.1 billion. Additionally, DApp volumes on the Solana network have remained relatively stable at approximately $6.3 billion weekly.