How crypto and inflation affect the world

Table of content

What is crypto and inflation?

⚡️ How does cryptocurrency help with inflation?

Investing in cryptocurrencies over traditional and alternative assets offers investors the chance to grow their wealth. With a cryptocurrency, an investor buys with the expectation that it will appreciate which protects them from any fluctuations of the U.S. dollar's value.

⚡️ Are cryptocurrencies recession-proof?

There are thousands of cryptocurrencies, and nearly all will not survive a market fall. Those that survive will dominate the market and improve returns for first-time investors.

⚡️ Which crypto will dominate?

According to experts, Bitcoin is predicted to dominate the crypto market in 2022. It's one of the most popular cryptocurrencies, thanks to its use of a blockchain or registry distributed across thousands of machines.

⚡️ Which cryptocurrency has potential?

For savvy investors, 2022 presents an opportunity to capitalize on the most lucrative cryptocurrencies. Ethereum stands out as a top choice given its impressive market capitalization and established smart contract platform that allows developers to create DApps and digital tokens. With a dedicated development team alongside an engaged user base, Ethereum is undoubtedly one of the best investments currently available in cryptocurrency markets.

Inflation in cryptocurrency means there's an overall increase in prices of items and services within the economy. So, when inflation happens, purchasing power decreases because you need more crypto to buy the same thing. There are a few reasons this might happen: The supply of crypto. If more crypto is available than buyers, this will lead to downward pressure on prices and increased demand for goods and services denominated in crypto.

- Economic activity. Amidst an economic boom, businesses exploit heightened demand by raising prices and increasing costs.

- One of the reasons a cryptocurrency might appreciate is due to government policies. If, for example, the money supply is increased by a government body, this will lead to higher prices as there is more crypto available relative to goods and services. There are several ways that cryptocurrencies can be protected against inflation:

- Use a cryptocurrency that is not subject to inflation. While all fiat currencies are subject to inflation, some cryptocurrencies are not. Take Bitcoin and Ethereum as instances; both have a fixed amount of coins. For example, the limit of Bitcoin is 21 million whereas that for ETH is predetermined too. This implies they are not prone to the same inflation pressures which impact fiat currencies remarkably.

- By reserving your crypto in a wallet that isn't subject to inflation, you can keep the same purchasing power. On the flip side, if you store your crypto using fiat currency, then it will be influenced by inflation and as time passes prices of goods and services shall elevate resulting in lower purchasing power.

- Protect your crypto from the effects of inflation by swapping it for a non-inflationary asset like gold or silver. Doing so will preserve the value of your investment and ensure that you can maintain purchasing power even amidst inflating prices.

Inflation can affect the value of cryptocurrencies, yet not always to a detrimental extent. As prices for goods and services rise due to inflationary pressures, cryptos may in turn increase their own worth as well. To help protect against this however, users may store their cryptocurrenices in wallets that are unaffected by inflation or switch over into another asset outside of it's control; such as using an altcoin that is less vulnerable. By doing so you'll be able to ensure your holdings remain secure from any deterioration caused by economic instability!

In analyzing the inflation of fiat and cryptocurrencies, we observe that:

- Fiat currencies are subject to inflationary forces, while cryptocurrencies are not.

- Cryptocurrencies provide judicious users with a great shield against inflation, allowing them to store their crypto in wallets that are not vulnerable to price hikes; convert it into another asset that is impervious to inflation, or use cryptocurrencies that aren't susceptible to the same.

Although inflation has both advantageous and disadvantageous effects, the choice of whether to accept or reject it is personal. On the contrary, climbing prices could make goods and services costly. However, some benefits can arise from this phenomenon such as protection against economic instability caused by inflationary forces. Ultimately, the decision rests with each individual depending on their circumstances.

Cryptocurrencies not subject to inflation

Having compared all cryptocurrencies, representatives of the research center concluded that the following digital money can be called the most deflationary:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Monero (XMR)

Let's analyze each of them in more detail.

Bitcoin stands out as the most prominent and well-known cryptocurrency, often referred to as digital gold. The most notable feature of BTC is that its emission is limited to 21 million coins. It is this factor that makes Bitcoin deflationary – since new units are not produced as demand increases, only the price will go up.

