Funding Rates: What Determines Them and How to Adjust for Greater Profit

Table of content

- What factors influence the funding rate?

- The market's mood plays an important role

- A side-by-side comparison of historical financing rates on cryptocurrency derivatives platforms

- How to use the leverage

- Binance Futures Trading for Beginners: A Complete Guide for Novices

- What's the difference between marking to market and the previous price?

- What kinds of orders are available, and when should you use them?

- In the Stop Market field, you can create a Take Profit market order.

- What Is Arbitrage? – A Low-risk Profit Strategy Using Funding Rate

⚡️ What is the future funding rate?

Crypto funding rates rates are payments made between individuals in the perpetual futures market on a regular basis. Because open-ended futures never expire, the spot price and the open-ended contract price can diverge. mutual fund rates interest rate aid in the synchronization of these prices. The longs will pay the shorts the funding amount if the funding rate is positive.

⚡️ What is an open-ended funding rate?

The price of an open-ended futures contract is near to the value of an index because funding rates close the gap between them. It approaches spot prices and covers some of the loss caused by perpetuity. Funding rates are used by all cryptocurrency derivatives exchanges for perpetual contracts, with percentages being the usual unit.

⚡️ What is FTX funding?

From the perspective of a broker, funding is cash that has been invested in order to open and close a trade. Payments between long and short positions in perpetual futures are made every hour as FTX Funding Transactions. If you have a long position and the TFX Funding was positive, you'll need to pay this proportion of the size of your position's

⚡️ Is the funding rate indicative of interest charges?

The financing rate is a harmonious union of two determinants: the interest rate and the premium index. The interest rate, which is generally presented as a percent, consists of what amount you will pay your lender. Alternatively, investors may choose to secure their investment by paying an additional fee referred to as the premium index.

⚡️ Is spot trading halal?

On the other side, spot trading entails the customer buying and putting his or her bitcoin in their wallet. They have the capacity to exchange, purchase, and sell coins at today's market value. According to certain theologians, this is the only sort of crypto trading that is permissible.

The funding rate is the fee charged to longs or paid by shorts per eight-hour period. It is settled between the buyer and seller so that the contract's price doesn't deviate too far from the Index Price, which tracks underlying assets' spot prices. Open-ended contracts on most cryptocurrency derivatives exchanges use percentage-based funding rates because it encourages balanced buying and selling Pressure.

High funding rates are often seen as a negative sign by traders, but this correlation may not be accurate. In reality, during periods of market growth (bull markets), higher financing rates tend to occur alongside increased prices.

Bybit's funding rate is impacted by the activity in the market and can give insight into trader behavior. It's also one of the key pricing factors that create discrepancies between cryptocurrency exchanges that use different models.

The option to trade more frequently with shorter holding periods.

What factors influence the funding rate?

The interest rate and the premium are both components of the funding rate.

The interest rate on Binance Futures is fixed at 0.03% per day (0.01% per funding interval), except for contracts like BNB USDT and BNB USD, which feature a sliding interest rate of 0%. Meanwhile, the premium varies depending on the difference in price between the perpetual contract and the mark-to-market price.

In highly erratic markets, the mark-to-market price and that of a perpetual contract may deviate. In such circumstances, the premium rises or falls in accordance.

A high premium means a huge spread. A narrow spread between the two prices is indicated by a low premium.

When the financing rate is positive, the perpetual contract price is greater than the mark-to-market price, so long traders must pay for short positions. A negative funding rate indicates that the open-ended price is lower than the mark-to-market, implying that short positions cost long ones.

