Investors Flock to Ethereum: $176M Crypto Inflows Signal Massive Buy-the-Dip Opportunity

Last week, crypto funds attracted $176 million in new investments, with Ethereum (ETH) products leading the charge, bringing in $155 million, according to data from CoinShares. The total assets under management (AUM) for these investment products, which had previously dipped to $75 billion due to market correction, have now rebounded to $85 billion.

These recent gains bring the year-to-date inflows for Ethereum funds to $862 million, marking the highest levels seen since 2021. This impressive growth has been largely fueled by the launch of new US spot-based exchange-traded funds (ETFs). Many investors took advantage of the recent price dip, viewing it as an opportune moment to increase their holdings.

Bitcoin, which initially experienced outflows, saw a turnaround later in the week, securing $13 million in inflows. Conversely, short Bitcoin exchange-traded products (ETPs) faced their largest outflows since May 2023, with $16 million being withdrawn. This significant outflow has brought the AUM for short positions down to its lowest point since the beginning of the year.

In addition to these developments, every region recorded positive inflows, reflecting a broad-based recovery in sentiment following the price correction. The United States led the way with $89 million in new investments, followed by Switzerland with $20 million, Brazil with $19 million, and Canada with $12.6 million.

Trading activity in exchange-traded products (ETPs) also saw a notable increase, reaching $19 billion for the week.

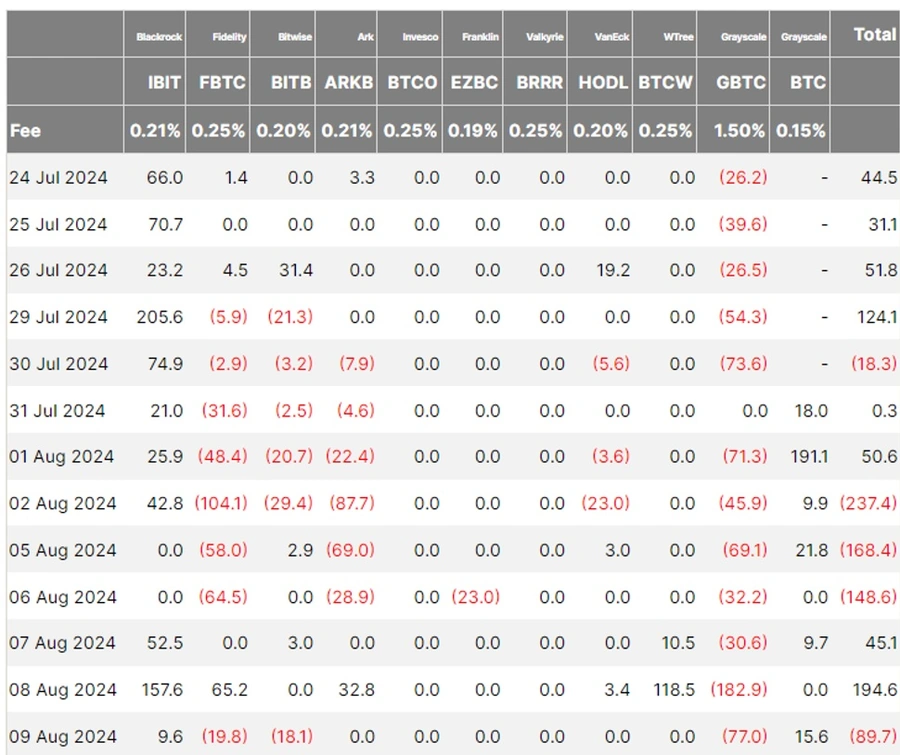

This figure is well above the average weekly trading volume of $14 billion for the year. However, it wasn't all positive news. US-traded spot Bitcoin and Ethereum ETFs wrapped up the week with net outflows.

US ETFs Finish the Week with Outflows

Specifically, Ethereum ETFs experienced outflows of nearly $16 million between August 5 and August 9, bringing the total outflows during that period to $68.5 million, which represents about 1% of their total AUM.

One notable development is that BlackRock’s ETHA is on track to reach $1 billion in net inflows, showcasing the strong interest in Ethereum despite the market's volatility.

On the other hand, Bitcoin ETFs saw net outflows totalling $167 million over the same period, with $89.7 million in outflows recorded just last Friday.

This reduction in AUM, equivalent to 0.32%, caught Bloomberg ETF analyst Eric Balchunas off guard. He had anticipated more substantial outflows, in the range of 2% to 3%, following Bitcoin's 21% price correction earlier in the week.

In a post on X, Balchunas expressed his surprise, noting,

“I’m bullish as it gets re ETF investors’ intestinal fortitude (in all asset classes) but even I’m surprised here. I was expecting 2-3% of the aum to leave and declare that as ‘strong“.