Ethereum took the world by storm when unveiled in 2015 and has since established itself as a top player in its market cap. Offering users the unusual ability to construct smart contracts and blockchain-based DApps, Ethereum grants unparalleled control over their resources. The limited quantity of ETH coins is also handsome – with no more than 110 million available for circulation ever!

Litecoin was designed to be the lighter, more accessible version of Bitcoin and functions with its native algorithm, Scrypt. With a total supply of 84 million LTC tokens, Litecoin is an attractive choice for those wishing to invest in cryptocurrency.

In 2017, Bitcoin Cash (BCH) was born due to a hard fork from the original Bitcoin. The primary distinguishing factor between them is BCH's increased block size which enables it to process more transactions in shorter periods. Additionally, the maximum amount of BTUs that will be created and released into circulation is capped at 21 million units.

Monero is the leading anonymous cryptocurrency that uses CryptoNote to guarantee user privacy. With a limited supply of 18.4 million units, it is deflationary, thus driving up its value over time in contrast to most other coins, which tend to depreciate. As one of the world's foremost and most popular cryptocurrencies, Monero towers above all others regarding dependability and potential for growth!

We can observe that all well-known and renowned cryptocurrencies are deflationary, as their issuance is restrained. This means that with time, their value will only rise.

The Best Crypto Exchanges Of April 2022 https://www.forbes.com/advisor/investing/cryptocurrency/best-crypto-exchanges/

How cryptocurrencies can protect against inflation

While crypto assets are not subject to inflationary forces, they can offer some protection against inflation. Ultimately, deciding whether to invest will come down to each individual's circumstances and preferences. Some benefits of investing in cryptocurrency during periods of high inflation are that crypto assets aren't susceptible to inflation and can provide some defense against it. On the other hand, a downside might be that prices for consumer goods usually increase during high inflation. Before deciding whether or not to invest in cryptocurrency, individuals should think about their situation and what they value most.

Biggest Prospects

Cryptocurrencies are a high-risk asset, especially for untrained users. History has taught us that taking risks can often lead to significant rewards.

Cryptocurrency inflation is a natural process that affects all fiat currencies. However, crypto assets are not subject to inflationary forces due to their limited supply. This allows them to offer some protection against inflation. Ultimately, whether to invest in cryptocurrency will rely entirely on each person's unique financial situation and preferences.

Pros and cons of inflation and crypto

Cryptoinflation, according to economists, has the same negative effects as any other form of inflation. Despite this, several benefits and outcomes may be observed.

An increase in money circulation leads people to spend more, which then drives up demand and has a positive effect on factories. The current economic climate is in disarray, leaving countless individuals desperately seeking employment opportunities. Reducing unemployment by working even harder so that economic difficulties don't affect your pocket. This relates to the economy's growth by investing more money in various aspects of life.

Protection from financial ruin. The “paradox of thrift” is a phrase used in small circles by specialists. Keynes coined the term (the most renowned economist of the twentieth century). People save and put off purchases as long as prices are decreasing (meaning that the overall cost of items and services is going down). Conversely, inflation causes people to want to spend all of their money until it runs out.

Let's get started. For years, the Federal Reserve has been striving to decrease and control inflation by reducing the amount of money in circulation – albeit with limited success. This is because printing more money changes the value of everything else in society (including digital currency like Bitcoin). Despite government concern over inflation, it also affects those who are less fortunate. InflationWhat factors can contribute to the rise and fall of the cryptocurrency

Besides the detriment of inflation, another possible consequence is increasing interest rates. Whether it be cryptocurrency or fiat money, any funds being stored will diminish in value over time. Whenever governments inflate their currency to gain more profits, this can have dire consequences like making saving for retirement and acquiring a higher education harder than ever before. Do you still have queries regarding crypto-inflation? Don't be shy! Share your opinion in the comment section below – we'd love to hear from you.

Have any lingering questions about crypto inflation? Share them with us in the comments section and let's explore it together!