The market's mood plays an important role

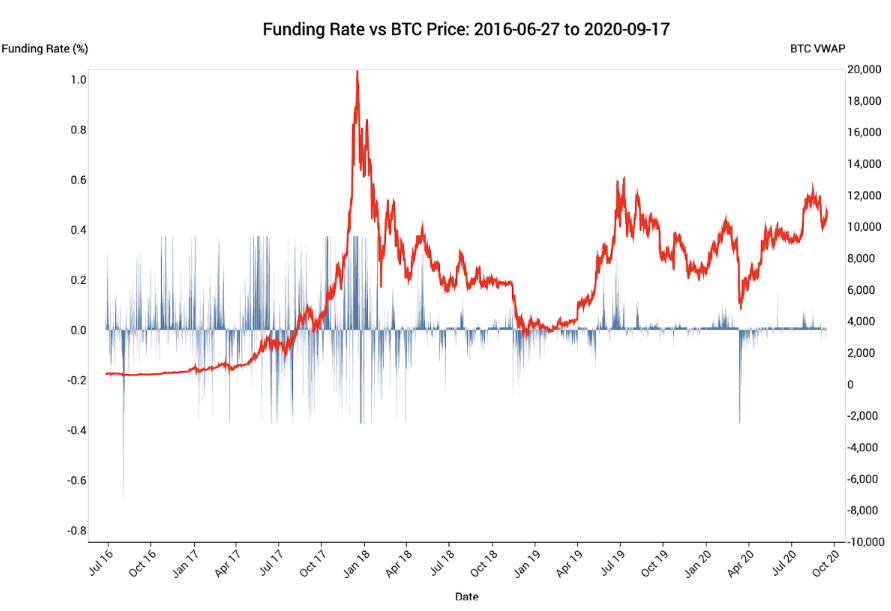

Historically, cryptocurrency funding rates have been inextricably linked to the overall trend of the underlying asset. The relationship is not cause-and-effect; instead, it is one of correlation. During the 30 days, there was a direct correlation between funding rates and BTC spot prices as follows:

Chart 1 reveals that, as Bitcoin prices have elevated, funding rates are up substantially since the start of the year. Traders have taken advantage of the higher funding rate to open long open-ended contracts, keeping prices in sync with spot exchanges.

A side-by-side comparison of historical financing rates on cryptocurrency derivatives platforms

Open-ended contracts are now accessible on seven of the most reputable trading platforms, and traders prioritize those with low funding rates since they can have a major impact on gains or losses. To provide you a better insight into this matter, here is an overview of bitcoin futures financing rates among top exchanges.

Overall, the top exchanges offered 0.015 percent in financing on average. These rates are affected by shifts in the underlying asset's price.

According to Skew, the historical funding rates for Binance Futures are lower than average market rates, with a median of 0.0094 percent. For example, while other platforms may charge ten to 20 percent more for the same position, a trader pays only $9.4 per $100,000 position on Binance Futures.

WHAT IS THE FEAR AND GREED INDEX?WHAT FACTORS AFFECT ASSET PRICE BEHAVIOR? CRYPTO SENTIMENT ANALYSIS

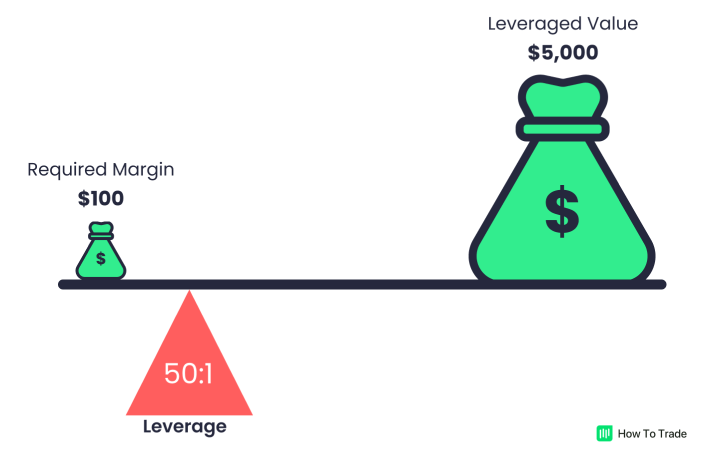

How to use the leverage

Binance Futures allows you to manually adjust the leverage for each contract. To select a contract, go to the upper left corner of the page and hover your mouse over the current one (by default, BTCUSDT).

To alter your leverage, go to the order entry area and change the current amount of leverage (by default, 20x). Adjust the slider or input a figure using the keyboard to adjust your leverage, and then “Confirm.”

Binance Futures Trading for Beginners: A Complete Guide for Novices

Keep in mind that if you have a large position size, you'll be less powerful. The opposite is also true–the smaller your position size, the more powerful you'll be.

It is important to consider that using more leverage brings with it a greater risk of being liquidated. Traders who are just getting started should weigh the amount of leverage they employ carefully.

What's the difference between marking to market and the previous price?

Binance Futures' last price and mark-to-market price are used to avoid peaks and unnecessary liquidations during periods of high volatility.

“Last price” simply means the most recent trade in terms of prices. In other words, it's used to calculate your realized PnL (profit and loss).

The mark-to-market price is meant to prevent market manipulation. It's calculated by taking a basket of prices from several spot exchanges and combining it with financing data. The mark-to-market price is used to calculate your liquidation prices and unrealized PnL.

When you specify an order type that utilizes a stop price as a trigger, you can select whether to use the last price or the mark-to-market price as the trigger. To make this change, go to the “Trigger” drop-down menu at the bottom of the order entry area and choose your preferred price.

What kinds of orders are available, and when should you use them?

Binance Futures allows traders to place various orders, each requiring a specific execution strategy. Several order types may be utilized on Binance Futures:

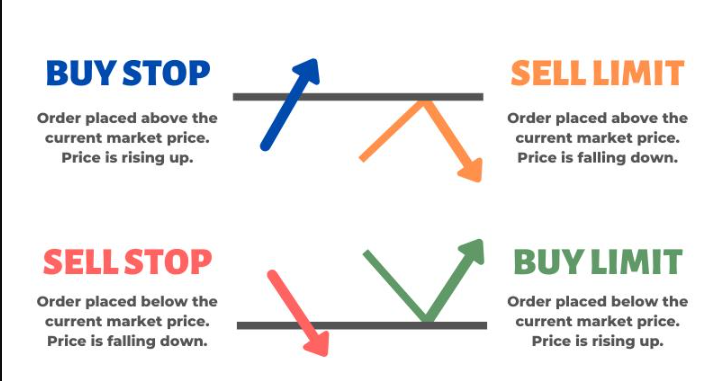

- A limit order is a market order that has a specified limit price. When you place a limit order, the trade will be carried out if the market value reaches (or exceeds) your limit price. Consequently, you can leverage limit orders to acquire items at a more affordable cost or sell them for a premium rate compared to current market prices.

- Market order A market order is an order to buy or sell at the best available current price. It is executed against limit orders that have previously been placed in the order book. When you place a market order, you pay a commission as a market-sticker.

- A limit order is a market order that has a specified limit price. When you place a limit order, the trade will be carried out if the market value reaches (or exceeds) your limit price.

- Market order A market order is an order to buy or sell at the best available current price. It is executed against limited orders that have previously been placed in the order book. When you place a market order, you pay a commission as a market sticker.

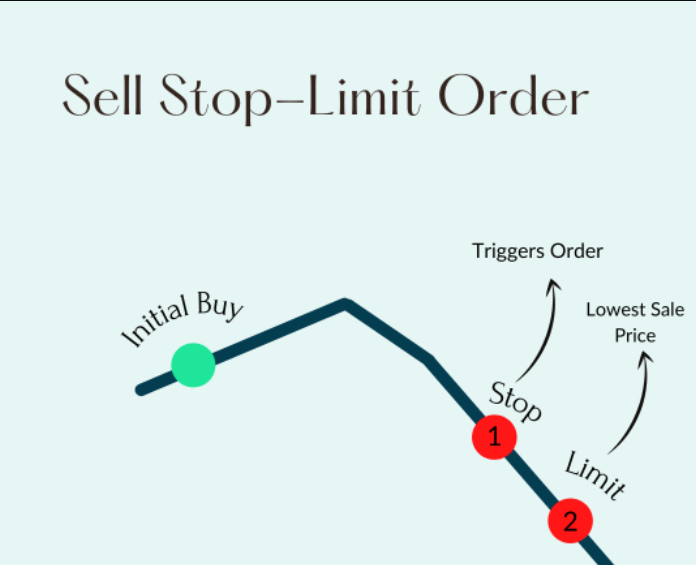

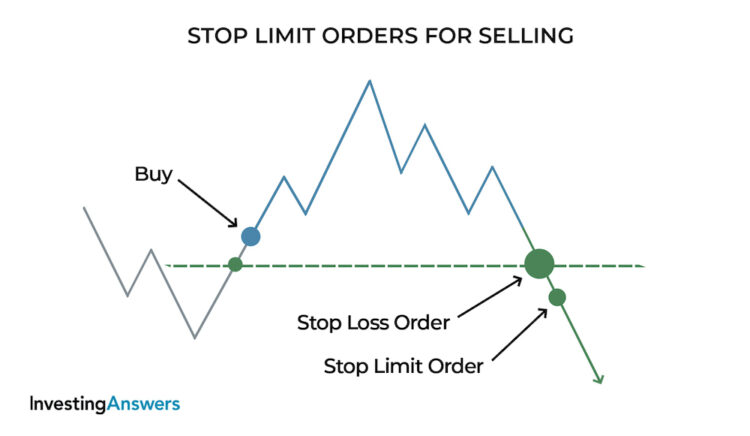

- The simplest approach to comprehend a stop-limit order is to break it down into a stop price and a limit price. The stop price is the price at which the limit order is activated, while the limit price is the purchase cost of the triggered limit order. As a result, as soon as your stop price has been met, your limit order will be placed at the limit price (or better).