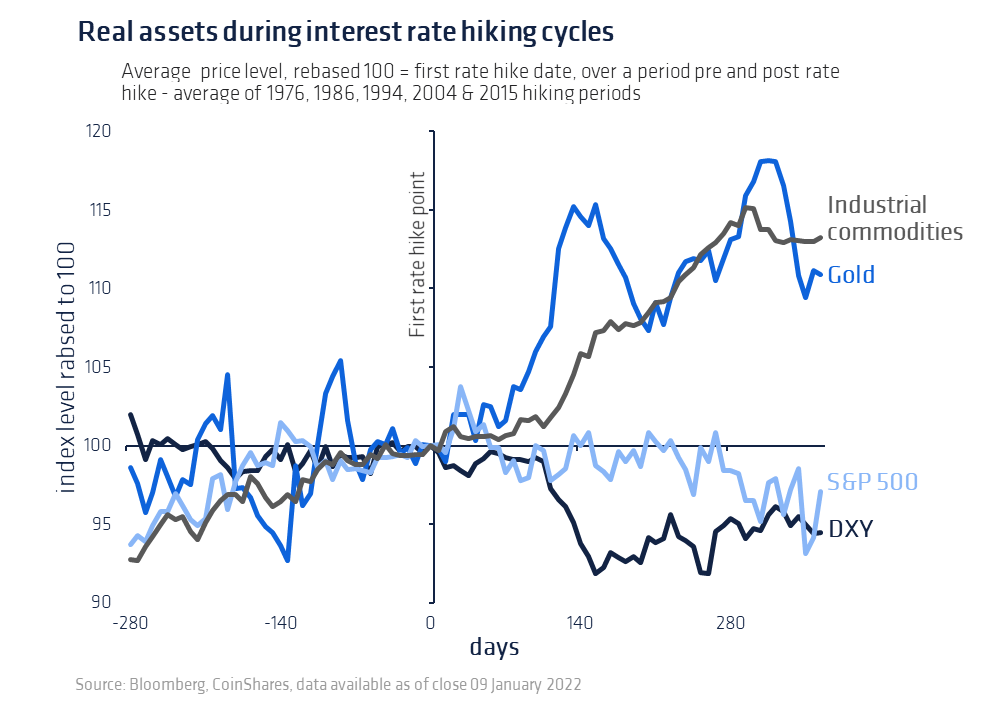

Can cryptocurrency protect your assets from inflation?

In a nutshell, cryptocurrency has yet to prove itself as a reliable inflation hedge. Although it is still an up-and-coming investment asset with potential, nothing in the investing world can be taken for granted. As such, diversifying your portfolio by including cryptocurrency should be done at your own risk and discretion.

Choosing to invest in cryptocurrency comes with inherent risks, one of which is inflation. There are many narratives – some misleading – about how crypto can act as a hedge against inflation. When buying or storing crypto, you must do your due diligence to choose a reputable service provider that offers high-quality security measures.

YouHodler is a FinTech service in Europe that is regulated and always acts in its client's best interests. With extensive professional finance experience, YouHodler employs various features to suit your specific goals and risk tolerance.

YouHodler's crypto interest feature is a great way to generate yield on stablecoins or cryptocurrency without putting your investment at risk. If you're looking for something with a higher potential return, try Turbocharge or Multi HODL.

Are you new to Dual Asset? It's a perfect solution for both the risk-averse crypto HODLer and active trader. With this dual currency investment tool, you can acquire more crypto or stablecoins by the state of your position and the crypto market. Take advantage of market volatility while reaping great returns!

The best part is that you don't need extensive cryptocurrency knowledge. Inflation isn't going anywhere, but that doesn't we should give up on crypto altogetheR there are plenty of bull and bear markets that offer opportunities. With the right tools at your disposal, provided by YouHodler, it's time to take a chance and experience all these platform offers!

Conclusions

For investors who fear inflation and its consequential damage, Bitcoin and other digital currencies may be the answer. Cryptocurrencies are not typically seen as deflationary because miners have a purpose-driven incentive to validate ongoing transactions on their respective networks. Additionally, some cryptocurrencies can be shown to possess inflationary traits in certain cases.

For example, Ethereum's gas fees go up during periods of high demand on the network. While crypto may offer some protection against inflation, it is essential to remember that crypto assets are volatile and risky investments. Individuals should consider their circumstances and preferences when deciding whether to invest in crypto.