- Although the stop price and limit price are sometimes the same, this is not a requirement. It would be safer to set the stop price (trigger price) somewhat above the limit price for sell orders or somewhat below the limit price for buy orders. This increases the chance of your limit order being carried out when the stop price is hit.

- A Take Profit Limit Order can be a useful tool for managing risk and ensuring profits at particular price levels. It may also be used in conjunction with other sorts of orders, such as stop-limit orders, to better manage your positions.

A stop market order is a specific type of stop limit order that activates when the stop price is reached. When compared to a stop limit order, it works in the same way. However, rather than halting trading at the specified amount, as with a regular stop limit order, once the halt quantity has been met (by comparing prices for comparable quantities), the stop market order becomes a market order.

In the “Stop Limit” option in the order entry area, you may include a Take Profit limit order.

- A market Take Profit order functions similarly to a limit Take Profit order in that it activates when the stop price is hit. When the stop price is reached, however, rather than being filled, the market order is triggered.

- If you're familiar with stop-limit orders, then a Take Profit limit order will make sense to you since they share the same trigger price and limit price. The main difference between the two is that a take-profit limit order can only be used to close a position, while a stop limit may be used to open or close positions.

- A Take Profit Limit Order can be a useful tool for managing risk and ensuring profits at particular price levels. It may also be used in conjunction with other sorts of orders, such as stop-limit orders, to better manage your positions.

In the Stop Market field, you can create a Take Profit market order.

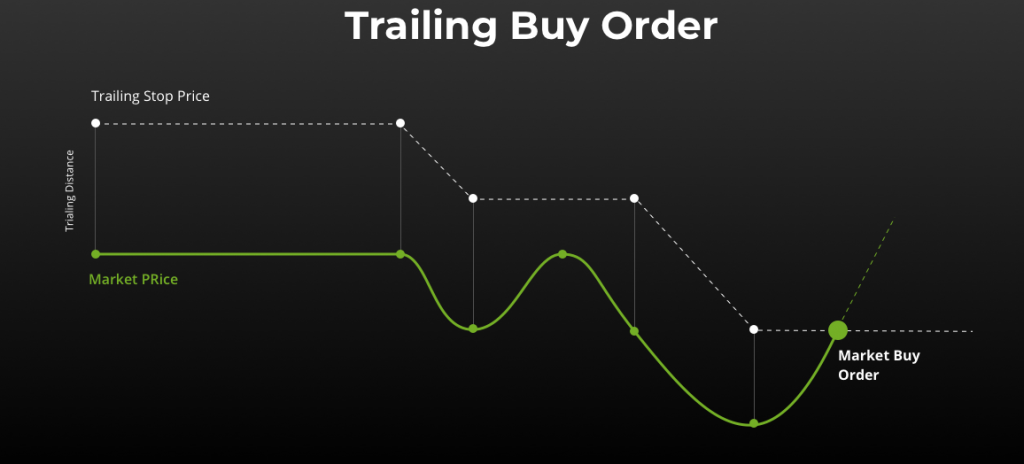

A trailing stop order helps you manage potential gains and minimize potential losses on your open positions. When the price of a long position rises, the trailing stop rises as well. However, if the price falls, the trailing stop comes to a halt. You place a sell order when the price moves a particular percentage in either direction, depending on whether your position is part of the long or short bet.

For a long position, you must have a stop loss; however, the exact opposite holds true for short positions. A trailing stop is activated if the market starts to increase and it follows in congruence with how far up or down the price of an asset moves. If there are fluctuations greater than what has been predetermined, then an automated buy order will be placed.

By setting a “triggering price,” you can activate the trailing stop feature – if no activation cost is provided, it will revert to either the most recent trade or mark-to-market value. You may specify which pricing option should be used as your trigger in the bottom of your order entry area.

The trailing stop will “follow” the price by a percentage equal to the callback rate if you're using an algorithm. As a result, if you set the Callback Rate to 1%, the trailing stop will continue to follow the price from a distance of 1% after your trade goes in your favor. If prices move more than 1% in the other direction, the order will not be carried out.

When you submit a trailing stop order, you're required to provide an activation price. This is the price at which your order will become active and start following the market. If you don't provide an activation price, it will default to the most recent trade or mark-to-market value.

You can choose the price at which your order should be triggered in the “Trailing Stop” field. If you don't provide an activation price, it will default to the most recent trade or mark-to-market value.

With the mark-to-market strategy, investors can get a precise understanding of their portfolio's value on any day. This enables them to take action depending on current market conditions; whether they should buy, sell or preserve assets. Consequently, it is essential that portfolio holders have a full comprehension and expertise in using this process so as to make sound investment decisions.

The last price is the most recent transaction price of an asset. It may not always reflect the current market value of an asset, but it is still helpful information for investors.

Mark-to-market values are used to calculate funding rates. A funding rate is a fee that a long or short position pays (or earns) for every four hours that the position is held. There are two types of funding rates: overnight and intraday. Overnight funding rates are paid when a position is held overnight, while intraday funding rates are paid when a position is held during regular trading hours. The funding rate is calculated using mark-to-market prices and is paid out of (or into) your account balance every eight hours.

When the cost of an asset is rising, funding rates tend to be positive; whereas when it's declining, those same rates are negative.

To ascertain the funding rate for a long position, you will need to subtract the last price from its mark-to-market value. Conversely, when calculating the funding rate for a short position, take the last price and deduct it from its mark-to-market value.

When the cost of an asset is growing, the funding rate is positive; conversely, when it drops lower, so does the corresponding funding rate.

By altering your leverage, you are essentially transforming the amount of risk that you can undertake. Greater leverage equips one with the capacity to assume more risks and consequently reap greater profits; yet this also raises the odds of encountering losses.

The prices of cryptocurrencies have a big influence on the open-ended futures market. To maintain contract prices in line with the index, most cryptocurrency derivatives exchanges employ a funding rate mechanism. These rates are influenced by whether asset values rise or fall and are controlled by market forces.

What Is Arbitrage? – A Low-risk Profit Strategy Using Funding Rate

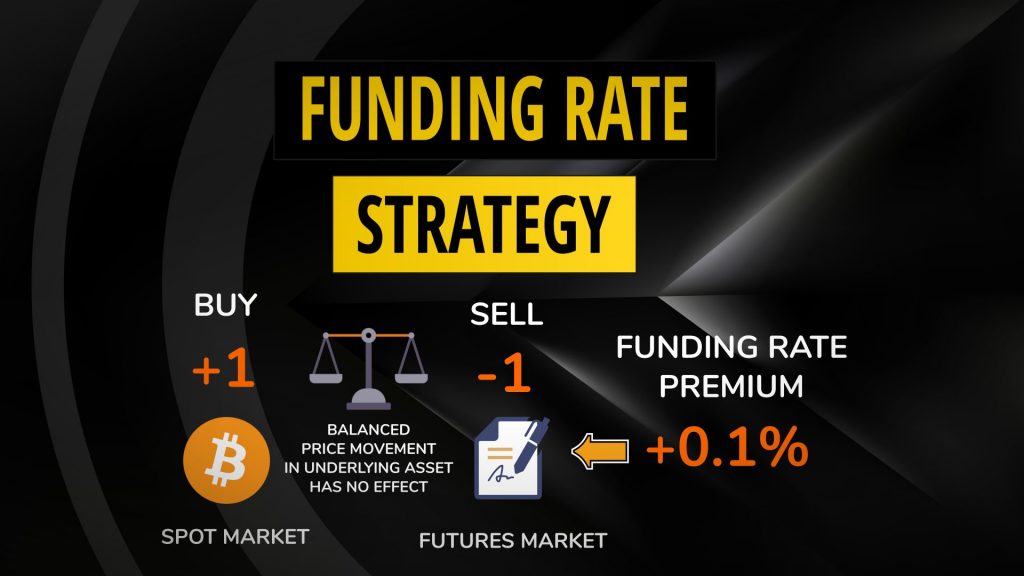

You can also make money from funding without betting in a particular direction. This is called funding arbitrage. The funding rate isn't the same across all exchanges; usually, one exchange has a higher rate than another. So, for example, if you borrow 400 dollars from Binance and lend an equal amount on Bybit, the difference in rates goes into your pocket. You won't lose your investment due to market movements, because the losing position will be covered by the winning one.

These are just a few easy ways you can get started using funding rates to your benefit. Funding analysis can be much more complicated than this, but that's beyond what we're discussing here today.

Remember, this article is only based on my personal experience in crypto trading and should not be taken as investment advice. Do your research, enjoy yourself, and hopefully, you'll make some money!